The book of accounting for income and expenses (KUDiR) is a tax accounting register mandatory for all simplifiers (Article 346.24 of the Tax Code). Filling out the book is a responsible occupation: it serves as a source for the formation of the tax return and calculation. Is it realistic to independently conduct KUDiR on the "revenue" USN? What you need to know to fill out the register correctly?

Issue price: if you don’t

Organizations and entrepreneurs who apply simplification are required to maintain KUDiR. The absence of a book is considered a gross violation of accounting rules and is punishable by a fine of 10,000 rubles. and more - the size depends on the seriousness of the violation (Article 120 of the Tax Code). The book must be stored for 4 years after the end of the tax year (Article 23 of the Tax Code).

KUDIR for a 6 percent STS: form and content

The book should contain information that is involved in calculating tax. KUDiR data is used when filling out the declaration (check out the procedure for compiling the declaration on the simplified tax system 6%). Therefore, the books of “income-generating” and “income-spending” simplists differ. The form and rules for filling out the Books of income and expenses under the simplified tax system in 2015 are the same as in the previous two years - they have been applied since January 2013 (see the order of the Ministry of Finance N 135н from 10/22/12).

Simplified “incomers” of KUDiR fill mainly with information about incomes: in non-sales and from sales, which form the tax base (see the procedure for calculating the tax base for the simplified tax system “income”).

Not all income / income is taken into account when calculating tax. Those of them for which the single tax is not paid (not calculated) are not entered into the KUDiR or reflected in the book in a special way.

| Income / receipts do not participate in the calculation of the “simplified” tax: |

|

|---|---|

| Of organizations | |

| received from activities on imputation and patent system |

|

| dividends, interest on certain types of securities and others, listed in paragraphs. 2 p. 1.1 Art. 346.15 | dividends, winnings, prizes and other specified in paragraphs. 3 p. 1.1 Art. 346.15 |

| listed in Art. 251 of the Tax Code, and receipts that are not income in essence:

|

|

In the book of the “profitable” simplist, in addition, some expenses are recorded:

- actual expenditures from the amount of subsidies received from the state under the programs: support for small / medium-sized businesses or assistance to self-employment of the unemployed;

- deductible from the calculated tax payments under paragraph 3.1 of Art. 346.21 Tax Code.

The tax at USN6% is reduced by the paid:

- compulsory insurance contributions: pension, medical, social;

- contributions for employees' VHI if the first three days of incapacity for work are insured, and the amount of insurance payments does not exceed benefits for the specified period;

- the amount of sick leave for the first three days, which are paid at the expense of the employer and are not covered by insurance payments under VHI;

- the amount of the trade fee, provided that the organization (SP) was registered as the payer of the fee and presented a supporting document (clause 8 of article 346.21 of the Tax Code).

As a general rule, the listed payments can reduce the calculated tax by 50%. There are exceptions. So, an individual entrepreneur without employees can, without limitation, reduce the tax on the amount of contributions in a fixed amount paid for themselves. The Tax Code has not yet spelled out a procedure for reducing tax on the amount of the trade fee, but there is a position of the Ministry of Finance (letter N 03-11-10 / 40730 of 07.15.15): there are no restrictions on collection in the code, therefore it is deducted from the amount of tax on “revenue »USN completely.

Book keeping: methods, procedure for registration and correction

For the first time, KUDiR is started at the moment of transition to simplification. Then a new register is opened for each regular calendar year. Organizations with separate divisions (not branches!) Keep only one book. KUDiR can be filled in electronically or on paper. During the tax year, it is allowed to switch from manual recordings on paper to electronic form (letter of the Ministry of Finance dated 01.16.07 N 03-11-05 / 4).

KUDIR does not need to be certified by the Federal Tax Service Inspectorate from 01/01/13. If there was no activity, organizations / entrepreneurs should prepare a “zero” register for the period.

Before making the first entry, the paper version of the register must be:

- to lace up (flash) and number;

- on the last page indicate the number of sheets, put the signature of the head / IP and the seal (if any) at the place of stitching.

An electronic book should be printed quarterly (all sections, even not completed), and at the end of the tax year should be drawn up in the same manner as a paper one.

Correction of any error / clerical error in the paper version is done according to the following rules:

- the adjustment must be reasonable and dated;

- the correction is confirmed by the signature of the head (IP) and the seal.

Writing in paper form is best done with a black / blue pen, cannot be corrected using corrective means (cross out the wrong text with one line, write the correct text from the bottom or top). The Ministry of Finance recommends filling out the KUDiR in full rubles (letter dated 07.24.13 N 03-11-06 / 2/29385), but the BAC considers it correct to indicate the amounts in rubles and kopecks (decision dated 08.20.12N 8116/12). The second option is preferable.

In terms of corrections, the electronic form is more convenient. However, if the clarification needs to be made in an already printed copy, then this is done according to the rules for adjusting the paper version.

Book structure and general filling rules

The register consists of a title page and four sections. The simplified duties of the Book of income and expenses under the simplified tax system “income” are to fill in two sections.

General filling rules:

- information about households is entered into the book. operations involved in the calculation of tax;

- any entry should be justified by the primary document;

- operations are entered in chronology, each of them - in a separate line (without layout by type of operations or days);

- entries are made in Russian.

The procedure for filling KUDiR with the simplified tax system 6%

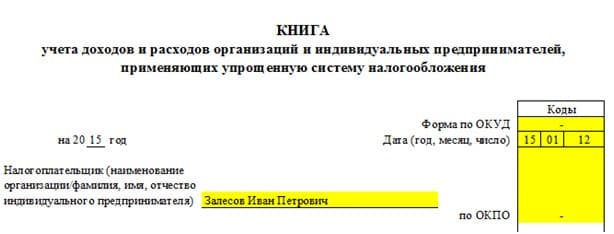

Title page

It can be filled arbitrarily - the rules are not set.

Some points worth paying attention to:

- oKUD form code can be omitted - for KUDiR it is not approved by the State Standard;

- in the cell "Date (year, month day)" indicates the day the book was opened - the date of the first record;

- IE do not affix the code for OKPO;

- the address of the location / residence is indicated in the one indicated in the constituent documents;

- in the cell “Numbers of settlement accounts”, it is necessary to indicate for each account its number and the name of the bank.

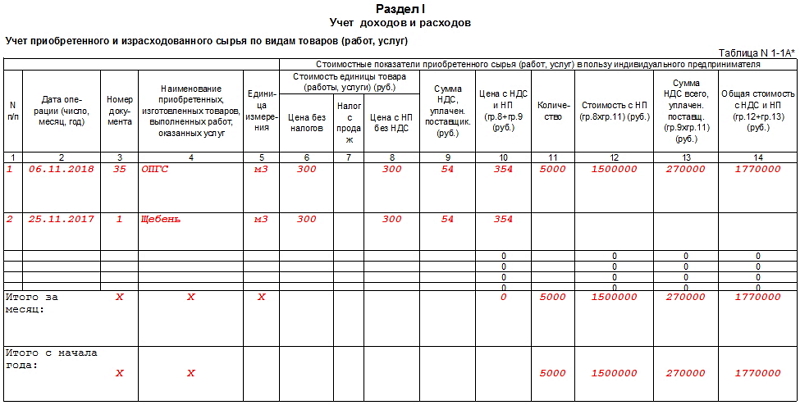

Section I

It consists of four tables (one for each quarter of the year) and a certificate that Simplists do not need to fill out.

It is worth paying attention to the following:

- Column 1 indicates continuous numbering throughout the year.

- In column 2, it is recommended to indicate in addition to the date and number of the primary document its name. The primary element of simplists, since they determine the income upon receipt, will be: payment orders, cash receipts, etc.

- In column 4, income is indicated on the day of receipt of funds. State subsidies are reflected in the amount of expenses incurred at their expense as of the date such expenses were incurred (so that the USN base does not increase). Revenues that are not income (see table 1) are not displayed or are paid with features.

- In column 5, simplistic “income-earners” should show what they spent from the received state subsidies. Costs must be documented. Reflect in gr. 5 other costs are not needed.

Example 1. Attention, return!

The entrepreneur on 04/07/15 had to return an advance payment in the amount of 50,750.50 rubles to the buyer, which was received on 04/01/15 and taken into account in income (in column 4). The tax base should be reduced for the amount of the return. To do this, on the day of transferring the prepayment back to gr. 4, an entry is made with a minus sign.

Example 2. Obtaining subsidies

IP Zalesov applies the “profitable” USN. As a small business entity, on 12.01.15 he received a subsidy from the local budget for reimbursement of expenses for the rental of premises in the amount of 60,000 rubles. (in January, the subsidy to KUDiR is not reflected).

The entrepreneur spent 02.15.15 to rent 30,000 rubles. He will contribute this amount in February 2015 in two columns of Sec. I: 4 and 5.

Section IV

Designed to reflect expenses that reduce tax:

Example 3. Payment of sick leave

The individual entrepreneur paid the employee disability benefit in the amount of 6,500 rubles in March 2015. according to the payroll No. 6 dated 03/05/15. The amount of the allowance for the first three days is 3,100 rubles. The entrepreneur did not conclude agreements on the VHI of employees. In gr. 9 sec. IV for March 2015, you need to record 3,100 rubles (part of the benefit paid to the employee at the expense of the Social Insurance Fund is not reflected here - it is deducted from the amount of contributions payable to the fund).

KUDiR according to the “profitable” simplification is a relatively simple register that can be completed without even having special accounting knowledge.

Watch the video about the need for maintaining and responsibility for the absence of KUDIR:

Placed here: we wrote about the tax itself, who can apply it, what are the restrictions, how to calculate it and how to fill out a declaration. Today, finally, we got to filling KUDIR. In this article you will find an example of registration of KUDIR for STS from Income.

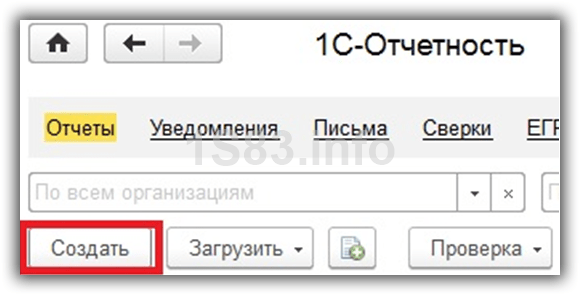

Filling KUDIR automatically, keeping records and submitting reports is most convenient in special service.

First, we recall that KUDIR is a book of accounting for income and expenses, it should be kept by both individual entrepreneurs and companies that pay taxes on simplification. Individual entrepreneurs and legal entities fill it the same way, there are no significant differences, so our example is suitable for everyone - it reflects the main points. The differences in filling out the book are due only to different objects of taxation. Here is an example for STS-Revenues.

So, a few highlights:

- KUDIR is carried out without fail, if you have not carried out activities during the year, you should have zero KUDIR;

- all operations are entered in KUDIR, always in chronological order;

- operations are entered in KUDIR on the basis of the primary;

- information is reflected positionally: one operation - one line;

- all entries are made in Russian;

- errors in KUDIR can be corrected, but such a correction must be reasoned and certified by the signature of the IP (general director of the legal entity) with the date of correction and stamped (if used);

- records are kept in full rubles;

- KUDIR can be printed and filled out on paper, or you can keep an Excel file on a computer, in the second case, at the end of the period it will need to be printed. The accounting book must be flashed: lace up and numbered, sealed with signature and seal.

The KUDIR form is unified, the form is approved by Order of the Ministry of Finance of the Russian Federation No. 135n of 10/22/2012. In it you can find the form itself and instructions for filling it out.

IMPORTANT!!! Starting January 1, 2018, all entrepreneurs applying the simplified tax system must keep KUDIR on a new form approved by the above order, subject to changes from December 1, 2016. No. 227n. For 2019, there were no changes in it.

What's new in KUDIR?

- The V section has been added, which is necessary to reflect the trade collection, which is relevant, at the moment, for Moscow entrepreneurs.

- A new VI section has been added to the instructions for completing KUDIR, explaining how to correctly reflect the trading fee (Appendix No. 2 to Order No. 135n).

We emphasize once again that these changes concern the completion of KUDIR from 01.01.2018, 2017 and the previous years you must have completed according to the old Rules and the old KUDIR form.

How to fill KUDIR

Filling KUDIR on your own is quite simple, especially for IP with a small number of operations. You can also use the services of an accountant or special online services. Today we will talk about how to fill in the KUDIR yourself.

We will deal with them in turn:

- Cover page - a standard title page in which you must specify the taxpayer data and the year for which the document is prepared;

- Section I Income and expenses - it is filled by all individual entrepreneurs and legal entities on the USN;

- Section II Calculation of expenses on fixed assets and intangible assets, which are taken into account when calculating the base for tax;

- Section III Calculation of the amount of loss taken into account when calculating the simplified tax system

These two sections are filled out only by those who switched to the simplified tax system with the base Income - expenses.

- Section IV Expenses that reduce the tax on the simplified tax system in accordance with the Tax Code of the Russian Federation (in other words, the insurance premiums that you pay for yourself and employees) - in this section only those who choose a simplification with the Income base are entered.

What is the result? An individual entrepreneur on USN-Income must fill out the title, sections I and IV.

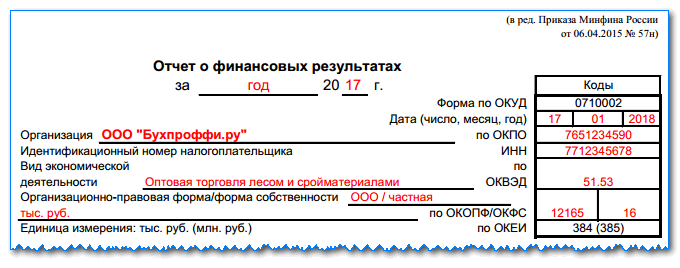

Step 1: fill out the cover page

What should be indicated on the title page? We write the following data:

- the year for which the book is kept - “for 2019”;

- book opening date - 2019/01/01;

- Full name of IP (name of organization);

- INN IP (INN / KPP legal entity);

- The object of taxation is “income”;

- Address (for individual entrepreneurs - place of residence, for legal entities - location);

- No. r / s and the bank.

An example of filling in the KUDIR title is presented below:

Step 2: Complete Section I Income and Expenses

IE on USN-Revenues records his income in this section. Some expenses are also indicated, but I will say more about this below.

So, there are four tables in the section - one per quarter. Each operation is written in a separate line, you add the number of lines yourself when you print the form. In table 5, the graph:

- No. p / p - put down the record number in order;

- Date and number of the primary document - register information on the document, which is the basis for the reflection of the operation;

- The contents of the operation - prescribe the essence of the operation;

- Revenues - indicate the amount of income;

- Expenses - the amount of expenses is indicated here (the column is filled in by those who the STS considers on the basis of the Income - expenses).

Here are a few examples, as income can come in different ways:

- Upon receipt at the cash desk (for those who use cash registers) - indicate the date and number of the Z-report, which is done at the end of the day;

- Upon receipt of revenue according to BSO:

- If it is BSO on demand, then put the date and its number;

- If this is several BSOs per day, then make up one FFP and indicate its date and number. At the same time, all BSOs that you wrote out per day should be indicated in the FFP.

Important! So you can draw up BSOs issued in one day - they all will have one date. BSO for different days can not be reflected all together in one line.

- Upon receipt at the settlement account - indicate the date of arrival and payment number / bank statement number.

An example of filling KUDIR in each case is given below:

There are situations when you need to issue a refund, and the parish has already been recorded in KUDIR. This can be done with a reversal record. The refund amount is also shown in the "Revenue" column, but with a minus sign.

See the format of the recording in the example above. Paragraph 4 reflects the return to the supplier of the excessively paid advance amount.

At the end of the quarter, the total income is displayed in the table. In our example, it amounted to 47,600 rubles. The remaining tables are filled in during 2, 3 and 4 quarters. They summarize the income for the quarters and the cumulative results for the half year, 9 months and a year. Imagine that in the following periods we did not have any operations, then the remaining tables will be like this:

In some cases, payers of USN-Revenues show in KUDIR and expenses. There are actually two such cases:

- Expenses due to payments on assistance to unemployed citizens;

- Expenditures from subsidies received as part of the SME support program.

These amounts are reflected immediately in two columns - as income and as expenses. As a result, they cancel each other out and have no effect on the calculation of the tax base.

An example of such a record is here:

The reference to section I is not filled out; information is given in it by those who chose a simplified tax system with a different database.

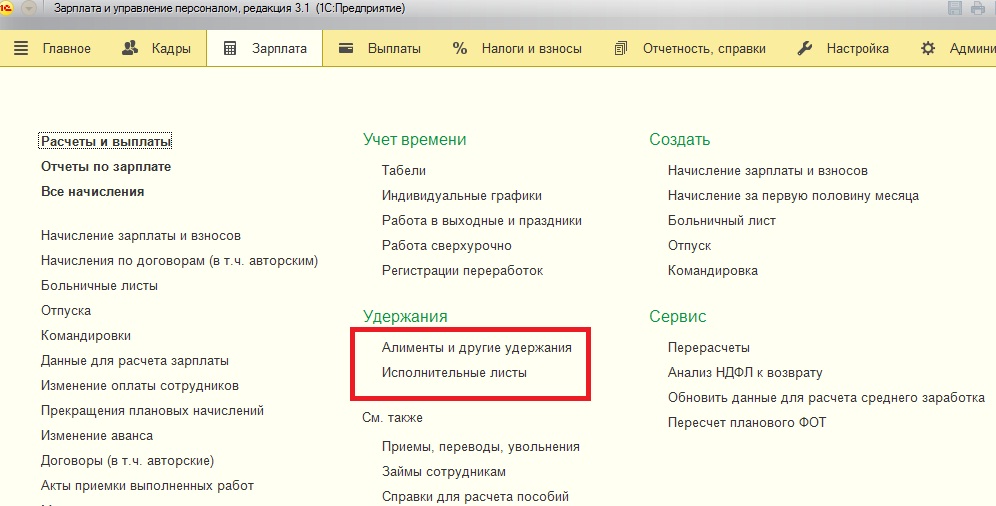

Step 3: Complete Section IV

This section has a large table, but there is nothing complicated about it. It is divided into 10 columns:

- No. p / p - serial number of the operation;

- Date and number of the primary document confirming the operation;

- The period for which contributions are paid;

- Columns 4-9 - types of contributions and payments;

- Column 10 - total line.

How to fill in this section? If you are an individual entrepreneur who works alone, without attracting workers, then here you must indicate the payment of contributions to the funds for yourself. For example, you transferred them in full in March: 29,354 rubles for pension insurance, 6,884 rubles for medical insurance.

The completed section will look like this:

Further, it remains only to take stock of the quarters and for the periods with a cumulative total.

Individual entrepreneurs with employees in this section should show not only payments for themselves, but also the amounts paid for their employees, since they can also be deducted from tax within the established limits.

Organizations fill KUDIR in a similar way. On the title page indicate your name, TIN and KPP, address of the location. There are no differences in the reflection of income. In Section IV, as well as individual entrepreneurs with employees, they show the amounts of payments for their employees.

You can download the completed sample, which was presented in the article, by THIS link.

You can download pure KUDIR for filling. here.

KUDiR must be filled in according to certain rules. Since this document in some cases is required to be submitted to the tax authorities.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve your problem - contact the consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24 HOURS AND WITHOUT DAYS OFF.

It is fast and IS FREE!

The presence of errors in it can lead to serious problems with the Federal Tax Service, as well as fines and penalties.

General information

When an individual entrepreneur or a company transfers to the simplified tax system, it is imperative to study the legislation covering this tax regime as thoroughly as possible.

Since the use of a simplified tax system is fraught with many nuances. All of them should be taken into account in the necessary order, otherwise the organization cannot avoid the close attention of the tax authorities and conducting a desk audit.

Taxation basics

Today, a simplified taxation system can be used when certain conditions are met:

Fixed assets are recognized only as property that directly takes part in the activities of the enterprise.

The total value of fixed assets should not be more than 40 thousand rubles. At the same time, the useful life is not more than 12 months.

Keep records of fixed assets when using the simplified taxation system should all organizations, regardless of their type.

Registration of fixed assets is carried out by:

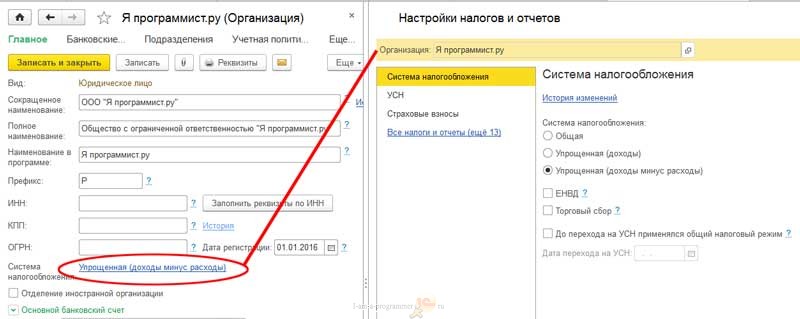

STS is of two types:

- income tax 6%;

- income tax 15%.

When using the 15% rate, that part of the income that remains after deducting expenses from the profit for the entire calendar year is taxed.

If a legal entity has decided to switch to a simplified taxation system, then it has the right to independently choose a scheme for calculating the amount of tax.

What kind of reporting

The use of the simplified tax system is associated with the mandatory submission of reports to the Federal Tax Service. This process is carried out only once a year, but should be treated as responsibly as possible.

To submit reports, the following documents must be submitted:

- Reporting regulated by federal law.

- Information on the number of employees hired ()

It is also necessary to submit reports to a pension fund, but this should be done quarterly. At the same time, a type form is required quarterly.

It is a calculation of contributions of the insurance type FMOS, as well as in the FIU. Do not forget that the FSS also requires every quarter to file.

Normative base

The basis for maintaining a book on the simplified tax system today is the tax law, or rather. It affects both organizations and individual entrepreneurs.

The form for filling out this document, which is a register, is regulated.

According to the order №135Н, the book for the simplified tax system used by individual entrepreneurs and organizations has a different form from books used by similar legal entities, but working in a different taxation regime.

Merchants who use the simplified taxation system to calculate the tax base carry out accounting of income, as well as expenses on the basis of.

And at the same time they are not required to keep accounting records. Individual entrepreneurs and other organizations conducting KUDiR are required to carry out accounting.

The book of the account of expenses and income at the simplified tax system

To date, there are two varieties of KUDiR - old and new. Any can be used in the simplified tax system, but the new format for maintaining this book is more convenient.

If desired, legal entities and individual entrepreneurs can switch to a new format at the end of the calendar year - but it is necessary to notify the tax service in advance.

Document Sections

The books of income and expenses with the simplified tax system of 6% and 15% do not differ from each other (in addition to the filled in columns of some tables).

The title page is filled as follows:

- the field “OKUD form” should remain empty (required in other taxation systems);

- a field called date: is entered on the date of the first record in the document (format - yy.mm.hh);

- oKPO field: it is necessary to fill in if there is a letter from Rosstat in which the necessary information is indicated;

- in the field "object of taxation" is written either "income minus expenses", or simply income - depending on the selected form of STS.

Section No. 1 contains four tables. In each of them there is information for the quarters of the reporting period. Each table has 5 columns:

Section No. 2 is filled in case of using the simplified tax system of the “income minus expenses” type and only if there are expenses for the acquisition of fixed assets (fixed assets), intangible assets.

Section No. 3 is completed if a simplified taxation system of the type “income minus expenses” is used and the company incurs losses in the current tax period or in the past one.

Section No. 4 was recently introduced - in 2013. Its completion is required only if the applied simplified tax system is of the “Revenue” type. It identifies all insurance type contributions that reduce the tax on the simplified tax system.

With the object "income"

If the taxpayer uses a regime that implies the payment of taxes on income, then filling in the column "expenses" is not required. Since there is no need to subtract expenses from income received.

Therefore, the need for such information is simply absent. But there are exceptions to this rule, enshrined at the legislative level.

The “expenses” field is required if:

- the company received any subsidies (their form is not important - cash or otherwise);

- the company provided any financial assistance.

That is why entrepreneurs using a simplified taxation system of the “income” type are exempted from the need to fill in the “expenses” column in KUDiR.

But, despite this, organizations of the type in question must necessarily keep records of expenses of certain types. This applies to payments to various funds at their own expense.

If you have “income minus expenses”

Filling the book of expenses and income of the STS 15% and 6% has its own characteristics. They must be taken into account without fail, otherwise there is a high probability of any problems with the tax service.

It is necessary to pay attention to the following points:

- refund of advance payment, prepayment;

- income not taken into account;

- costs;

- payment by installments.

It happens that the contract is terminated and the prepayment is returned to the budget. In this case, the “expenses” in KUDiR should be reduced by the amount of the advance payment. In no case should this amount be recorded as expenses - the entry is made with a “-" sign.

The following budget revenues should not be included in the income and expenses book:

- mistakenly transferred money;

- indemnities for disability certificates;

- amounts returned for VAT;

- return of the deposit if the company participated in any auction.

The consumable part must be covered as thoroughly as possible. So when using such a regime, the tax service examines as much as possible the cost section.

Any inaccuracy may be considered as an attempt to reduce the tax base. Moreover, revenue accounting is mandatory on a cash basis.

KUDiR filling procedure

The book of income and expenses must be completed in accordance with the rules approved at the legislative level.

Otherwise, this document will not be considered valid. It is necessary to take into account all the important nuances regarding the information reflected in KUDiR.

Income reflection

In the document of the type in question, the section that contains the recorded income is particularly extensive. It goes under number 1. In this section there are tables in the columns of which information about income is located.

The following data are taken into account:

- in column No. 2:

- column No. 3 indicates the contents and purpose of the operation.

The calculated tax base is reflected in column No. 4. The format of the tables is completely identical for each of the four quarters of the calendar year. Only the information indicated in them differs.

Expense reflection

When checking the KUDiR, the tax service is very attentive to the cost section. Especially if the simplified tax system “income minus expenses” is applied when the residual part of the income acts as a taxable object (15% rate). Costs are reflected in sections No. 1, 2, 4.

Section No. 1 contains tables in the graphs of which the information of the type in question is described in the most detail:

Section No. 2 displays information on the acquisition of fixed assets and intangible assets. Section №4 - reflects expenses allowing to reduce the amount of tax - directly advance payments on it.

Filling example

A document of the type in question is very important to compile correctly, without any errors or inaccuracies. It is advisable to find. This will minimize the likelihood of errors.

When combining USN and UTII

The book of accounting for income and expenses (KUDIR) is a tax register of accounting for income and expenses under the simplified tax system. The book of income and expenses is also needed to determine the tax base for a single tax calculated using simplified tax system. The article will discuss how to fill out a book and what information should be contained in it.

The book of the account of incomes and expenses: form

The fact that a simplified book needs to be kept confirms Art. 346.24 of the Tax Code of the Russian Federation.

There are 2 types of books on income and expenses: for “simplistic” and taxpayers on the patent system of taxation. Both forms are approved by order of the Ministry of Finance of Russia dated 10.22.2012 No. 135н.

The same order contains the texts of instructions for filling out both types of books. The book of accounting for income and expenses used by "simplisticists" (organizations and entrepreneurs) is devoted to appendices 1 (form of book) and 2 (order of filling, hereinafter referred to as the Order).

You can familiarize yourself with the rules of accounting at the simplified tax system in detail in the article "Procedure for accounting at the simplified tax system (2019).

The book of accounting for income and expenses in the simplified tax system: principles of reflection of income

According to Art. 346.24 of the Tax Code of the Russian Federation the book of income and expenses is intended only for the accounting of operations under the simplified regime. From this it follows that reflect operations associated with the receipt of funds or property, which, in accordance with Art. 346.15 of the Tax Code of the Russian Federation are not income for tax purposes under the simplified tax system, the book of income and expenses is not required.

Example

The Sisyphus organization uses the simplified tax system with the object "income minus expenses". In the 1st quarter, the organization had revenues in the form of revenue from the sale of goods, as well as expenses in the form of payment for the rental of premises and the purchase of goods. In addition, the bank received a loan to replenish working capital.

Income generated as a result of revenue, as well as expenses, should be reflected in the book of income and expenses on the dates corresponding to the transactions.

The loan amount should not be entered into the book, because according to sub. 10 p. 1 art. 251, sub. 1 p. 1.1 Art. 346.15 of the Tax Code of the Russian Federation credit facilities do not form an object of taxation.

The book of accounting for income and expenses for individual entrepreneurs and organizations: features of the reflection of operations in the transition from the general tax regime

Features of entering into the book of accounting of income and expenses of operations by organizations and individual entrepreneurs who switch to the simplified tax system from the general tax regime are stipulated by the norms of paragraph 1 of Art. 346.25 of the Tax Code of the Russian Federation.

Funds received before the transition to the simplified tax system under contracts that are executed after the transition to the simplified tax system are to be reflected in the book of income and expenses.

If the income was included in the tax base for income tax, then it is not necessary to reflect it, even if it is received after the transition to the simplified tax system.

It is not required to reflect expenses in the book of income and expenses accounting, which, according to Art. 346.16 do not reduce the size of the single tax base.

The book of income and expenses: a form when combining two modes

Some taxpayers combine 2 modes: USN and UTII. In this case, the book of accounting for income and expenses on the simplified tax system should not contain any income corresponding to UTII, nor expenses on it.

This is confirmed by the letter of the Ministry of Finance of Russia dated October 29, 2004 No. 03-06-05-04 / 40. The authors of the letter are based on the provisions of paragraph 8 of Art. 346.18 of the Tax Code. Since no changes were made to this paragraph, the conclusions set out in the letter are relevant to this day.

In addition to accounting for revenue and expense transactions, the book calculates the tax base and determines the amount of losses of past periods that reduce it (Article 346.24 of the Tax Code of the Russian Federation, paragraphs 2.6-2.11, 4.2-4.7 of the Procedure).

But the tax payable in the book of accounting for income and expenses is not calculated - this is the purpose of the tax return.

For information on where to see the control ratios for checking the declaration data, read the article "The Federal Tax Service has issued control ratios to the declaration on the simplified tax system" .

The income book at the simplified tax system 6%

If the taxpayer, preferring to work on the simplified tax system, has chosen the “income” object, the list of operations should indicate:

- payments permitted by paragraph 3.1 of Art. 346.21 of the Tax Code to reduce the amount of tax (paragraphs 5.1-5.7 of the Procedure);

- expenses in the form of subsidies as part of state support for small and medium-sized businesses;

- expenses in the form of payments to stimulate the employment of unemployed citizens (column 5, section I, paragraph 3-6, paragraph 2.5 of the Procedure).

According to para. 7 p. 2.5 of the Procedure, other expenses taxpayers with the object "income" can contribute to the book of income and expenses on their own initiative. If they are absent, it is allowed not to fill out the certificate to Sec. I, sect. II, sect. III, as well as column 5 of Sec. I (paragraph 2, paragraph 2.5, paragraphs 2.6, 3.1, 4.1 of the Procedure).

Where to download the free book of income and expenses of 2018 (changes in KUDiR from 2018)

Starting in 2018, taxpayers applying the simplified tax system for accounting for income and expenses should use the updated form of the book of income and expenses. The fact is that by order of the Ministry of Finance of Russia dated 07.12.2016 No. 227n, which entered into force on 01.01.2018, the KUDIR form was supplemented by section V, which reflects the amount of the trade fee, which reduces the amount of the single tax on the simplified tax for the simplified tax payer with the object "Income." The same order approved changes to the Procedure for completing KUDIR, both regarding the filling of this section and those containing technical changes.

The blank form of the book of income and expenses of 2018 can be downloaded in a convenient format for free on any accounting website or use the available reference and legal system.

The income and expense book form, applicable since 2018, can also be downloaded on our website.

Summary

All “simplists”, regardless of the chosen object of taxation, fill out the first section of KUDIR. The filling out of other sections of the KUDIR is due to the fact that the object of taxation, “income” or “income minus expenses”, is used by the payer of simplified tax. For “simplists” with the object of taxation, “income” from 01/01/2018 KUDIR is supplemented by another section that reflects the amount of the trade fee paid.

In our article you will find books on accounting of income and expenses (KUDIR) for FE on USN 6 sample filling in 2016. Such a book should be kept by all IEs on the USN.

Is it necessary to certify KUDIR for SP on USN 6% tax

Since 2013, it is not necessary to certify the Tax Book. However, her absence from the entrepreneur will lead to a fine.

Breaking news for all entrepreneurs:. Read the details in the magazine

An accounting book may be required during an on-site tax audit. Issued at the written request of the tax authorities.

But you don’t need to submit the accounting book along with the simplified tax system declaration to the tax office.

How IP on USN to keep a book of accounting

The KUDIR form for individual entrepreneurs on a simplified tax system with a rate of 6% (sample fill out here) was approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135н.

By the way, it is suitable for all simplists, regardless of the applicable taxation object. True, the filling rules for simplistic people with an object of income differ from those who chose the object of income minus expenses.

You can fill out the Accounting Book with a fountain pen on paper or on a computer. In the first case, the KUDIR form should be printed, numbered, stitched, sealed with a seal (if any) and signature before filling out. In the second case, all these actions must be done after the end of the year. In electronic form, an accounting book can be kept in Excel or.

Features of filling in section 2016 of KUDIR for IP on USN 6% in 2016

Entrepreneurs on a simplified tax system with an object of income in section 1 of KUDIR reflect sales income and non-operating income. Their amounts are entered in column 4 of section 1. Non-taxable income is not required to be recorded in the accounting book.

In column 2 of section 1 KUDIR for IE on USN 6 percent (sample fill) indicate the date and number of the document on the basis of which income is received. This can be a cashier's check or Z-report, if the money arrived at the cashier. If the money came to the current account, in column 2 you need to indicate the details of the bank statement. In addition, commodity invoices, acts of acceptance and transfer of property, etc. can confirm the receipt of income.

In column 3 of section 1 KUDIR for individual entrepreneurs on the USN 6% record the contents of the operation.

Note that entries in the Book of Accounting are made in chronological order. Since the cash method is used with the simplified system, incomes are reflected on the day of actual receipt.

Sample fill in 2016 Section 1 KUDIR for IE on STS percent, sample fill in 2016

The situation when you have to return previously received money is not uncommon. In this case, the amount of return must be indicated in column 4 of section 1 KUDIR with a minus sign.

Sample filling KUDIR in 2016 in case of a return of previously received funds.

The help to section 1 is filled out only by simplists with an object of income minus expenses. So it is said in paragraph 2.6 of the procedure for filling KUDIR. Nevertheless, those who use the object of taxation of income can indicate the total amount of income received in line 010 of the information part.

How to fill out section 4 KUDIR for IP on the USN with a rate of 6%

IE on USN 6% without employees reflect in this section insurance premiums paid for themselves in a fixed amount, namely:

- in column 4: pension contributions;

- in column 6: contributions for compulsory health insurance.

Often, FE pay contributions at the end of the year. In this case, the entire amount should be indicated in that part of the table that relates to the fourth quarter. Accordingly, you can reduce the tax only at the end of the tax period.

But if the contributions were transferred in each quarter, then you need to show them quarterly. This is a more profitable option for IP. Since you will be able to reduce not only tax at the end of the year, but also advance payments.

Sample fill Section 4 KUDIR in 2016 for entrepreneurs with a rate of 6 percent, sample fill without employees.

If the individual entrepreneur has employees, then he shows in section 4:

- contributions paid from employees' salaries;

- temporary disability benefits paid by the employer at his own expense;

- payments under voluntary personal insurance contracts;

- insurance premiums paid for themselves in a fixed amount.

A sample of filling out section 4 of KUDIR in 2016 for an individual entrepreneur with a rate of 6% who has employees.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

What is KUDiR and how to fill it in?