How to reflect the received financial assistance from the founder in the program "1C: Accounting 8". The Handbook of Business Transactions. 1C: Accounting 8 added a practical article "Receiving gratuitous cash assistance from the founder (share of more than 50%)", which considers the receipt of gratuitous financial cash assistance from the founder of the organization, whose share in the authorized capital of the company is 77%. The founder of this organization - an individual (resident of the Russian Federation) - is not an employee. The purpose of financial assistance is replenishment of current assets. The main purpose of creating a commercial organization is to make a profit (paragraph 1 of article 50 of the Civil Code of the Russian Federation). The founders (participants, shareholders) of companies of various forms of ownership can be both individuals (residents and non-residents of the Russian Federation, including employees of organizations), and legal entities (Russian and foreign organizations). The founders are entitled to provide financial assistance to the company through the free transfer of funds, securities or other other property. The goals of gratuitous assistance may be: conducting statutory activities; payroll; transfer of taxes; payments for rent, communication and office maintenance; payment of travel expenses; repayment of borrowed obligations, etc. The document on the basis of which gratuitous financial assistance can be obtained is, as a rule, an agreement on the provision of financial assistance. In accounting, funds received by a Russian organization from the founder free of charge are other income and are recognized at the date of their receipt (paragraph 7 of PBU 9/99 "Organization income", approved by order of the Ministry of Finance of Russia dated 05.06.1999 No. 32n). In tax accounting in accordance with paragraphs. 11 p. 1 Article 251 of the Tax Code of the Russian Federation income is free of charge received property (work, services, property rights) is not for calculating income tax. Funds donated by the founder of a Russian organization, not related to payment of goods (work, services) subject to value added tax, are not included in the VAT base of the receiving party (subparagraph 1, paragraph 1, article 146, paragraph 2 Clause 1, Article 162 of the Tax Code of the Russian Federation). In addition, in connection with the release of new releases in the "Directory of Business Operations. 1C: Accounting 8" the following articles were updated: Generating a bank statement; Inventory of funds in the current account (surplus identified); The act of reconciliation of settlements with the supplier; The act of reconciliation of settlements with the buyer. Please note that starting with the release 3.0.33 of the "1C: Accounting 8" program, the new "Taxi" interface is used. Along with the Taxi interface, the previous 1C: Enterprise 8 interface is also saved. The user can choose the type of interface in the program settings. A source

The requirements of the current legislation established: if the share of the owner in the authorized capital of the company exceeds 50%, he can provide it with no tax consequences in the form of gratuitous provision of funds. The amount, as a rule, is credited to the organization’s account and should have a specific purpose (for example, an increase in working capital). When providing free assistance by one of the owners, an agreement must be concluded between him and the company.

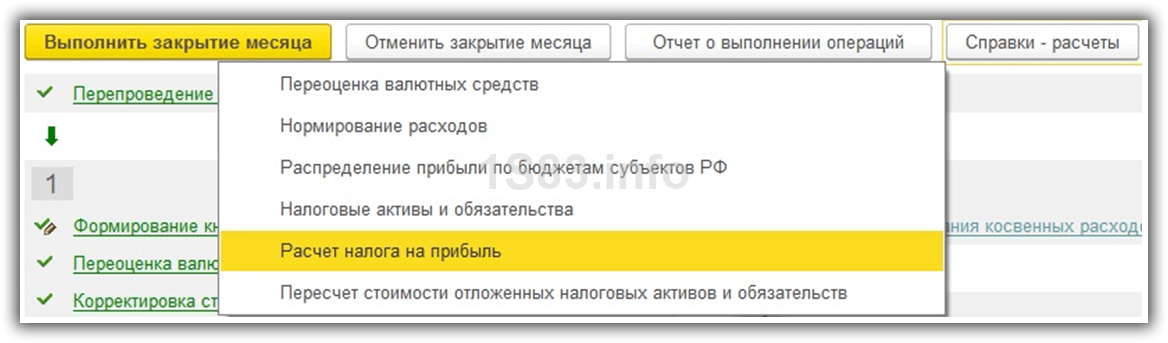

First of all, it should reflect the receipt of money in the bank account of the company. In 1C Accounting for this, the document of the same name is used. When working with him, you should be very careful, because he forms the posting, which means it affects the content of the statements.

When filling out a document registering in 1C Accounting 8.3, the flow of funds to the organization’s account in a bank, one should be guided by certain rules:

- It is recommended to create it from the menu section with bank statements using the button that fixes the receipt of funds.

- As a type of transaction, you should choose settlements with other counterparties.

- In the fields with the incoming number and date, you must enter the relevant details contained in the bank order.

- The payer should indicate the founder who transfers the gratuitous financial assistance. Information about it must be entered in the directory with counterparties.

- The basis for the transfer is an agreement on the provision of assistance, therefore, information on such an agreement should be indicated in the field with the details of the agreement. The type of contract in this case is “Other”.

- For posting, account 98.02 is used, which reflects gratuitous receipt of funds.

- After completion of the filling procedure, the document must be completed.

The second step is the reflection of the financial assistance received free of charge in the registers of 1C Accounting 8.3. To do this, you must use the manually created operation, since a standard document is not provided for in such legislation in such legislation. It should also be borne in mind that the “Operation” document generates postings, therefore, before it is carried out, it is necessary to check the contents to be sure that in 1C Accounting, the accounting of gratuitous assistance is carried out correctly.

When filling out the form for the operation, the following nuances must be taken into account:

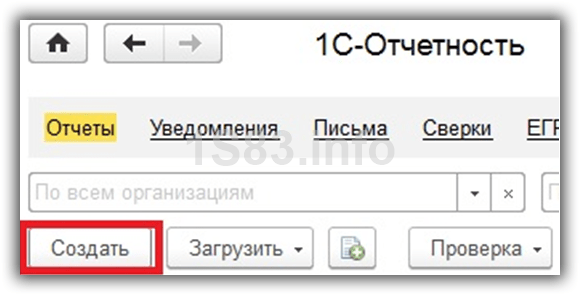

- The document is in the menu section with all the operations that are entered manually. To display the form to fill out, use the "Create" button.

- The type of document is an operation.

- In the corresponding field, the essence of the operation should be briefly described. This must be done so that in the future it would be easy to recall the contents of the operation and the documents-grounds for its implementation, since the regulatory authorities pay close attention to such actions.

- To form the wiring, use the add function. The debit account must be 98.02 (used to register gratuitous receipts), and the loan account - 91.01 (records all other income that is not reflected in other accounts when generating the financial result). Be sure to specify the subconto for the loan. To do this, from the list of types of other income, you must select the desired name. If there is no element, it should be created. The need for such an action is due to the fact that assistance from the founder, received free of charge, does not affect the taxation of profits, therefore, the appropriate settings should be made for this element of the directory (the checkbox indicating the need to be reflected in the NU is removed). As a debit subconto, the founder who transfers funds free of charge should be indicated.

- The amount of proceeds should be entered in the appropriate field.

- Fields with data for tax accounting and the value of the permanent difference will be filled in automatically in 1C Accounting 8.3. It should be remembered that as a result of such an operation, the company will have a constant difference between accounting and tax accounting due to the fact that gratuitous assistance for tax purposes is not taken into account.

- To print the accounting statement for this operation, use the button with the same name.

- At the end of the filling process, the document must be recorded and closed.

Check the correctness of reflection of gratuitous financial assistance in 1C Accounting using the balance sheet on account 98.02.

Competition for market position requires enterprises to constantly change, adapting to the needs of consumers. In conditions of limited working capital, many firms resort to the founder for help. Consider the main transactions generated when receiving free financial assistance from the founder.

According to the Civil Code of the Russian Federation, proceeds from the founder can be received on a reimbursable basis (in the form of an interest loan) and free of charge (transfer of assets, interest-free loan or money as a gift).

Interest-bearing loans carry an additional credit burden for the enterprise in the form of interest, upon receipt of which the founder - individual must also pay personal income tax.

Non-monetary assistance provided in the form of transfer of property (fixed assets, materials, goods, etc.) to property or gratuitous use is not very relevant for the company. Therefore, we consider the options for providing free financial (monetary) assistance.

The procedure for accounting gratuitous assistance of the founder

The main goals of providing free financial assistance are two: replenishment of working capital or increase of capital of the enterprise.

Working capital replenishment

According to RAS 9/99, gratuitous assistance is other income in accounting.

The receipt of cash assistance from the founder is reflected by posting Dt 50 (51) Kt 91.1, while VAT is not allocated, since the transaction is not recognized as a sale. Based on Clause 1, Article 251 of the Tax Code of the Russian Federation, gratuitous assistance from the founder, owning more than 50% of the authorized capital, is not included in the calculation of tax in income. Therefore, accounting, there is a difference that forms a permanent tax asset (PBU 18/02), which is reflected by the posting Дт68 Кт99.

If the founder owns shares of 50% or less, gratuitous assistance should be recognized as income in tax accounting.

Account 98 “Gratuitous receipts” is not used when receiving cash assistance. It can take into account the amount of gratuitous receipt of non-monetary assets. It is important to know that assistance in the form of property can not be recognized as income in tax accounting only if the company does not transfer it to third parties within a year.

Situation: In the Krona society there are three founders, the shares between them are divided equally. Founder No. 3 listed on June 12, 2016. gratuitous assistance for the payment of wages in the amount of 1.5 million rubles to the account of the Company. Krona 06/15/2016 paid employees a salary of 1.305 million rubles, paid personal income tax 0.195 million rubles.

Financial assistance from the founder - postings will be reflected in accounting:

Get 267 1C video lessons for free:

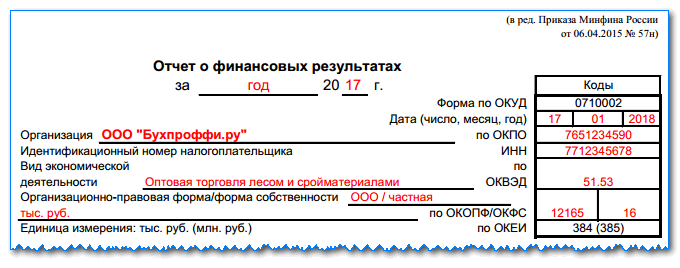

Additionally, in tax accounting reflect income tax:

Capital increase (through the formation of additional or reserve capital)

It is permissible to form a reserve fund at the expense of retained earnings; accordingly, reserve capital is increased when summing up the account 84 “Retained earnings” at the end of the year (letter of Min.Fin dated 08.23.2002 No. 04-02-06 / 3/60). On this basis, the founder’s gratuitous contributions must first be accounted for on account 91.1.

Royalty-free financial assistance from the founder of the transaction:

If, after an increase in the reserve capital, its size exceeds the limits established by the charter, then appropriate amendments must be made to it (Article 12, Article 30 of the Law No. 14-ФЗ “On LLC” dated 08.02.1998; Article 35 of the Law No. 208-FZ from 12/26/1995)

If financial assistance is made to generate additional capital, the accountant will reflect this by posting Dt51 (50) Kt83.

For documenting business operations, it is necessary to draw up a decision of the founder (minutes of the general meeting), which indicate the amount of cash assistance, property transferred (if the assistance is not cash) and its purpose. When this condition is met, tax risks are reduced to zero.

The procedure for accounting for interest-free loans from the founder

If the gratuitous contribution is planned to be returned to the founder after a certain time, he is recognized as a loan and taken into account by posting Dt 51 (50) Kt 66 (67).

To apply for a loan, it is necessary to draw up an appropriate contract, with the obligatory indication of the amount of interest and the term for repayment. The loan may also be targeted, which is reflected in the contract.

Theoretically, the founder has the right to give an interest-free loan to the company. However, such transactions are interpreted ambiguously from the point of view of lost material benefits if the transaction is recognized as controlled on the basis of Art. 105 of the Tax Code.

To reduce the risk of recognition of such assistance as taxable income, it is better to conclude an interest loan agreement. The founder who provided such a loan, provided that he owns more than 50% of the charter capital, can forgive the amount of accrued interest without tax consequences (letter of the Federal Tax Service dated 03.03.2009 No. 3–2-06 / 32). The forgiveness of interest will be reflected in accounting by posting Dt 66.3 (67.3) Kt 91.1.

Situation: In the society "Krona" there is one founder, who transferred on June 30, 2015. a loan to the Company account for a period of 3 years in the amount of 1.5 million rubles. at 15% per annum. 03/31/2016 The founder forgave the company a loan and the amount of accrued interest.

Royalty-free financial assistance from the founder in the form of a loan posting:

| date | Account Dt | Score CT | Amount, rub | Operation | Base |

| 06/30/2015 | 51 | 67 | 1 500 000 | Received a long-term loan from the founder | Decision of the sole participant of the Company, loan agreement |

| 12/31/2015 | 91.2 | 67.3 | 112 500 | Accrued interest on the loan (for the 2nd half of the year) | Bukh.pravka, loan agreement |

| 03/31/2016 | 67 | 91.1 | 1 500 000 | Loan forgiven, income of the Company reflected | |

| 03/31/2016 | 67.3 | 91.1 | 112 500 | The accumulated interest is forgiven, the income of the Company is reflected | Sole Member Decision |

Additionally, in tax accounting reflect the permanent tax asset:

But on this issue, the positions of the Ministry of Finance and the Federal Tax Service diverge (letters from the Ministry of Finance dated 10/14/2010 No. 03-03-06 / 1/646, dated 04/17/2009 No. 03-03-06 / 1/259, etc.), therefore when deciding on the provision of gratuitous financial assistance by the founder to the company, it is advisable to carefully consider the options.

Accounting for the provision of property support An enterprise that has performed the act of donating property to another legal entity must necessarily reflect the transaction in the accounting data. According to the instructions of the RF Ministry of Finance, charity expenses are included in the category of other expenses. To collect information about the donations listed, use account 91. Its structure is active-passive. The provision of gratuitous financial assistance is accompanied by correspondence with a debitable 91 account. Postings made by the philanthropy The process of gratuitous transfer of property (including money) must necessarily be documented by both the receiving and the giving parties. Inaccuracies in accounting can lead to violations of tax laws, which entails prosecution.

What to make postings for operation "financial assistance of the founder" in 1s?

According to the instructions for using the standard chart of accounts, passive account 98 (subaccount 2) is used to reflect information on the amounts of gratuitous receipts. In this case, the accounts of the property being transferred are debited. As the allocated funds are used, the amounts are recognized as non-operating income, partially debited to account 91.1.

This is necessary according to the PBU: donated assets received as a result of charity are considered non-operating income and are reflected in account 91. The amount of assistance received is reduced when:

- vacation in the production of MPZ;

- depreciation charges;

- repayment of accounts payable;

- other operations due to targeted financing.

Accounting data should fully reflect the sources of non-operating income and the conditions for their use.

Postings on gratuitous financial assistance from the founder or director

Attention

The founders are entitled to provide financial assistance to the company through the free transfer of funds, securities or other other property. The goals of gratuitous assistance may be: conducting statutory activities; payroll; transfer of taxes; payments for rent, communication and office maintenance; payment of travel expenses; repayment of borrowed obligations, etc. The document on the basis of which free financial assistance can be obtained is, as a rule, an agreement on the provision of financial assistance.

In accounting, funds received by a Russian organization from the founder free of charge are other income and are recognized at the date of their receipt (paragraph 7 of PBU 9/99 “Organization Income”, approved by order of the Ministry of Finance of Russia dated 06.05.1999 No. 32n). In tax accounting in accordance with paragraphs. 11 p. 1 Article

Financial assistance free of charge from the founder

If it is necessary to cover losses and prevent bankruptcy, the founders have the right to provide financial assistance to their organization. This can be done in the form of a loan, a contribution to the property of the organization (only for LLC) or donate money (property). The funds received during the year from the founder must be included in other income:

- Dt 50 (51) - Kt 91-1 - receipt of donated money from the founder.

It is worth noting that account 98.02 “Gratuitous receipts” is not used when receiving financial assistance in the form of cash, since it takes into account income from gratuitous receipts of non-monetary assets.

Example 1 - the founder’s contribution to the posting account 10.09.2015 Firm A received free financial assistance in cash from the founder A. Ivanov

Write the postings if the founder contributes financial assistance to the current account.

Based on Clause 1, Article 251 of the Tax Code of the Russian Federation, gratuitous assistance from the founder, owning more than 50% of the authorized capital, is not included in the calculation of tax in income. Therefore, accounting, there is a difference that forms a permanent tax asset (PBU 18/02), which is reflected by the posting Дт68 Кт99. If the founder owns shares of 50% or less, gratuitous assistance should be recognized as income in tax accounting.

Account 98 “Gratuitous receipts” is not used when receiving cash assistance. It can take into account the amount of gratuitous receipt of non-monetary assets. It is important to know that assistance in the form of property can not be recognized as income in tax accounting only if the company does not transfer it to third parties within a year.

Situation: In the Krona society there are three founders, the shares between them are divided equally. Founder No. 3 listed on June 12, 2016. free assistance to pay salaries in the amount of 1.5 million to the Company's account

How to reflect financial assistance in accounting

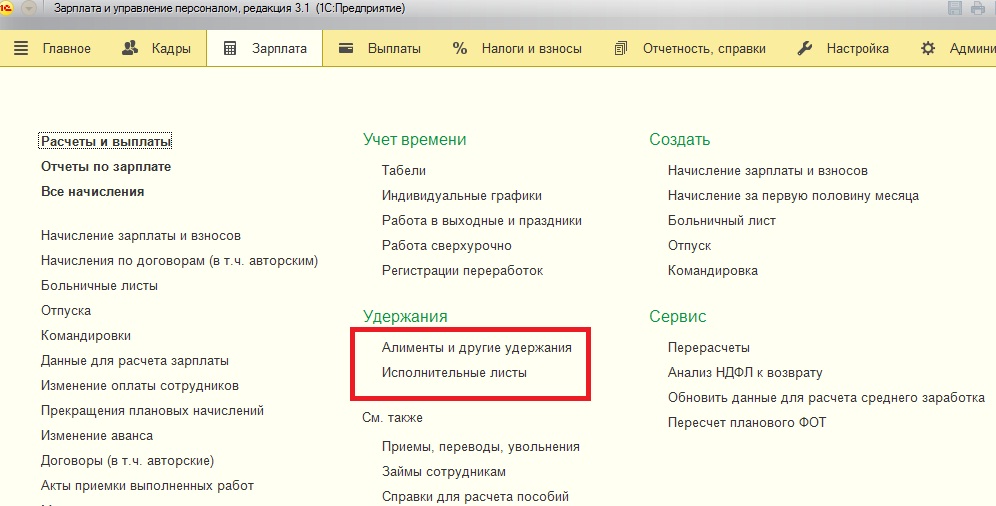

With Accounting 8.3 and 8.2;

- Self-tutorial on the new version 1C ZUP 3.0;

- A good course on 1C Trade Management 11.

Date Account Dt Account CT Amount, RUB Operation Basis 12.06.2016 51 91.1 1 500 000 Received gratuitous contributions of the Founder No. 3 Minutes of the general meeting of the Founders 06/15/2016 70 51 1 305 000 Salary paid Settlement sheet 06/15/2016 195,000 PIT paid Settlement sheet In addition, in tax accounting we reflect income tax: Date Account Dt Account Kt Amount, RUB Operation Basis 30.06.2016 99 68 300 000 Income tax accrued Accounting help Capital increase (through the formation of additional or reserve capital) It is permissible to form a reserve fund at the expense of tons of retained earnings, respectively, the reserve capital is increased when summing up the account 84 “Retained earnings” at the end of the year (letter from the Ministry of Finance of 23.08.2002.

Royalty-free financial assistance: accounting entries

Info

Typical account assignments reflecting the charity process Dt Kt Characteristic of the business transaction 76 51 Granted financial assistance was transferred 76 41 Goods were transferred for charity purposes 76 04 Securities were transferred to the ownership of another company 91 76 Expenses related to donating the property were transferred to other 91 68 The amount of VAT was calculated for transferred goods 99 68 The tax liability is reflected from the amount of funds transferred free of charge. To account for the transfer of property, a current account 76 is used, which is debited to the account gifts containing information on donated assets. After that, the amounts of expenses are written off to the debit of account 91, and also, if necessary, reflect the amount of tax liabilities. Tax accounting of gratuitous assistance The provision of financial support to other legal entities is regulated not only by accounting standards, but also by the instructions of the Tax Code.

Postings upon receipt of gratuitous financial assistance from the founder

Acceptance certificate 20 02 Calculation of depreciation of fixed assets Accounting certificate 98 / "Gratuitous receipts" 91 / "Other income" The value of the fixed asset is written off as other income Act on write-off, accounting statement If financial assistance was received in the form of materials, then: Account Dt Account CT Contents of the transaction Document 10 98 / "Gratuitous receipts" Reflects the market value of materials received free of charge. Act of acceptance-transfer 20 10 Write-off of used materials. Act for write-off, accounting statement 98 / "Without reimbursable income "91 /" Other income »Write-off of the cost of consumed materials as a part of other income The debit statement, accounting statement Example 2 - assistance for paying off losses Let's consider how to reflect in the accounting the financial assistance provided free of charge from the founder aimed at paying off the loss for the reporting year .

Gratuitous financial assistance - a common business transaction, which entails the transfer of property to a legal entity from other entities. Most often, philanthropists donate assets in the form of cash. But there are other types of gratuitous financing by third parties.

Reflection in the legislation Depending on the branch of legal regulation, which controls the process of free transfer of assets, the meaning of the definition of “financial assistance” changes. The Civil Code considers it as a transfer of property by outsiders or founders as a gift. Gratuitous financial assistance in accounting is understood as the result of charity or earmarked funding. The Tax Code provides for a number of exceptions and additional comments on the taxation of donated property.

1s 8 3 accounting for non-refundable financial assistance postings

On this basis, the founder’s gratuitous contributions must first be accounted for on account 91.1. Gratuitous financial assistance from the posting founder: Account Dt Account CT Operation 51 (50) 91.1 Received gratuitous contributions 91.1 99 Reflected profit 99 84 Reflected net profit 84 82 Replenished reserve fund If, after increasing the reserve capital, its size exceeds the limits established by the charter, it is necessary to make relevant amendments to it (Article 12, Article 30 of Law No. 14-ФЗ “On LLC” of 08/08/1998; Art. 35 of Law No. 208-ФЗ of 12/26/1995) If financial assistance is made to generate additional capital, then an accountant reflect this wiring Dt51 (50) Kt83. For documenting business operations, it is necessary to draw up a decision of the founder (minutes of the general meeting), which indicate the amount of cash assistance, property transferred (if the assistance is not cash) and its purpose.

The founders of a limited liability company can at any time provide financial assistance to the enterprise. This is often very convenient in case of financial difficulties of the organization. It’s easier to get help from a founder than to get a loan from a bank. How can financial assistance be provided from the founder, how to reflect it in accounting, what transactions to make?

Financial assistance can be in cash or in material (in the form of property).

How the founder can provide financial assistance to the organization:

- Interest-free loan;

- Interest charge loan;

- Transfer of property or finance free of charge;

Let us consider in more detail each of these cases, what are their features, what postings should be made by an accountant.

Financial assistance in the form of a cash loan

A loan in the form of cash is repayable financial assistance from the founder, which involves the return of funds transferred to the organization to the founder after a certain period of time.

In this case, funds are transferred from the founder to the enterprise on the basis of a loan agreement, the preparation of which must comply with the norms of the Civil Code of the Russian Federation.

A loan may be interest-bearing or interest-free.

In the first case, the interest rate should be specified in the loan agreement, if its size is not specified in the agreement, then it is assumed to be equal to the refinancing rate effective at the current date. In this case, every month, to reflect the interest accrual transactions, you need to check the current rate at the moment.

If the loan is interest-free, then this should also be indicated in the text of the contract. Moreover, the loan amount received is not included in the organization’s income and is not taxed. Material benefits arising from savings on interest are also not subject to income tax. As a rule, it is this method of providing financial assistance that the founders choose.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

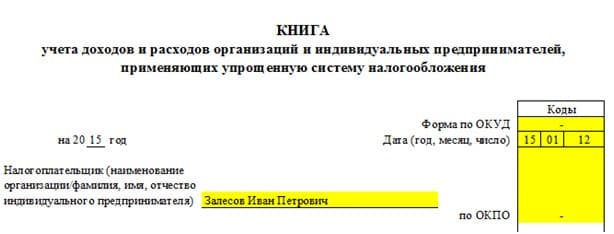

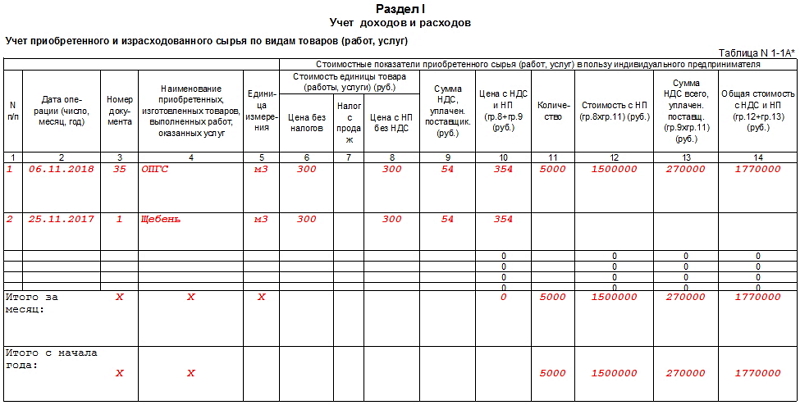

What is KUDiR and how to fill it in?