Transitions to the new version 3.1 of the 1C: ZUP and 1C: PGU programs are in full swing. So, a new database is created, and the data is automatically transferred from the previous version. What is necessary to check first of all, and where in the new program to find the treasured documents with data? We have prepared a small cheat sheet for you.

1. Basic employee information

Section "Main" - "Data on the start of operation"

Type of document:

- Initial staffing: planned accruals and the amount of the advance payment, position and unit of the employee, the rest of the holidays.

- Initial salary arrears: balances on mutual settlements (+ debt for the organization, - debt for the employee).

- Periods paid before the start of operation: Holidays paid in the previous program before the transfer, falling on the current period.

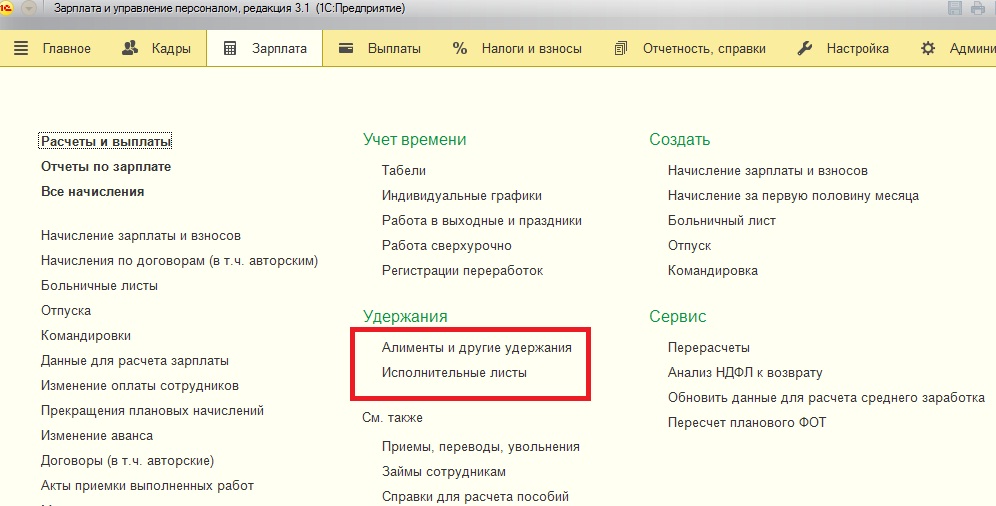

2. Executive Lists

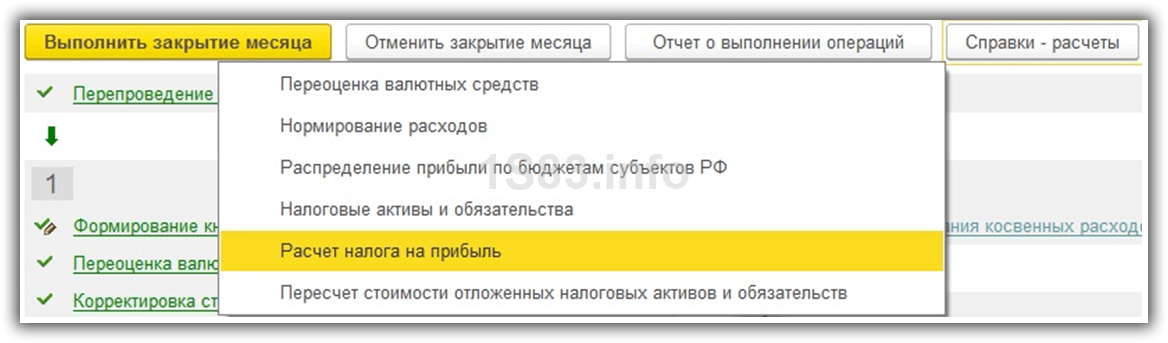

Section "Salary" - "Alimony and other deductions."

3. The right to personal income tax deductions

Section "Taxes and Contributions".

Type of document:

- PIT deduction application - standard deductions;

- Notice of BUT on the right to deductions - property deductions, notification BUT must be entered manually.

4. Estimated data (average earnings)

The “Administration” tab - “Data transfers” (the average for the FSS is carried over for the previous 3 years, for calculating the holidays for the previous 15 months).

To see the average employee, you need to use the "Reports" - "Universal Report". Also, the amount and number of days that are taken when calculating the vacation can be seen directly in the document, for example, "Vacation".

5. If there are loan agreements with an employee (tab “Salary” - “Loans to employees”), then they must be entered manually. Also, if there is a parental leave (“Salary” - “Holidays for childcare”), you must also enter information manually.

For example, in 1C, payroll accounting has been carried out since January 2013, and historical data for calculating average earnings have not been entered. When trying to accrue leave to an employee in July 2013, an appropriate information message is issued that the earnings data are incomplete and that the missing data needs to be supplemented:

Accordingly, from January to June 2013, there are data for the calculation, they are determined by the results of calculations carried out in 1C ZUP, but the data from July to December 2012 must be added:

Sections of the data to be updated are determined dynamically.

- If the checkbox is selected that a bonus is accrued, then the data must be entered separately by type of income: basic earnings, bonuses, annual bonuses. Because they are included in different ways in the average earnings base.

- If the checkbox is checked that there is indexation, then you need to divide all the income into indexable and not indexable.

In our example, there are no indexations or premiums, so just enter:

- the amount of charges and information about the hours worked,

- the number of days worked, this is important.

- The number of days worked on a six-day day must be paid if holidays are provided on working days.

- The days worked by the calendar, it is very important, this is for vacation basic information.

- And the norms of days according to the production calendar can also be indicated, sometimes it is used:

Missing data can be entered manually, directly in the Data entry form for calculating average earnings. But in ZUP it is possible to predict what incomes were paid to the employee for the missing period, based on his current personnel data - by the button “Add”:

After clicking the “Add” button in 1C, the necessary information is automatically filled. Immediately according to the entered data, the average earnings are calculated:

Once the income entered into this form can be used in the future if the employee accrues subsequent leave, or, for example, payment for a temporary stay on a business trip or in some other cases.

In addition, it is possible to check the box and use the same data for average earnings when calculating sick leave and childcare benefits:

We save the entered data by pressing the “ok” button and spend the vacation document:

Next, we register another vacation for the same employee, for example, from September 1, 2013 to September 7, 2013. In 1C ZUP, the average earnings were calculated automatically, and for the period from January 2013 to August 2013, information from the information base was used according to the accrual results . And for the period from September 2012 to December 2012, the data was used when calculating the previous vacation to the employee:

In this case, you will need to add data for 2012, starting in January. Also enter data for 2011, as the average income for the previous two calendar years is taken for payment of temporary disability. Therefore, to calculate the sickness benefit, the average earnings should be added:

Setting calculation of average earnings in 1C ZUP

In 1C ZUP there is the ability to configure the base for calculating average earnings. When setting up any types of charges, you can determine whether they will be included in the calculation of average earnings or not included:

In addition, the program has a general form where you can view a list of all charges that are included in the base for calculating average earnings, and which are not in the base for calculating average earnings:

Full list of our offers:

Rate this article:

In this article, I will talk about another way to start working with “1C: Salary and Human Resource Management 3.0” (ZUP 3.0) - entering the initial balances. This method is used in cases where the company has been operating for some time, but the ZUP 3.0 database was not conducted (for example, other software was used) or for some reason it is impossible to transfer data from the old configuration.

The latter often happens if the database is damaged or it was run with gross errors, making it easier to start all over again in a new database than to fix the long-standing "schools" of unskilled employees. After all, most errors lie in long-closed periods, and an attempt to correct them leads to the appearance of new problems.

By the way, one of the global advantages of “1C: Salary and HR Management 3.0” and “1C: Accounting 3.0” is the protection against erroneous actions. The program monitors the documents that the user is trying to post and does not allow this if the document is executed incorrectly. And when data with errors is imported into the ZUP 3.0 database, these errors immediately flourish in a lush color in the warning window.

More recently, in my practice there was a characteristic case. It was necessary to transfer data for an organization that had been working with the 1C: Salary and Personnel 7.7 program for more than fifteen years - almost since this configuration appeared. The number of errors detected after the transfer went off scale and caused an obsessive desire to throw the server into the fire. These were improperly issued vacations, erroneously issued personnel orders, and much more. Correcting all this was simply unrealistic. But since the staff of the organization contained only about twenty people, the problem was very easily solved by entering the initial balances.

So, let's see how this is done. First you need to carry out the initial configuration settings using the wizard, as described in the articles and “Settings. In the process, information about the organization will be filled in and the personnel records, as well as payroll, will be set up.

After filling in, all settings must be checked and, if necessary, adjusted and supplemented. I talked about where to look for these settings in the program in articles, and. It also said what each of these settings is responsible for.

If you need to create new accruals or deductions, it's time to do it at this stage.

Then you need to fill out the lists of departments, positions, work schedules and staffing, if you intend to keep it.

When all this is done, you need to add all individuals and employees to the database.

When entering the initial balances of employees, you can add not with documents for employment, but with a special document “Data on the start of operation of the program”, which is located in the “Personnel” section.

This document records the working periods for each employee and the rest of the holidays.

At the same stage, it is worth adding the existing parental leave, other absences, loans, as well as writ of execution, if any.

If at the time of entering the initial balances between the organization and employees there are salary arrears, they must be recorded with the document “Initial salary arrears”, which is located in the "Payments" section. If my memory serves me, earlier this document was in the section "Salary".

Debt must be indicated at the end of the month. Moreover, if the employee owes the company, then the amount in the corresponding column should be negative.

The amount of average earnings in documents using the calculation of average earnings can be adjusted directly in these documents when they are created.

If you do not enter the opening balances at the beginning of the year, you must also enter information about taxes and contributions.

Information on personal income tax is entered using the document “Personal income tax accounting transaction” (previously called “Personal income tax accounting transaction”), which is located in the section “Taxes and contributions”.

According to the current legislation, the calculation base for calculating average earnings includes all types of wages, with the exception of social and other payments (compensation for medical examination, payment of travel and meals, expenses for training and others). Depending on the settings of the infobase, the above accruals can both be indexed and remain unchanged (the exception is only non-indexable accruals that are not tied to the employee’s salary, for example, surcharge by amount). This setting can be seen in the section Settings - Payroll - checkbox “The indexation of employee earnings is in progress”.

When the checkbox is enabled in the settings of the accrual type, the check mark of accrual indexing becomes active. This possibility is provided just for such cases when you need to indicate whether the accrual is subject to indexation or not. (Section Setup - Charges).

Compensation payments are not taken into account in calculating average earnings. And if we create (or select from the list of available) accruals, then when choosing the purpose of accrual “Compensation payments”, the section Average earnings becomes unavailable for editing.

Some types of charges make it possible to independently determine whether they are included in the base for calculating the average or not. For example, material assistance related to covering the needs of an employee refers to social benefits and is not taken into account in the calculation. And material assistance for vacation (if agreed in the collective agreement) refers to incentive payments and is taken into account when calculating average earnings. If its sign of inclusion in the calculation has been changed in the form of accrual, then in order to update the accumulation register without resorting to recounting all documents of payroll, you can use the service "Update data for calculating average earnings", which is located in the "Salary" section.

It is inconvenient to analyze the settings of the average earnings base through a single accrual. Therefore, in the configuration, it is possible to massively view all the charges included in the database. To do this, in the Settings - Charges section, click the “Personal income tax, average earnings, etc.” button

As you can see in the figure, the setup consists of two columns: on the left are all the charges determining the base, on the right are all not taken into account. To change the accounting order, it is enough to move the accrual from one column to another. Moreover, here we can immediately change the order of indexation of charges.

After setting up the base, we can go directly to the accruals themselves, calculated on the basis of average earnings. Such accruals include paid leave, business trip, days of disability, days of caring for a disabled child, paid downtime. By default, the calculation period is 12 months (this norm is established by Article 139 of the Labor Code of the Russian Federation), but if a different period is specified in the collective agreement, the calculation of the calculation allows us to correct it.

Accrual documents (e.g. Business trip, Vacation, Sick leave, etc.) have a separate data entry form for calculating average earnings. In this form, all employee earnings are collected for all accruals that make up the average base, the number of actually worked days is taken into account. Based on these data, the average daily (hourly average employee earnings) is calculated.

If you still have questions about calculating the average earnings in 1C ZUP, we will be happy to answer them as part of a free consultation.

We talk about the nuances of calculating average earnings and give examples of setting up the base for calculating average earnings in “1C: Salary and Human Resource Management 8”, edition 3.

In cases specified by the legislation of the Russian Federation, an employee should be paid in the form of average earnings, and not wages. The procedure for calculating the average wage for sick leave and, for example, business trips and vacations, varies. 1C experts clarify what you need to know about calculating average earnings in accordance with Decree of the Government of the Russian Federation of December 24, 2007 No. 922 for cases provided for by the Labor Code of the Russian Federation, and also give examples of setting up the base for calculating average earnings in “1C: Salary and Human Resource Management 8” Revision 3 and the effect of deviations from the employee’s work schedule on the calculation.

In what cases is the average earnings calculated

The term "average earnings" is used in regulatory documents to describe the rules of calculation in different cases. From the calculation of average earnings, sick days, holidays, business trips and others are paid. In this case, the average earnings are calculated in different ways. Thus, Federal Law of December 29, 2006 No. 255-FZ and Decree of the Government of the Russian Federation of June 15, 2007 No. 375 determine the procedure for calculating benefits for temporary disability, maternity and childcare until they reach 1.5 years.

The general rules for calculating average earnings for cases when an employee was not at the workplace, but such earnings were retained for him according to the Labor Code, are established in article 139 of the Labor Code of the Russian Federation.

The calculation procedure is defined in Decree of the Government of the Russian Federation of December 27, 2007 No. 922 (hereinafter - Resolution No. 922).

This article discusses the calculation of average earnings in accordance with Article 139 of the Labor Code of the Russian Federation and Resolution No. 922.

The specified decree defines a different procedure for calculating average earnings for two cases:

1. Leave and compensation for unused vacation.

2. Other cases provided for by the Labor Code of the Russian Federation (except in cases of determining the average earnings of employees who have established a cumulative record of working time).

Cases named in the Labor Code of the Russian Federation, when the average earnings are saved:

- business trip (Article 167 of the Labor Code of the Russian Federation);

- medical examination (Article 185 of the Labor Code of the Russian Federation);

- transfer of an employee to another job (Articles 72.2 and 182 of the Labor Code of the Russian Federation);

- blood donation and its components (Article 186 of the Labor Code of the Russian Federation);

- employee participation in collective bargaining (Article 39 of the Labor Code of the Russian Federation);

- non-fulfillment of labor standards, non-fulfillment of labor (official) duties due to the fault of the employer (Article 155 of the Labor Code of the Russian Federation);

- etc.

The Labor Code of the Russian Federation establishes a non-closed list of cases of maintaining average earnings.

The formulas for calculating average earnings are different for the first and second cases, but in each of them you need to know the calculation period, the number of days worked in the calculation period, and the actual earnings of the employee received in the calculation period.

Billing period

In the general case, the billing period consists of 12 months preceding the month of maintaining average earnings (paragraph 4 of Resolution No. 922).

In accordance with article 139 of the Labor Code of the Russian Federation, the employer may set a different billing period if this does not worsen the situation of workers.

In the program “1C: Salary and personnel management 8” edition 3 in the documents registering the days of payment for average earnings (for example, Vacation, Business trip), there is a pencil icon - Change average earnings calculation data (fig. 1).

Fig. 1. Change in billing period

Clicking on it opens a window Data entry for calculating average earnings. Switch The estimated period of average earnings provides the ability to select a period: Standard, detected automatically and Manually set.

If local regulatory documents provide for a settlement period other than 12 months, then when working with such documents in the program, the user should independently control so that Average earningscalculated on a manually set billing period was no less than the standard. It is convenient to make control in the form of rearranging the switch.

The billing period includes the time of the actual work. If, for example, an employment contract was concluded with an employee less than 12 months before calculating the average earnings, then in the standard billing period (12 previous months) the time before employment will be excluded.

That is, the billing period does not change, but unworked time is allocated in it. The list of excluded periods is defined in paragraph 5 of Resolution No. 922.

So, the time when the employee:

- received average earnings (with the exception of breaks for feeding a child);

- was on maternity leave, on sick leave;

- did not work due to downtime due to the fault of the employer or due to circumstances beyond the control of the parties;

- could not work due to a strike in which he himself did not participate;

- used additional paid days to care for a disabled child;

- in other cases, he was dismissed from work with full or partial preservation of earnings or without it.

In the program “1C: Salary and personnel management 8” edition 3 provides for the exclusion of such periods.

The exclusion periods are set in the calculation type card (menu Setup - Charges) on the bookmark Average earnings.

If the flag not established, then the period and earnings for this period are excluded from the calculation of the average.

When there are no days worked in the billing period, the calculation is made for the current month.

For example, a business trip or vacation takes place in the month when an employee entered into an employment contract. In the shape of Entering data to calculate average earnings button Add according to payroll data fills in the data for calculating average earnings with information of the current month.

Actual earnings

When calculating the average earnings, the employee’s actual earnings include all types of payments provided for by the payroll system accrued to the employee in the billing period, regardless of the source of funds. In other words, the calculation of the average includes all payments established by the employer in the wage system as wages.

In addition, the following are included in the calculation:

- allowances and surcharges to tariff rates and salaries for professional skills, length of service, knowledge of a foreign language, combination of professions, increase in the volume of work, etc .;

- payments related to working conditions (district coefficients, surcharges for working in harmful, dangerous and difficult conditions, for working overtime at night, on a day off);

- bonuses and remuneration provided by the wage system, fixed in local regulatory acts;

- other types of salary payments from the employer.

note, one-time bonuses not included in the remuneration system do not participate in the calculation of average earnings. In the program “1C: Salary and personnel management 8” edition 3 all types of calculation, which are installed Purpose of accrual - Awardnecessarily fall into the calculation of average earnings.

Flag Include in the accrual base when calculating average earnings in the calculation type card on the tab Average earnings for such charges is set by default and is not available for switching. For premiums not included in average earnings, you should create new types of calculation with Purpose of accrual - Other accruals and payments.

Calculation of average earnings for ...

... all but vacation

Calculation of average earnings for all cases, except for vacation, is carried out according to the same formula, but depends on the wage system, more precisely - on the way of accounting for time.

If the employee is set to the mode of cumulative working hours, then the calculation is done by the hour, and the average hourly earnings of the standard account are calculated by the formula:

SChZ \u003d RFP / HPF,

where:

High pass filter - the actual hours worked;

RFP - earnings accrued to the employee for the billing period.

If the employee does not have a regime of cumulative working hours, then the calculation is carried out by days and the average daily earnings of SDK are calculated according to the formula:

SDZ \u003d ЗП / ФВД,

where FVD - the actual hours worked in days.

To calculate the average earnings for the period in this case, the average daily earnings are multiplied by the time payable according to the employee’s schedule in days.

However, not in all cases the time to be paid is calculated according to the schedule. The exception is payment of donor days. In letters No. 14-2 / \u200b\u200bOOG-1727 dated March 1, 2017 and No. 14-2 / \u200b\u200bB-1087 dated October 31, 2016, the Ministry of Labor of Russia clarified that payment should be made for the days of blood donation and its components based on an eight-hour working day, regardless of the schedule employee.

... vacation

When calculating the average earnings for the purpose of calculating vacation, regardless of the method of recording working time, the accounting is carried out every day.

The average daily earnings of SDK is calculated by the formula:

SDZ \u003d ЗП / 29.3 х Мes + Dnepr,

where:

Month - the number of full calendar months worked;

Dnepr - the number of days in incomplete calendar months, calculated by the formula:

Dnipro \u003d 29.3 / KD x OD,

where:

Cd - the number of calendar days in a month;

OD - the number of days worked.

Examples of the influence of deviations from the work schedule on the calculation of average earnings

Consider how the deviation from his work schedule affects the calculation of the average employee’s earnings, for example, due to being on vacation, a business trip, etc.

Example 1

When calculating the vacation (Fig. 2), the average daily earnings amounted to 1,022.68 rubles. (358 571.43 RUB / 350.62 days). In November, one day was not worked out, and earnings amounted to 28,571.43 rubles. The month of November is not fully accounted for - 28.32. In total, 358,571.43 rubles were accrued for the billing period. and recorded 350.62 days.

Fig. 2. The calculation of the average earnings for the vacation, Example 1

When calculating the trip (Fig. 3), the average daily earnings amounted to 1,451.71 rubles. (358 571.43 RUB / 247 days). In total, 358,571.43 rubles were accrued for the billing period. and 247 days worked are counted.

Fig. 3. The calculation of the average earnings for a business trip, Example 1

Example 2

When calculating the vacation (Fig. 4), the average daily earnings amounted to 1 019.83 rubles. (358 571.43 rubles / 351.6 days), which is less than in Example 1. The fact is that the day off affected the employee’s earnings - in November 28 571.43 rubles were accrued, as with any other failure to appear . But time off does not reduce the number of days worked, and the month is considered worked out completely. In total, 358,571.43 rubles were accrued for the billing period. and recorded 351.6 days.

Fig. 4. The calculation of the average earnings for the vacation, Example 2

However, when calculating a trip, the time off is not included in the number of actually worked days, and the average earnings are 1,451.71 rubles, as in Example 1 (see Fig. 3).

Example 3

When calculating the vacation (Fig. 5), the average daily earnings amounted to 1,032.18 rubles. (362,914.98 rubles / 351.6 days), which is more than in Example 1. The fact is that work on the day off affected the employee’s earnings - 32,914, 98 rubles were accrued in November. But work on a day off does not change the fact of a fully worked month, and a coefficient of 29.3 is used for the calculation. In total, 362,914.98 rubles were accrued for the billing period. and recorded 351.6 days.

Fig. 5. The calculation of the average earnings for the vacation, Example 3

When calculating a business trip, work on a day off increases the actual days worked, and the average earnings are 1,457.49 rubles. (362,914.98 RUB / 249 days). In total, 362,914.98 rubles were accrued for the billing period. and 249 days worked are taken into account (Fig. 6).

Fig. 6. The calculation of the average earnings for a business trip, Example 3

From the editors. To get even more information about the rules for calculating average earnings, about accounting for bonuses, about indexing average earnings with increasing salaries, about the regulation on calculating average earnings in local documents, and also get acquainted with other examples of calculating average earnings in the 1C: Salary and HR Management program 8 "Edition 3 is possible from

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

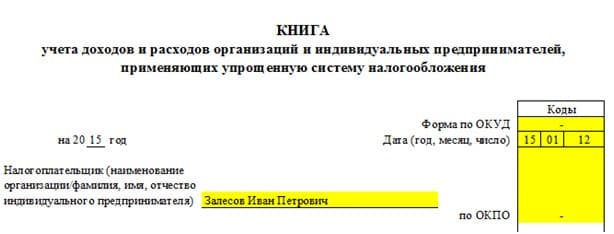

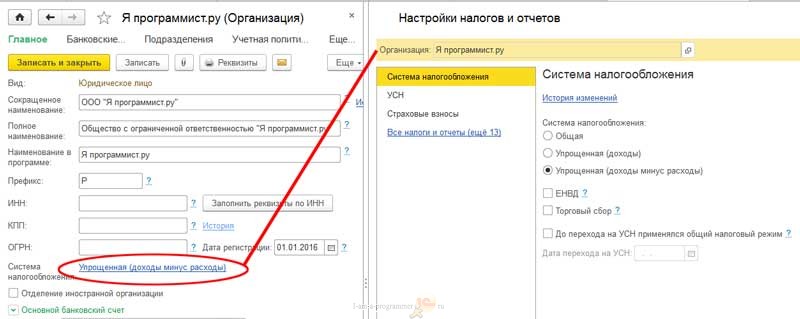

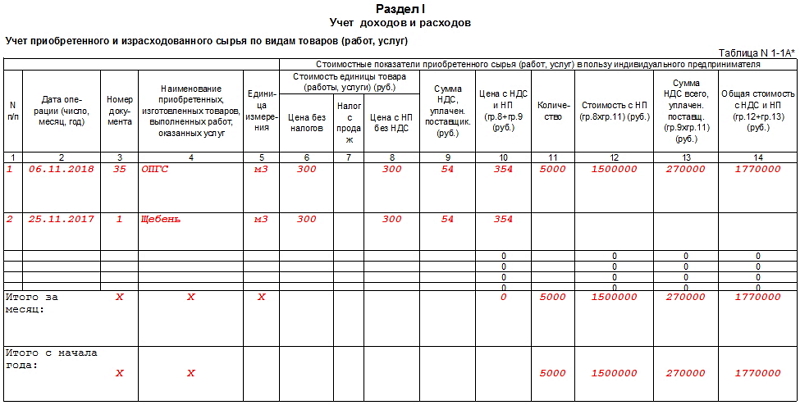

What is KUDiR and how to fill it in?