30.09.2015

As in 1C: Accounting 8, rev.2.0. to configure KUDIR so that it is formed automatically?

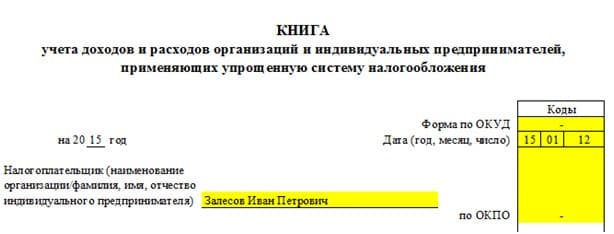

1. Accounting for the simplified tax system in 1C: Accounting 2.02. KUDiR The task of tax accounting according to the simplified tax system is to automatically generate a book of accounting for income and expenses. If KUDiR was conducted in electronic form, it is signed by the tax inspectorate based on the results of the tax period.

3. Enterprise accounting and STS In order for the program to be used for accounting under the conditions of STS application, it is necessary to set the switch to the “Simplified taxation system” position in the accounting settings tab on the “Taxation Systems” tab (Enterprise- Accounting Settings-Taxation System). Also, for a comfortable user experience, a special interface is provided. Switching is carried out through the menu Service-Switch interface-USN.

4. Setting up the accounting policy Due to the settings made in the previous paragraph, a new tab appears in the organization’s accounting policy - STS (Enterprise - Accounting policy - Accounting policies of organizations - your organization ”- STS), on which it is possible to select a taxation object. “Revenues” The monetary base is the monetary expression of the income received. Records of the KUDiR registers are formed directly by payment documents. Advances are included in income. The automatically calculated amount of income for reflection in KUDiR can be manually changed by clicking on the “KUDiR ...” button of the payment document. To do this, you must uncheck the box "The amount of income and expenses is determined automatically." If the reflection in KUDiR is manually adjusted, but at the next change in the type of operation or amount, the question will be asked about the need for an automatic display order in KUDiR. “Income minus expenses” With this setting, the register “Expenses under the simplified tax system” appears. 1C decided to provide taxpayers with the opportunity to independently determine the recognition of material costs and expenses for the purchase of goods in economic programs. When choosing the object of taxation "Revenues reduced by the amount of expenses" in the accounting policy, you must specify the list of events whose implementation is necessary for the recognition of material costs, expenses for the purchase of goods and input VAT. You can accomplish this by going to the tab "Cost Accounting"

5. The methodology for including the organization’s expenses in “expenses taken to reduce the tax base” In order to accept the expenses incurred in the expenses that reduce the tax base (column 7 of the Book of revenue and expenses accounting), for a specific business transaction, a set of rules is checked for each situation and expenses include that part of the amount for which all these rules are implemented. For this setting, the tab "Cost Accounting" in the accounting policies of a particular organization.

6. The most typical situations in accounting and how and when they are reflected in KUDiR 1. Receipt of materials (“By payment to the supplier”): The rules must be met: - the material is capitalized - paid to the supplier IMPORTANT: The expression “paid to the supplier” means direct payment through 50 or 51 accounts. If the payment goes according to the scheme “they gave money to the accountable person, the accountable person paid the supplier”, then another combination of conditions is checked: - money should be given to the accountant - advance report should be drawn up Example: 01/15/2010. - they paid the supplier 10,000 rubles (not reflected in KUDiR). 01/20/2010 - entered into the program the receipt of the MPZ in the amount of 14,000 rubles (10,000 are recorded in the KUDiR as expenses, since the required combination of conditions was fulfilled for them). 01/30/2010 - they paid the supplier 20,000 rubles (4,000 rubles will be reflected in the book as expenses, because the required combination of conditions was fulfilled for them. Overpayment to the supplier in the amount of 16,000 rubles is not yet reflected in the book in the accepted costs, since something needs to be purchased for this money, to recognize this money as expenses).

7. The most typical situations in accounting and how and when they are reflected in KUDiR 2. Services of third-party organizations (“By payment to the supplier”): The rules must be followed: - receipt of the service is reflected - paid to the supplier Similar to the recognition of expenses for materials. 3. Receipt of goods (“Upon receipt of income”): The rules must be followed: - the goods are capitalized - paid to the supplier - the goods are shipped to the buyer or written off - payment from the buyer is received. Similarly to paragraphs 1 and 2.

8. Receipt of fixed assets: The rules must be met: - a non-current asset must be capitalized - a supplier must be paid - a fixed asset must be put into operation The technique here is also complicated by the fact that the amount received as a result of these rules is not included in the book at the time fulfillment of all these conditions, and is divided by the number of quarters remaining until the end of the tax period (year). Example: 05/10/2009 - bought a non-current asset worth 30,000 rubles. (not reflected in the book). 05/15/2009 - they paid the supplier 10,000 rubles. 05/20/2009 - put into operation the main asset. 06/30/2009 - in the document “closing of the month” an additional option “Recognition of expenses for the acquisition of fixed assets” will appear. When carrying out we get the following move: the system determines that for three thousand rubles all three conditions have been met and they can be charged to expenses. Further, the number of quarters during which this object will be used in the tax period is considered. In this example, these are the 2nd, 3rd and 4th quarters; therefore, our 10,000 will be allocated to expenses in equal shares (3333.33 each) in the 2nd, 3rd and 4th quarter. 10/10/2009 - we pay the balance to the supplier, that is, 20,000, for them a separate calculation will also be performed according to the algorithm of distribution by quarters and it will be found out that 20,000 should be written off as expenses in the 4th quarter. That is, the mechanism is as follows: paid-up parts of the value of the fixed asset are allocated and for each of them, they are included in expenses by the end of the current year on a quarterly basis in equal shares.

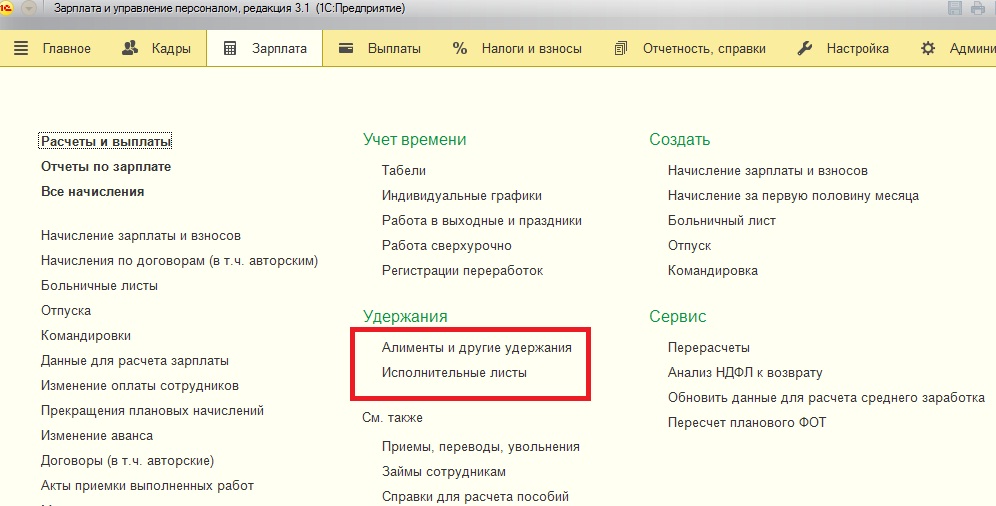

9. Salary: The rules must be followed: - salary must be accrued - salary must be paid. Please note that all accrued salaries are expenses of the enterprise. For example: 10,000 rubles were accrued to an employee, but personal income tax is retained (for example 1300) and it turns out that in the end the rule “salary should be paid” will be fulfilled only for 8700 rubles, because only for this amount there will be revolutions of the type D70- K50. And the remaining 1300 rubles will be taken into account at the time determined by clause 6. 6. Costs for any taxes and fees: The rules must be followed: - the tax must be accrued - the tax must be transferred to the budget Obviously, if you charge a tax of 1000 rubles , and transfer to the budget 7000 rubles, then only 1000 will fall into the costs. The remaining 6000 will go into the book as they accrue.

10. To obtain information about which particular conditions are not enough for the recognition of expenses, a report on the balance of the register “Expenses under STS” is used. The report is generated in the menu Reports-Other-List / Crosstab. At the same time, in the "Accounting Section" field, select "Costs under the simplified tax system"

11. Input of initial balances 1. Object of taxation “Revenues” The input of initial balances is not required. 2. Object of taxation “Income minus expenses” Balances on tax accounting of the simplified taxation system and accounting are entered simultaneously by the document “Entry of initial balances” of the menu “Enterprise” Accounting for fixed assets Expenses for the acquisition of fixed assets are recognized as reducing the tax base for the single tax paid when applying the simplified taxation system. The costs for the acquisition of fixed assets must meet the following conditions: - fixed assets put into operation - fixed assets paid to the supplier To accept for accounting, you must use the document "Acceptance of fixed assets for accounting." Ax OS is entered on the tab “Tax Accounting (USN).” As a result of the document, in addition to commissioning, payment is recorded to the OS supplier. At the beginning of accounting, this information is recorded by the document “Entry of initial balances.” Information about the payment of OS to the supplier is used to recognize expenses and the formation of section “KUDiRa.” To register payment to the supplier in the NU USN for the operating system and intangible assets that have already been put into operation, the document Operations-Other operations- Registration of payment of the operating system and intangible assets for the STS is used.

12. Report KUDiR Report KUDiR The report is intended for the formation of the Book of accounting of income and expenses of organizations and individual entrepreneurs using a simplified taxation system. Records of the “Book of accounting for income and expenses (KUDiR)” are automatically generated when conducting business transactions and are stored in the revolving registers “Kudir (section 1)”, “Kudir (section 11)”, “Kudir (NMA)”.

13. Analysis of the status of tax accounting. To analyze the structure of income and expenses of tax accounting by the simplified tax system, it is convenient to use the report “Analysis of the status of tax accounting by the simplified tax system” from the menu Reports - Tax accounting by the simplified tax system ”

Accountants whose organizations are on the STS periodically complain that KUDiR in 1C Accounting 3.0 is filled out incorrectly. It happens that the entries from the balance sheet do not get into the book of accounting for income and expenses as expected. The publication will consider the most common errors that occur when maintaining a simplified tax system in 1C Accounting 3.0 and 1C processing is proposed to correct accounting STS errors.

In order to connect the terminology of accountants and programmers to communicate in a common language, I will introduce a few clarity:

- The platform 1C object “Accounting Register” stores accounting entries, the main report using accounting entries is the “Turnover balance sheet”. Therefore, the terms " accounting register data"And" balance sheet data»Display one essence.

- KUDIR - short for " The book of accounting for income and expenses“Conducted by organizations and entrepreneurs with a simplified tax system for calculating the tax base. According to the Book, taxes are paid in accordance with the tariff: 6% of the tax base (Only income) or 15% of the tax base (Income - Expenses).

For an unambiguous understanding of the problem, let's look at the causes of USN errors in 1C Accounting 3.0.

The main reasons for the occurrence of USN accounting errors in 1C Accounting 3.0

In fact, there are not many reasons, and all of them are associated with a misunderstanding of the work of the cost accounting mechanism 1C. Comrade users, records of the book of accounting for income and expenses are formed not according to the accounting register (turnover balance sheet), but according to completely different registers.

So I want to write in bold letters again that

the amounts that fall into KUDiR are not taken from the accounting register or the balance sheet, but are formed in separate registers 1C Accounting 3.0

We will consider all these registers below. And I pay so much attention to this issue because

when maintaining the simplified tax system in 1C Accounting 3.0 introducing a manual operation with adjustment accounting register only (amounts in the balance sheet) without adjusting the registers of the simplified tax system, you 100% make a mistake!!!

After entering a manual operation, the data becomes correct in the balance sheet, but the cost offsets are performed incorrectly! Therefore, if you want to fix something in salary, taxes, goods, consult with people who know how to do it correctly in 1C Accounting 3.0. By doing so, you will ultimately benefit from saving your time and nerves in the future when reporting.

The problem is aggravated by the fact that the accounting periods are closed after the reporting period, and the correction of errors in the closed period can lead to discrepancies between the submitted reporting and 1C data. Therefore, when KUDiR in 1C Accounting 3.0 is filled out incorrectly, the only right decision is to correct the data at the beginning of the open period and do a general re-check of documents, as a result of which a correct book of income and expenses should be formed.

How to do it yourself, I will show you later in this article. And now we will consider the accounting policy settings for the simplified tax system, since sometimes KUDIR in 1C Accounting 3.0 is filled in incorrectly due to incorrect accounting policy settings.

Setting up accounting policies for the simplified tax system in 1C Accounting 3.0

Accounting policy settings for the simplified tax system are set before starting accounting and, in theory, do not change during the year.

For the correct change in the accounting policy for the simplified tax system in the middle of the year, after the change, it is necessary to redraw all documents from the beginning of the year.

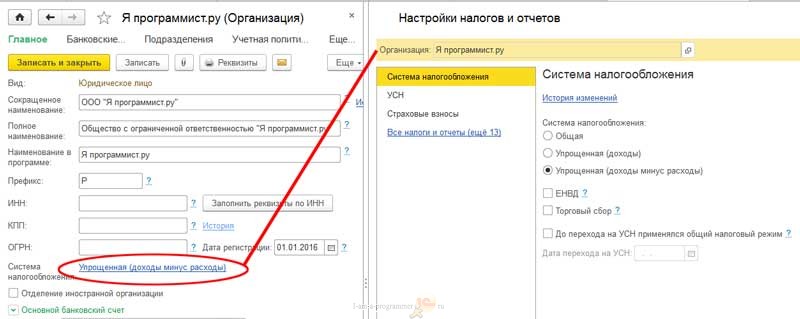

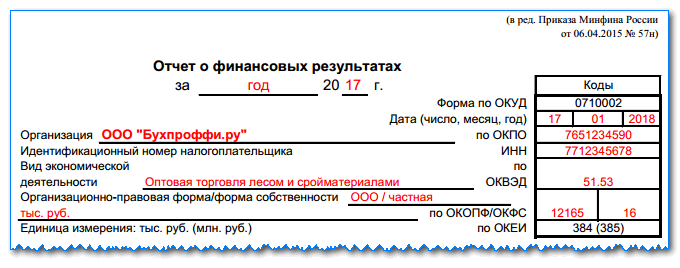

To study the acceptance of accounting corrections in the simplified tax system, when KUDiR in 1C Accounting 3.0 is filled in incorrectly, we will create a new organization in the directory “Organizations” - IP - with a simplified taxation system of 15%. Fill in the basic details in the card manually or by TIN, if 1C Counterparty service is connected. After filling in, we proceed to the adjustment of the tax system, indicate that the organization has a tax system Simplified (income minus expenses).

The most important settings of the simplified taxation system in 1C Accounting 3.0 are on the second tab “USN".

In this tab, for each type of USN expenditure, you can specify the recognition order. Ticks, without the possibility of withdrawal, set the events of recognition of expenses, fixed by law. Each organization decides whether or not to take events into account when recognizing expenses with the possibility of change, by checking or unchecking the corresponding boxes. Therefore,

if there are no expenses in KUDiR, when the necessary conditions for the recognition of expenses are met, see in the settings for recognition of expensesfor additional events of recognition of expenses.

Correction of errors in the recognition of the costs of goods and materials

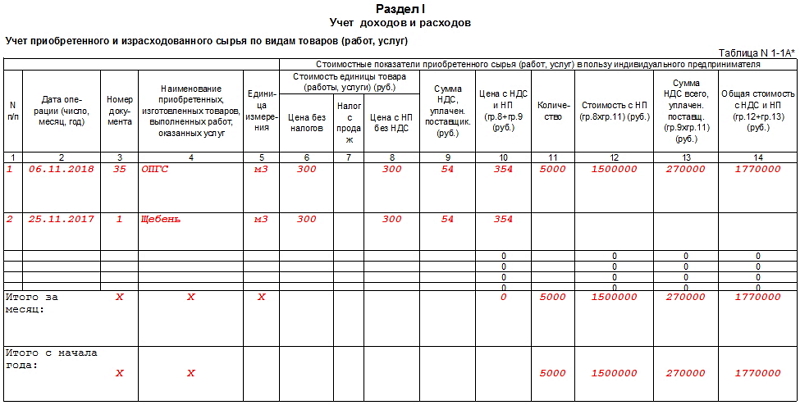

Consider the mechanism of cost formation for KUDiR for purchased goods and materials. For a better understanding of the steps to straighten out the simplified accounting system, we will create a simple accounting situation.

First of all, we will make a constituent contribution to the authorized capital of 10,000 rubles to the bank account.

We make payments for goods and materials, for this we transfer an advance payment to the supplier in the amount of 4720 rubles (of which 720 rubles are VAT). In this case, the posting is formed Dt 60.02 Ct 51 and the entire amount of the payment falls into column 6 "Costs of all" KUDiR.

We make the arrival of paid stock items, and we divide the receipt into goods in the amount of 3 units. and come to the account 41.01 for resale and materials in the amount of 1 unit. into account 10.01. for your own use. 1C Accounting will generate the receipt entries, but only the payment for the purchased material will fall into the income and expense book.

The received items of goods did not fall into the KUDiR, because in the settings on the simplified tax system it is indicated that events are necessary to recognize the costs of the purchased goods: purchase of the goods, its payment and sale. For the recognition of materials in expenses, a sufficient condition is the purchase of materials and their payment:

Accordingly, the goods will go to KUDiR after the sale. We will make the implementation of one unit of products from the three purchased, so that it would test the operation of the cost recognition mechanism under the simplified tax system. We draw up a sales document for the purchased products (by the way, if you need to display gross records in TORG 12, then we read the gross publication in TORG 12 for 1C Accounting 3.0).

Indeed, after the execution is completed, we see the records of the expenditure of one commodity unit in the records of the book of income and expenses of the STS.

The example shows how the initial settings of the system affect the formation of entries in the books of the accounting of income and expenses of the STS. Therefore,

if the entries in KUDIR have not been formed, then look at the settings for the events of recognition of expenses of the STS and check the entire path of movement of the goods or material - from purchase to sale or consumption in the organization.

This rule will apply if entries do not fall into the Book at all after completed events. But more often there are situations when the recognition of expenses is incorrect.

Search and correction of errors when KUDiR in 1C Accounting 3.0 is filled incorrectly

One example of such an error is considered when you sell goods for one amount, and another amount falls into KUDiR. In this case, the programmer’s name is 1C and they begin to prove with great passion that the program does not work correctly !!! 😡

To correct these kinds of errors, a little more knowledge is needed. If you pay attention to the registers by which 1C Accounting 3.0 makes entries, then when trading operations notice the movement on the register Costs. In this register, all expenses are accumulated, which should be included in the KUDiR simplified tax system. Accordingly, it is necessary to look into this register when trading operations KUDIR in 1C Accounting 3.0 is filled incorrectly.

You can view the data of the accumulation register “Expenses under the simplified tax system” through the “Universal Report” (located in the “Reports” section), where we select the register and set up groupings and indicators. The accounting register data is generated in the balance sheet. To make a reconciliation, it is necessary to form both of these registers for the same period and examine the data for discrepancies.

If you go to understand the nature of the error, check the speed and calculate the operations, because of which the accounting has “left”. If you need to make a correction of a previously made error, then look at the balances and, in case of discrepancies, make an adjustment to the register “Expenses under STS”. Theoretically, you can edit the accounting register, but usually accountants are guided by the data of the balance sheet, therefore, the data in this report are taken for the truth.

To enter the correction, the document Operation is used, in which the editable register is selected, in our case, “Costs under the simplified tax system”.

Using this document, we bring the remains of the register “Expenses under the simplified tax system” to the balances of the balance sheet. After this, it is necessary to make a general re-examination of the documents from the moment of adjustment and then the entries in KUDiR will be accepted correctly.

The publication examined the correction mechanism trading operationsat which KUDiR in 1C Accounting 3.0 is filled incorrectly. If you noticed, then throughout the article it was emphasized that we are talking specifically about trading operations. The fact is that operations on settlements with employees and settlements with funds are formed differently. In the next publication, we will talk about this.

See you soon!

KUDIR in 1C Accounting 3.0 is filled out incorrectly, how to fix it (part 1)

Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen a simplified tax system to keep records of taxes through the Book of Income and Expense Accounting (hereinafter - KUDiR, Book). Violation of this requirement threatens the company with a fine of up to 10 thousand rubles for the tax period. If the violation affects more than one such period, the fine will be up to 30 thousand rubles (Article 120). The matrix KUDiR, as well as the rules for its completion, were approved by order of the Federal Tax Service of Russia of October 22, 2012 No. 135n. In absolute accordance with it, 1C implements the functionality for the formation of the Book.

How to configure KUDIR in 1C 8.3

Setting up compilation of the Book in 1C 8.3 you need to start by checking the settings of taxes and reports in the main menu.

If you find that any expenses or income are not reflected in KUDiR, you need to look for the problem in this section.

You can also check taxes and reports settings in another way by going through the "Main" menu, then "Accounting Policy".

We get to the menu "Tax and Report Settings".

Here it is necessary to pay attention that there are a number of settings that cannot be edited due to the requirements of the current legislation. At the same time, it is possible to make some amendments to the established policy, in particular, to the “Transfer of materials to production” in the section “Material costs”. You can also tick off the receipt of income (payment from the buyer) in the section "Costs for the purchase of goods." In the section "Incoming VAT" there is the possibility of accepting the costs of purchased goods, works, services. At the discretion of the taxpayer, the inclusion of the costs of writing off goods (section "Customs Payments") or inventory (section "Additional Costs Included in the Cost of Production") in the KUDiR formation is established.

How to fill KUDiR in 1C

Like most reports in 1C, KUDiR is generated automatically based on the results of reporting or tax periods. After carrying out routine operations to close the month, the accountant needs to go to the "Reports", in the section "STS" - "Book of income and expenses of STS".

It is possible to select the desired tax period (this is a quarter, six months, 9 months and a year). By pressing the “Generate” button, the printed form of the Book is displayed.

On the left side is a list of sections:

- Section I. "Income and expenses" in a tabular form in chronological order displays all business operations for the period indicating the amounts.

- Section II. “Expenses for fixed assets and intangible assets” reflects information on expenses for fixed assets and intangible assets for the period. For organizations that have chosen the simplified tax system, income minus expenses.

- Section III. The “loss calculation” is filled in if there are losses that reduce the company's tax base for a number of years.

- Section IV. “Tax reduction” here shows the amounts that (clause 3.1 of Article 346.21 of the Tax Code) reduce the amount of the calculated tax, for example, on insurance contributions to the Pension Fund or other contributions.

- Section V “Trade Fee” reflects the amount of the trade fee that reduces the amount of tax due.

By clicking on each line of the section, the right window of the generated report opens on the right.

When you click the "Show Settings" button, the settings of the KUDiR form are opened.

It is possible to display transcripts, inclusion of the columns “Revenues of all”, “Expenses of all” and “VAT printing mode”. When you check the box “Include in the report form and fill in” and with the subsequent formation of the KUDiR, the columns of all income and expenses are displayed on the screen, including those taken into account when calculating the tax base. This function allows visual control of indicators that are not included in tax accounting.

Double click on the line of the indicator allows you to display the primary document, which served as the basis for inclusion in KUDiR.

The formed KUDiR form can be printed in the context of sections of interest.

Manual changes to KUDiR

For example, during visual inspection of KUDiR it was found that for some reason the expense recognized in tax accounting did not fall into the column “Including expenses taken into account when calculating the tax base”.

Double-clicking on this line opens the primary document.

We hover over the fourth button in the panel, the note “Show postings and other document movements” pops up, when clicked, the document moves in accounting and tax accounting.

We go to the section "Book of accounting for income and expenses (section 1)."

In the upper part of the document, check the box "Manual adjustment (allows editing the movements of the document)." Then you can put down the amount of the document in the column "Costs".

In the KUDiR menu, press the "Generate" button again. The program will ask you to update the information, as changes have been made.

In the subsequent formation of KUDiR, we see that expenses are reflected in both columns - both in accounting and in tax accounting.

There is also another way to manually make changes to KUDiR. To do this, select the "Records of the USN income and expenses book" section in the "Operations" menu.

In the window that opens, we will generate an arbitrary document for the amount of the necessary adjustments, in our example, 1.0 million rubles to the supplier for the delivered goods.

After carrying out this document, we proceed to the formation of KUDiR and see a line with our adjustment.

Accounting Status Analysis

The finished book of accounting for income and expenses in 1C is analyzed in the menu "Reports", then - "Analysis of accounting for the simplified tax system".

In the window that opens, select the period to be analyzed, and click the "Generate" button.

In the form of a block diagram, various items of income and expenses are displayed on the screen. By clicking on each cell, you can see a list of primary documents included in it. This function is successfully implemented in management accounting.

The implementation of accounting in the 1C program eliminates errors interpreted by regulatory authorities as a gross violation of accounting and reporting requirements. The program is aimed at maximum control over the work of the accounting service and its individual links.

KUDIR is a book of accounting for income and expenses. It is conducted in organizations and among entrepreneurs using the simplified tax system (USN). In order for all data to be correctly formed, it is necessary to check or configure the parameters in the accounting policy of the organization. Go to the tab menu "Main", open the item "Taxes and reports" and select the organization. Here should be noted the item "Receiving income (payment from the buyer)" in the section "Procedure for the recognition of expenses" on the tab "STS".

If the “Procedure for the recognition of expenses” is not active, then the value “Field of taxation” is incorrect, which should indicate “Income minus expenses”. Only under this condition it is possible to clarify additional parameters for the recognition of expenses.

There is also a setting for outputting the printed form of the book, which is located in KUDIR itself. Located on the menu tab "Reports" section "Reports on the STS" link "Book of income and expenses of the STS."

Press the button “Show settings” and check the necessary options for displaying when printing:

Let's pay attention to the topmost parameter “Show decryption”. When activated, the book will display detailed information prior to the initial document for any income and expense.

The remaining parameters determine the interface of the book. Consider the shape of the book:

Filling out the Book is carried out quarterly by clicking “Generate”. The KUDiR report relates to regulated reporting and is submitted to the tax service at the end of the year. The structure of the book consists of sections with the content of certain information:

income and expense with quarterly calculation for the entire reporting period (year);

operating expenses and intangible assets;

data on the calculation of the amount of losses;

section for the introduction of amounts that reduce taxation.

The formation of KUDiR occurs automatically and is based on documents of implementation and receipt.

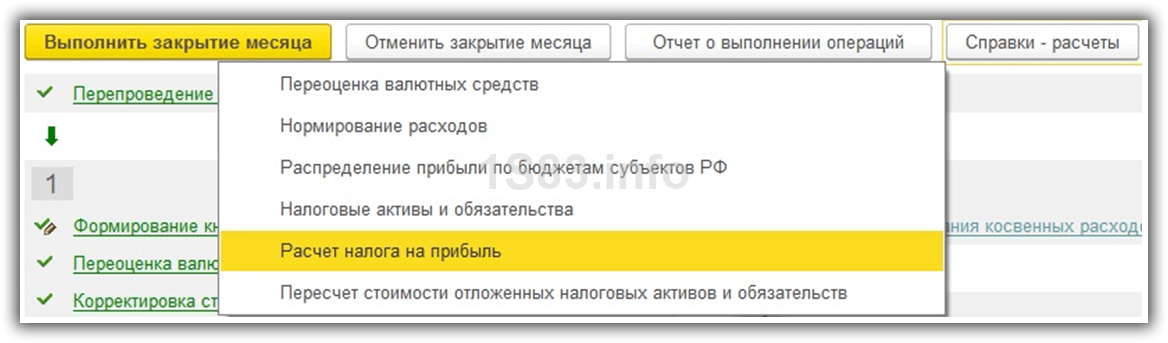

The sales document gets to KUDiR only after full payment of the issued invoice, and KUDiR itself is formed only after the scheduled operation “Closing the month” is completed.

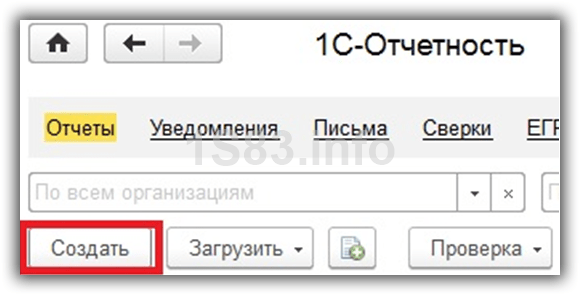

Sometimes situations arise when you need to adjust the data for the correct tax report. This action can be carried out through the document "Record the book of income and expenses of the simplified tax system." Located on the menu tab "Operations", then the section "USN".

We go in, to create a new document, click "Create" and get into the document form:

Through this document, it is possible to adjust the data for sections, each of which is located in its own tab:

income and expenses;

calculation of expenses for the acquisition of fixed assets;

calculation of expenses for the acquisition of intangible assets.

Filling out the document is not difficult, the main thing is to enter the information correctly. When keeping records for several organizations, the head of the document will contain a field for selecting the name of the organization in which you want to make an adjustment. The reflection of the document in KUDiR will occur after.

The book of accounting for income and expenses (abbreviated KUDiR) in 1C 8.3 is kept by organizations and entrepreneurs who use the simplified taxation system (STS).

Let's start with a simple question: where to find KUDIR in 1C? It can be found as follows: go to the menu "Reports", then in the section "Reports on the simplified tax system" click on the link "Book of income and expenses of the simplified tax system". We get into the book fill window:

The book is filled automatically, quarterly. Usually it is formed at the end of the year and handed over to the tax inspector along with the regulated accounting statements.

The book of income and expenses contains several sections:

- income and expenses are indicated quarterly, from the beginning of the year to the end of the year;

- expenses on fixed assets and intangible assets;

- section with the calculation of the amount of losses;

- and a section where you can specify amounts that reduce taxation for one reason or another.

Basically, the book is formed according to the documents of the sale of goods, services and according to the documents of receipt of goods and services.

Important to considerthat the implementation (expenses) will fall into the book of accounting for income and expenses after payment for goods or services (however, in the program for this you need to make the appropriate settings, in the figure I highlighted it). Even before the formation of the book, it is necessary to do the necessary regulatory operations, which are carried out at the end of the quarter. For example, make a closing month.

Get 267 1C video lessons for free:

Setting up the formation of the book of accounting for income and expenses in 1C 8.3

Before you form KUDIR, you should check. They can affect the correctness of the formation of the book.

We’ll go to the “Main” menu, then click on the “Organizations” link to go to the list of organizations. We’ll go to the organization we need, and then to the “Accounting Policy”. In 1C, 90% of cases like “do not fill KUDiR” or “do not get into KUDiR” are solved by setting up an accounting policy.

Press the button “Recognition of expenses” (this button appears when the object of taxation is “income - expenses”).

In addition to the general settings in the Accounting Policy, there are also settings when printing the book itself.

Let's go back to KUDIR and press the button “Show settings”.

A window opens with the settings:

The most interesting and necessary here is the checkbox “Display transcripts”. By checking this box, you can see what document generated this or that income or expense.

Other settings affect the appearance of the book. Different tax require differently.

Correction of records of the book of accounting for income and expenses in 1C Accounting 8.3

As I mentioned, the book is generated automatically. But sometimes it is necessary to manually adjust the data for accounting in the tax. To do this, use the document "Records of the book of accounting for income and expenses (USN)."

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

What is KUDiR and how to fill it in?