The financial statements include such a form as a statement of financial results form 2. In contrast to the balance sheet, it reflects dynamic indicators, such as income, expense, profit resulting from economic activities. This register is formed on the basis of accounting information, and is often requested by the owners, when applying for loans, as well as by the competent authorities.

The legislation determines that accounting is the responsibility of each business entity that is registered with the IFTS as a legal entity.

In this case, no exceptions are made and the organizational form of the enterprise, the taxation system used, etc. are not taken into account. The financial statements, and in its composition and the report on financial results, must be sent to the Rostat and INFS bodies without fail.

Non-profit organizations and bar associations must also submit an income statement form 2, as this form is required to be completed by all entities.

Only citizens who are in the legal form are exempted from this obligation. The same right exists in units of foreign companies. Reporting all of these entities can compile and send to the authorities on a voluntary basis. Previously, reporting did not have to be compiled and submitted to the appropriate authorities only by USN companies.

A firm may be a small business. In this case, the provisions of the laws for such companies provide a simplified reporting process.

Attention!Even if you use this benefit, the company must draw up and submit accounting reporting forms, but in a simplified form. Companies must remember that this financial statement includes a statement of financial results, form 2 and.

Which form to use - simplified or complete

An enterprise that does not meet the criteria for classification as a small business must submit a balance sheet form 1 and a statement of financial results form 2 in full on the stipulated reporting forms.

Organizations that have the right to use simplified reports are determined by the legislation on accounting, these include:

- Companies classified as small businesses.

- Nonprofit organizations.

- Participants in research projects, development of legislation on Skolkovo.

Only these entities are given the right to prepare simplified financial statements. On their own, based on the circumstances and characteristics of the enterprise, I can decide on the application of reporting forms. They must fix this decision in the accounting policy of the company.

However, the use of simplified reporting is unacceptable for such business entities as:

- Firms whose reporting must be checked by a statutory audit. They are determined by relevant legislation.

- Companies related to housing and housing cooperatives.

- Credit consumer cooperatives.

- Microfinance companies.

- Government organizations.

- Parties and their branches in the regions.

- Bar associations, law offices, chambers of lawyers, legal consultations.

- Notaries.

- Non-profit enterprises.

Report deadlines

The financial statements, including the balance sheet form 1, the statement of financial results, form 2, etc., must be sent to the tax authorities and Rosstat no later than March 31 of the following year. This time limit exists only for the above listed authorities.

However, for statistics, it is possible that upon the occurrence of certain events, it will be necessary to attach to the standard package an audit opinion regarding the prepared annual report. The company must submit it to Rosstat within ten days from the date of issuance of the report by the auditors, but no later than December 31 of the following after the reporting year.

In addition, reporting can be submitted to other competent authorities, as well as published due to the nature of the type of activity carried out in accordance with the law. For example, companies that are tour operators must submit accounting forms to Rostourism within three months from the date of its approval.

The rules of law establish a different reporting procedure for companies registered on October 1. They can exercise the right and submit reports not until March 31 of the next year, but after a year.

For example, Rassvet LLC was registered with the Federal Tax Service Inspectorate on October 23. By decision of the management, the company will submit the annual report by March 31, 2019, including information for the entire period of activity in one report.

Attention! Companies must report annually. Reporting, especially the statement of financial results form 2, may be presented except for the year, also monthly or quarterly.

As a rule, in this case, its recipients are owners who use it for managerial decisions, credit institutions for obtaining loans and credits, etc. Such accounting statements are called interim.

Ways to provide

The statement of financial results form 2, which is included in the annual report, can be sent to the competent authorities using the following methods:

- To come to the institution and submit the financial statements to the responsible person in person on paper in duplicate. Sometimes they may ask for another electronic file. This method is not available for companies with more than one hundred employees.

- Send a valuable letter through post offices or courier service. The mail will request an obligatory description of this letter.

- Using electronic document management, you can submit annual reports to all these authorities, if any. For this purpose, a specialized program, a website of tax authorities, etc. can be used.

Form and sample for filling out the statement of financial results on form 2 in 2019

How to fill out an income statement form 2: full version

When filling out the statement of financial results form 2, you should adhere to a certain sequence.

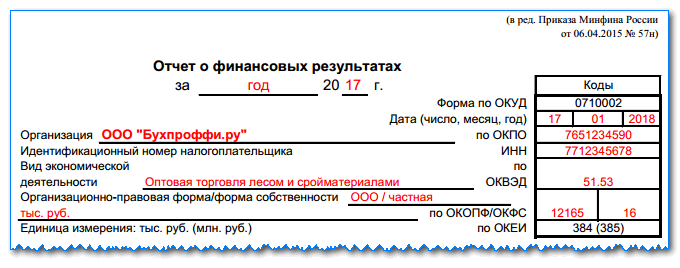

The report period is written under the name of the report. The table on the right shows the date the report was compiled. Below you need to write down the full or abbreviated name of the company, and the tabular part - the registration code in Rosstat.

Then the TIN of the reporting company is reflected. Next, the words indicate the name of the main type of activity that the company carries out, and the numbers indicate the OKVED code 2.

The next line indicates the organizational form and ownership of the organization, and the corresponding codes are affixed next to it. Next, the unit used is fixed.

The report itself is a table, in terms of which indicators of the company’s activity are reflected, and in columns - their value in the considered period of time and similar to the previous one. Thus, a comparison of two periods of activity occurs.

Line 2110 should reflect the income received for the reporting period from all types of activities. This indicator is equal to the credit turnover in the account. 90.1. In this case, VAT should be removed from the proceeds.

In the next lines of this subsection, you can decipher the amount of income by type of activity. Small businesses may not do this.

Line 2210 shall reflect the amount of expenses incurred by the enterprise for the manufacture of products or the provision of services (works). Reflected the amount of the account turnover. 90.2.

At the same time, depending on the used method of cost formation, the amount of expenses may include administrative expenses or not. If they are not included in the cost, these amounts are reflected in line 2220.

If necessary, a breakdown of expenses by area of \u200b\u200bactivity is also done here.

Form 2 of financial statements is a profit and loss statement known to all accountants. More recently, he changed his name, but the essence remains the same. Where can I find the current form form? How to fill it in correctly? How to check for errors? The answers to these and other questions will be considered as an example in the material below.

Accounting statements: forms 1 and 2

The financial statements are prepared and presented in the forms approved by order of the Ministry of Finance of Russia dated 02.07.2010 No. 66n. The financial statements - forms 1 and 2 - are submitted by all organizations. In addition to forms 1, 2 of the financial statements, there are annexes to them (paragraphs 2, 4 of the order of the Ministry of Finance of Russia dated 02.07.2010 No. 66n):

- statement of changes in equity;

- cash flow statement;

- explanations to the balance sheet and statement of financial performance.

For small enterprises, only annual reporting forms 1 and 2 are required as part of the annual reporting.

Faced with difficulties in filling out financial statements? Ask on our forum! For example, experts advise members of the forum on the reflection of a major transaction in the balance sheet.

Balance sheet form 2: one report - two names

Form 2 of the balance sheet - by this name we traditionally mean the reporting form, which contains information on income, expenses and financial results of the organization. Its current form is contained in the order of the Ministry of Finance of Russia dated 02.07.2010 No. 66n, in which it is called the report on financial results.

In the Law “On Accounting” dated November 21, 1996, No. 129-ФЗ, which was in force until 2013, this form was called the Profit and Loss Statement, and in the law that replaced it dated December 6, 2011 No. 402-ФЗ, the Statement of Financial Results. At the same time, the form itself began to bear this name quite recently: the “Profit and Loss Statement” was officially renamed to the Statement of Financial Results only on 05/17/2015, when Order No. 57н of the Ministry of Finance of Russia dated April 6, 2015, which amended the reporting forms, entered into force. .

By the way, now Form 2 is not the official, but the generally accepted name of the report. It ceased to be official since 2011, when Order No. 67n of the RF Ministry of Finance of July 22, 2003, which approved the previous forms of accounting, which were called so: Form 1 “Balance Sheet”, Form 2 “Profit and Loss Statement”, Form 3 “Statement of changes in equity”.

The form of form 2 of the balance sheet is a table above which are given:

- reporting period and date;

- information about the organization (including OKPO, TIN, OKVED, OKOPF, OKFS codes);

- unit of measurement (most often it is expressed in thousand rubles).

The table with reporting indicators consists of 5 columns:

- report Explanation Number

- name of indicator;

- line code (it is taken from Appendix 4 to Order No. 66n);

- the value of the indicator for the reporting period and the same period of the last year, which is transferred from the report for the last year.

The indicators of the past and reporting year should be comparable. And this means that last year in the event of a change in accounting rules should be transformed into the rules applicable in the reporting year.

Report on financial results - lines are decrypted according to certain rules. Consider how to fill out individual lines of a report.

1. Revenue (line code - 2110).

Here you can see the income from ordinary activities, in particular from the sale of goods, performance of work, and the provision of services (paragraphs 4, 5 of PBU 9/99 “Income of an organization”, approved by order of the Ministry of Finance of Russia dated 06.05.1999 No. 32n).

This is the turnover on the credit of the account 90-1 “Revenue”, reduced by the debit turnover on sub-accounts 90-3 “VAT”, 90-4 “Excise taxes”.

About whether it is possible to judge the value of revenue on the balance sheet, read the article “How is revenue reflected in the balance sheet?” .

2. Cost of sales (line code - 2120).

Here is the sum of expenses for ordinary activities, for example, expenses associated with the manufacture of products, the acquisition of goods, the performance of work, the provision of services (paragraphs 9, 21 of PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 05.06.1999 No. 33n).

This is the total debit turnover for subaccount 90-2 in correspondence with accounts 20, 23, 29, 41, 43, 40, 46, except for accounts 26 and 44.

The indicator is given in parentheses, since it is deducted when the financial result is derived.

3. Gross profit (loss) (line code - 2100).

This is the profit from ordinary activities excluding business and management expenses. It is defined as the difference between the indicators of lines 2110 “Revenue” and 2120 “Cost of sales”. Loss, as a negative value, is hereinafter reflected in parentheses.

4. Selling expenses (line code - 2210, the value is written in parentheses).

These are various costs associated with the sale of goods, works, services (paragraphs 5, 7, 21 of PBU 10/99), that is, the debit turnover for subaccount 90-2 in correspondence with account 44.

5. Management expenses (line code - 2220, the value is written in parentheses).

It shows the costs of managing the organization, if the accounting policy does not include them in the cost, that is, if they are not written off to account 20 (25), but to account 90-2. Then on this line indicate the debit turnover for subaccount 90-2 in correspondence with a score of 26.

6. Profit (loss) from sales (line code - 2200).

Here they derive profit (loss) from ordinary activities. The indicator is calculated by subtracting lines 2210 "Selling expenses" and 2220 "Management expenses" from line 2100 "Gross profit (loss)"; its value corresponds to the balance of account 99 in the analytical account for accounting for profit (loss) from sales.

7. Income from participation in other organizations (line code - 2310).

These include dividends and the value of property received upon exit from the company or upon its liquidation (paragraph 7 of PBU 9/99). Data is taken from the analytics on the credit of the account 91-1.

8. Interest receivable (line code - 2320).

This is the interest on loans, securities, commercial loans, as well as paid by the bank for using the money available on the account of the organization (paragraph 7 of PBU 9/99). Information is also taken from the credit analysis of account 91-1.

9. Interest payable (line code - 2330, the value is written in parentheses).

Here reflect the interest paid on all types of borrowed obligations (except those included in the cost of the investment asset), and the discount due to payment on bonds and bills. This is a 91-1 debit analytics.

10. Other income (terms code - 2340) and expenses (code - 2350).

This is all other income and expenses that passed through 91 accounts, except for those indicated above. Costs are recorded in parentheses.

11. Profit (loss) before tax (line 2300).

The line shows the accounting profit (loss) of the organization. To calculate it, to the indicator of line 2200 "Profit (loss) from sales" you need to add the values \u200b\u200bof lines 2310 "Income from participation in other organizations", 2320 "Interest receivable", 2340 "Other income" and subtract the indicators of lines 2330 "Interest to payment ”and 2350“ other expenses ”. The value of the line corresponds to the balance of account 99 in the analytical account for accounting for accounting profit (loss).

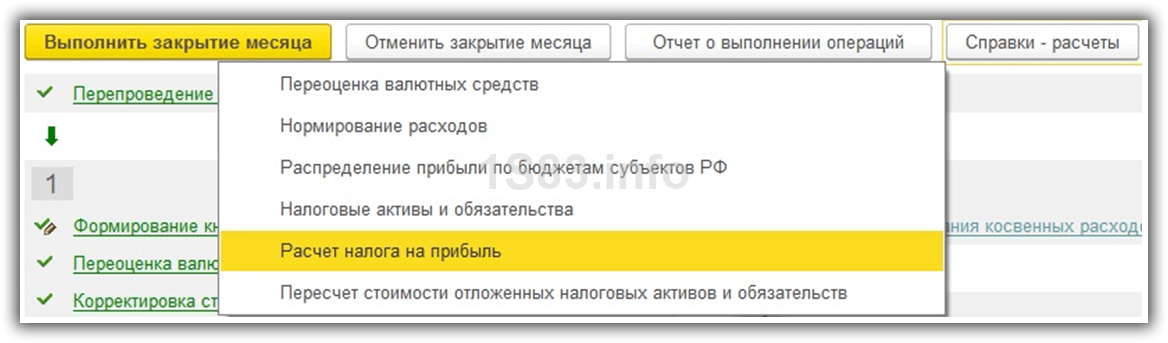

12. Current income tax (line code - 2410).

This is the amount of tax accrued according to the income tax return.

Organizations in special regimes reflect on this line the tax corresponding to the applicable regime (for example, UTII, Unified State Customs Union). If taxes under special regimes are paid along with income tax (when regimes are combined), then the indicators for each tax are shown separately on separate lines entered after the current income tax indicator (Appendix to the letter of the Ministry of Finance of Russia dated 06.02.2015 No. 07-04- 06/5027 and 06.25.2008 No. 07-05-09 / 3).

Organizations using PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n) further show:

- permanent tax liabilities (assets) (line code - 2421);

- change IT (line 2430) and IT (line 2450).

Line 2460 “Other” shall reflect information on other indicators affecting net profit.

Net profit itself is shown on line 2400.

- on the result of the revaluation of non-current assets not included in the net profit (loss) of the period (line 2510);

- the result of other operations not included in the net profit (loss) of the period (line 2520);

- the aggregate financial result of the period (line 2500);

- basic and diluted earnings (loss) per share (lines 2900 and 2910, respectively).

The head of the organization signs the form 2 of the balance sheet. The signature of the chief accountant has been excluded from it from 05.17.2015 (order of the Ministry of Finance of Russia dated 04.06.2015 No. 57n).

Report on financial results: an example of filling

For clarity, we give extracts from the balance sheet for 2018 (in rubles), formed before the reform of the balance sheet and necessary to fill out a report on financial results.

|

Account (subaccount) |

|||

|

Name |

|||

|

Deferred tax assets |

|||

|

Deferred tax liabilities |

|||

|

Cost of sales |

|||

|

Management expenses |

|||

|

Profit / loss on sales |

|||

|

other expenses |

|||

|

Balance of other expenses |

|||

|

Profit and loss |

|||

|

Gains and losses (excluding income tax) |

|||

|

Income tax |

|||

|

Contingent income tax expense |

|||

|

Standing tax liability |

|||

During the reformation of the balance by posting Dt 99.01.1 Kt 84.01 net profit in the amount of 8 590 800 rubles will be written off.

Based on the above data, we will consider form 2 of the financial statements - a sample of filling in for 2018 (data for 2017 are taken from last year's report):

|

Name of indicator |

For 2018 |

For 2017 |

|||||

|

Cost of sales |

|||||||

|

Gross profit (loss) |

|||||||

|

Selling expenses |

|||||||

|

Management expenses |

|||||||

|

Profit (loss) from sales |

|||||||

|

Income from participation in other organizations |

|||||||

|

Interest receivable |

|||||||

|

Percentage to be paid |

|||||||

|

Other income |

|||||||

|

other expenses |

|||||||

|

Profit (loss) before tax |

|||||||

|

Current income tax |

|||||||

|

including permanent tax liabilities (assets) |

|||||||

|

Change in deferred tax liabilities |

|||||||

|

Change in deferred tax assets |

|||||||

|

Net income (loss) |

|||||||

|

Name of indicator 2) |

For 2018 |

For 2017 |

|

|

The result from the revaluation of non-current assets not included in the net profit (loss) of the period |

|||

|

Result from other operations not included in net profit (loss) of the period |

|||

|

The total financial result of the period |

|||

|

For reference Basic earnings (loss) per share |

|||

|

Diluted earnings (loss) per share |

Where to find the balance sheet form 2

The form 2 of the balance sheet can be downloaded from our website.

Also, templates of all forms of accounting and tax reporting are on the website of the Federal Tax Service of the Russian Federation in the section “Tax and accounting reporting”.

Summary

Form 2, or a report on financial results, is created on the form of the established form and is subject to certain filling rules. His data show what kind of income and expenses net profit is formed in the reporting period.

Question:

We form the balance sheet and form 2 “Profit and loss statement” for the 1st half of 2016. Accountants are told that the line “retained earnings” in the balance sheet should converge with a similar line 2400 in form 2, and we have it diverges by 8 thousand. If you look at the balance sheet, then the balance on the account 99.01.1 clearly falls into the balance, but in form 2, line 2400 is calculated according to the formulas and collected from different accounts. And here the question arises: should these lines converge? And for any period, maybe they will coincide already at the end of the year, when there will be reports for the whole year and there will be a reformation of the balance sheet?

Our opinion:

The relationship between the balance sheet and the Profit and Loss Statement is observed under the following conditions:

Please note that the indicators are interrelated (equal) if during the reporting period there were no turns on the account 84 (except for the reformation of the balance sheet). For example, no dividends were accrued, no allocations to reserve capital were made. If the balance of retained earnings was used in the reporting period, then there should be a discrepancy between the amount of profit used between lines 1370 of the Balance sheet and 2400 of the Statement of financial results.

The procedure for filling out the balance sheet and the profit and loss statement in the preparation of interim reporting has the following features:

The procedure for filling out the balance sheet and the profit and loss statement in the preparation of annual reports:

Conclusion:

Comparability of indicators of lines 1370 “Retained earnings (uncovered loss)” of the balance sheet and 2400 “Net profit (loss)” of the Statement of financial results should be observed in any reporting period if during this reporting period there were no revolutions on account 84 (except for the reformation balance). If the balance of retained earnings was used in the reporting period, then there should be a discrepancy between the amount of profit used between lines 1370 of the Balance sheet and 2400 of the Statement of financial results.

Zaitsevskaya Elena Alexandrovna

project manager

website: algorithm74.rf

VK group:

Individual organizations have the right to conduct accounting in a simplified form and create simplified financial statements. These organizations include: small businesses, Skolkovo project organizations and non-profit organizations (except recognized by foreign agents).

Simplified balance sheet

At the same time, small enterprises can choose the form of preparation of financial statements independently. They can provide reports in both general and simplified forms. The composition of the reporting will depend on this. So, for small enterprises, special forms of simplified financial statements have been approved, which are given in the 5th appendix of the order of the Ministry of Finance of Russia No. 66n dated 02.07.2010. The composition of simplified financial statements is as follows:

- Balance sheet;

- Income statement.

If the company will need to provide any additional information, and the simplified reporting forms do not contain the necessary columns, then general reporting forms can be used.

Thus, in what forms small businesses decide to hand over financial statements independently. The main thing is that the decision was reflected in the accounting policy.

Simplified Balance Requirements

The annual balance sheet should contain data on assets and liabilities that the organization has at the end of the reporting year, that is, on December 31. Additionally, information is added to the balance sheet for previous years, that is, on December 31 of last year and on December 31 of the year before last. For example, the balance sheet drawn up by an enterprise for 2017 should contain data as of December 31, 2017, December 31, 2016 and December 31, 2015.

All last year’s information is taken from last year’s reports. And for indicators for the current year, information is taken from sources such as: (click to expand)

- The balance sheet for the organization as a whole for the reporting year;

- Indicators of accrued interest on loans (loans) for the reporting year.

If there is no data to fill in any line of the balance sheet, they do not fill it in and put a dash.

Simplified balance filling procedure

| Balance line | Accounting account |

| Assets | |

| 1150 "tangible non-current assets" | Sum of indicators: · Account 01 “Fixed assets” minus account 02 “Depreciation of fixed assets” · Balance on account 07 “Equipment for installation” · Balance on account 08 “Investments in non-current assets” |

| 1170 "Intangible, financial and other non-current assets" | Sum of indicators: · Account 04 “Intangible assets” minus account 05 “Depreciation of intangible assets” · Balance on account 08 “Investments in non-current assets” (in relation to expenses on development of mineral resources) · Balance on account 09 “Deferred tax assets” · Balance on account 58 “Financial investments” If there are no balances on these accounts, a dash |

| 1210 "Stocks" | Sum of indicators: · The balance of the account 10 "Materials" · Balance on account 20 “Main production” · The balance of the account 41 "Goods" · Balance on account 43 “Finished goods” · The balance of the account 44 "Costs for sale" If other accounts are used in accounting, then Inventories are calculated according to the general rules for drawing up the balance sheet. |

| 1250 "Cash and cash equivalents" | Account Balance Amount: · 50 "Cashier" · 51 "Settlement accounts" · 52 “Currency accounts” · 57 “Transfers on the way” |

| 1230 “Financial and other current assets” | Amount of debit account balance: · 70 “Settlements with staff for remuneration” · 75 "Settlements with the founders" Less the credit balance in account 63 “Provisions for doubtful debts” |

| 1600 Balance | Sum of indicators in rows: 1150 + 1110 + 1210 + 1250 + 1240 |

| Passive | |

| 1300 "Capital and reserves" | 80 "Authorized capital" 82 "Reserve capital" 83 “Additional paid-in capital” 84 “Retained earnings” After deduction of the amount of debit balance on accounts: 81 "Own shares (shares)" 84 “Retained earnings” |

| 1410 "Long-term borrowed funds" | Credit balance on account 67 "Settlements on long-term loans and borrowings" |

| 1450 “Other non-current liabilities” | This line is not filled by small enterprises, therefore a dash is put |

| 1510 "Short-term borrowed funds" | Credit balance on account 66 "Settlements on short-term loans and borrowings" |

| 1520 "Accounts payable" | Amount of credit balance on accounts: · 60 "Settlements with suppliers and contractors" · 62 "Settlements with buyers and customers" · 76 “Settlements with various debtors and creditors” · 68 “Calculations on taxes and fees” · 69 "Calculations for social insurance and security" · 70 "Payroll calculations" · 71 “Settlements with accountable persons” · 73 "Settlements with staff for other operations" · 75-2 "Calculations for the payment of income" |

| 1550 “Other current liabilities” | Account Balance Amount: · 98 “deferred income” · 96 “Reserves for future expenses” · 77 “Deferred tax liabilities” |

| 1700 Balance | Sum of row indicators: 1310 + 1410 + 1450 + 1510 + 1520 + 1550 |

After filling in all the balance sheet, it is necessary to verify whether the amount equal to the asset liabilities balance. Subject to equality, the balance is considered to be drawn up correctly, and if the amounts do not converge, then mistakes were made in filling out the balance.

Procedure for filling out a simplified statement of financial performance

| Report line | Accounting account |

| 2110 "Revenue" | The difference of indicators: · Turnover on the loan of the sub-account “Revenue” to the account “Sales” · Turnover of the debit of the sub-account “VAT” to the account “Sales” |

| 2120 "Expenses for ordinary activities" | The sum of the debit of sub-accounts to account 90 "Sales", which are kept records: · Cost of sales · Selling expenses · Management expenses |

| 2330 "Interest payable" | The amount of accrued interest on loans for the current year is indicated. The indicator is indicated in brackets, the minus sign is not put. |

| 2340 "Other income" | The difference of indicators: · Turnover on the loan of the sub-account “Other income” to account 91 “Other income and expenses” · Turnover of the debit of the sub-account “VAT” to account 91 “Other income and expenses” |

| 2350 "Other expenses" | The difference of indicators: · The turnover at the debit of the sub-account “Other expenses” to account 91 “Other income and expenses” · The indicator on line 2330 “Interest payable” The indicator is indicated in brackets, the minus sign is not put. |

| 2410 "Taxes on income (income)" | · If the organization pays income tax, then the value of 180 line 02 of the income tax return sheet is recorded · If the organization is in the simplified tax system (income), then the difference in indicators is indicated on lines 133 and 143 of section 2.1.1 of the declaration on the simplified tax system · If the organization is on STS (income minus expenses), then the indicator is indicated on line 273 of section 2.2 of the declaration on STS. When paying the minimum tax, the indicator is indicated on line 280 of section 2.2 of the declaration on the simplified tax system. · If the organization is on UTII, then the amount of UTII for all quarters is indicated. The indicator is indicated in brackets, the minus sign is not put. |

| 2400 "Net profit (loss)" | Calculate the value as follows: page 2110 - page 2120 - page 2330 + page 2340 - page 2350 - page 2410 |

If the result of "Net profit (loss)" is obtained with a minus sign, then it must be recorded in the report, taking in brackets, minus is not indicated. If the obtained value is positive, then it is not necessary to take it in brackets.

The legislative framework

See table: (click to expand)

The financial statements include several forms, one of which is a statement of financial results, form 2. However, it is with its help that one can trace the income received in the process of activity, expenses incurred and the final result - profit or loss. This report should be compiled on the basis of accounting data for government agencies, company owners and other institutions.

The law determines that each business entity that is a legal entity must conduct accounting in full.

In this case, no exceptions to the applicable tax calculation system or organizational form are not provided.

A set of financial statements, which includes a report on financial results, must be submitted by the company to the tax service and statistics.

In addition, this report must be compiled by bar associations and non-profit organizations.

The law exempts from compulsory drafting of this form only those who are engaged in activities as an individual entrepreneur, as well as units established in Russia by foreign companies. They themselves can generate these reports and submit them to government agencies in a voluntary form.

Previously, it was not necessary to compile and submit reports to companies that use the simplified tax system as a tax calculation system.

Attention!In addition, the company may have the status of a small business. In this case, reports should still be drawn up and sent to government agencies, but this is allowed to be simplified.

Using this privilege, it will be necessary to draw up both the balance sheet form 1 and the statement of financial results form 2 in simplified forms.

Which form to use - simplified or complete

If the organization does not meet the established criteria for small business, then it does not have the right to use simplified forms. In this situation, it is necessary to draw up both the balance sheet and the profit and loss statement in their full version.

Companies that can fill out a simplified form are defined in the current Law on Accounting, which includes:

- Firms that have received small business status;

- Nonprofit companies

- Firms involved in development and research in accordance with the provisions of the Skolkovo center.

Thus, only these entities are entitled to use simplified reporting forms.

However, based on the real circumstances of the activity and the characteristics of the companies, they can choose, including abandoning simple forms and filling out full ones. At the same time, they definitely need to consolidate their choice in accounting policies.

Attention!There are exceptions in which it is unacceptable to fill out reports in simplified forms, even if the requirements of the laws are followed.

These include:

- Companies whose reporting, in accordance with applicable laws, is subject to statutory audit;

- Firms that are housing or housing cooperatives;

- Consumer credit cooperatives;

- Microfinance firms;

- State organizations;

- State parties, as well as their regional representations;

- Law offices, chambers, legal advice;

- Notaries

- Nonprofit firms.

Report deadlines

The package of financial statements consists of a balance sheet form 1, a report on financial results form 2 and other forms. All of them must be sent to the tax inspectorate and Rosstat no later than March 31 of the year that follows the year the report was built. This date is valid only for these government agencies and when submitting an annual report.

For statistics, upon the occurrence of the conditions specified in the law, it may also be necessary to submit an audit report confirming the accuracy of the annual reporting information. This must be done within 10 days from the date of publication of this opinion by the audit company, but no later than December 31 of the year following the year of construction of these reports.

In addition to the Federal Tax Service and Statistics, reporting can also be provided to other bodies, as well as published in the public domain. This may be due to the nature of the activities that the legal entity conducts. For example, if a company is engaged in tourism activities, then it is obliged to submit it to Rostourism within 3 months from the date of approval of the annual report.

If a company is registered after October 1, then the current legislation determines for them a different deadline for submitting financial statements for the first time. They can do this for the first time before March 31 of the second report drawn up after a year.

For example, Gars LLC was registered on October 23, 2017. The first time they will submit financial statements by March 31, 2019, and it will reflect the entire period of activity, starting from the opening.

Attention! Firms on a common basis must prepare financial statements annually. However, in certain situations, the balance sheet and the statement of financial results form 2 can also be drawn up monthly and quarterly.

Such reporting is called interim. As a rule, it is provided to owners and heads of companies to assess the situation and make decisions, to credit institutions when processing the receipt of funds, etc.

Where is provided

The law establishes that the financial statements package, which also includes the okud 0710002 profit and loss statement form, is submitted:

- For the tax authority - at the place of registration of the organization. If the company has separate divisions and branches, then they do not submit financial statements by their location. Information on them is included in the general summary reporting of the parent organization, which sends it by its location.

- Rosstat authorities - must be sent at the same time as the Federal Tax Service. If this is not done, fines will be applied to the company and responsible persons.

- Founders, owners of the company - they must approve the statements;

- Other bodies, if this is expressly indicated in the current legislation.

Ways to provide

Profit and loss statement form 2 can be submitted to government agencies in the following ways:

- Personally come to a state agency, or authorize an authorized person for this, and submit reports on paper. At the same time, two copies must be provided - one will be marked with an admission. Sometimes it is also required to provide the file in electronic form on a flash drive. This method of filing is available for firms with up to 100 people.

- Send by post or courier. When sent by Russian Post, the letter must be valuable, and also contain an inventory of the documents that are enclosed in it.

- Using the Internet through a special communications operator, a reporting program or the FTS website. This feed method requires availability.

Report on financial results form 2 download form

Download in Word format.

Download the form for free (without line codes) in Excel format.

Download (with line codes) in Excel format.

Download in Excel format.

In pdf format.

How to fill out an income statement form 2: full version

When filling out the profit and loss statement, the form for okud 0710002 must follow a certain sequence of actions.

Title part

Under the name of the report you need to write the period for which it is issued.

Then in the right table indicates the date of compilation.

Then in the right table indicates the date of compilation.

The full or short name of the company is recorded in the column below, and the code assigned to it in the OKPO directory is written in the table on the right. Here, the line below is the TIN code.

In the next column, it is necessary to write with words the main activity of the company, and in the right table its digital designation according to OKVED2.

The next step is to record in what units of measurement the report is compiled - thousands of rubles, or millions.

The report is built in the form of a large table, where the rows indicate the necessary indicators of financial activity, and the columns are indicators of the reporting time period and previous ones. Thus, the data are compared for several periods of activity.

Table on the front sheet

Line 2110 represents the income that was received during the reporting period for all types of activities. This information must be taken from the credit turnover on the account 90 subaccount "Income". From this figure it is necessary to remove the amount of VAT received.

Line 2110 represents the income that was received during the reporting period for all types of activities. This information must be taken from the credit turnover on the account 90 subaccount "Income". From this figure it is necessary to remove the amount of VAT received.

Next come the lines in which the total amount of income can be decomposed into individual activities. Small businesses may not perform this decryption.

Line 2120 represents the costs that the company incurred in the manufacture of products or the provision of work, services. For this line, you need to take the turnover on the account 90, subaccount "Expenses".

Attention!Management costs may also be included in the amount, depending on the costing method used in accounting. However, if this is not done, then it is necessary to reflect this indicator further separately on line 2220.

If necessary, then in the following lines you can make a breakdown of all expenses depending on the areas of activity.

Line 2100 represents gross profit or loss. To calculate this indicator, you need to subtract the value of line 2120 from the value of line 2110.

Line 2210 contains the expenses that the company incurred in connection with the sale of its goods, services - advertising, delivery of goods, packaging, etc.

Line 2200 represents the total gain or loss on sales. It is calculated as follows: from line 2100, it is necessary to subtract the indicators of lines 2210 and 2220.

Line 2310 contains the organization’s income in the form of dividends from participation in other legal entities, as well as other income to the company as a founder.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

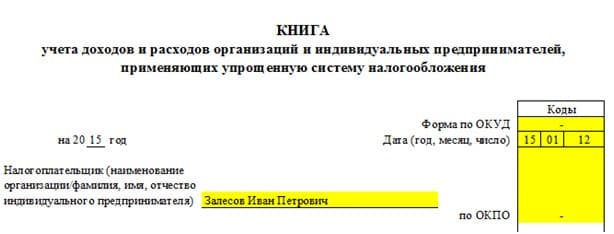

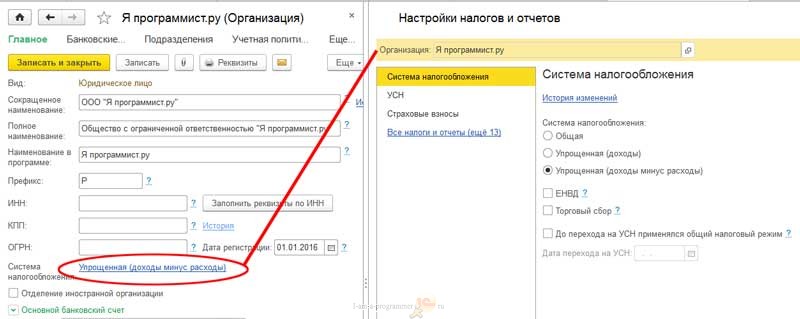

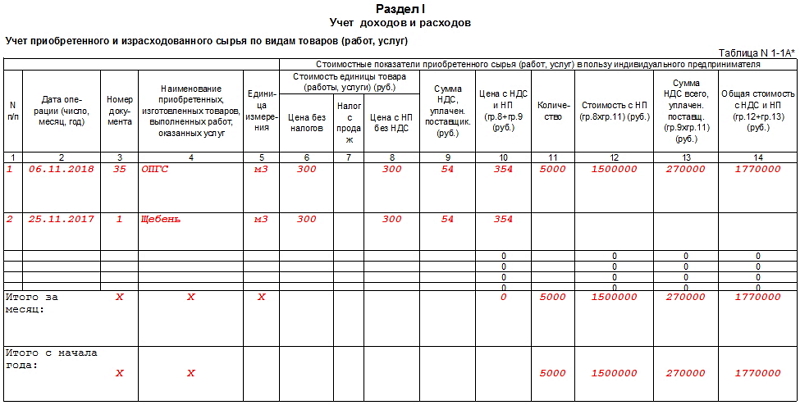

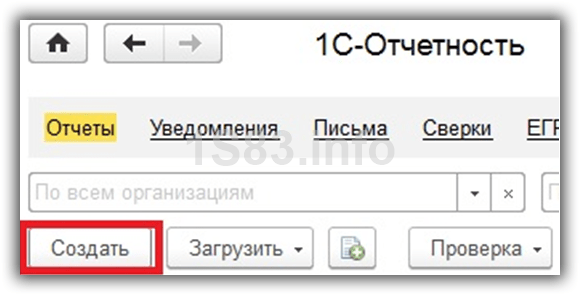

What is KUDiR and how to fill it in?