Life does not stand still, as well as the amendments to the laws of our country. So, starting from 2017, the calculation of insurance premiums is submitted in the form of KND 1151111. These changes were approved by order of the Federal Tax Service of the Russian Federation No. MMV-7-11 / 551 @ of October 10, 2016. Earlier, a report was submitted to the supervisory authority in the form of RSV-1 FIU January 16, 2014. Naturally, the report on the form of KND 1151111 appeared in the programs 1C ZUP and Accounting.

Filling "Calculation of insurance premiums" in 1C

All actions will be performed in the program 1C 8.3 ZUP 3.1. For 1C 8.3 Accounting, the principle is the same.

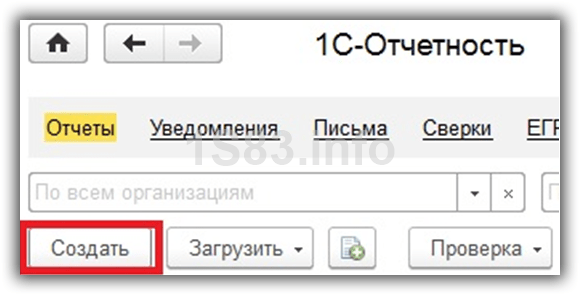

First, let's figure out where in 1C 8.3. Calculation of insurance premiums. Go to the menu "Reporting, Help" select "1C-Reporting". In accounting: “Reports” - “Regulated reports”.

You will see a window with a list of previously created reports. Create a new one.

In the window that opens, go to the "Everything" tab.

The previous report on the calculation of insurance premiums was in the group “Reporting to Funds” and was called “RSV-1 PFR”. If you choose it now, then the program will simply not let you form it for a period starting from 2017. The reason will also be indicated here - the report is no longer valid.

The new reporting form is located in the “Tax Reporting” group. We recommend adding it to your favorites by double-clicking the star sign with the left mouse button. An irrelevant report “RSV-1 PFR” should be deleted from the selected report to avoid confusion.

After selecting "Calculation of insurance premiums" a window will appear where you need to specify the organization and period. In addition, there is background information on the deadlines, responsible and changes to the law.

The yellow and light green fields of the report are editable. Nevertheless, in case of inaccuracies and errors, it is recommended to edit not the report itself, but the data in the program, on the basis of which it was generated.

Description of report sections

- The title page is required to be completed by all those responsible for the submission of this report.

- Section 1 reflects the total data on insurance premiums that must be paid to the budget. Details of the purpose of these contributions are located in the relevant annexes to this section.

- Section 2 in our example is not displayed, since it is formed by peasant (farmer) enterprises. It will become available when the code for the location of the registration “124” is indicated on the Title page.

- Section 3 contains detailed information about individuals with their passport data, TIN, SNILS and other.

Reporting to the FIU is a mandatory quarterly procedure, and the 1C program allows the accountant to greatly simplify the work by automating the generation of reports. In order for everything to form correctly, it is only necessary for a separate period to correctly and timely enter all documents into the system.

For the correct reflection of information, it is necessary to enter into the system:

- Information on monthly accruals for OPS and compulsory medical insurance. These accruals are carried out in the document “Payroll” automatically. In this case, the tariff value is pre-set in the accounting settings.

- Contributions should be reported to the FIU. It is reflected in the bank statement “Write-off from the current account” and an indication of the type of operation “Payment of taxes”.

Reporting RSV-1

After all the preliminary data has appeared in the system, you can begin to create a report for the FIU. It is created through the section “Salary and Personnel” - “Insurance Contributions” - “Quarterly Reporting in the FIU”.

In order for all reports to be generated, it is enough for the user to set the time interval of interest to him and click on the "Create a Set" button.

If previously similar kits have already been created for previous periods, they can always be found in the general list of documents. In this case, the formation of a new set is possible provided that for sets of previous periods the status is “Sent” or “Will not be transmitted”. Changing the status is possible through the "Set Status" button.

After the Create Kit button is pressed, the 1C system independently conducts reporting, including the RSV-1 form. The form will have the status "In Work", reflecting data on the size of the taxable base and the assessed contributions.

If in the upper half of the screen the “Sections 1-5” link is activated, the user enters directly into the RSV-1 report. The section panel is located on the left side. After clicking on any of them, it is revealed for a detailed acquaintance.

Section 1 reflects the amount of deductions made in the FIU and the FFOMS, including those made (+ debts).

Section 2 includes calculations to determine the tax base and the tariff used. If there are sick leave certificates for the period, they are reflected in lines 201 and 211 “Amounts not subject to insurance premiums”.

How to change the data in the RSV-1 reporting in 1C

If in the RSV-1 report go to the line “Pack of sections 6 RSV-1”, then at the bottom of the screen a list of employees with the amount of deductions for each of them will be presented. This information subsequently goes to the "Individual Information".

It is required to double-click on the selected employee, after which a form for editing in manual mode will open. You can correct the data in any of the graphs, including adding rows.

The tab “Section 6.8” reflects information on the experience of each employee of the enterprise. If there are sick leave, it is envisaged the formation of the mark “VRNETROD”. You can edit the data in manual mode, for example, if a person has days without content in the reporting period.

You can fill out information on special working conditions, grace periods, and so on. Provided that the employee worked in harmful conditions, it is provided for him to complete section 6.7. You can edit the experience through the work form in the document RSV-1.

Unloading RSV-1 and other reporting to the FIU

RSV-1 reports can be printed or file downloaded. At the same time, there are technical capabilities for checking reports, including using third-party programs. Using the workplace “Quarterly reporting in the FIU”, you have access to create the corrective report RSV-1.

Most recently, the next reporting period began in the FIU, and so I decided on the pages of this site to talk about how to prepare the regulated report RSV-1 in 1C ZUP revision 3.0.

This article will focus primarily on the sequence of preparing the report in 3.0 and, of course, on some features that are worth checking and taking into account for the correct formation of the RSV. In this regard, I think the article will be useful for both beginners and experienced users of the ZUP 3.0 program (By the way, for beginners of the 3.0 edition or for those who want to learn how to eat useful material).

For those who have not yet implemented and still work in ZUP 2.5, there is also similar material that can be found by clicking on. I published it a little earlier, but it is still relevant today.

The sequence of preparation of the report RSV-1 in ZUP 3.0

✅

✅

✅

To begin with, I will tell you in general how to prepare a regulated report in the FIU.

Everything regarding regulated reporting (not only in the FIU, but also in the FSS, IFTS, etc.) can be found in the main menu section “Reporting, inquiries”. To generate the RSV-1 report, you must use the specialized workstation, which is launched from this section by the link “Quarterly reporting in the FIU”.

The main thing here is to use precisely this working, and not the 1C-Reporting magazine (in the picture a little higher). Of course, it will be possible to create RSV-1 from it, but this report will not contain individual information, they simply will not be filled with this method of creation. Therefore, the workplace should be used. “Quarterly reporting in the FIU.”

✅ Workshop "Lifehacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s zup 3.1:

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-checking of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

Before you start creating a report for the current quarter, you must set the status "Sent" for the report for the previous quarter, if this has not been done before. To do this, use the menu item of the workstation "Set Status" and select the status "Sent".

After that, you can use the button "Create a set for _ square. 201_ ".A form will open in a new window, which will be filled with information for some time. After completing this process, we will receive two or more packets of information.

The topmost pack corresponds to the general sections of the RSV-1 (sections 1-5). If positioned on this line, then below is presented to us the basic information from the general sections. To open and view / check these sections, directly click on the line "Sections 1-5."

If we position ourselves on the bottom line (this is a pack of individual information - Section 6), then below we will see a list of all the employees included in this pack. Here we can see for each its base and the calculated insurance premiums.

Of course, all the individual information for each individual can be viewed directly in RSV-1, but it will be rather inconvenient to scroll through this entire “footcloth” and analyze the information in this form.

There are three tabs in this window. In the first - “Sections 6.4 (earnings), 6.5 (contributions)” - You can find information on the monthly earnings of the employee in the current quarter, as well as on assessed contributions (in the picture above).

✅ Workshop "Lifehacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s zup 3.1:

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-checking of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

In the second tab, which is called "Section 6.7 (earnings harm.)",information on earnings is presented, which is subject to additional contributions for harmful and difficult working conditions. Naturally, this tab is filled out only for employees whose position provides for such contributions.

And finally the third tab - "Section 6.8 (length of service)". This reflects the experience of the employee for the past quarter. At the same time, the program itself is able to break down periods if, for example, there was a sick leave or leave at its own expense. And for pests it is important to indicate correctly in the position special conditions code and list item codeso that the corresponding fields can be automatically loaded in the experience.

To refill the report, use the button “Update” -\u003e “Update completely”.

If for some reason you made manual changes to the report, but you need to update it, then you can do this without losing the correction - “Update with corrections.”By the way, employees who have manual corrections will be reflected in bold.

Next to the Refresh button, you can see the button Add. It allows you to manually add another pack of sections in the reporting, for example, corrective. But I again i do not recommend doing it manually. After all, we have a smart program that knows better how to do this. And so that she could automatically create adjustments, it is enough to reflect in the database the fact of additional assessments of contributions for previous periods, or to make a correction for any other situation in connection with which an adjustment is required. The program will track this and create the bundle itself (for an understanding of how this is done, you can read on the example of articles about adjustment from).

However, there is a useful button here. Add -\u003e Additional Files. In my practice, there were situations when the FIU required clarification on some situations in a regular Word file. It is these additional files that are added to the report with this button.

Further, it all depends on what program you use to send the report. If this is a third-party program, then from 1C, the report must first be unloadedusing the button of the same name in the workplace menu. When unloading, an internal check of the report passes and if there are errors, the program will tell you about it. Then the report is loaded into the report sending program.

There is another option, more convenient. You can send a report directly from 1C. And confirmation of the accepted reports will also come in 1C. Pretty convenient and, incidentally, cheaper. The connection conditions for different regions are different, so if you are interested to know the details, you can . I will be happy to advise you.

That's all for today, if you have any questions about preparing reports in ZUP 3.0, you can write in the form of feedback or.

To be the first to know about new publications, subscribe to my blog updates:

How to generate PFR reporting in 1C 8.3 Accounting?

Consider how the computer program 1C Accounting 8.3 helps the accountant to make quarterly reports in the FIU.

If the necessary documents were entered into the 1C system in a timely and correct manner, then the formation of “pension” reports is not difficult, as it is done automatically. In order for all the data to get to the right places in the reports, the following operations should be entered in 1C.

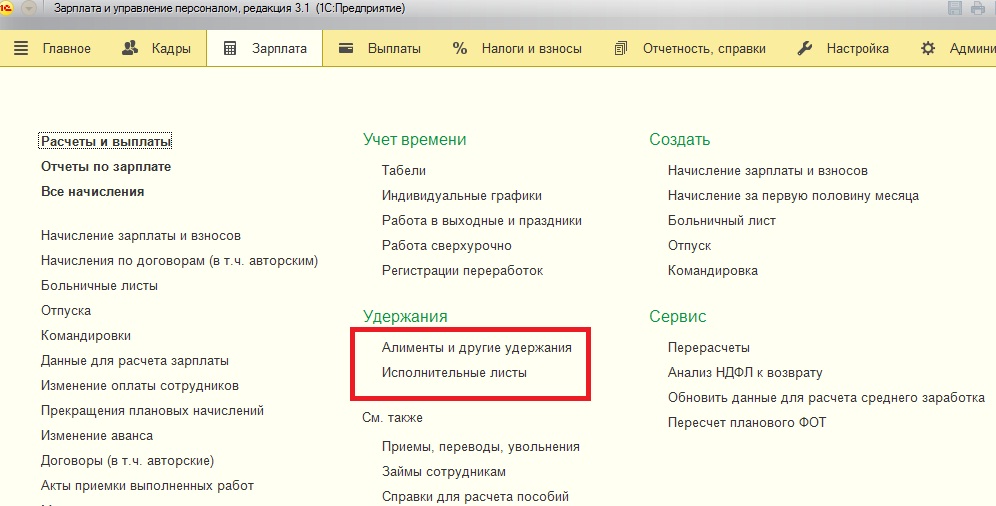

- First of all, the monthly accrual of contributions to the OPS and CHI. It is carried out by the program at the same time as the payroll of employees with document 1C “Payroll”. The contribution rate is pre-set in the salary accounting settings (see the item “Directories and Settings” in the “Salary and Personnel” section).

- Payment of contributions should also be reported to the FIU. It should be reflected in 1C bank statement “Write-off from the current account” with the transaction type “Payment of tax” (tax “Insurance contributions to the Pension Fund” or “FFOMS”, type “Contributions”).

Reporting RSV-1

When documents on the calculation and payment of contributions have been successfully entered into the program, you can start generating reports to the Pension Fund. In 1C, the workplace serves for this purpose:

Salary and staff / Insurance contributions / Quarterly reporting in the FIU

To create a new set of reporting bundles, it is enough to set the current period and click "Create Set" (the period on this button will be indicated automatically).

If the program 1C 8.3 has previously created and saved sets for other periods, then they are displayed in the list. Moreover, the creation of a new set of forms is possible only if earlier sets have the status "Sent" or "Will not be transmitted." To change the state, use the "Set Status" link.

At the click of the “Create Kit” button, the program creates and automatically fills out the RSV-1 form. The window that opens displays general information about the taxable base and assessed contributions for the required period. The status of the form is “In progress”.

Section 1 includes the amounts of contributions to the PFR and FFOMS that were accrued and paid during the period, as well as debt (if any).

Section 2 reflects the calculation of contributions based on a taxable base and applicable tariff. If during the period in the program documents “Sick leave” were entered, according to which benefits were accrued, the amount of benefits will automatically be reflected in section 2 on lines 201 and 211 “Amounts not subject to insurance premiums”.

How to change the data in the RSV-1 reporting in 1C 8.3

If we return to the form of working with RSV-1 and select the line “A pack of sections 6 RSV-1” here, we will see that a list of employees with the sums of earnings and assessed contributions has appeared below. This is the data that falls into the "Individual Information" (section 6).

Double-clicking on the line with the employee opens the editing form for section 6 of the RSV-1 for the employee. If necessary, all the information here can be edited manually: change the amount, add new lines.

The tab “Section 6.8 (length of service)” of the same form reflects information about the length of service of the employee. If a sick leave has been entered on it, then the period of the disease is automatically displayed here with the HR code. This section is also available for manual editing. For example, if an employee was given “no maintenance” leave by agreement with the management, you should add the lines here and indicate the required vacation period by selecting the required code in the “Calculated length of service” section.

If necessary, such data as periods of work in special conditions or at a preferential position are also filled. In case of work in conditions of “harmfulness”, section 6.7 is filled out.

Another feature that allows you to edit the experience of employees is the “Experience” link in the form of working with RSV-1:

By clicking on this link, the experience editing form opens in the form of a list of employees. This form also contains columns for information on the appointment of early retirement. Changes made to the experience should be saved using the corresponding button.

How to unload RSV-1 and other reports to a pension fund

The finished RSV-1 report can be printed on paper or downloaded from 1C in the form of a file in the PFR format. There is an opportunity to verify the correctness of filling out the report using both built-in 1C verification and third-party programs.

The workplace “Quarterly reporting in the FIU” also allows you to create a corrective form RSV-1 and load sets of forms into the program from reporting files.

Starting with version 3.0.43 and higher, the 1C: Accounting 8.3 program also generates a monthly SZV-M report (it is available in the “References and Settings” section of the “Salary and Personnel” program section).

Based on materials: programmist1s.ru

The sequence of preparation of the report RSV-1 in ZUP 3.0

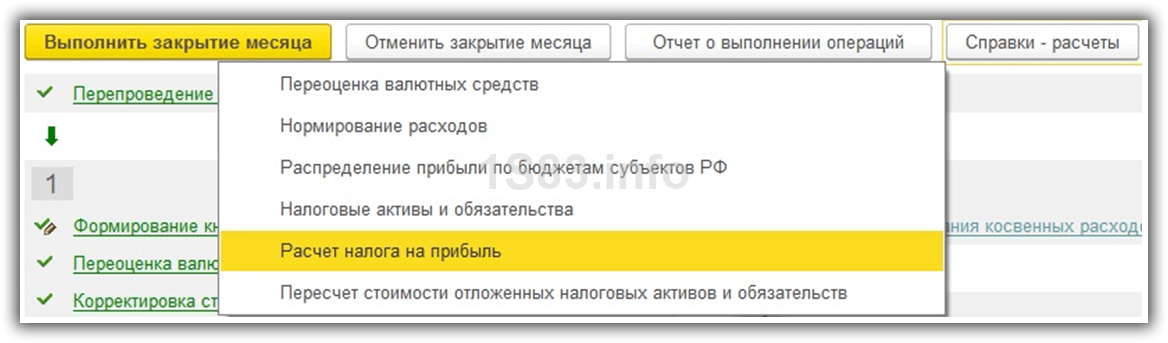

Information on regulated reporting (in the FIU, but also in the FSS, IFTS, etc.) is located in the main menu section - Reporting, references. Formation of the RSV-1 report passes through a specialized workstation, which is launched from this section by the link - Quarterly reporting to the FIU.

In order for the report to contain individual information, the workplace should be used - Quarterly reporting in the FIU. In another case, autocompletion of all required forms will not occur.

Before generating a report for the current quarter, it is necessary to set the status - Sent, if this has not been done before, select the menu item - Set status and status - Sent.

Next, click the button - Create a set for _ square. 201_ d. A form will open in a new window, which will be filled with information for some time. Upon completion of this process, you will receive two or more packets of information.

The topmost pack corresponds to the general sections of the RSV-1 (sections 1-5), the following is the basic information from the general sections. To open and view / check these sections - click on the line Sections 1-5.

To view detailed information on an employee of interest, you need to position yourself on it and double-click or use the "edit" button to open the individual information form.

There are three tabs in this window:

1. Sections 6.4 (earnings), 6.5 (contributions) - it contains information on the monthly earnings of the employee in the current quarter, as well as on assessed contributions.

2. Section 6.7 (earnings harm.) - the tab contains information on earnings taxed by additional contributions for harmful and difficult working conditions. This tab is filled out only for employees whose position provides for similar working conditions and contributions.

3. Section 6.8 (seniority) - to reflect the employee's seniority for the past quarter. The program automatically breaks up periods if, for example, there was a sick leave or leave at your own expense. For "wreckers" it is important to correctly indicate in the position - the code for special working conditions and the code for the position of the list so that the corresponding fields can be automatically loaded in the service.

The information in the workplace of the preparation of the RSV-1 report can be edited manually, but in most cases this is not recommended. In case of finding incorrect information or an error, it is necessary to find the reason in the account or in the program settings, correct (eliminate) it and re-fill the report.

To replenish the report, select the item - Refresh -\u003e Refresh completely.

If for some reason you have made manual changes to the report, but you need to update it, then you can do this without losing the correction - Update taking into account the corrections. Employees for whom the information has been manually adjusted are displayed in bold.

Next to the Refresh button, there is the Add button. With its help, it is possible to add another pack of sections to the reporting, for example, corrective. However, this is also not recommended. To create automatic adjustments, it is enough to reflect in the database the fact of additional assessments of contributions for previous periods, or to make a correction for any other situation in connection with which an adjustment is required. The program will "see" it and create a bundle automatically.

The function - Add -\u003e Additional files, is necessary when, for example, the FIU requires clarification on certain situations in a “regular Word” file. It is these additional files that are added to the report with this button.

Further, it all depends on what program you use to send the report. If this is a third-party program, then first you need to unload the report from 1C using the button of the same name in the workplace menu. When unloading, an internal check of the report passes and if there are errors, the program will notify you of this. After the report is loaded into the report sending program.

There is even more convenient. The report can be sent directly from 1C. And confirmation of the accepted reports will also come in 1C. Which is quite convenient and allows you to save. Price conditions for different regions are different.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

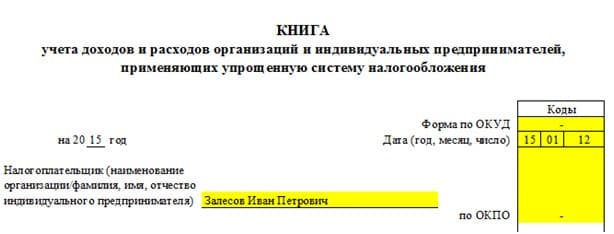

What is KUDiR and how to fill it in?