Bookmarked: 0

In today's world, cash is being replaced by plastic cards. Using "plastic" in many situations is much more convenient, and Internet banking makes it possible to pay any bills. Therefore, the phenomenon of a salary project for entrepreneurs has gained popularity.

What it is

Many are interested in what is a salary project? This is a contract concluded with the bank, under which the organization or entrepreneur has the opportunity to transfer the salaries of their employees to plastic cards.

Initially, large industrial enterprises were provided as part of the salary project, but the development of the banking sector led to the availability of services for legal entities and private entrepreneurs.

Financial regulators offer comfortable conditions for a salary project, which can be compared on the websites of banks. However, they do not tie the provision of services to the number of employees in the enterprise. There is even the opportunity to apply for a Sberbank salary project for entrepreneurs without employees.

Banks want to expand the circle of potential customers and focus on servicing employees of a particular organization or individual entrepreneur.

The essence of the salary project is to issue a debit plastic card (most often at the expense of the organization) and transfer salaries of employees to it.

Such an opportunity is enshrined in labor law and may be displayed in an employment agreement with employees or a collective agreement.

All leading banks of the country offer a service. To receive it, it is enough to conclude an agreement with a credit organization on providing support for employees' salaries.

When drawing up the contract you need:

Pros for employees

Participants in salary projects face the pros and cons of services.

Benefits for employees who receive a card as part of a payroll project:

On the video: Bookkeeping 3.0, lesson number 32 - payroll on cards

An employer who decides to apply for a payroll project receives:

What do banks get

Credit organizations that provide online salary project services also remain in positive territory:

- customer base is growing. This promises an increase in credit projects, since for the financial regulator the risk is minimal;

- employees' money transferred to the account remain intact until a certain time, which allows the bank to manage it;

- if an individual entrepreneur conducts business online, the salary project will include payment of a commission to the bank, a monthly fee and other fees stipulated by the contract.

Documents for the transition to a similar pay scheme

To receive the “salary project for individual entrepreneurs” service, a statement is required from each employee of the organization expressing a desire to receive the money earned on a plastic card. Additionally, a copy of the passport is required.

When concluding an agreement with each employee, instructions for an accountant include notification requirements on the rules for using “plastic” and the cost of all the main types of operations included in the register of a salary project.

The obligation in the preparation of the contract for the salary project of Sberbank for individual entrepreneurs is to provide:

- company charter;

- full list of employees. The salary project for entrepreneurs without employees excludes this point. It will be enough to provide an entrepreneur's passport;

- other documents at the request of the bank. Their list is not fixed by law and is determined by the credit institution on their own.

Bank Offers

Almost every major bank in the Russian Federation offers services to support the salaries of employees of an organization or individual entrepreneur.

Some credit organizations are developing plans for budgetary institutions, others suggest installing ATMs in the companies office.

Each bank tries to attract a potential customer with a unique offer.

leading three banks:

- Sberbank salary project. The largest bank in the country offers support for the movement of funds within large organizations, public sector enterprises or individual entrepreneurs. Sberbank provides the opportunity to receive an international plastic card serviced in all branches of the bank. After six months of using the card, the client gets the opportunity of a simplified procedure for issuing a credit card or a loan on preferential terms. Very often, an employee is not required to write a statement. Sberbank salary project involves a visit of a bank employee to the organization to draw up the necessary documents. Top managers and company heads can order premium cards under the contract. The cost of servicing a Sberbank Gold card is 3,000 rubles. for the first year.

- VTB24 salary project. Visa and Maestro cards are offered for participants. VTB Bank, whose salary project is subject to a 0% commission, offers Esq. At a reduced rate - only 1.64%. When connecting the service, you can open your personal account and conduct operations using the 3D secure technology. To order a service, you must call the hotline. Paperwork takes no more than 7 days.

- Salary project Alfa Bank. This is a comprehensive solution designed to simplify the procedure for calculating and paying salaries as much as possible, which is confirmed by the reviews of employees receiving money on the cards of this bank. The salary project rate is flexible. The Bank offers the absence of limits on cash withdrawals at ATMs during the day, individual service tariff plans, and the absence of hidden fees.

Other credit organizations

In addition to the main players in the financial arena, there are smaller regulators offering to use salary card issuing services:

- Tinkoff Salary Project. Another successfully developing bank conducting its online business is the "brainchild" of Oleg Tinkov. Reviews about the salary project are only positive. The bank offers card issuance absolutely free of charge, with zero commission for cash withdrawals and delivery of issued plastic to the specified address. One of the “chips” that the bank offers is a cashback to the card in the amount of up to 30% and 7% per annum on the balance on the card account. Round-the-clock technical support will help to resolve any issue.

- Russian Agricultural Bank salary rate. A tool to accompany salaries, not only for state employees in the agricultural sector, but for everyone who wants to receive benefits and convenient rates. The official website of the bank invites you to familiarize yourself with the terms of issue and maintenance of "plastic."

- Salary project world. As part of the creation of the national payment system, it was decided to launch the MIR brand, aimed at ensuring the movement of funds among public sector employees. Starting in 2018, at the initiative of the government, state employees will be obliged to pay only with the MIR salary card.

- Salary project discovery. A “young” bank offering its own version of the salary project service. Instructions for opening a card and drawing up a contract are provided on the website. A positive difference between the offer and the Discovery is the delivery of "plastic" to the house and the complete absence of a commission for withdrawing, and servicing a card account.

- Project from Europe Bank. Another small bank, which makes it possible to arrange support for the salaries of IP employees. A credit institution offers a number of advantages: issuing premium segment cards for executives, connecting SMS-information services. Another plus that gives a salary project is a loan on favorable terms. Accountants' reviews confirm the high quality of service at Credit Europe Bank.

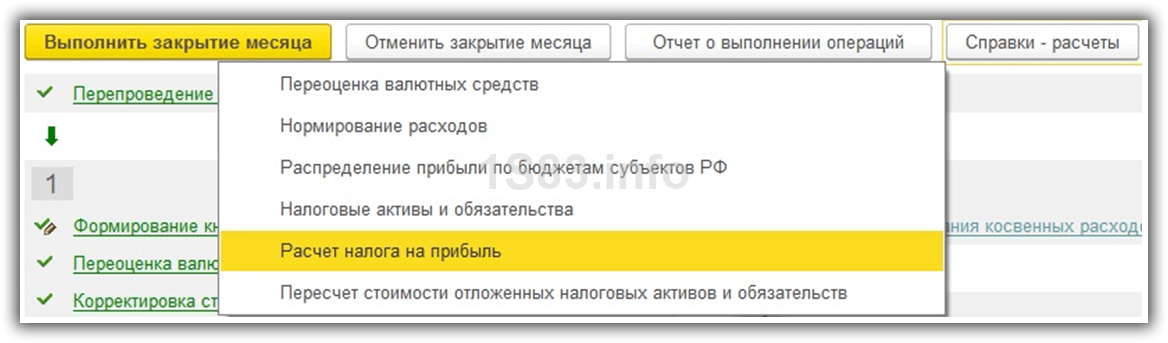

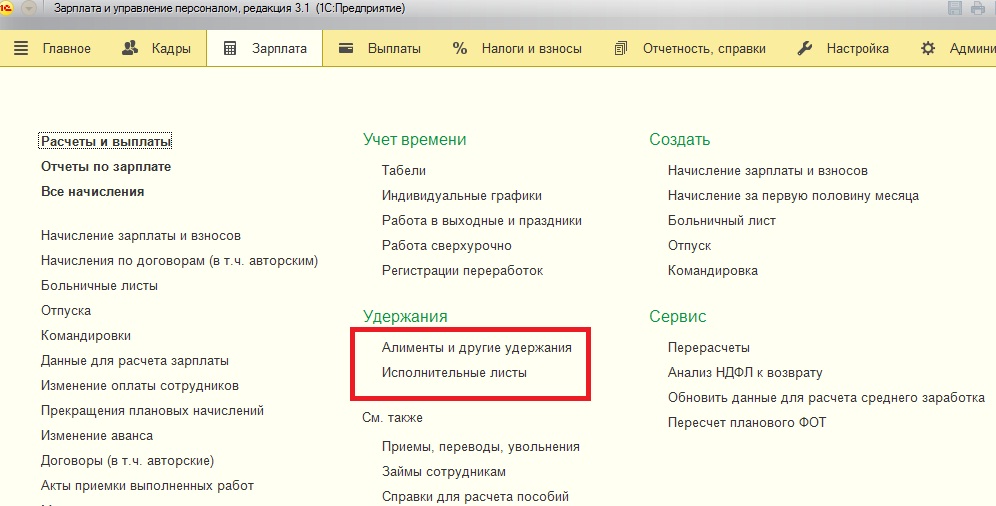

Setting up project software support

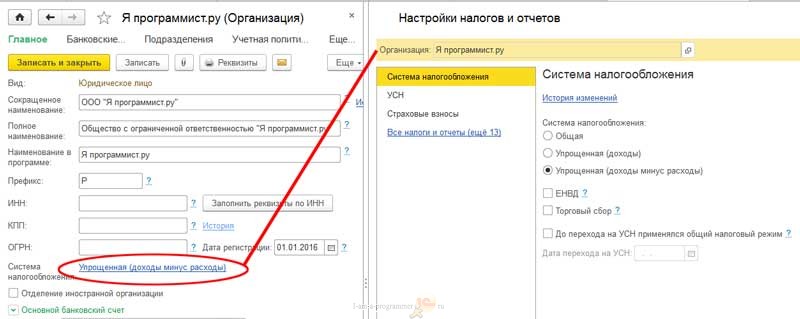

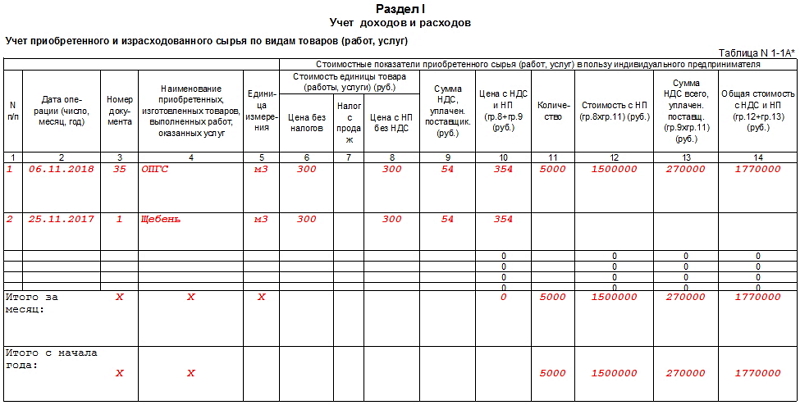

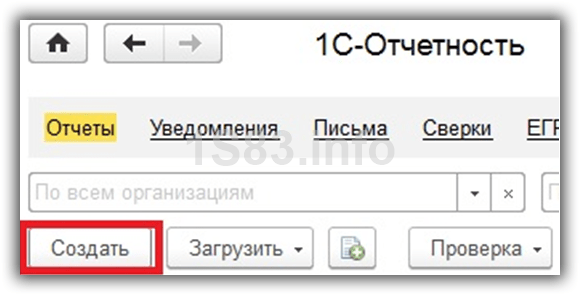

The availability of software to simplify accounting allows you to conduct a salary project in 1s. The program supports the possibility of accruing employee benefits, transferring the required amount to the bank, and maintaining electronic document management.

The salary project in 8.3 (the latest version of the program) allows you to pay salaries and manage personal data of each employee.

To set up, you need to enter the "Payments" menu and create a new payroll project.

Instructions for the accountant are in the documentation for the software.

First you need to fill in the bank details, selecting it from the drop-down list or entering all the data manually. When using the electronic document management procedure, this fact should be indicated in the settings. After filling in the required fields, the created file must be saved and closed.

On video: Salary plastic card entrepreneur

Source: https://biznes-prost.ru/nuzhen-li-ip-zarplatnyj-proekt.html

What conditions can offer a salary project of Sberbank

Sberbank is one of the largest banks in the country. In terms of the coverage of issuing cards for transferring salaries, he also holds a leadership position.

450 thousand companies they have already entrusted their finances to the bank, including, they have decided the issue of settlement with employees.

One of the advantages of crediting money to pay salaries through Sberbank is simplicity in formation registry and short terms of transfer finance on a payment card.

Project terms

Sberbank's salary project is a contract of two organizations. On the one hand, a banking structure, on the other, an individual entrepreneur.

The corporate client agrees to submit to the bank a register with the data of employees, accounts and amounts for crediting on time.

In turn, the bank undertakes to promptly transfer the amount of money to the bank payment cards of employees.

All actions are carried out. in remote mode. The expected banking time is 90 minutes. But as a rule, enrollment occurs within 10 minutes.

First of all, to connect the services, it is necessary that the corporate client is registered in the Sberbank Business Online service. After signing the contract, a new section is activated in your account.

To test the operation of the service, two experimental transactions are made.

Sberbank Salary Project - Tariffs for Legal Entities

Cooperation of legal entities and individual entrepreneurs with Sberbank makes it possible to use such projects offers:

- Settlements with employeescash and cashless transactions;

- Crediting Amounts to a bank card;

- Cashing Your Own Money;

- Opportunity carry out operations remotely through the Internet service.

Registration of the contract is in progress for a fee. The cost of servicing the project depends on the amount that will be transferred monthly through the Internet service.

If the corporate client uses additional services, then loyalty programs could be organized for him.

For corporate users, salary transfers are organized on such conditions:

Tariffs and conditions for the provision of services may vary depending on the turnover of monetary amounts and the connection of additional services.

If an employee of the company wishes to receive an individual card, then the commission on it will be explained personally by the bank employee.

Offers for SP without employees

Legislatively stipulated that an individual entrepreneur cannot pay wages for himself.

Often, the registration of a service for crediting wages is a tool for transferring funds of IP to the card of an individual.

This is more beneficial for the account holder, as it is one and the same person.

The income of a businessman is transferred through an account opened for crediting salaries. Sberbank salary project for entrepreneurs without employees allows you to reduce the commission for transferring money up to 0.3%.

Banking operation is carried out through sberbank Online service - a salary project for small businesses. To withdraw funds, the entrepreneur independently creates a register for admission. The payment belongs to the category " other payments».

Benefits for payees

If an organization becomes a client of Sberbank for transferring money to pay for labor, then its employees and accounting become the owners of a number of advantages.

Sberbank salary project - instructions for the accountant:

First of all, accounting can use simplified payroll procedure.

Accrued funds are transferred to a bank payment card.

There is no need to keep a large amount from the bank in the organization, to ensure their safety and organize the issue to employees.

It remains for the accountant payroll, work with taxes, drawing up statements for the bank. According to the payroll data, funds are transferred to the payment cards of employees.

What is debt restructuring and how to arrange it? The answer is here.

What are bonuses Thank you from Sberbank and how to use them: bigbinary.ru/money/other/spasibo-ot-sberbanka.html

In addition, you can organize the transfer of wages through Sberbank without opening a current account.

Business accountants have another advantage. This is an opportunity to transfer funds independently through your personal account. And also perform a number of other procedures online.

To enter your personal account there is a username and password that the accountant receives when connecting this service.

Sberbank card - it is profitable and convenient for both corporate clients and individual users.

: advantages of using a salary project from Sberbank

Source: http://bigbinary.ru/money/other/zarplatnii-proekt-sberbank.html

How to organize a salary project in an organization?

Want to minimize the costs of cashless payments with employees? You will need to draw up an agreement with the bank and open subordinate card accounts to transfer money.

The terms of such an agreement should be beneficial not only to the company, but also to the employee. Otherwise, he may require transfers through another financial structure, and the law will be on his side.

What it is?

Salary project is one of the ways of cashless fulfillment of obligations to employees.

Under this scheme, the company selects a credit structure for performing operations related to the issuance of remuneration, assumes all associated costs and resolving organizational issues.

To transfer funds to the name of each employee, an account is opened and a plastic card is issued.

Why and for what is needed?

The implementation of the salary project is, first of all, the reduction of the organization's costs associated with the issuance of salaries.

This may include:

- streamlining the workflow and work of the accounting settlement group;

- reduction in cash transportation costs;

- saving of working time, since there is no need to separate subordinates from the performance of immediate duties.

The transfer of wages from the company account in favor of individuals who are clients of the same credit structure is carried out in accordance with the terms of the agreement concluded with the bank:

- money is sent by the total amount by the payment order of the organization;

- accrual of employee benefits is reflected in the register, which is provided to the financial institution no later than the day following the transfer of instructions on the operation;

- based on the data contained in the received statement, the funds will be posted to the card accounts of employees;

- the register must contain the name of each employee, the details of his account, the amount to be credited, the signatures of authorized persons and a seal imprint;

- if the credit institution does not receive the necessary lists within the time frames indicated above, it will not be able to pay the salary and will return the money to the company within five days after receiving the payment.

Advantages and disadvantages

The attitude to salary projects of banks from the side of business is very ambiguous. This is due to the fact that the conditions of cooperation depend on many parameters and therefore are determined individually.

For the bank

To date, an agreement on crediting salaries to card accounts of employees cannot be classified as independent financial products that bring profit to a credit institution.

Rather, it is a tool to attract retail customers with a predictable level of regular income.

Thus, the salary project gives the bank access to a large amount of information. This allows you to make adequate proposals and calculate risks, which is of particular value to financial institutions.

They, in turn, are ready to make every effort to attract new organizations to cooperation.

This may include:

- zero commission for enrollment;

- free card service;

- soft loans;

- lack of requirement to open an account;

- connection of companies with a small staff (from one person).

For the enterprise

For a company, a salary project is an opportunity to save time and money:

- salaries for employee cards are sent without commission;

- no need to collect a huge amount of payments;

- no need to store and transport large amounts;

- you can get a loan on favorable terms;

- conveniently pay with employees who are not in the office.

As the weaknesses of the centralized payment, the heads of organizations call the following:

- additional costs for the production and maintenance of plastic;

- disagreement of subordinates to join the payment system chosen by the company;

- the probability of the bank refusing to prolong the agreement for next year.

For staff

Employees pay attention to the product properties of the cards and the general parameters of the banking service.

Therefore, the presence of pluses and minuses is evaluated depending on a number of conditions:

- plastic category;

- number and availability of terminals;

- cash-back;

- interest on the balance;

- cash withdrawal fee;

- availability of information;

- internet bank;

- preferential offers for other products of the financial structure.

How to arrange and organize a salary project in 2018

A good cashless settlement scheme with employees should solve two important needs of the company:

- cost savings;

- simplification and transparency of business processes.

To achieve the goal, it is necessary to competently approach the choice of a product and comply with the norms of the Labor Code of the Russian Federation.

What do you need?

According to the law, the payment of salaries to employees by transferring funds to a bank account must be fixed by local acts of the enterprise.

If this condition has not yet been spelled out, it should be added to the collective agreement, or an additional agreement to the labor agreement should be drawn up.

In addition, you will have to prepare regulations for the use of cards and make changes to the accounting policy.

Transition stages

In order to avoid mistakes, when applying for a payroll project, you must adhere to the following algorithm:

- issue an order on the issue of remuneration for the performance of labor functions by non-cash means;

- obtain the written consent of each employee;

- make appropriate records of payment through a bank account in the local acts of the organization;

- conclude an agreement with the credit institution on operations to credit employees' cards.

Bank Documentation

To draw up a contractual relationship with a financial institution, you need to submit a package of documents:

- a list of persons whom the company trusts to transmit to the bank salary information (in paper and electronic form);

- a list of employees authorized to certify the records for admission, with examples of signatures;

- register of employees;

- card agreement;

- statement of commitment of each subordinate;

- certified duplicate identity cards of subordinates;

- reward schedule.

Conclusion of an agreement

For the practical implementation of the project, the head of the company must sign an agreement with the bank that establishes the procedure for servicing the operations of transferring salary funds to the card accounts of employees.

The form of the document is usually provided by the financial structure.

Cost and service features

Today, in the lines of many banks you can find products with a minimum commission. The purpose of such offers is to attract customers. At the same time, users of salary projects have to bear some costs.

Such expenses are attributed to others and transferred by separate order.

For example, at the expense of the organization, the following is paid:

- production and maintenance of cards;

- reward to the bank for transferring money to the accounts of employees.

The employee, for his part, can only spend money on cash withdrawals from a third-party ATM.

Registration in the organization

After concluding an agreement with a credit institution, an account is opened and a card is issued for each individual participating in the project.

The management of the company, in turn, is obliged to issue an order to introduce a new scheme with an indication of the start date of its operation.

Sample order:

Employee Notification

The Labor Code of the Russian Federation establishes the obligation of the employer on the day of transfer of salary to submit to each subordinate a pay slip containing the following information:

- salary components in the corresponding period;

- other accrued amounts;

- deductions made;

- amount of funds to be issued.

Are employees statements necessary or not?

According to the current legislation, the organization of settlements with employees in non-cash form is impossible without their consent.

Therefore, written confirmation of such an agreement is mandatory and must be submitted to the bank along with a package of documents.

The process of crediting funds to cards

To transfer a salary, an accountant needs to take several steps:

- prepare a payment for the total amount and send it to the bank;

- compile a salary register, certify and transfer it to the financial structure serving the operations, in paper form or via telecommunication networks;

- funds will be posted to accounts according to the statement no later than the next day.

Accounting entries

The transfer of remuneration for the performance of labor functions to employee cards is reflected in the account in this way: Debit 70 Credit 51.

How to add a new employee?

If a newcomer has appeared in the organization, then in order to join him to the current cashless payment scheme, you will need:

- get the written consent of the employee;

- open an account for him and issue a card;

- include the necessary information in the registry.

Do I need to be reflected in the employment contract?

On the basis of Article 72 of the Labor Code of the Russian Federation and Article 136 of the Labor Code of the Russian Federation, the following clauses must be included in a labor or collective agreement:

- on the introduction of cards;

- on transferring a salary to a bank account.

Dismissal situation

In case of termination of the contract with the company, the employee has the right to continue to use plastic, provided that he will bear all the associated costs on his own.

Questions

Today, employees of many organizations have become participants in salary projects.

Trying to attract new customers, banks offer products on various conditions, which leads to misunderstanding. Some of the problems users encounter are listed below.

Is it possible to apply for individual entrepreneurs, including without employees?

In the employment contract concluded between the individual entrepreneur and his employee, you can add the possibility of cashless payments and in the future to organize a salary project.

If an individual entrepreneur carries out activities on a single person, then he can use this scheme to reduce the commission.

In this case, the register is formed indicating the purpose of the transfer, as Other payments.

Is it profitable to draw up with a large staff turnover?

If you choose a product with free maintenance and card issuance, you can avoid unnecessary costs and save.

Is it possible to pay dividends through such a project?

Shareholder income in the distribution of profits is not considered a salary.

Such a translation is a violation of the norms of the Labor Code of the Russian Federation.

At the same time, if you make the necessary changes to the employment contract and receive the corresponding application from an individual, then the specified action will become quite acceptable.

What is “other payments” in the project?

These are not salary transfers in favor of employees or their dependents, for example, benefits, compensation.

Can an employee refuse a card?

Legislation allows an employee to independently choose the method of receiving remuneration.

Can I get it for free?

In the product line of some credit institutions, such conditions are presented.

How can organizations refuse to work in a project?

The procedure for termination of the contract should be spelled out in one of its paragraphs.

Is it possible to organize in several banks?

Yes, if it is possible to conclude appropriate agreements with different credit institutions.

Who pays for card service?

While the employee is listed in the organization, it takes care of all the costs.

reference Information

To choose the most profitable salary project, several parameters must be taken into account:

- connection cost;

- amount of commission;

- reduction in labor costs;

- internet service availability;

- additional bonuses.

Moreover, credit institutions themselves, considering potential customers, in most cases select an individual work scheme, evaluating, first of all, the size of the wage fund and the number of employees.

Bank Terms

The proposals of financial institutions are most easily systematized according to the following characteristics:

- card issue price;

- annual maintenance costs;

- soft loans and additional fees.

top projects (comparison table)

Of the many products on the market, you can pay attention to some of the most interesting and make a decision based on the characteristics of the company and the needs of its employees.

Sberbank is one of the largest banks in the country. In terms of the coverage of issuing cards for transferring salaries, he also holds a leadership position. 450 thousand companies they have already entrusted their finances to the bank, including, they have decided the issue of settlement with employees. One of the advantages of crediting money to pay salaries through Sberbank is simplicity in formation registry and short terms of transfer finance on a payment card.

Sberbank's salary project is a contract of two organizations. On the one hand, a banking structure, on the other, an individual entrepreneur. The corporate client agrees to submit to the bank a register with the data of employees, accounts and amounts for crediting on time. In turn, the bank undertakes to promptly transfer the amount of money to the bank payment cards of employees.

All actions are carried out. in remote mode. The expected banking time is 90 minutes. But as a rule, enrollment occurs within 10 minutes.

First of all, to connect the services, it is necessary that the corporate client is registered in the Sberbank Business Online service. After signing the contract, a new section is activated in your account.

To test the operation of the service, two experimental transactions are made.

Sberbank Salary Project - Tariffs for Legal Entities

Cooperation of legal entities and individual entrepreneurs with Sberbank makes it possible to use such projects offers:

Cooperation of legal entities and individual entrepreneurs with Sberbank makes it possible to use such projects offers:

- Settlements with employeescash and cashless transactions;

- Crediting Amounts to a bank card;

- Cashing Your Own Money;

- Opportunity carry out operations remotely through the Internet service.

Registration of the contract is in progress for a fee. The cost of servicing the project depends on the amount that will be transferred monthly through the Internet service.

If the corporate client uses additional services, then loyalty programs could be organized for him.

For corporate users, salary transfers are organized on such conditions:

Tariffs and conditions for the provision of services may vary depending on the turnover of monetary amounts and the connection of additional services.

If an employee of the company wishes to receive an individual card, then the commission on it will be explained personally by the bank employee.

Offers for SP without employees

Legislatively stipulated that an individual entrepreneur cannot pay wages for himself. Often, the registration of a service for crediting wages is a tool for transferring funds of IP to the card of an individual. This is more beneficial for the account holder, as it is one and the same person.

The income of a businessman is transferred through an account opened for crediting salaries. 3 sberbank payment plan for entrepreneurs without employees allows you to reduce the commission for transferring money up to 0.3%.

Banking operation is carried out through sberbank Online service - a salary project for small businesses. To withdraw funds, the entrepreneur independently creates a register for admission. The payment belongs to the category " other payments».

Benefits for payees

If an organization becomes a client of Sberbank for transferring money to pay for labor, then its employees and accounting become the owners of a number of advantages.

Sberbank salary project - instructions for the accountant:

First of all, accounting can use simplified payroll procedure. Accrued funds are transferred to a bank payment card. There is no need to keep a large amount from the bank in the organization, to ensure their safety and organize the issue to employees.

It remains for the accountant payroll, work with taxes, drawing up statements for the bank. According to the payroll data, funds are transferred to the payment cards of employees.

For representatives of small business, Sberbank payroll cards are a great opportunity to save on the work of a cashier.In addition, you can organize the transfer of wages through Sberbank without opening a current account.

Positive points receiving salaries for company employees through bank cards:

Positive points receiving salaries for company employees through bank cards:

- possibility get cash at any time after accrual at a convenient time and at any ATM;

- a sufficient amount aTMs operating without commission;

- opportunity to take off any amount of money at any time;

- possibility transfer money without commissions;

- perhaps make cashless payments, pay for purchases on the Internet, pay utility bills, pay taxes;

- attachment " mobile bank"Provides many opportunities for its users;

- after six months of cooperation, the client can get an additional credit card from Sberbank, as well as take advantage of mortgage and consumer loans on preferential terms;

- can do duplicate payment instrument for your family;

- the card can be issued on the condition;

- bank card holders often become members shares and enjoy various bonuses.

Business accountants have another advantage. This is an opportunity to transfer funds independently through your personal account. And also perform a number of other procedures online. To enter your personal account there is a username and password that the accountant receives when connecting this service.

Sberbank card - it is profitable and convenient for both corporate clients and individual users.

Video: advantages of using a salary project from Sberbank

Sberbank salary project is a popular and demanded service. Clients of a credit institution appreciated the advantages and convenience of settlements. Among other things, along with a salary card, a client gets access to remote services of the bank and other privileges from a credit organization. Making a salary project can be done by both the employer and individuals themselves.

But often the bank independently offers its customers, owners of settlement accounts, to use this service. Moreover, such proposals come even if the individual entrepreneur does not have full-time employees. Of course, this can confuse and arouse suspicion. In this article, we answer the question of whether it is possible to use the Sberbank salary project service for entrepreneurs without employees, what is the catch.

Why do we need banking services for entrepreneurs

In fact, obtaining the status of an individual entrepreneur does not make him a legal entity, respectively, he is still an individual, but with a special status. Therefore, on the basis of the current legislation, monthly earnings are accrued to him in accordance with an employment contract in which two parties participate: the employer and the employee. As for an individual entrepreneur who does not have full-time employees, he is at the same time both an employer and an employee, and he can’t independently calculate wages for himself.

From the foregoing, one can come to the conclusion that a salary project for an individual entrepreneur, if he does not have employees, is not needed. But in practice, this is not quite true, then we will try to understand this issue in more detail.

Is it possible to draw up a salary project without employees: legal grounds

In fact, a salary project is a banking product, in accordance with which a credit institution regulates the procedure and design features of this service. But as for Sberbank, it does not have a definition for the minimum number of employees in the enterprise, respectively, as part of a salary project, an individual entrepreneur can use it. True, with the only peculiarity that, after submitting an application to the bank, the credit institution opens a salary card and a personal account for it, which will receive funds from the current account on a personal application and on behalf of the individual entrepreneur.

Profitable or not

Probably, most individual entrepreneurs believe that if there are no employees in the state, there is essentially no need to use the Sberbank salary project. But in reality, in practice, this is not so: in order to receive money for consumer needs, he is still forced to report this to the bank and sign documents. In addition, in this option, problems may arise with the tax inspectorate, because the movement of funds in the current account is monitored by regulatory authorities. Therefore, when transferring large amounts, they can be taxed at a rate of 13%. And the bank, in turn, will charge a commission for each transfer of 3% or more.

If an individual entrepreneur uses the salary project service, then he receives several advantages at once from Sberbank. Namely:

- his income will be transferred to a debit card, from which it will be possible to withdraw cash free of charge at any ATM of Sberbank;

- together with the card, the entrepreneur gets access to the personal account in the online system and the mobile bank, with the help of which it will be possible to effectively track their accounts;

- for transferring wages to a debit card, a commission of only 0.3% is charged for the operation;

- holders of salary cards, including individual entrepreneurs, receive from Sberbank preferential credit conditions: consumer and mortgage;

- holders of salary cards can take part in the bonus program Thank you and receive cashback for their expenses.

How to apply for a salary project at Sberbank if there are no employees

As a rule, Sberbank independently offers its customers to use the service, and as part of a personal offer. It will only be necessary to follow the instructions from the manager of the credit organization. But at the same time, individual entrepreneurs can initiate such a process on their own. They will need to go through just a few steps, namely:

- go to the official website of a credit organization, fill out an application for participation in a salary project;

- according to the contact details indicated in the questionnaire, the manager of the credit organization contacts the potential applicant and sets up a personal meeting;

- in the bank branch, an employee advises on connecting to a salary project service and offers to sign an agreement;

- within the framework of the salary project, the applicant must choose the type of plastic card to which the income will be transferred;

- the entrepreneur will be required to transfer the payroll sheet and other documents to the bank.

After the bank card is ready, it should be obtained at the bank branch, and with it the service contract. Based on the statement, the bank will debit the money from the entrepreneur’s bank account and transfer it to the plastic card account.

Please note that when applying for a bank from an individual entrepreneur, an extract from the Unified State Register of Individual Entrepreneurs, a passport and a tax registration certificate will be required.

Terms of Service

Probably, an individual entrepreneur, especially if there are no employees in the staff, is thinking about whether he should use a salary project if he can legally transfer money from a current account to his personal card. But it is worth noting here that the benefit really exists, because within the framework of the salary project, the commission fee for the operation is 0.3% of the transfer amount. And if you transfer funds directly to a personal card, then the commission increases, and will be from 1.12%, but not less than 115 rubles.

In addition, within this service, an individual entrepreneur can choose a plastic card with a reduced cost of service. Entry-level cards are provided in the first period at a rate of 0 rubles, from the next period their cost increases to 300 rubles per year. A visa or MasterCard Classic will cost 750 rubles per year.

As you can see, the Sberbank salary project for entrepreneurs without employees is a completely standard procedure. Each entrepreneur independently decides to use the service or not, but at the same time there are several advantages. In addition, from the side of the law, transferring funds from a current account to the personal needs of an individual entrepreneur is not a wrongful act.

Sberbank is recognized as the first institution in the country to implement a salary project. Now this program is used by most organizations - nevertheless, the advantages of this method of remuneration are significant. This is especially true for individual entrepreneurs - there is no need for additional activities and maintenance of unnecessary equipment. However, there are certain nuances even if the individual entrepreneur does not have employees.

Is there a need for entrepreneurs to draw up a salary project

Sberbank salary project is an effective option to achieve full optimization for individual entrepreneurs and legal entities. With it, you can provide a significant simplification of the procedure for paying salaries. In addition, other advantages are available to project participants that contribute to a clear increase in the organization's performance.

Is it possible to become a participant in a salary project in case of entrepreneurs without employees

The Ministry of Finance of the Russian Federation has already repeatedly covered that an individual entrepreneur has no right to accrue and pay salaries to himself. However, it is not uncommon when an entrepreneur uses a salary project even if there are no employees in his subordination. This is due to the fact that with the help of this service it is possible to achieve a reduction in interest when transferring money from an IP account to an individual’s card.

Judging by the reviews, the Sberbank salary project for entrepreneurs without employees involves a reduction in commission fees to 0.3%.

Advantages of the program for small / medium business owners

The program under consideration has considerable advantages in relation to representatives of small and medium-sized businesses:

- a significant simplification of the procedure for providing wages to employees of the organization. For example, there is no need to transport funds, allocate equipment and premises for their storage;

- there is no need to spend time on issuing a salary to each employee - this is especially true for large companies;

- accounting removes a significant layer of unnecessary activity;

- small businesses can save on cashier pay;

- securing document flow with the bank;

- allocation of premium cards to the management;

- help with 1C software;

- the ability to check the status of processing documents and transferring money to the cards of individuals in online mode.

Among other things, a legal entity may receive the additional function “Bank at work”. According to it, representatives of a financial institution arrive at the organization for on-site consultations.

How to become a member of a payroll project

Cooperation between IP and Sberbank is carried out on a contractual basis. To gain access to the salary project, the applicant will have to ensure that his own candidacy meets the requirements.

Existing conditions

The Sberbank project takes into account individual conditions both for those who have a cash register and without them. In particular, the following preferential rates are provided:

- lack of commission for issuing and servicing a card;

- cash withdrawal without charge within the established limit;

- the possibility of obtaining a card with more favorable conditions when applying for a unique tariff plan.

The features of each salary project option can be clarified on the official website of Sberbank.

Connection Order

To gain access to participate in a salary project, you can use one of the following methods:

- visit the official website, familiarize yourself with the options provided and study the terms of provision. Then you should fill out an application and send it through your personal account;

- to personally appear in the branch of Sberbank dealing with issues of legal entities and fill out a request in it;

- provide the necessary information for registration by phone - for this it is enough to contact the bank manager.

After the application is signed, the bank provides the client with all the requested information at the desired rate. Then a bilateral agreement is signed. The applicant sends to the financial institution all the documents that contain the necessary data for each employee. Within 10 days, the bank issues registered cards for each person specified in the application.

What problems may arise

The main problem is the employee’s refusal to receive a new card. Many simply do not want to multiply "plastic", others prefer cash, while others are afraid of setting a credit limit.

As for the obvious disadvantages for the organization, this is the payment of the commission and the need to pay off the obligatory amounts for annual card servicing. However, the alternative losses in the case of using the standard option of providing wages are much higher.

Offers from competitors

In addition to Sberbank, a salary project is provided by almost all the largest banks:

- VTB 24 - Esquiring is offered at a reduced rate;

- Alfa-Bank - flexible tariff plan;

- Tinkoff - free card registration, cashback up to 30%;

- Russian Agricultural Bank - special conditions for agricultural workers.

In general, each institution has its own characteristics, so the applicant will find the necessary conditions for himself without any problems.

conclusions

If we consider the salary project of Sberbank for individual entrepreneurs without employees, then what is the catch of this proposal? In fact, there are no unintended risks in this situation. The entrepreneur is merely pursuing the goal of lowering the commission. For the bank, this moment is permissible in connection with the desire to expand the client base and adjust statistics on the provision of relevant services in the direction of positive dynamics.

It serves more than 1 million organizations of which almost half (450 thousand legal entities) are connected to the salary project.

The opening of a salary project in Sberbank is available not only to enterprises, but also to individual entrepreneurs.

Advantages and disadvantages

The advantages of the Sberbank salary project should be considered by stakeholders.

For employer

The salary project in Sberbank for legal entities and individual entrepreneurs with employees allows you to get the following benefits:

- The service is provided to enterprises with or without a current account in Sberbank.

- Fully remote maintenance (RBS system is provided even without opening a current account).

- Support is available around the clock.

- Payroll occurs within 10-90 minutes.

- Ample opportunities for technical integration.

- If it is necessary to open a settlement account, a bank employee can draw up a contract at your office (the service is free).

- The transfer commission does not depend on the region in which the employee is located (the main condition is the availability of a bank card).

- Leaders may be granted privileges for servicing Gold personal cards (discounts depend on the volume of services consumed and are calculated individually).

- A small fee for transferring RFP.

- With a large number of staff and meeting the requirements for the premises, it is possible to install an ATM on the territory of the outlet.

- If the organization does not maintain its account in Sberbank, a subscription fee will be charged for using the RB system. For connection to it, a one-time payment is also required.

- Cardholders of other banks cannot be connected to the Sberbank salary project. Transfers to their cards will be executed in separate payment orders at an increased commission.

- If the funds required for payroll calculations are made through the cashier, an additional commission will be charged (according to the current tariff under the RCO package, or according to the standard bank commission).

- Tariffs depend on the region of service and are calculated individually (it is difficult to estimate the costs before concluding the contract).

- Special service packages for managers are offered only to large and medium-sized enterprises - with payment funds of 5 and 25 million rubles.

For staff

Sberbank salary package conditions for employees are quite comfortable:

- The Bank has the largest network of self-service devices (about 80 thousand ATMs) and branches (over 14 thousand offices, they are in almost all cities and regions) - most often within walking distance.

- All options for remote maintenance (including applications for all popular mobile platforms, even for Windows Phone) are free.

- A number of cards within the framework of the salary project are serviced for free or at a discount.

- Almost all salary clients have access to the Thank You program (Sberbank's own bonus program).

- Cash withdrawal within the limits without additional commissions, transfer within the region to Sberbank cards is free of charge.

- Cards can be added to Google / Apple / Samsung Pay systems (there are type restrictions).

- Consumer loans and mortgages to users of the Sberbank salary project are provided on special conditions. For example, a loan can be obtained even without visiting the department within a few minutes.

- Depending on the type of payment system and service package, special discounts and promotions may be offered to holders.

- If you already have a bank card, you can connect to the RFP project without reissuing it or opening a new one.

- Interest on the balance is not accrued on salary cards (a separate deposit must be opened).

- On ZP cards there is no possibility of activating an overdraft (at least at the most inexpensive - Electron and Maestro). Only a separate credit card and classic loan are offered.

- World maps, often offered as part of the RFP project, cannot be added to Google / Apple / Samsung Pay.

- Despite the fact that a comprehensive service agreement is concluded with all private clients, it is practically impossible to transfer the issue or even issue reissued cards to another branch.

- You cannot connect third-party bank cards to the project.

For an accountant

Benefits:

- Cards for Sberbank's salary project can be issued centrally (based on an electronic registry).

- The remote service system can integrate with accounting software (for example, with 1C via Direct Bank).

- The online system has a simple and intuitive interface. It takes no more than 10 minutes to download the sheet.

- A sufficient level of security is provided (logging in using a cloud signature as well as using hardware keys).

- The company has a separate manager who can help with many questions.

- Technical support is around the clock (there may be a limitation under the contract).

- You cannot connect third-party bank cards to the project. Such employees will need to make payments by separate payment orders with an increased commission.

- To issue cards, it is necessary to motivate employees to independently arrive at the bank office or the accountant will need to collect an impressive package of documents, which can take a considerable amount of time.

Salary Project Rates

For legal entities and individual entrepreneurs

The cost of servicing a salary project in Sberbank for an organization is formed on the basis of several components:

- Connection fee.

- Subscription fee.

- Percentage of transfers.

- Percentage of enrollment.

If you do not have a current account in Sberbank:

- Connection to the Sberbank Business Online system will amount to 960 rubles. one-time + for each hardware token of 1400 p. (“Cloud signature” with one-time SMS passwords - free of charge).

- The subscription fee for using the RB system is 650 rubles / month.

- The commission from each transfer of salary - 0.1-0.7% (calculated individually based on the region of service, the size of the wage fund and the number of employees). For example, in Central Russia with a staff of 10 people and payroll of 300 thousand rubles. the commission will be about 0.15%.

- Transfer of funds by electronic transfer is free of charge; deposit through the cash desk is 1%.

If an individual entrepreneur or organization already has an account in Sberbank:

- Connection and maintenance are carried out according to the tariffs of a package or contract for a cash settlement (here it is worth separately to stipulate that the project can even be connected to packages from the Easy Start line, where there is a completely free service package).

- The commission from the transfer is calculated from the same principle - 0.1-0.7% (does not depend on the presence of a bank account in the bank).

- In addition to the methods indicated above (transfer / cash desk), funds can be deposited to the account through self-collection (through a business card) - 0.15% (unless otherwise provided by the package).

For workers

Tariffs depend on the cards chosen by the enterprise. The Bank, in turn, offers a large number of different solutions. The most popular are listed below.

|

Operation |

Premium World |

|||

|---|---|---|---|---|

|

Issue / Reissue |

Is free |

Is free |

Is free |

Is free |

|

First Year Service |

||||

|

Service in subsequent years |

||||

|

Cash withdrawal |

Free (within the daily limit) |

Free (within the daily limit) |

Free (within the daily limit) |

|

|

Cash |

Is free |

Is free |

Is free |

Is free |

|

Internet banking and mobile applications |

Is free |

Is free |

Is free |

Is free |

|

Additional options |

Overdraft at 20% |

Overdraft at 20% |

Increased limits for issuing and depositing. No overdraft. |

|

|

Bonuses / cashback |

Up to 0.5% (and from partners up to 20%) of the purchase are converted into "Thank you" bonuses |

Up to 5% (and from partners up to 20%) of the purchase are converted into "Thank you" bonuses |

Up to 10% (and from partners up to 20%) of the purchase are converted into "Thank you" bonuses, special discounts from partners |

The cards are held shares held by the payment system.

Salary project for entrepreneurs without employees

Often, individual entrepreneurs who open an account with Sberbank receive notifications that they have access to the possibility of connecting to a salary project.

This is actually just an automatic newsletter. Using a salary project for entrepreneurs without employees in Sberbank, as in any other lending institution, is pointless.

An entrepreneur can withdraw any funds from his account at any time without any additional reporting and penalties.

The presence of the ZP-project IP for himself does not affect the credit history. For the bank, you will still remain the owner of the business, which means that when issuing loans it will rely on the turnover in your account, and not on transfers under the RFP project.

Cards for a salary project

The Bank offers a wide range of card products, including for ZP-projects.

The most popular cards are:

- classic (payment systems MIR, MasterCard, Visa) - from 0 rubles / year;

- gold (MIR, MasterCard, Visa) - from 0 rubles / year;

- cards with bonuses from Aeroflot (PS VISA, gold or classic - from 450/0 rubles / year, respectively).

There are other suggestions. The size of the commission for annual maintenance and the set of available services, as well as various bonuses and discounts, depend on the selected card.

Loans and mortgages for employees

Compared to regular customers, payroll card holders receive:

- reduced interest on consumer loans (2-1% lower than usual conditions + individual offers);

- reduced mortgage interest (by 0.5-0.7% compared to the rest);

- In addition, in accordance with the size of monthly receipts, salary clients are invited to receive a credit card with a pre-approved limit and a first payment delay of up to 50 days.

The application process is greatly simplified (in some cases, only a passport or application through the online bank is enough).

How to connect / disconnect

To open a salary project in Sberbank without a bank account you will need:

If you have an account in Sberbank, you just need to activate the service (this can be done through the operator by phone or online using the RB system).

To disable the service, you must apply to the service department or download the document through the online service system.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

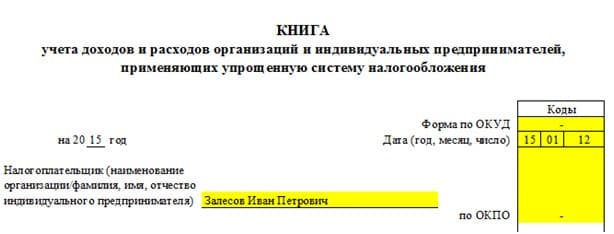

What is KUDiR and how to fill it in?