And this led to an underestimation of the amount of contributions payable. The provisions on amendments to the calculation are contained in Article 17 of the Law of July 24, 2009 No. 212-ФЗ and the Procedure for filling in the calculation of RSV-1 (approved by Resolution of the PFR Board dated January 16, 2014 No. 2p). We will tell in our article about how to make RSV-1 adjustment, whether it is always necessary to take the “clarification list”, and what nuances to take into account when submitting corrective and canceling information for registration.

RSV-1 adjustment: when to file

Correcting errors in the calculation of the RSV-1, you can use one of two methods:

- fill in and submit the updated calculation for the period in which the error was made,

- without handing over the clarification, take into account past errors in the current report of the RSV-1.

What is the deadline for submitting a clarification? The FIU in its letter dated June 25, 2014 No. NP-30-26 / 7951 recommended that the updated calculations be submitted no later than the 1st day of the third month following the reporting period. For example, an updated RSV-1 after 3 quarters can be delivered no later than December 1. For those who did not have time to correct this deadline, the RSV-1 adjustment needs to be done in the current report, in our example, in the annual report. Although, if you follow paragraph 5.1 of the Procedure for filling in the calculation of the RSV-1, you can submit the “clarification” before the deadline for the calculation for the next settlement period, that is, until 1 day of the next quarter. In our case, this period would have lasted until January 1.

When an error is detected before the next reporting period:

- if this led to an underestimation of contributions payable, then an updated calculation of RSV-1 should be submitted, in which the corrected section 6 with personalized information should be present. When filling out the clarification, all sections are filled out completely again, but with the correct indicators.

- if understatement did not happen, then you need to make an adjustment in the calculation of the RSV-1 for the current reporting period, but you do not need to submit a “clarification”.

How to fill out the updated calculation of RSV-1

Suppose, in the submitted report RSV-1 for 9 months of 2016, an error was found - an understatement of assessed contributions for one employee. Before 2016 ends, you need to submit an updated calculation in which:

- in subsection 6.3, we indicate the type of adjustment in RSV-1 “initial”, putting a “X” in the cell, and you do not need to fill in the reporting period and year;

- in subsection 6.4, we correct the amount of payments and the base for accrual;

- in subsection 6.5 we indicate the correct amount of charges;

- in subsection 6.6, data from the initial calculation are transferred, if they were present there;

- in subsection 6.7, if necessary, the payments are corrected, on which doptariff fees are charged;

- in subsection 6.8, if necessary, the data on the employee experience is corrected.

If mistakes are made for several employees, then the corrected sections 6 are filled out for each of them. The remaining information on employees where no errors were identified, also need to be re-entered in the updated calculation. At the same time, the number of packs with accounting information may change, which should be indicated in section 2.5.1.

On the title page we write the serial number of the refinement - “001”, “002”, etc. You should also indicate the code of the reason for clarification in RSV-1, the decoding of which is given in paragraphs. 5.1 p.5 Procedure for filling out the calculation:

- code 1 - clarification regarding the payment of pension contributions;

- code 2 - change in accrued pension contributions;

- code 3 - clarification regarding contributions to the CHI.

How to fill out the corrective RSV-1 if the deadline for the next billing period has already arrived

If an error in RSV-1 for 9 months of 2016 is detected, for example, in January 2017, then the corrected information in Section 6 is included in the calculation of RSV-1 for 2016:

- in subsection 6.3, the adjustment code in RSV-1 is designated as “corrective”, while indicating the reporting period and the year for which the correction is made;

- subsections 6.4 - 6.7 are adjusted by analogy with the updated calculation;

- in subsection 6.8, it is necessary to fill out information about the period of work, because this information will replace the previously specified in the initial report.

In the current calculation of RSV-1, this will include “initial” information for the reporting period for all employees, as well as “corrective” sections 6, filled out only for those employees for whom data from the previous period are corrected.

"Cancellation" adjustment of RSV-1 section 6

The “canceling” correction is indicated in subsection 6.3 if the previously presented accounting information must be completely removed, that is, canceled. For example, a worker who was already fired was mistakenly accrued salary and contributions.

For such employees, only subsections 6.1 - 6.3 are filled out, and in subsection 6.4 you only need to indicate the category code of the insured person. The remaining subsections of section 6 will remain blank.

Please note that you must take the corrective RSV-1 as well as the initial calculation: for the number of insured persons from 25 people or more - only electronically, if the number is less, then you can take the calculation electronically or on paper.

Field inspection of the FSS and PFR | Correction RSV-1

Date: 2018-06-20

Correction RSV-1 in 2018 for 2015-16

After the on-site inspection, according to the notice of elimination of errors and (or) inconsistencies, it is necessary to provide an updated calculation in the form of RSV-1 for 2016 no later than 5 working days, starting from the first day of the month following the month of the end of the quarter in which This Decision shall enter into force

The data for adjusting RSV-1 are specified in the decision on holding the payer of insurance premiums liable

According to the results of the audit, an underestimated base for calculating insurance premiums for mandatory pension and medical insurance in the context of the following employees was revealed, which is subject to additional premiums:

Please note that additional accruals occur for 2015 and 2016, which means that the correction data will be reflected in the individual data, as the table shows the periods: the 2nd quarter of 2015, the 1st quarter of 2016 and the 2nd quarter of 2016, which means as a result, when uploading files to the FIU, we obtain three correction files for individual information information systems and two RSV-1s for 2015 and 2016.

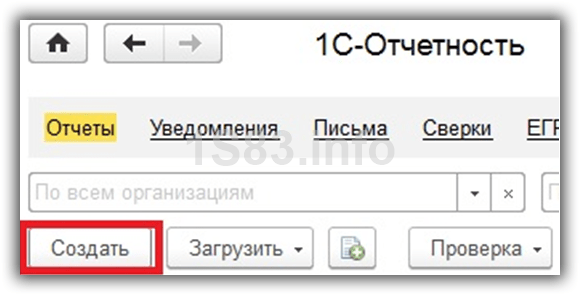

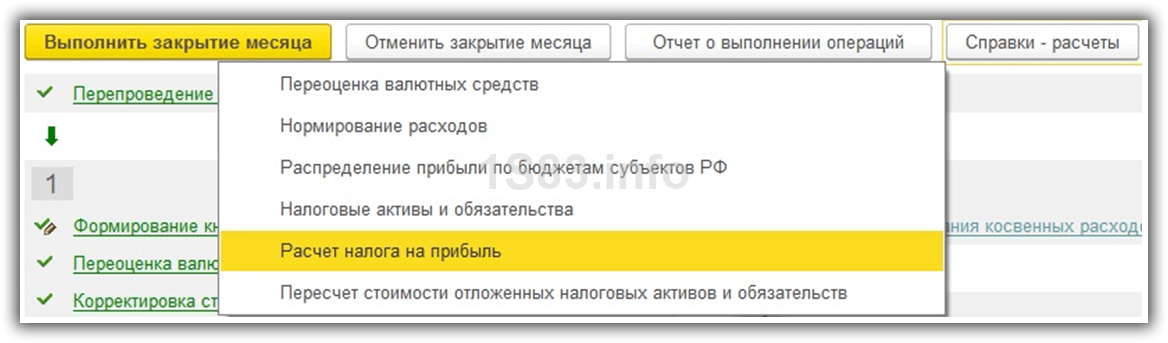

For work, you need the delivered RSV-1 files for 2016, upload them to the program

PU-6 and make an adjustment in RSV-1 for 2016.

The uploaded files fill the RSV-1 report with the data we need:

In fact, we have to reflect all the additional charges in RSV-1 for 2016 on line 120, this line is still empty,

Therefore, we begin to work with individual information: in the list of information we select the employee we need, below we see the source data for the employee for the period, attention to the data in the initial information should reflect the charges that the employee had in RSV-1 without the changes that we want to make now, that is, what was credited to him in the past period. A feature is the receipt of two correction files and two source files for each employee, as indicated at the bottom of the table:

Employee 1, the additional charge must be made in April 2015, which means we set the period for the 1st half of 2015 in the IS, as shown below:

We make an additional charge for employee 1 in section 6.4-6.5, namely for the month of April 2015, and we obtain the following data: i.e. additional charges in the amount of 540-12 rubles were reflected in the program. and the calculation of assessed contributions to the OPS in the amount of 118-83 rubles.

Source data for April show the amount accrued to the employee in April 2015

The initial data for 12 months of 2016 show the amount with additional charges i.e. RUB 40104.00 + 540.12 rubles we get 40,644.52 rubles.

Section 6.6 shows collapsed assessed contributions for employee 1

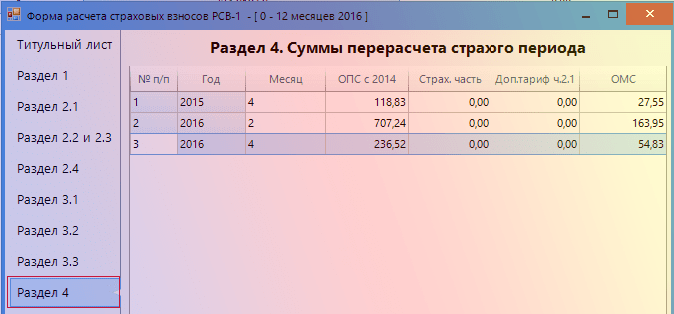

Section 4 forms a summary table for the recalculation of insurance premiums, i.e. the data of table 1 coincides with the data of the 4th section

The line 120 was loaded into the form with the sums of the recount of insurance premiums for the previous reporting periods for TSA and CHI, the data with the table of additional charges for employees agreed:

As a result, we have two corrective RSV-1

We proceed to the formation of packs of unloading, fill as follows:

Packs formed

save

All packs

Upload to the database PU-6

As a result, we get 5 files

We load and prepare for shipment to the FIU through the External Circuit, thus:

Filling in subsection 6.3 "Type of information correction"

section 6 Calculation

Adjustment of individual information for previous periods in the FIU

When completing subsection 6.3:

31.1. in the field "source", "corrective", "cancel" one of the values \u200b\u200bis filled with the symbol "X":

field "source" - information for the first time submitted by the payer of insurance premiums for the insured person.

If the submitted section 6 of the type of adjustment of the "source" information was returned to the payer of insurance premiums due to the errors contained in it, the "original" form is presented in return;

31.2. “corrective” field - information submitted with the aim of changing previously submitted information about the insured person for the specified reporting period.

If the payer of insurance premiums did not change his location and the registration number of the payer did not change, then when filling out subsection 6.3 "Type of information correction" of section 6 of the Calculation, the requisite "Registration number in the FIU in the adjusted period" is not filled.

(paragraph introduced by Resolution of the Board of the RF PF dated 06.06.2015 N 194p)

In case of re-registration of the payer of insurance premiums upon submission of corrective section 6, it is mandatory to fill in the requisite "Registration number in the FIU in the corrected period".

Section 6 with the type of adjustment of the information “corrective” indicates information in full, both correctable (correctable) and information that does not require adjustment. The data of the corrective form completely replace on the individual personal account the data recorded on the basis of the "original" form.

Sections 6 with the correction type of information “corrective” (“canceling”) are presented together with Section 6 the “initial” form for the reporting period in which the error was detected;

31.3. “canceling” field - information submitted in order to completely cancel previously submitted information about the insured person for the specified reporting period.

In case of re-registration of the policyholder upon submission of a canceling form, it is mandatory to fill in the field "Registration number in the FIU in the adjusted period".

In the "canceling" form, the fields for "Type of information correction" are filled in inclusively and the category code of the insured person.

“Cancel” forms are submitted together with the “original” forms for the reporting period in which the error was detected;

31.4. the fields "Reporting period (code)", "Calendar year" are filled out only for forms with the type "corrective" or "cancel".

SBiS ++: Features of filling corrective information in the PF

1. General requirements

1.1 The corrective form SZV-6-1 (2), the type of information - KORR, is created only for those insured persons who previously submitted the incorrect initial form SZV-6-1 (2), the type of information - ISKhD (otherwise there is simply nothing to adjust ) The KORR form completely replaces all the data on the personal account entered earlier by the ISKHD form, therefore the KORR form must contain ALL the correct information filled in, and not just the one that was incorrect and corrected.

1.2 CORR forms for previous reporting periods are mandatory submitted by the policyholder along with ISHD reporting forms for the current reporting period.

In the current reporting period, you can provide corrective information for several previous adjusted periods. When creating a CORR form, the "Reporting period" is indicated, in which the current reporting ISHD forms are presented, and the "Corrected period" for which incorrect information is corrected. Moreover, the adjusted period should be earlier than the reporting period. For example, “Reporting period”: 2012-1, “Adjustable period” - 2010 -2. In this case, along with ISHD forms for the reporting period of the 1st quarter of 2012, CORR forms for the 2nd half of 2010 are presented.

1.3 ISKHD and KORR-forms are accompanied by one common form of ADV-6-2, i.e. a general list of all presented packs, which describes: the name of the pack file, the number of GLs in each pack and the amount of contributions for the packs.

Form ADV-6-2 is divided into two parts:

The upper part for ISHS data for the current reporting period, it shows all the amounts of assessed and paid contributions in the current reporting period, the total line for all ISHS packages is compared with the submitted form RSV-1 for the current reporting period;

The lower part is for KORR information for previous reporting periods, in this part - information about packages with KORR forms: with the amounts of extra and paid contributions for each package, the total non-zero amounts of additional payments and extra payments for all KORR packages should be reduced to the specified RSV-1 form for previous reporting periods.

1.4 In the ADV-6-2 form, in the case of KORP-forms, in the part “Information on corrective (canceling) information” in the columns “Accrued ...”, “Extra paid ...” the difference between the amount of insurance premiums in incorrect ISHD- should be reflected forms and the correct KORR forms, and not the amounts for packs with KORR forms, for this, in the coding program, when generating KORR forms, all ISHD forms previously submitted to the PFR Office of those reporting periods that are now being adjusted should be loaded.

2. Adjustment of information on experience

2.1 If CORR-forms are submitted only because of a change in experience, then KORR-forms must indicate insurance premiums exactly the same as in erroneous ISHD data, both accrued and paid, and the length of service is already correct. In the ADV-6-2 inventory, in terms of information on additional accrued and paid amounts for packs, the values \u200b\u200b0 must be indicated, because the amount of contributions in the wrong ISHD forms and in the correct CORR forms is the same.

2.2 If KORR forms are submitted under the Documentary Inspection Act, then they must be submitted by the deadlines specified in the Act. If the deadline does not coincide with the submission of the report for the current reporting period, then the CORR registration forms must be submitted within the time period specified in the Act before the start of the reporting campaign without ISHD forms. When forming such CORR forms, the reporting period must select the current reporting period, and select the period for which corrections are necessary for the corrected period. When the reporting campaign comes for the current reporting period, it is necessary to generate the current ADV-6-2 inventory taking into account the previously submitted packs of KORP forms.

RSV-1 adjustment in 2016

The numbers of packs with CORR-forms do not change, because they are already registered !!!

3. “Forgot” to submit individual information to the insured person in previous reporting periods

3.1 In this case, in the reporting campaign for the current reporting period, it is necessary to form the ISHS - a form for that past period for one of this forgotten employee, indicating only the experience, without the amount of insurance premiums. Assign this pack a new next number in order. This pack is presented without the ADV-6-2 inventory and will be added to the report (form RSV-1) for the reporting period in which they forgot to submit information to this employee.

3.2. When forming a set of ISHD forms for the current reporting period, it is necessary to form and present in a new separate package the KORR form for this forgotten employee, indicating all the correct data: both length of service and insurance premiums. This CORR-form will replace the ISHD-form, which was presented only with experience. In this case, the ADV-6-2 inventory for the current reporting period should be formed as a general one, according to paragraph 1.3.

3.3 Together with the reporting kit for the current reporting period or earlier, it is necessary to submit updated RSV-1 forms from the past “forgotten” period to the current one, in which the amount of payments and accrued insurance premiums will be increased by the amount of this forgotten employee.

4. Have handed over individual information of the employee to the wrong "alien" insurance number

4.1 In this case, in the reporting campaign for the current reporting period, form the ISHD form for that reporting period to the correct employee insurance number, indicating only the experience, without insurance premiums.

Assign this pack a new next number in order. This pack is presented without the ADV-6-2 inventory and will be added to the report (RSV-1 form) for the reporting period in which information was submitted to this employee with the wrong “alien” insurance number.

4.2 In the current reporting period it is necessary:

Form a cancellation form SZV-6-1 (2) (OTMN form) on a “foreign” insurance number, indicating the correct name of the person whose insurance number was incorrectly used when submitting the report;

Form a KORR form for this employee, indicating all his correct data: both seniority and insurance premiums.

The form of inventory ADV-6-2 shall be formed in accordance with clause 1.3.

In the lower part of the inventory, “Information on corrective (canceling) information”, in the columns “Accrued ...” and “Paid ...” the same values \u200b\u200bof contributions

on OTMN-forms will be indicated with a minus sign (-),

and for KORR forms with a plus sign “+”,

therefore, the totals of this part of the inventory will be zero “0”.

5. Adjustment of premiums

5.1 CORR forms are formed in accordance with section 1.

5.2. The amount of contributions at the bottom of the list of ADV-6-2, “Information on corrective (canceling) information”, shall correspond to changes in contributions in the form of RSV-1.

It should be borne in mind:

If the adjustment of the information is done on the basis of the amounts of contributions assessed on payments to the employee made in the previous reporting period, i.e. if you forgot to tax (excessively taxed) the payments accrued to the employee, it is necessary to submit the updated RSV-1 forms for the erroneous reporting period and further up to the current reporting period;

If in the past reporting period they forgot to accrue payments to the employee or incorrectly accrued and all additional accruals of salaries, including “reversal”, are carried out in the current reporting period,

then the updated RSV-1 forms for past periods do not need to be submitted, because accrual (decrease) of contributions for additional accrued (reduced) payments will now fall into RSV-1 for the current reporting period.

6. Change in tariff and code of the category of PL

(For example, you need to change the report from the category PNED to HP)

6.1 Present the updated RSV-1 forms with the correct assessed and paid contributions according to tariff code 01.

6.2. Create ISHD forms on all ZL with the category category code HP for all reporting periods for which it is necessary to change the tariff, while indicating only the experience (accrued and paid insurance premiums must be zero (0)). Introduce these packs with the new following numbers in order to the FIU Directorate, first of all, without the ADV-6-2 inventory. This information will be linked to the relevant RSV-1 reports.

6.3 Together with ISHD forms of the current reporting period, submit:

6.4 To create a general form ADV-6-2 for ISHD-forms of the reporting current period and all generated in accordance with clause 6.3 of the OTMN and CORR-forms.

In this general inventory of ADV-6-2 in the part "Information on corrective (canceling) information" in the columns "Accrued ..." and "Paid up ..." different similar values \u200b\u200bfor OTMN-forms will be indicated with a minus sign “-”, and for CORR -forms with a plus sign “+”, the total amount will be equal to the sum of the difference in contributions in the new form RSV-1 with tariff 01 and in the old form RSV-1 with tariff 07.

Firstly, in order for the program to correctly calculate taxes and contributions, in July 2016 the documents “Payroll” with negative amounts were created. These documents completely repeated the required cancellation documents, only the date of the document was "07/29/2016" and the amounts were with a minus sign. The document “Calculation of taxes from the payroll” for the month of July issued a lot of postings with negative amounts. Do not worry, this is correct. Next, close July, August, September and proceed to complete the RSV-1 for the third quarter. Now we know how to do it. It will be easier. We create the initial section 6. The data for July and the results for the quarter the program will fill in incorrectly, fill in manually. Next, create an additional section 6 for the first quarter of 2016. And we introduce corrective information on employees. In the field “Including accrued ”the amount will be with a minus. We create section 6 to adjust the second quarter.

Subject: correctional rsv-1 on the act of field inspection

In the current reporting period, it is necessary: \u200b\u200b- to form a cancellation form SZV-6-1 (2) (OTMN form) on a “foreign” insurance number, indicating the correct name of the person whose insurance number was incorrectly used when submitting the report; - form CORR -form for this employee, indicating all his correct data: both length of service and insurance premiums. ADV-6-2 inventory form should be formed according to clause 1.3. At the bottom of the inventory, “Information about corrective (canceling) information”, in columns “Accrued ...” and “Paid ...” the same values \u200b\u200bof contributions from MH-forms will be indicated with a minus sign (-), and for CORR-forms with a plus sign “+”, therefore, the total amounts of this part of the inventory will be zero “0”. 5. Correction of the amount of insurance premiums 5.1 CORR-forms are formed in accordance with section 1.

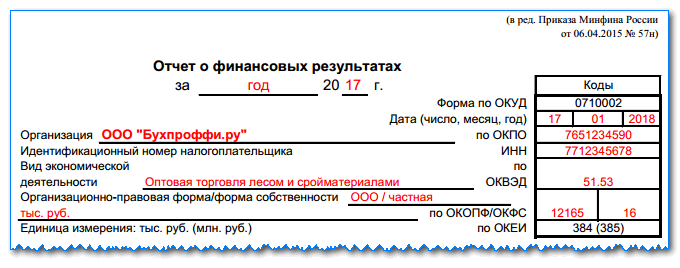

Prednalog.ru

How to make an adjustment to the RSV-1 and submit the update to the FIU? Based on the resolution of the PFR Management Board dated January 16, 2014 No. 2p, Romashka LLC is obliged to submit an updated calculation in the 1st quarter of 2017 in the form of RSV-1. We fill out the title page as follows: in the field “Reporting period (code)” - indicator “0”; in the field “Calendar year” - indicator “2016”; in the field “Update number” - serial number of the update (001 (if the change is made for the first time) , 002 - repeated change, etc.); in the field “Reason for clarification” - indicator “2”. The amount of additional charges in the FIU (2000 rubles) is reflected in line 120 of section 1 and in the corresponding lines of section 4 of form RSV-1.

In subsection 6.2 of section 6 it should be indicated: in the field "Calendar year" - indicator "2017"; in the field "Reporting period (code)" - indicator "3" (1 quarter).

Online magazine for an accountant

In this case, in the reporting campaign for the current reporting period, it is necessary to form the ISHS - a form for that past period for one of this forgotten employee, indicating only the experience, without the amount of insurance premiums. Assign this bundle a new next number in order. This pack is presented without an ADV-list 6-2 and will be added to the report (form RSV-1) for the reporting period in which they forgot to submit information on this employee. 3.2 When forming a set of ISHD forms for the current reporting period, it is necessary to form and submit in a new separate package the KORR form for this forgotten employee, indicating all the correct data: both seniority and insurance contributions. This KORR form will replace the ISHD form, which It was presented only with experience. In this case, the ADV-6-2 inventory for the current reporting period should be formed as a general one, according to paragraph 1.3.

An example of filling out the rsv-1 form with corrective section 6

The type of adjustment is set to “corrective” (in subsection 6.3 “Type of adjustment of the information in section 6) for the reporting periods (until 01/01/2017) in which the amount of insurance premiums has changed. And in subsection 6.2 “Reporting period” of section 6 of the RSV-1 form, the reporting period (until 01.01.2017) is indicated, to which the adjustment is made of the amount of accrued insurance premiums. An example of filling out RSV-1 clarifications At LLC Romashka an on-site inspection was carried out, as a result of which the amount of additional charges in the FIU amounted to 2000 rubles.

This amount was additionally charged for employee benefits P.Rudenko, including: 1300 rubles - additional charges for March 2014; 700 rubles - additional charges for June 2015. The decision to prosecute LLC Romashka entered into force in February 2017.

Upfr in the city of Izhevsk (inter-district) of the Udmurt Republic

For each insured person, a section is separately drawn up, which reflects:

- Name and SNILS physical person (in subsection 6.1);

- the amount of payments and remuneration accrued in his favor (in subsection 6.4);

- the amount of contributions accrued from his payments to the TSO (in subsection 6.5);

- start and end dates of the individual’s work period for the last 3 months of the reporting / settlement period (in subsection 6.8). Based on this information, the FIU will determine the length of service of the employee (paragraph 37 of the Procedure for filling RSV-1).

Subsection 6.6 of the RSV-1 is completed only if you need to enter corrective individual information for this employee (paragraph 35 of the Procedure for filling in the RSV-1). And subsection 6.7 - if you charged contributions from employees at additional rates.

RSV-1 PFR - 2016: sample filling

And just fill it with the necessary data. Then for 3 and 4 quarters. Part of the work is done. Have a rest. And they continued. Click "Show all sections." And proceed to fill out this form. To get started, go to section 4.

Info

Here, for each adjusted month, a separate line should be filled. Moreover, the amounts in columns 6, 7 and 14 may be with a minus sign if the taxable amount has decreased. Be precise, the totals will be transferred to section 1 of lines 120 and 121.

Checking the report data. It can be sent. The second quarter is calm. No additional sections 6 need to be created. Do not forget only in section 4 to repeat all the data that you filled in when preparing the report for the first quarter.

We will still need to look at section 2.1. The third quarter is coming. And here it turns out that many charges made in the first and second quarter need to be canceled.

That is, if some section of the form remains empty for you, for example, section 2.4, which reflects the amount of contributions accrued at additional tariffs, and you should not accrue and do not accrue, then this section should not be presented to you as part of the calculation. Mandatory must be in RSV-1 section 1 and subsection 2.1 of section 2, as well as the title page (paragraph 3 of the Procedure for filling RSV-1). The remaining pages are included in the calculation as necessary.

For this reason, the example below filling out the form of the RSV-1 PFR also does not have all the sections. Thus, the policyholder first fills out the necessary sections in the calculation, and then already puts a continuous numbering on each page. Filling out the RSV-1 report: cover page Filling out the RSV-1, like many other reporting forms, you can start with the cover page.

Corr RSV 2016 on the act of verification example filling

Attention

C Accounting 2.0.65.48) Attention! When filling out the RSV-1 form for the 4th quarter of 2016, the OKVED code of edition 2 is indicated. Consider the extreme situation. When preparing the report for the first quarter of 2016, it turned out that an adjustment was required for all quarters of 2015. Getting down. At first everything is as usual. Create a new report.

Automatically fill source section 6 with data for the first quarter. And now on. We create another section 6. We note that this is “Corrective Information”, and “Corr. the period of the 1st quarter of 2015. " In the list of insured persons, we include everyone whose data must be adjusted.

We fill in the data on a monthly basis for each employee, do not forget to fill in the field “Including additional charge ”, where we must indicate the difference between the previously calculated and the new value. If the amount decreases, the field will be with a minus sign. Next, create another section 6 for the 2nd quarter of 2015.

If KORR forms are submitted under the Documentary Inspection Act, they must be submitted within the time specified in the Act. If the deadline does not coincide with the submission of the report for the current reporting period, then KORR forms for registration must be submitted within the time specified in the Act before the start reporting campaign without ISHD forms. When generating such CORR forms, the reporting period must select the current reporting period, and select the period for which corrections are necessary for adjusting. When the reporting campaign for the current reporting period comes Heat-then form a current inventory of ADV-6-2 must be based on previously submitted reams CORR-form.Nomera packs with CORR-forms do not change, because they are already registered !!! 3.

The remaining sections in the RSV-1 PFR (form) After you have completed sections 6, proceed to filling out section 1 of the RSV-1 and subsection 2.1. Both of them are compiled on the basis of the data reflected in sections 6. Information specified separately for each individual in sections 6, in sections 1 and 2.1 are reflected as a whole for the insured. Here, the total values \u200b\u200bof accrued payments and contributions for all employees for each month, in total for the last 3 months of the reporting period, as well as for the period from the beginning of the year on an accrual basis are indicated. Example of filling RSV-1 for 2016. You can comment on instructions for filling RSV-1 as much as you like, but with an example it is always easier to understand the topic. Therefore, below the link you can download the calculation of RSV-1 (sample) for 9 months of 2016.

Subject: correctional rsv-1 on the act of field inspection

For example, you need to change the report from the PNED category to HP) 6.1 Present the updated RSV-1 forms with the correct assessed and paid contributions according to the tariff code 01. 6.2 Create ISHD forms on all APs with the HP category code for all reporting periods for which it is necessary to change tariff, while indicating only experience (accrued and paid insurance premiums should be zero (0)). Submit these packs with new numbers in the following order to the PFR Directorate first of all without the ADV-6-2 inventory. This information will be sent to relevant reports P B-1. 6.3 Together with ISHD forms of the current reporting period, submit: a) CORR forms with the category HP with all the correct data: experience and insurance premiums - for all variable reporting periods for which ISHD packages were formed according to clause 6.1; b ) OTMN-form with the category PNED for all periods for which the tariff code and the category code ZL are changed.

Prednalog.ru

Attention

Home → Accounting consultations → RSV-1 Actual on: October 6, 2016. According to the results of 9 months of 2016 and for the whole of 2016, policyholders must report to the FIU in the usual form of RSV-1 (form). But from 2017, reporting on contributions will need to be submitted to the tax authorities in a different form, which, by the way, has not yet been approved.

No new form of the RSV-1 appeared in 2016. That is, the RSV-1 form for 2016 looks the same as for 2015. You can download the RSV-1 PFR form from the website of the ConsultantPlus reference legal system or from the website of the Pension Fund. RSV-1 form: download the form How to fill out the RSV-1 In the form of the RSV-1 form, the FIU needs to fill out (and submit to the controllers) only those sections in which you have something to indicate.

Online magazine for an accountant

Along with the reporting kit for the current reporting period or earlier, it is necessary to submit updated RSV-1 forms from the past “forgotten” period to the current one, in which the amount of payments and accrued insurance premiums will be increased by the amount of this forgotten employee. 4. We handed over the employee’s personal information to the wrong “alien” insurance number 4.1. In this case, create the ISHD form for that reporting period for the correct insurance number of the employee for the current reporting period, indicating only the seniority, without insurance premiums. Assign a new next one to this pack number in order. This pack is presented without the ADV-6-2 inventory and will be added to the report (form RSV-1) for the reporting period in which information was submitted to this employee with the wrong “alien” insurance number.

An example of filling out the rsv-1 form with corrective section 6

The adjustment of RSV-1 for the periods 2014, 2015, 2016 has a number of features when submitting updated reports. Despite the fact that since 2017 the administration of insurance contributions to the PFR and MHI has been transferred to the Federal Tax Service, the reporting to the PFR, including the updated one, for the periods until January 1, 2017, as before, is submitted to the territorial bodies of the PFR. The procedure for filling out such reports has not changed. Reporting is filled out on the basis of Resolution of the PFR Management Board dated January 16, 2014 No. 2p.

How is the clarification filed in the FIU according to RSV-1? Based on the above document, the amount of the changed (accrued or reduced) insurance premiums are reflected in line 120 “The amount of the recalculation of insurance premiums for the previous reporting (settlement) periods from the beginning of the billing period” and in section 4 “Amounts of the recalculation of insurance premiums from the beginning of the billing period” form RSV-1 for the current reporting period.

Upfr in the city of Izhevsk (inter-district) of the Udmurt Republic

The R-form completely replaces all the data on the personal account entered earlier by the ISHD-form, therefore KORR - the form should contain ALL the correct information filled in, and not just the one that was incorrect and corrected. 1.2 CORR forms for the previous reporting periods are mandatory submitted by the policyholder along with ISHD reporting forms for the current reporting period. In the current reporting period, you can provide corrective information for several previous adjusted periods. When creating the CORR form, the "Reporting period" is indicated in which presents the current reporting ISHD forms, and “Adjustable period” - for which incorrect information is adjusted. Moreover, the adjusted period must be earlier than the reporting period. measures "Reporting Period": 2013-1, "Adjustable period" - 2012 -2.V this case with ISKHD-forms during the period of the 1st quarter of 2013

RSV-1 PFR - 2016: sample filling

Info

Along with the RSV-1 form, corrective individual information is provided for persons for whom adjustments are made. How to pass the RSV-1 update for 2014, 2015, 2016? Along with the updated form RSV-1, individual information is provided on the insured persons, the amounts of accruals for which have been changed. The type of adjustment is set to “initial” (in subsection 6.3 “Type of adjustment of information” of section 6), reflecting information on the changed insurance premiums (in subsection 6.6 “Information on corrective information” of section 6).

And in subsection 6.2 “Reporting period” of section 6 of the RSV-1 form, we indicate the reporting period (after 01/01/2017), to which the date of presentation of the updated reporting refers. Along with the abovementioned documents, individual information is provided on the insured persons, the amounts of accruals for which have been changed.

The amount of contributions at the bottom of the inventory of ADV-6-2, “Information on corrective (canceling) information”, must correspond to changes in contributions in the form of RSV-1. In this case, you must keep in mind: - if the adjustment of information is made according to the amount of contributions before accrued on payments to the employee made in the previous reporting period, i.e. forgot to tax (overly taxed) the employee’s payments, then it is necessary to submit the updated RSV-1 forms for the erroneous reporting period and further up to the current reporting period; - if in the past reporting period you forgot to accrue payments to the employee or incorrectly accrued all additional salary payments, including “Storno”, are carried out in the current reporting period, then the updated RSV-1 forms for past periods do not need to be submitted, because accrual (decrease) of contributions for additional accrued (reduced) payments will now fall into RSV-1 for the current reporting period. 6.

Corr RSV 2016 on the act of verification example filling

Information on corrective (canceling) information ”in the columns“ Accrued ... ”,“ Paid up ... ”should reflect the difference between the amount of insurance premiums in the wrong ISHD forms and the correct KORR forms, and not the amount for packs with KORR forms, for this when forming CORR-forms, all ISHD forms of those reporting periods that are now being adjusted must be loaded in the coding program during the formation of CORR forms; 2. Correction of experience 2.1. If KORP forms are submitted only because of a change in length of service, then the KORP forms must indicate the insurance premiums exactly the same as in the erroneous ISHD data, both accrued and paid, and the length of service is already correct. In the ADV-6- inventory 2 in terms of information on additional accrued and paid amounts in batches, the values \u200b\u200b0 must be indicated, because the amount of contributions in the wrong ISHD forms and in the correct CORR forms is the same.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

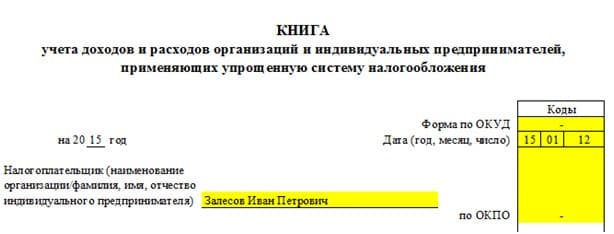

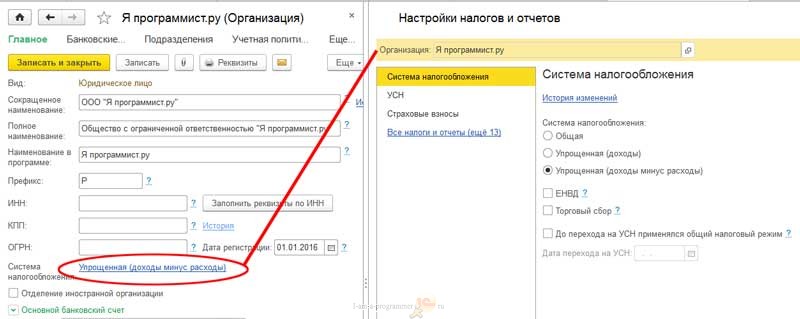

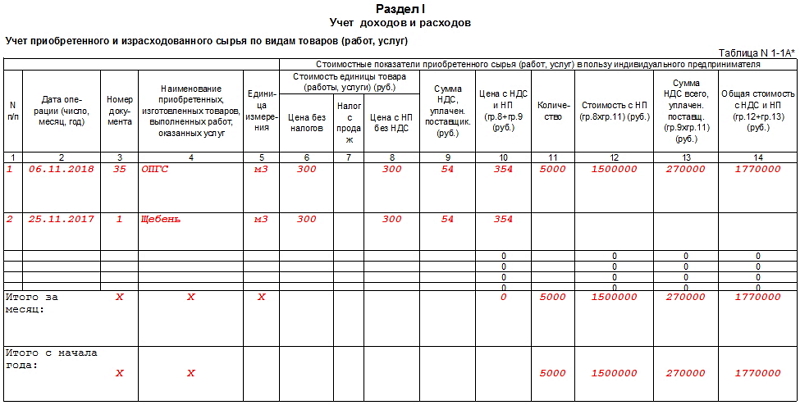

What is KUDiR and how to fill it in?