Suppliers and contractors are organizations that supply raw materials and other inventory items, as well as perform various work (major, maintenance of fixed assets, etc.) and provide various types of services.

Settlements with suppliers and contractors are carried out after their shipment of inventory, work or services, or at the same time with the consent of the organization or on behalf of it. An advance payment may be issued to suppliers and contractors in accordance with a business agreement.

Currently, organizations themselves choose the form of payment for delivered products, work performed, services rendered.

To summarize information on settlements with suppliers and contractors, account 60 “Settlements with suppliers and contractors” is intended. All operations related to settlements for acquired material assets, accepted work, rendered services are reflected in this account regardless of the time of payment.

The basis for the registration of accounts payable to suppliers are settlement documents (invoices, invoices) and documents proving the fact of the transaction (freight waybills, receipt orders, acceptance certificates, acts on the performance of work and services). Typical accounting entries for account 60 are presented in table 1

Table 1 Typical accounting entries for account 60

On account 60 the debt is reflected within the amount of acceptance. If there are shortages in the received material and commodity values, price discrepancies caused by the contract, account 60 is credited for the corresponding amount in correspondence with account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”).

The amount of VAT is included by suppliers and contractors in the payment invoices and is shown to the buyer on the debit of account 19 “Value Added Tax on Acquired Values” and credit of the account 60. The cost of interest on loans from suppliers and contractors for acquired values, work performed and services rendered are reflected in the debit of accounts of property acquired or production costs (since they are included in the cost of production) and the credit of account 60.

Repayment of debt to suppliers is reflected in the debit of account 60 and the credit of cash accounts (51, 52, 55) or bank loans (66, 67). The procedure for accounting records when repaying debt to suppliers depends on the forms of settlement used.

Without the consent of the organization, requirements for dispensed gas, water, electricity issued on the basis of indicators of measuring instruments and current tariffs, as well as for sewage, telephone, and postal and telegraph services are paid without acceptance.

Advances paid are recorded separately in separate analytical accounting registers in order to obtain information on settlements with specific suppliers and to monitor their conditions. Amounts of advances issued are transferred by payment order from a settlement or other bank account. These operations are made out of the accounting record:

Debit 60 "Settlements with suppliers and contractors"

Credit 50, 51, 52, 55.

The transferred advances to suppliers and contractors are recorded at the debit of this account until the delivery of inventories or the volume of work and services provided for in the contract are documented and documented. For goods received and work performed, documented, there is a debt to suppliers or contractors, which is reduced by the amount of previously issued advances.

If the supply contract is not fulfilled, unused advances will be returned by the supplier to the buyer's current account. Such an operation is executed by a payment order, which must necessarily indicate the basis (number and date of the payment order, according to which the receipt of the advance payment, as well as the contract) is recorded. The return of the unused advances by the supplier shall be made out in an accounting record:

Debit 50.51.52.55

Credit 60 "Settlements with suppliers and contractors."

The total differences for the acquired property after its arrival or for the work (services) performed are taken into account 60 and 91 “Other income and expenses” as operating income or expenses, depending on the value of the total differences.

Exchange differences on acquired property (work, services) are also reflected in accounts 60 and 91 as operating income or expenses, depending on the value of exchange differences.

Termination of obligations (in addition to proper performance) may be carried out on the following grounds: when offsetting mutual claims, novation, debt forgiveness, liquidation of a legal entity (Articles 410, 414, 415, 419 of the Civil Code of the Russian Federation).

The termination of obligations when offsetting mutual claims is reflected in the debit of account 60 and the credit of account 62 “Settlements with buyers and customers” or account 76 “Settlements with different debtors and creditors”.

Forgiveness is essentially a form of gift. The forgiven debt is non-operating income and is recognized in the debit of account 60 and the credit of account 91 “Other income and expenses”.

Upon the termination of obligations by novation, one obligation is replaced by another. This replacement is not reflected in synthetic accounts; marks are made in analytical accounting.

Termination of obligations as a result of liquidation of a legal entity and when writing off accounts payable for which the limitation period has expired. Take into account the debit of account 60 and the credit of account 91 “Other income and expenses”. Write-off of accounts payable, according to which the limitation period has expired, is carried out based on the results of the inventory, written justification and order of the head of the organization.

Analytical accounting for account 60 is carried out for each invoice presented, and settlements in the order of planned payments for each supplier and contractor. At the same time, the construction of analytical accounting should provide the opportunity to obtain the necessary data on: suppliers on accepted and other settlement documents, the due date of which has not arrived; suppliers on unpaid on time settlement documents; Unbilled deliveries advances paid; suppliers of issued promissory notes whose due date is not due; overdue suppliers of bills; suppliers on a received commercial loan, etc.

Accounting for settlements with suppliers and contractors within the group of interconnected organizations, the activity of which is compiled by consolidated financial statements, is kept on account 60 separately.

In the journal-order form of accounting, accounting of settlements with suppliers is kept in order journal No. 6. In this journal, synthetic accounting is combined with analytical. Analytical accounting of settlements with suppliers in the calculations and the order of planned payments is carried out in statement No. 5, the data of which at the end of the month include general results for offsetting accounts in order journal No. 6.

When automating accounting, on the basis of bank statements, automated synthetic and analytical accounting are compiled for each account used to account for settlements with suppliers and customers (“Settlements with suppliers and contractors”, “Settlements with buyers and customers”,

“Settlements with various debtors and creditors”, sub-account “Settlements on claims”). These typograms serve as the basis for the development of typograms - negotiable statements of accounts, the totals of which are made entries in the General Ledger.

Account 60 of accounting is an active-passive account “Settlements with suppliers and contractors”, opens the “Settlements” section of the chart of accounts and serves to summarize information on all types of company accounts:

- With various legal entities and individuals;

- Including on-farm calculations.

All operations related to settlements for purchased goods, materials, consumed services or accepted work are reflected on account 60 regardless of the fact of payment. Account 60 is credited according to the settlement documents of the supplier, debited to the amount of fulfillment of obligations, that is, payment of bills, including advances and prepayment, in correspondence with cash accounts, etc. In this case, the amounts of advances paid are recorded separately in a separate subaccount.

Account 60 is used to conduct analytical accounting for each supplier’s invoice received, and settlements in the order of planned payments, that is, for each supplier separately.

Typical Wiring

Consider the main entries of account 60 in the table:

| Account Dt | Account CT | Wiring Description | A document base |

| 07/10/41 | 60 | Payment to the supplier for equipment / materials / goods | An invoice for payment |

| 60 | 50.01/51/52 | Payment of debt to the supplier | |

| 94/76 | 60 | Write-off of shortages within the normal rate of loss / excess, in case of error or price mismatch | Acceptance Act |

| 19 | 60 | VAT on purchased assets | An invoice for payment, Get 267 1C video lessons for free: invoice |

| 50/51/52 | 60 | Invoice payment to supplier / contractor | CSC, statement from the current or currency account |

| 10/15/41 | 60 Neotfak. deliveries |

Capitalized material assets without payment invoices | Act of acceptance of materials |

| 60 Unreported shipments | 60 | Payment by invoice for previously capitalized materials without settlement documents | An invoice for payment |

| 60/91.02 | 91.01/60 | Write-off of exchange differences on the account, positive / negative | Payment |

| 91.02/63 | 60 Advances paid | Write-off of advance payment not returned by the supplier / contractor at the expense of profit / reserve for doubtful debts |

Account analysis 60: balance sheet, account card

The reverse balance sheet for account 60 is a report in the form of a table in which the initial and final balances are presented, the turnover for the selected period in the account or subaccounts, subconto, foreign currency amounts, and the expanded balance.

An account card is a report with details before posting (account).

You can analyze the mutual settlements and movement of documents on settlements with suppliers in the 1C Accounting program of the enterprise using standard reports Account Card and Turnover Balance Sheet (hereinafter - SAL) on account 60 “Settlements with suppliers and contractors” with a specific counterparty or in general for all.

It is right to do this according to subaccounts:

- On subaccount 60.01 the settlements with suppliers themselves are reflected;

- Subaccount 60.02 reflects advances paid.

In SAL, the balance of subaccount 60.01 is reflected in the loan, and the balance of subaccount 60.02 is shown in debit.

For example, when posting a bank, if paid to the counterparty on the invoice, then the goods have been received and payment should be reflected on the debit of subaccount 60.01. If there was an advance payment for goods or materials to the counterparty, then - according to the debit of subaccount 60.02.

If the wiring is incorrectly made, then in the WWS, the account 60 will “hang” the balance with a minus. If with a minus the balance on the credit of the subaccount 60.01, this means that the prepayment was not reflected correctly, not on the subaccount 60.02.

Example

LLC Snegir transfers the advance payment to LLC Bor for goods in the amount of 23,600 rubles. A few days later the goods arrived from the supplier on account of the advance payment issued in the amount of 23,600 rubles.

Postings to account 60 on the advance payment to the supplier.

Account 60 is used in the accounting of the organization to reflect information on settlements with suppliers and contractors on received inventory items, as well as work performed and services rendered, on their surpluses, on transportation services received and others.

The account is credited to the cost of goods accepted for accounting (work performed, services rendered) and corresponds to the accounts for their accounting. In synthetic accounting, the account is credited based on the supplier’s settlement documents, regardless of the valuation in analytical accounting.

An account is debited for the amount of fulfillment of obligations, including advances and prepayments (they are accounted for separately) and corresponds to accounts in which cash is recorded.

Analytical accounting for the account 60 is maintained separately, in the context of each submitted invoice. At the same time, it is necessary to organize this accounting in such a way as to ensure the receipt of the necessary information on suppliers on settlement documents that have not yet reached the due date, on suppliers on settlement documents that have not been paid on time, on suppliers on issued bills that have not yet reached the due date, by suppliers on the loan received and others.

Among subaccounts in accounting, 60 accounts usually distinguish the following:

- - serves directly to reflect mutual settlements with creditors;

- - it reflects advance payments to suppliers;

- - a special sub-account for reflecting securities;

As well as accounts for accounting for settlements in USD and currency:

- - an analogue for currency accounting;

- - an analogue for calculations in arbitrary units;

- - an analogue for calculations in arbitrary units.

Active or passive 60 account?

Since this account may contain both receivables and accounts, 60 accounts are considered active-passive. That is, in the balance sheet of an enterprise, it can refer to both an asset and a liability.

60 balance sheet example

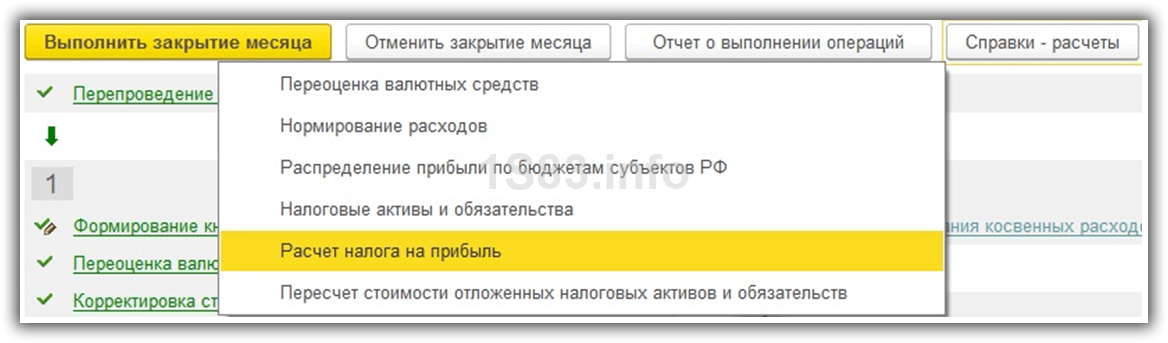

Here is an example of the balance sheet for 60 accounts from the popular 1C program with full details on sub-accounts and analytics:

For example, from OSV it is clear that over the past year we paid the counterparty “Supplier OOO” 13’681 rubles, and received goods or services in the amount of 154’727 rubles. And the total debt on the final balance of the loan is 141’046, that is, our debt.

Basic accounting entries for account 60 with sub-accounts

By debit of account:

| Account Dt | Score CT | Contents of operation |

| 60 | Repayment of debt to the supplier from the cash desk | |

| 60 | Repayment to the supplier of debt in cashless form | |

| 60 | Repayment of foreign currency debt to a supplier | |

| 60 | Write-off of the amount of the used letter of credit for settlements with the supplier | |

| 60 | The offset of counterclaims of homogeneous claims is reflected. | |

| 60 | 66 | Transfer of debt to a supplier into a short-term loan |

| 60 | 67 | Renewal of debt to a supplier into a long-term loan |

| 60 | Withholding the amount of a recognized claim from the funds payable to the supplier | |

| 60 | Outstanding payables included in other income due to the expiration of the limitation period | |

| 60 | on receivables in foreign currency, included in other income |

Credit account:

| Account Dt | Score CT | Contents of operation |

| 60 | Included equipment requiring installation | |

| 08 | 60 | Accounts of suppliers accepted for payment for acquired non-current assets |

| 10 | 60 | |

| 15 | 60 | Taking into account the purchase value of stocks for which settlement documents from suppliers were not received |

| 15 | 60 | Costs related to stockpiling |

| 19 | 60 | VAT on capitalized material assets |

| 20 | 60 | The cost of the work performed by contractors (services) is taken into account in costs. |

| 60 | As part of overhead costs, the cost of work (services) performed by contractors was taken into account | |

Account 60 “Settlements with suppliers and contractors” is used in almost every enterprise, and today we will consider how the turnover sheet for account 60 is formed in program 1C Accounting 8 edition 2.

In our example, we first made an advance payment in advance of Tom LLC in the amount of 50,000 rubles from the current account. The following transaction was generated for this operation: Debit 60.02 Credit 51. This amount was transferred to the sub-account advances. Account 60 “Settlements with suppliers and contractors” is active-passive, but subaccount 2 to it is already active. You can see this by calling the chart of accounts from the bottom of the "Enterprise" tab of the 1C Accounting 8 edition 2 program.

Active account - means that an increase in the account will occur on a debit, and a decrease on a loan. In our example, with subaccount 2 of account 60, the debit of the account reflects an increase in the amount of advances, and on the loan, their decrease. The final balance in our example on this account is 50,000 rubles in debit. This means accounts receivable, that is, the debt of our counterparty - LLC Tom. We paid him cash in advance and now he must either deliver us any value (goods, services, etc.), or return the amount of the advance.

If you need a turnover sheet for account 60 in the context of sub-accounts, then in the "Settings" panel on the right side of the turnover you need to check the "By sub-accounts" box.

Now, when the turnover sheet for account 60 is being formed, it is immediately clear by which subaccounts this or that amount is reflected.

Debit 41.01 Ct 60.01 in the amount of 100,000 rubles

Dt 19.03 Ct 60.01 in the amount of 18 000 rubles

Dt 60.01 Ct 60.02 in the amount of 50 000 rubles

Subaccount 01 to account 60 is passive, respectively, the debit account reflects a decrease in debt to the supplier, and on the credit of the account - an increase.

In our example, when goods arrive from the supplier with VAT, there is an increase in debt to the supplier for a total of 118,000 rubles.

At the same time, debt is reduced by the amount of the advance payment paid - 50,000 rubles.

As a result, our company remains owed to LLC Tom 68 000 rubles (118 000 - 50 000). This is payables and this amount is reflected as the balance on the loan of sub-account 01 to account 60 “Settlements with suppliers and contractors”.

This can be seen more clearly when the revolving sheet for account 60 is formed in program 1C Accounting 8 edition 2.

In the following articles, I will discuss how to make a turnover on accounts 62 and 71 using specific examples, similar to how a turnover sheet for account 60 is formed. And how to create a turnover sheet for account 60 as amended. 3.0

Cf. 60 “Settlements with suppliers and contractors” is used to register facts of economic activity related to the acquisition of goods and materials, works and services and is used in every Russian company.

Account 60 in the accounting of Russian companies allows you to summarize information about interaction with partners in ongoing operations, such as the purchase of inventory, the performance of work of any type (including construction and installation), the provision of services, which include, in particular, utilities services.

Thanks to this analytical system, information on deliveries can be provided for which the relevant documents are both accepted and absent (in this case, we can speak of unbilled deliveries of goods or services).

All business events that are related to operations between companies and their counterparties are reflected in 60 accounts regardless of the actual payment of goods and materials or services, as a result of which the turnover on this accounting instrument can demonstrate both receivables and payables.

Cf. 60 “Settlements with suppliers and contractors” in accordance with the approved plan can be assigned to the active-passive category. Payment to the counterparty of the transferred goods and services is reflected at the debit in correspondence with indicators of accounting for the company's financial resources. The credit of this account is intended for situations in which accounts payable to a partner arise, namely at the time of shipment of the goods (services), that is, the transfer of ownership to it.

Basic subaccounts

In order to organize an analytical system, i.e. detailed accounting developed a system of sub-accounts to reflect operations with suppliers, such as:

- 60.01 - is intended to reflect the company's operations with suppliers and contractors;

- 60.02 - used in settlements with an advance payment (advance payment);

- 60.03 - contains information on promissory notes issued by the company.

If a company carries out a transaction in foreign currency and / or conventional units, the following sub-accounts will be opened in the working chart of accounts:

- 60.21 and 60.31 - are used to register settlements with partners in foreign currency and arbitrary units, respectively;

- 60.22 and 60.32 - are intended for prepayments transferred in foreign currency and arbitrary units;

These subaccounts are mainly used by companies engaged in export-import activities and having foreign counterparties.

Regulatory framework for counterparty operations

The relationship between the supplier and the buyer is regulated by the Civil Code. This document discloses all aspects of the contractual relationship of partners and the claims arising from them. If we talk about transactions between partners, then the law prescribes payment in cash and in non-cash form. Depending on this, apply:

- Regulation on the procedure for conducting cash transactions and the rules for storing, transporting and collecting banknotes and coins of the Bank of Russia in credit organizations in the territory of the Russian Federation "(approved by the Bank of Russia on 04.24.2008 N 318-P) (as amended on 02.16.2015);

- Regulation on non-cash payments in the Russian Federation N 2-P, approved by the Central Bank of the Russian Federation on October 3, 2002 (as amended on March 3, 2003).

Basic accounting entries

Purchased materials, goods or non-current assets from the counterparty:

Dt 10, 41, 08 Cr 60

- A claim was made to the supplier in connection with a price mismatch and the presence of arithmetic errors:

- Payment was made to the partner for the delivered goods and materials:

- Payment to the counterparty made through an accountable person:

- The document on offsetting mutual claims between the supplier and the buyer was signed:

- The debt of the creditor is charged to other expenses in connection with the expiration of the limitation period:

Workflow for calculating counterparties

The main documents used in settlements with counterparties - suppliers are:

- Consignment note (TORG-12 form). This document is used to reflect information on the purchased goods: the quantity, price and purchase amount, and allows the buyer to capitalize the goods.

- Invoice. It is not possible to receive a VAT deduction without a correctly issued invoice. This document is provided by the supplier of the product or service, which indicates all the main details of the counterparties, the VAT rate and the tax amount allocated.

Victor Stepanov, 2017-02-25

Questions and answers on the topic

The material has not yet been asked a single question, you have the opportunity to do it first

Accounting for the receipt, disposal of fixed assets and the procedure for their inventory

D 08 - K 60 - reflects the costs of construction and installation works received from contractors;

D 19 - K 60 - reflects VAT presented by the contractor for payment to the customer;

D 01 - K 08.3 - fixed assets put into operation.

When the organization performs construction and installation works in an economic way, the following entries are made in accounting:

D 10 - K 60 - purchased materials for the construction of the facility;

D 19 - K 60 - reflected VAT on purchased materials.

Reflected the costs of the construction of buildings, structures, installation and other expenses for capital construction minus VAT:

D 08 - K 07 - reflected the cost of installation of equipment;

D 08 - K 10 - reflects the costs of the materials used;

D 08 - To 70 - wages to employees;

D 08 - K 69 - the amount of insurance premiums from the wages of employees;

D 08 - K 19 - non-refundable VAT has been written off to increase the actual costs of construction and manufacturing;

D 08 - K 68 - VAT is charged on the volume of work performed;

D 60 - K 51 - money is transferred;

D 68 - K 19 - reflects VAT on purchased materials, work performed, services rendered;

D 01 - K 08.3 - fixed assets put into operation.

Acceptance of completed work on the completion and retrofitting of the facility, made in the order of capital investments, is made out by the acceptance certificate of the repaired, reconstructed and modernized facilities (form No. OS-3). The transfer of equipment for installation is made out by the act of acceptance and transfer of equipment for installation (form No. OS-15). For equipment defects identified during installation, commissioning or testing, as well as based on the results of the inspection, an act is drawn up on identified equipment defects (form No. OS-16).

One of the ways of receiving fixed assets is to receive objects on account of a contribution to the charter capital of a newly formed or increasing the charter capital of the organization. When making contributions to the charter capital of an organization, the founders act on the basis of the memorandum of association, and when they are added to the organization’s accounting records, the monetary value agreed by the founders of the organization is recognized as the initial value. When taking into account the fixed assets contributed by the founders on account of their contribution to the charter capital of the organization, the following accounting entries are made:

D 75 - K 80 - the amount of the founders' debt in monetary value on contributions to the authorized capital when creating the organization;

D 08 - K 60 - reflection of the cost of delivery;

D 08.4 - K 75.1 - receipt of deposits in the form of fixed assets from the founders;

D 19 - K 83 - VAT on contributions to the authorized capital;

D 01 - K 08.4 - the adoption of fixed assets in operation;

D 68 - K 19 - VAT on contributions to the authorized capital has been deducted.

According to the gift agreement, one party (donor) transfers or undertakes to transfer the thing to the property or property right (claim) to itself or to a third party free of charge or undertakes to release or undertakes to release it from the property obligation to itself or to a third party. Items of fixed assets received under a gift contract are accepted for accounting at market value. The market value of property is established by documentary or expert means. Costs of establishing and confirming the market price are included in the initial cost of fixed assets. According to RAS 9/99 “Income of an organization”, assets received free of charge are included in other income of the organization.

Acceptance of fixed assets received from other legal entities and individuals under a gift agreement, as well as in other cases of their free receipt, are reflected in the following accounting records:

D 08 - K 98 subaccount 2 “Gratuitous receipt” - receipt of fixed assets under a gift agreement;

D 08 - K 60 - reflection of the costs associated with the transportation of fixed assets;

Go to page: 1 2 34

Other articles

Market Formation and Economic Growth

Market: conditions of occurrence, role and functions The market is a system of economic relations arising on the basis of sustainable economic relations between producers of goods and services and consumers. For a market to be competitive, there must be more than one buyer or ...

Features of accounting for settlements with suppliers and contractors (account 60)

Account Description 60.01 Settlements with suppliers and contractors

Account 60.01 Settlements with suppliers and contractors is intended for accounting settlements with suppliers and contractors for acquired values, works, services

Account 60.01 Settlements with suppliers and contractors is credited to the cost of received inventory, accepted work, consumed services in correspondence with the accounts of these values \u200b\u200bor the accounts of the corresponding costs.

It is debited to the amount of fulfillment of obligations (payment of bills) in correspondence with cash accounts, etc.

Account analytics 60.01 Settlements with suppliers and contractors

Analytical accounting is carried out by suppliers and contractors (subconto “Contractors”), the basis of settlements (subconto “Contracts”), as well as by settlement documents (subconto “Documents of settlements with a counterparty”). Each supplier and contractor is an element of the Counterparties directory. Each basis of calculations is an element of the reference book “Contracts of counterparties”.

Use of account 60.01 Settlements with suppliers and contractors

Dt 60 Kt 50.01 - Repayment of debt to the supplier from the cash desk

Dt 60 Kt 51 - Repayment of non-cash debt to a supplier

Dt 60 Kt 52 - Repayment of debt in foreign currency to a supplier

Dt 60 Kt 55.01 - Write-off of the amount of the used letter of credit for settlements with the supplier

Dt 60 Kt 62 - The offset of the counter homogeneous claims is reflected

Dt 60 Kt 66 - Renewal of debt to a supplier in a short-term loan

Dt 60 Kt 67 - Renewal of debt to a supplier into a long-term loan

Dt 60 Kt 76.02 - Withholding of the amount of a recognized claim from the funds payable to the supplier

Dt 60 Kt 91.01 - Unpaid payables included in other income due to the expiration of the limitation period

Dt 60 Kt 91.01 - Positive exchange rate differences on receivables in foreign currency, included in other income

On credit:

Dt 07 Kt 60 - Capitalized equipment requiring installation

Dt 08 Kt 60 - Accounts of suppliers accepted for payment for acquired non-current assets

Dt 10 Kt 60 - Capitalized materials received from suppliers

Dt 15 Kt 60 - The purchase value of stocks for which settlement documents from suppliers were not received has been taken into account

Dt 19 Kt 60 - VAT on capitalized material assets

Dt 20 Kt 60 - The cost of the work performed by contractors (services) is taken into account in costs

Dt 25 Kt 60 - As part of overhead costs, the cost of the works (services) performed by contractors was taken into account

Dt 26 Kt 60 - As part of general business expenses, the cost of the works (services) performed by contractors was taken into account

Dt 28 Kt 60 - The cost of the work of contractors is included in the cost of eliminating marriage

Dt 41 Kt 60 - The goods received from suppliers are capitalized

Dt 44 Kt 60 - Inclusion in the cost of the cost of work and services related to the sale process

Dt 50 Kt 60 - Supplier returns the excess of funds paid to him to the organization’s cash desk

Dt 51 Kt 60 - The supplier returns the excess of funds paid to him to the account of the organization

Dt 52 Kt 60 - Supplier returns the excess of funds paid to him to the organization’s currency account

Dt 76.02 Ct 60 - The amount of the claim to the supplier is reflected

Dt 91.02 Ct 60 - Accepted for payment bills of other organizations for services related to the disposal of other assets

Dt 94 Kt 60 - Reflection of a shortage in the acceptance of values \u200b\u200breceived from the supplier

Dt 97 Kt 60 - Reflection of debt to suppliers for work performed, for which costs are included in deferred expenses

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

ON APPROVAL OF ACCOUNTING ACCOUNT PLAN

FINANCIAL AND ECONOMIC ACTIVITIES OF ORGANIZATIONS

AND INSTRUCTIONS FOR ITS USE

(as amended by Orders of the Ministry of Finance of the Russian Federation of 07.05.2003 N 38n,

dated September 18, 2006 N 115н, dated 08/08/2010 No. 142n)

In pursuance of the Accounting Reform Program in accordance with international financial reporting standards, approved by Decree of the Government of the Russian Federation of March 6, 1998 N 283, I order:

1. To approve the Chart of accounts of accounting of financial and economic activities of organizations and instructions for its use.

2. Enact this order from January 1, 2001. The transition to the application of the Chart of Accounts for the accounting of financial and economic activities of organizations is permitted to be carried out during 2001 as the organization is ready.

Minister of Finance of the Russian Federation A. Kudrin

| Name of account | Account number | Number and name of subaccount |

|---|---|---|

| 1 | 2 | 3 |

| Section I. Non-current assets | ||

| Fixed assets | 01 | By types of fixed assets |

| Depreciation of fixed assets | 02 | |

| Profitable investment in material assets | 03 | By types of material assets |

| Intangible assets | 04 | By types of intangible assets and expenses on research, development and technological work |

| Depreciation of intangible assets | 05 | |

| ……………………………………………… | 06 | |

| Equipment for installation | 07 | |

| Investments in non-current assets | 08 | 1. Acquisition of land 2. The acquisition of natural resources 3. Construction of fixed assets 4. The acquisition of fixed assets 5. The acquisition of intangible assets 6. Transfer of young animals to the main herd 7. The acquisition of adult animals 8. The implementation of research, development and technological work |

| Deferred tax assets | 09 | |

| Section II. Productive reserves | ||

| Materials | 10 | 1. Raw materials 2. Purchased semi-finished products and components, structures and parts 3. Fuel 4. Tare and tare materials 5. Spare parts 6. Other materials 7. Revolving balance sheet on account 60: accounting entriesOutsourced materials |

| Animals for growing and fattening | 11 | |

| ……………………………………………… | 12 | |

| ……………………………………………… | 13 | |

| Reserves for reducing the value of material assets | 14 | |

| Procurement and acquisition of wealth | 15 | |

| Deviation in the value of material assets | 16 | |

| ……………………………………………… | 17 | |

| ……………………………………………… | 18 | |

| Value Added Tax on Acquired Values | 19 | 1. Value added tax on the acquisition of fixed assets 2. Value added tax on acquired intangible assets 3. Value added tax on acquired inventories |

| Section III. Production costs | ||

| Primary production | 20 | |

| Semi-finished products of own production | 21 | |

| ……………………………………………… | 22 | |

| Auxiliary production | 23 | |

| ……………………………………………… | 24 | |

| Overhead costs | 25 | |

| General running costs | 26 | |

| ……………………………………………… | 27 | |

| Marriage in production | 28 | |

| Service industries and farms | 29 | |

| ……………………………………………… | 30 | |

| ……………………………………………… | 31 | |

| ……………………………………………… | 32 | |

| ……………………………………………… | 33 | |

| ……………………………………………… | 34 | |

| ……………………………………………… | 35 | |

| ……………………………………………… | 36 | |

| ……………………………………………… | 37 | |

| ……………………………………………… | 38 | |

| ……………………………………………… | 39 | |

| Section IV. Finished products and goods | ||

| Release of products (works, services) | 40 | |

| Goods | 41 | 1. Goods in stock 2. Retail products 3. The container under the goods and empty 4. Purchased products |

| Trade margin | 42 | |

| Finished products | 43 | |

| Selling expenses | 44 | |

| Goods shipped | 45 | |

| Completed steps for work in progress | 46 | |

| ……………………………………………… | 47 | |

| ……………………………………………… | 48 | |

| ……………………………………………… | 49 | |

| Section V. Cash | ||

| Cashbox | 50 | 1. Cash desk of the organization 2. Operational cash desk 3. Cash documents |

| Settlement accounts | 51 | |

| Currency accounts | 52 | |

| ……………………………………………… | 53 | |

| ……………………………………………… | 54 | |

| Special Bank Accounts | 55 | 1. Letters of credit 2. Checkbooks 3. Deposit accounts |

| ……………………………………………… | 56 | |

| Transfers on the way | 57 | |

| Financial investments | 58 | 1. Units and shares 2. Debt securities 3. Loans granted 4. Deposits under a simple partnership agreement |

| Provisions for impairment of financial investments | 59 | |

| Section VI. Calculations | ||

| Settlements with suppliers and contractors | 60 | |

| ……………………………………………… | 61 | |

| Settlements with buyers and customers | 62 | |

| Bad debt provisioning | 63 | |

| ……………………………………………… | 64 | |

| ……………………………………………… | 65 | |

| Settlements for short-term loans and borrowings | 66 | By types of loans and borrowings |

| Settlements for long-term loans and borrowings | 67 | By types of loans and borrowings |

| Payments for taxes and fees | 68 | By types of taxes and fees |

| Settlements for social insurance and security | 69 | 1. Calculations for social insurance 2. Calculations for retirement benefits 3. Calculations for compulsory health insurance |

| Settlements with staff for remuneration | 70 | |

| Calculations with accountable persons | 71 | |

| ……………………………………………… | 72 | |

| Settlements with staff for other operations | 73 | 1. Settlements on loans granted 2. Settlements for compensation for property damage |

| ……………………………………………… | 74 | |

| Settlements with founders | 75 | 1. Settlements on contributions to the authorized (joint-stock) capital 2. Settlements for the payment of income |

| Settlements with various debtors and creditors | 76 | 1. Settlements for property and personal insurance 2. Settlement of claims 3. Settlements on due dividends and other income 4. Settlements on deposited amounts |

| Deferred tax liabilities | 77 | |

| ……………………………………………… | 78 | |

| On-site settlements | 79 | 1. Settlements for the allocated property 2. Settlements for current operations 3. Settlements under a trust management agreement |

| Section VII. Capital | ||

| Authorized capital | 80 | |

| Own shares (shares) | 81 | |

| Reserve capital | 82 | |

| Extra capital | 83 | |

| Retained earnings (uncovered loss) | 84 | |

| ……………………………………………… | 85 | |

| Special-purpose financing | 86 | By type of financing |

| ……………………………………………… | 87 | |

| ……………………………………………… | 88 | |

| ……………………………………………… | 89 | |

| Section VIII. Financial results | ||

| Sales | 90 | 1. Revenue 2. Cost of sales 3. Value Added Tax 4. Excise taxes 9. Profit / loss on sales |

| Other income and expenses | 91 | 1. Other income 2. Other expenses 9. The balance of other income and expenses |

| ……………………………………………… | 92 | |

| ……………………………………………… | 93 | |

| Losses and losses from damage to values | 94 | |

| ……………………………………………… | 95 | |

| Reserves for future expenses | 96 | By types of reserves |

| Future expenses | 97 | By type of expenses |

| revenue of the future periods | 98 | 1. Income received on deferred periods 2. Donations 3. Upcoming arrears of arrears identified in previous years 4. The difference between the amount to be recovered from the perpetrators and the carrying value of shortages |

| Profit and loss | 99 | |

| Off-balance accounts | ||

| Leased fixed assets | 001 | |

| Inventories accepted for safekeeping | 002 | |

| Recycled Materials | 003 | |

| Commodities accepted for commission | 004 | |

| Equipment accepted for installation | 005 | |

| Strict reporting forms | 006 | |

| Debt receivable from insolvent debtors | 007 | |

| Secured obligations and payments received | 008 | |

| Security of obligations and payments issued | 009 | |

| Depreciation of fixed assets | 010 | |

| Fixed assets leased | 011 | |

Greetings. In this article we will talk about suppliers.

60 Postings

About those organizations without which our company could not work. For accounting suppliers in accounting has its own accounting area.

Accounting calculations with suppliers - a minimum of theory

If we talk about the essence of the site working with suppliers, then we say only two words - we buy, and we pay. Details of this site are disclosed in situations that arise when we buy or pay. For instance.

We buy materials, goods, fixed assets, services from suppliers. And if material values \u200b\u200bcame with additional amounts for transportation, then how to take them into account? And if it turns out that the supply is defective, shortage. How to act here?

The supplier can say that we owe him a certain amount, and we have a completely different amount in the account. What to do? Here, reconciliation of mutual settlements is indispensable. And that's not all.

The supplier we owe made a new firm and transferred our debt to it. and what should we do in this case?

You see, it turns out a lot of different situations. But they are simple and with a correct understanding of the essence - it can easily be assumed what kind of wiring is needed.

In addition, these situations for small enterprises are rare cases. In general, there is nothing difficult and terrible. Read website articles, do practical exercises and, in the shortest time, you will understand everything. Well, now we continue.

Accounting accounts for accounting calculations with suppliers

It is generally accepted in accounting to use two main accounting accounts for accounting for mutual settlements with a supplier. These accounts include:

- account 60 “Settlements with suppliers and contractors”

- 76.5 "Settlements with other suppliers and contractors"

When we work with suppliers, on these accounts we record debts arising from our company to them. Debts for the fact that we buy from them some material values \u200b\u200bor services.

Primary documents for accounting suppliers

The supplier settlement section works in two directions: “we are buying something from suppliers” and “we are paying for purchases”. For each direction we have our own primary documents.

1. Primary documents from the supplier to us

Contract

One of the very first documents is a sales contract between companies. However, it may not be, and the companies cooperate. In practice, I noticed when the tax inspects our company and focuses on the absence of a contract, then our company concludes it with a supplier.

In any case, the contract is insurance of each participant, supplier and our company, from any unpleasant affairs of one or the other. for example, the supplier delivered something or rendered services to us, and we "waved a hand at him and did not say thank you." Or, we paid the supplier in advance to deliver / deliver, for example, goods to us. And the supplier took and "forgot" about us. In general, a contract is a legal document that describes the obligations of two parties and the consequences for failure to comply.

Supplier invoice

The second document from the supplier is the invoice for payment, which indicates what exactly we are buying, how much it costs and bank details. This document does not bear any legal force, but carries only background information. Moreover, such a document serves as the basis for payment. Those. if our company decides to pay, then the basis of payment will indicate the details of the account: such-and-such number, from the number of such-and-such, from the counterparty of such-and-such, for the amount of such-and-such.

Invoice, or Act on the service, work performed

The supplier exposes these documents to our company as the final result: goods and materials were delivered, the service was provided, and the work was completed. The signature and seal of these documents on our part confirms our agreement. And already these documents carry legal force.

Vendor invoice

The supplier applies this type of document to the Consignment Note, to the Service Certificate or the Work Completed. This document is issued by those supplier companies that pay Value Added Tax (VAT). This document repeats the contents of the Payment Account, Invoice, Acts. But the main essence of the invoice is to show how much the total amount of goods / services put up contains the amount of VAT (we will talk about VAT in other articles).

2. Primary documents in our company

Checkout

As you know, our company is required to draw up documents for the purchase. Regardless of what we buy: materials, goods, fixed assets, services, we draw up a document of the corresponding type “Receipt / Purchase of something”. If required, we register the vendor invoice.

Payment processing

For our part, we pay the supplier. To decide what primary documents we will use, we need to decide How we will pay: Cash or Bank transfer (Cash or non-cash). After we decide, we will only select the necessary documents.

Examples of primary documents for accounting for settlements with suppliers

Interaction of the supplier settlement area with other accounts

I propose to complete the task on my own. From what you read now, worked through the previous articles, write out the main accounting accounts with which 60 accounts interact. You can from memory - great. If not yet, open a chart of accounts and try to choose.

If you carefully studied the previous materials, then I’m sure that a chart of accounts is not required.

Plan accounts for the account of the calculation of accounts with suppliers

Now it is time to look into the chart of accounts and look at the 60 account, its characteristics and think about what it gives us.

As you can see, account 60 “Settlements with suppliers and contractors” has several sub-accounts and sub-accounts. For us, of interest are accounts 60.1 and 60.2. Why?

Because these two sub-accounts share information on “Asset” and “Liability”, look at the letters A and P. Information is divided so that our debts to the supplier must be on account 60.1 (because, like “P”). But if we pay in advance, i.e. we give an advance - they should already indicate 60.2.

If we have a debt to the supplier, and we pay a little more, then first we close 60.1, and the remainder will go in advance, i.e. at 60.2.

Now one more independent task. Write what the debt will be called on 60.1 and 60.2 accounts.

- The balance on 60.1 account will go to the balance sheet

- The balance on account 60.2 will go to the Asset balance

Subconto "Counterparties" will allow you to select a specific company name in the wiring.

Subconto “Contracts” will allow you to select a specific contractor agreement in the transaction within which the business transaction takes place.

These subaccounts and subcontos predict us that in the SAL for account 60 we will see the situation with counterparties and their contracts: who, to whom how much, under what contract. What we will not see is precisely what.

Additionally

At trading or manufacturing enterprises, a vendor accountant is closely linked to warehouse operations. The accountant collaborates with storekeepers. Storekeepers directly accept the purchased goods, materials, check the marriage, quantity and only then give the primary documents of the supplier with their mark to the accounting department.

If necessary, claims are drawn up to the supplier, a request for a refund of part of the money paid, or surcharge.

The accountant and the storekeeper make an inventory of the warehouse, where they compare the accounting credentials and the actual data in the warehouse. The results of the inventory, and this is most often - shortages, surpluses, re-grading are documented with their primary documents and accounting entries.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

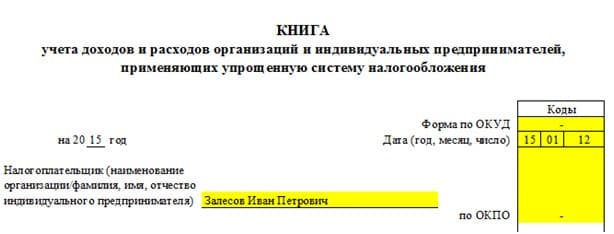

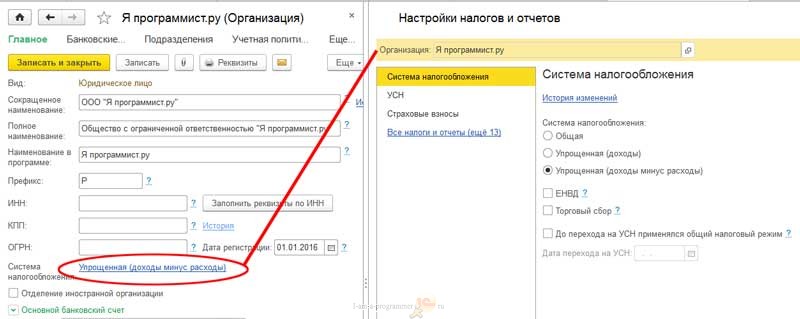

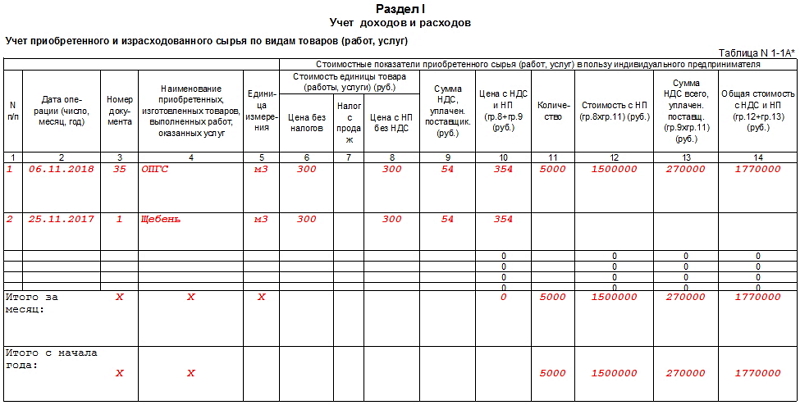

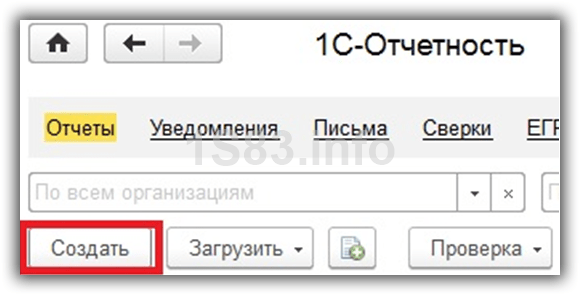

What is KUDiR and how to fill it in?