When conducting accounting in the organization, there are such cases when during the conduct of business a loss is generated and it must be transferred to the next period. It is also not uncommon for the need to reflect such data in the program when you start working with the program after its acquisition. In this article we will analyze in detail all such situations.

Consider the situation when, according to the results of 2016, our company incurred a loss of 338 138.43 rubles. The following month, our profit was exactly 300,000 rubles.

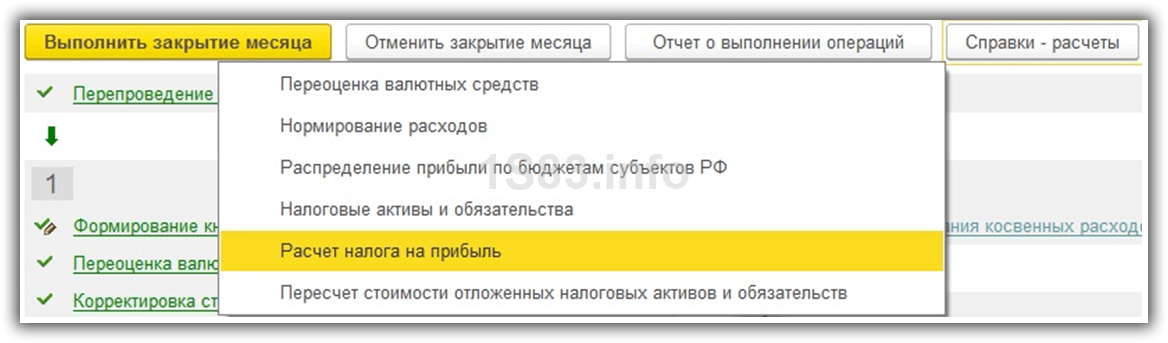

The loss is calculated at the close of the month by a special assistant, which is located in the section of the "Operations" program. As part of our example, the closure of December 2016 is carried out simultaneously with the closure of the fourth quarter and the whole year.

After completing the closing operation in December 2016, we can get a certificate “Calculation of income tax”. It will reflect detailed data, including the amount of loss we need for 2016.

As we can see from the formed report that for the entire current year 2016, which we are closing, the loss amounted to 388 138.43 rubles. This amount is calculated for all months of 2016 and is its financial result.

Now this loss should be attributed to later dates due to the fact that in the future it is compensated by the income received.

Loss transfer

Before proceeding with this transaction in 2016, we find out the amount of deferred tax assets (IT) for a given period. This can be done by receiving the SAL for 09 account for the entire 2016. The figure below shows that the amount amounted to 77 627.68 rubles, which is 20% of the loss for the year under review.

As part of our article, only two lines will be added to the tabular section:

- SHE in the amount of 77 627.68 will be carried forward to deferred expenses. The score 09 remains unchanged.

- The loss for 2016, which amounted to 338 138.43 rubles, will be attributed to other expenses of future periods.

As you can see in the figure above, when transferring the loss, we indicated the sub-account “Loss for 2016”. In our case, this position of the deferred expenses directory was created manually.

The name you can specify any. As a type for tax accounting will appear "Losses of past years." We also indicate that these losses will be written off from January 1, 2017 to the end of 2023.

After making all the changes, we will reform the turnover and see that the final balance, which amounts to 77,627.68 rubles, is listed as deferred expenses.

Now you can return to the close of December 2016 and reform the balance sheet reformation. In this situation, there is no need to redraft documents again.

Income in the current period

Now we proceed to make profit of 300,000 rubles in the base. It was received by our company in January 2017 Fin. we get the result the same as in December - after the close of the month.

The figure below shows the write-off of loss for 2016 to 300,000 rubles, which is income for January 2017.

Also, at the close of the month, the tax amount was calculated.

Losses of the past years when switching to 1C: Accounting

Not always accounting for losses of past years is made while working in the program. In some situations, you need to add this information to the program when you start working with it.

All required actions are performed using the assistant for entering balances, which is located in the main section of the program.

In the processing header, select the organization and specify the date. First of all, we will enter the data on the IT-09 account.

In this situation, the amount that is charged to deferred expenses will amount to 77,627.68 rubles.

Next, we will add to the program loss data for 2016 in the amount of 338 138.43 rubles, which will be listed on account 97.21. At the same time, note that the input of this data should be done in a separate document, which will contain only data on loss for the last year.

" № 2/2017

The mechanism for transferring losses received in previous tax periods was changed from January 1, 2017. What is the essence of the changes and how to correctly take them into account in the income tax return?

As follows from paragraph 1 of Art. 50 of the Civil Code of the Russian Federation, making profit is the main goal of a commercial organization. But this goal is not always achieved. For one reason or another, organizations may receive a loss.

In tax accounting, loss is understood as a negative difference between incomes determined in accordance with Ch. 25 of the Tax Code of the Russian Federation, and expenses accounted for tax purposes in the manner provided for in this chapter (paragraph 8 of Article 274 of the Tax Code). Upon loss in the reporting (tax) period, the tax base is considered equal to zero. At the same time, the Tax Code allows taking into account such a negative difference when calculating the taxable bases of the following periods (transfer loss to the future). The loss transfer mechanism is set forth in Art. 283 of the Tax Code of the Russian Federation, and from January 1, 2017, it was changed.

How to reflect the transfer of losses received earlier in tax accounting in 2017? How to show this in a tax return? You will find the answers in this material.

Rules for tax accounting for the transfer of losses.

Paragraph 1 of Art. 283 of the Tax Code of the Russian Federation provides that taxpayers who have incurred loss (s) calculated in accordance with Ch. 25 of the Tax Code of the Russian Federation, in the previous tax period or in the previous tax periods, has the right to reduce the tax base of the current reporting (tax) period by the entire amount of the loss they received or by a part of this amount (transfer the loss to the future).

At the same time, the tax base of the current tax period is determined taking into account the features established by the following articles of the Tax Code of the Russian Federation: 264.1 (acquisition of rights to land plots), 268.1 (acquisition of an enterprise as a property complex), 274 (tax base), 275.1 (use of property protection facilities), 275.2 (carrying out activities related to the production of hydrocarbon raw materials in the new offshore hydrocarbon field), 278.1 (income received by the parties to the KGN), 278.2 (income received by the parties to the investment partnership agreement TWA), 280 (operations with securities), 304 (operations with financial instruments of derivatives transactions).

According to paragraph 3 of Art. 283 of the Tax Code, if a loss has been incurred in more than one tax period, the transfer of such loss to the future is made in the order in which it is incurred.

Rules valid until 2017.

The loss transfer rules, valid until 2017, were spelled out in paragraph 2 of Art. 283 of the Tax Code of the Russian Federation. Their essence is as follows:

1. The taxpayer was entitled to carry forward the loss to the future within 10 years following the tax period in which the loss was received (in other words, if during that time the organization did not receive enough profit to cover the loss, then starting from the eleventh year after receiving the loss of the outstanding balance for tax purposes could not be taken into account).

2. The taxpayer could transfer the loss incurred in the previous tax period to the current amount without any restrictions (for example, the loss could be recognized in an amount equal to the tax base of the current tax period).

3. A loss that was not carried forward to the next year following the “loss-making” one could be transferred in whole or in part to the second year and the next 10 years (that is, the organization could reduce the tax base for losses not with each tax period, but intermittently, observing this is a ten-year loss transfer period).

Example 1

The organization (according to tax accounting) for 2014 received a loss of 1,600,000 rubles. In the following tax periods, she made a profit: in 2015 - 700 000 rubles .; in 2016 - 1 200 000 rubles.

When calculating income tax for 2015, an organization could reduce the entire tax base by the amount of loss for 2014. The remaining loss in the amount of 900,000 rubles. (1,600,000 - 700,000) carried over to 2016.

When calculating income tax for 2016, the organization could also reduce the tax base (1,200,000 rubles) by the balance of the transferred loss in the amount of 900,000 rubles. Income tax for 2016 would be calculated from the amount of 300,000 rubles.

Rules in force from 2017 to 2020.

From 01.01.2017 p. 2 of article 283 of the Tax Code is set forth in a new edition, and the article itself is supplemented by paragraph 2.1.

Taxpayers, as before, are entitled to transfer the amount of losses incurred in previous tax periods.

However, for the period 2017 - 2020, the following rule is introduced: the income tax base for the current reporting (tax) period, calculated in accordance with Art. 274 of the Tax Code of the Russian Federation cannot be reduced by more than 50% by the amount of losses incurred in previous tax periods.

In addition, from Art. 283 of the Tax Code of the Russian Federation, the rule on temporary (ten-year) restriction on loss transfer has disappeared.

note

The provisions of Art. The new edition of 283 of the Tax Code of the Russian Federation applies to losses incurred by taxpayers for tax periods beginning on 01.01.2007. This is stated in paragraph 16 of Art. 13 of the Federal Law of 30.11.2016 No. 401-ФЗ.

Thus, despite the removal of the ten-year restriction on the transfer of losses, organizations are not entitled to take into account in 2017 losses incurred in 2006.

Example 2

According to the results of 2016, the organization suffered a loss of 200,000 rubles.

Reporting periods are I quarter, six months, nine months.

The taxable income tax base in 2017 amounted to: according to the results of the first quarter - 60,000 rubles, six months - 140,000 rubles, nine months - 270,000 rubles, and years - 240,000 rubles.

When calculating income tax for the I quarter of 2017, the organization has the right to reduce the tax base by a portion of the transferred loss in the amount of 30,000 rubles. (60 000 rub. X 50%).

An organization may also recognize a loss for 2016 when calculating income tax based on the results of the next reporting periods of 2017, that is, for the half year in the amount of 70,000 rubles. (140,000 rubles. X 50%) and for nine months - 135,000 rubles. (270,000 rubles. X 50%).

According to the results of 2017 (the tax period), an organization may only take into account a loss of RUB 120,000 for tax purposes. (240,000 rubles. X 50%).

The balance of the loss as of January 1, 2018 will be 80,000 rubles. (200,000 - 120,000).

Let's summarize the results in a table.

Reporting (tax) periods

The tax base

50% tax base

(p. 1 x 50%)The tax base,

with which tax will be paid

(p. 1 - p. 3)I quarter

Half year

Nine month

As can be seen from the example, the profit during the year following the results of each reporting period can both increase and decrease (profit at the end of the year may be less than at the end of nine months). Thus, the amount of loss carried forward to the following tax periods depends on the amount that was recorded at the end of the tax period.

Example 3

Let us continue with Example 2. The balance of the non-transferred loss resulting from the results of 2016 as of 01.01.2018 amounted to 80,000 rubles.

The taxable income tax base in 2018 is equal to: according to the results of the first quarter - 72,000 rubles, six months - 210,000 rubles, nine months - 90,000 rubles, and years - 200,000 rubles.

When calculating income tax for the I quarter of 2018, the organization has the right to reduce the tax base by a portion of the transferred loss in the amount of 36,000 rubles. (72 000 rub. X 50%).

When calculating income tax for the six months, the tax base can be reduced by no more than 105,000 rubles. (210 000 rub. X 50%). However, the remaining loss as of 01.01.2018 is 80,000 rubles. Therefore, the entire amount of the transferred loss can be accounted for in the first half of the year. Thus, in fact, the base will be reduced by 80,000 rubles, and the tax will have to be calculated from the amount of 130,000 rubles. (210,000 - 80,000).

The profit for the first nine months amounted to 90,000 rubles. (which is less profit for the six months). Thus, when calculating income tax for nine months of 2018, an organization has the right to reduce the tax base by a portion of the transferred loss in the amount of 45,000 rubles. (90 000 rub. X 50%).

When calculating income tax for 2018, the tax base can be reduced by no more than 100,000 rubles. (200,000 rubles. X 50%). However, the remaining loss as of 01.01.2018 is 80,000 rubles. Therefore, the entire amount of the transferred loss can be accounted for at the end of the year. Thus, in fact, the base will be reduced by 80,000 rubles, and the tax will have to be calculated from the amount of 120,000 rubles. (200,000 - 80,000).

Let's summarize the results in a table.

Reporting (tax) periods

The tax base

50% tax base

(p. 1 x 50%)The amount of loss recorded in the reporting (tax) period

The tax base,

with which tax will be paid

(p. 1 - p. 3)I quarter

Half year

Nine month

Reflection of carry-forward loss in income tax return.

Information on losses of previous years is reflected in Appendix 4 “Calculation of the amount of loss or part of the loss that reduces the tax base” to sheet 02 of the corporate income tax declaration (hereinafter referred to as the declaration), the form of which and the Procedure for filling it out (hereinafter the Procedure) are approved by the Order of the Federal Tax Service Russia dated 10.19.2016 No. MMV-7-3 / 572 @.

According to clause 1.1 of the Procedure, the title sheet must include the title page (sheet 01), subsection 1.1 of section 1, sheet 02, appendices 1 and 2 to sheet 02.

Appendix 4 to sheet 02 of the declaration is included in the reporting only for the I quarter and for the tax period. At the same time, the appendix 4 for the I quarter indicates the balance of the loss carried forward at the beginning of the tax period, and the appendix 4 indicates the balance of the balance both at the beginning and at the end of the tax period.

According to clauses 9.1, 9.3, 9.4 of the Procedure, line 010 of appendix 4 to sheet 02 reflects the balance of the non-transferred loss at the beginning of the tax period, and lines 040 - 130 - losses by the years of their formation.

Line 140 shows the tax base that is used in calculating the loss amount of previous tax periods, which reduces the tax base of the current tax period.

The indicator on line 140 is equal to the indicator on line 100 “Tax base” of sheet 02.

Line 150 shall reflect the amount of loss by which the taxpayer reduces the tax base of the current tax period.

note

The form and procedure for filling out the current declaration was approved by Order of the Federal Tax Service of Russia dated 10.19.2016 No. MMV-7-3 / 572 @, that is, before the release of the Federal Law of 30.11.2016 No. 401-ФЗ. In this regard, the indicators of the lines in which the loss transfer is reflected should be formed taking into account the changes made to the Tax Code of the Russian Federation by the specified law. Such clarifications are given, in particular, in the Letter of the Federal Tax Service of Russia dated 01.09.2017 No. SD-4-3 / 61 @.

In Appendix 4 to sheet 02, the indicator on line 150 “, - total” cannot be more than 50% of the indicator on line 140 “Tax base for the reporting (tax) period”.

In the balance of non-transferred losses at the beginning of the tax period (lines 010, 040 - 130 of Appendix 4 to sheet 02), losses incurred by taxpayers starting from losses for 2007 can be taken into account.

The indicator on line 150 is transferred to line 110 “Amount of loss or part of the loss that reduces the tax base for the reporting (tax) period” of sheet 02 of the declaration.

Line 160 is filled in when preparing a tax return. The balance of the loss carry forward on this line is determined as the difference between the sum of lines 010, 136 and 150. If a loss is received in the expired tax period for which the declaration is submitted, the balance of the loss loss at the end of the tax period (line 160) includes the indicators of lines 010, 136 and The amount of loss for the past tax period.

The rest of the loss carry-over at the end of the tax period (line 160) is transferred to lines 010 - 130, 136 of the calculation presented for the reporting (tax) period of the next year. In this case, the amount of loss of the expired tax period is indicated last in the list of years for which losses were received.

As noted above, Appendix 4 to sheet 02 is included in the declaration only for the I quarter and for the tax period. However, this will not prevent the taxpayer from taking into account the loss of previous years in reducing the tax base for the six months and nine months of the current year.

We turn to paragraph 5.5 of the Procedure, which states that in declarations for the I quarter and for the tax period, the amount of loss or part of the loss that reduces the tax base for the reporting (tax) period is transferred from line 150 of Appendix 4 to sheet 02 to line 110 of this sheet.

In declarations for other reporting periods, line 110 of sheet 02 is determined based on the data of line 160 of Appendix 4 to the declaration for the previous tax period, lines 010, 135, 136 of Appendix 4 to the declaration for the first quarter of the current tax period and line 100 for the reporting period for which a declaration is being drawn up.

Example 4

We will use the data of Example 2. We will demonstrate how to fill out some indicators of sheet 02 and Appendix 4 to this sheet in declarations for the reporting and tax periods of 2017.

Corporate income tax calculation

Indicators

Line code

I quarter

Half year

Nine month

Total profit (loss)

The tax base

The amount of loss or part of the loss that reduces the tax base for the reporting (tax) period

(line 150 of annex 4 to sheet 02)

Tax base for tax calculation

(line 100 - line 110)

Calculation of the amount of loss or part of the loss that reduces the tax base

Indicators

Line code

I quarter

The balance of the loss loss at the beginning of the tax period - total

Including for 2016

The tax base for the reporting (tax) period

(line 100 of sheet 02)

The amount of loss or part of the loss that reduces the tax base for the reporting (tax) period

The balance of the loss carried forward at the end of the tax period

Duration of storage of documents confirming loss.

When calculating income tax, organizations are given the right to take into account losses, subject to the requirements established by law. Among them, paragraph 4 of Art. 283 of the Tax Code of the Russian Federation assigned the obligation of taxpayers to keep documents confirming the amount of loss incurred for the entire period when it reduces the tax base of the current tax period by the amount of previously received losses.

The loss is the financial result of the organization’s business, the amount of which is affected by the amount of expenses incurred in the tax period, taken into account when determining taxable profit if they meet the requirements listed in Art. 252 of the Tax Code of the Russian Federation. Expenses must be justified and documented, incurred for the implementation of activities aimed at generating income.

During the time the loss was recorded, the company is obliged to keep documents confirming its size (see letters of the Ministry of Finance of Russia dated 05.25.2012 No. 03-03-06 / 1/278 and dated 04/23/2009 No. 03-03-06 / 1/276). Such documents are tax accounting registers and primary documents (see resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 24.07.2012 No. 3546/12 and FAS SZO dated November 16, 2012 in case No. A56-4116 / 2012).

Thus, if a loss is reflected in the tax return without corresponding supporting primary documents based on tax accounting registers and other analytical documents, the procedure established by paragraph 4 of Art. 283 of the Tax Code of the Russian Federation, cannot be considered complied with, since the relevant costs will not satisfy the criteria established by paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

Since the opportunity to take into account the amount of loss is declarative and the taxpayer is obliged to prove their legitimacy and validity, in the absence of confirmation of the loss by relevant documents, including primary accounting documents, during the entire period when he reduces the tax base by the amount of the earlier loss, the taxpayer bears the risk adverse tax consequences (see Decision of the AC MO dated 07.22.2016 No. F05-10138 / 2016 in case No. A41-81431 / 2015).

In practice, such a situation is possible. The period of occurrence of the loss was checked during the on-site tax audit, as a result of which the inspection had no comments on the legality of reflecting the loss. The taxpayer, believing that the loss was confirmed, did not begin to store documents for more than four years. The question arises: is the taxpayer entitled to transfer the loss to the future if there is an act based on the results of the tax audit, if there is no primary evidence of loss? For example, at the end of 2010, the organization received a loss. Part of the loss was taken into account when calculating the income tax base for 2011 - 2016. In 2014, it was held, as a result of which there are no comments on the validity of the loss transfer to the future. Is the organization obliged to keep documents confirming the loss received in 2010, or can they be destroyed, given the audit?

In arbitration practice, there are two opinions on this issue. First: organizations are required to keep documents for the entire period of writing off losses even if tax audits have already been carried out for the periods in which the loss is incurred. The tax audit report is not a document proving the legitimacy of loss accounting; it does not contain an analysis of documents confirming the amount of loss. In addition, tax legislation does not provide for the termination of the taxpayer’s obligation to store documents after the tax audit (this conclusion follows from the decisions of the FAS PO dated 01.25.2012 in case No. A12-5807 / 2011, dated 12.04.2011 in case No. A55-18273 / 2010 ) The second opinion: in the absence of primary accounting documents, the amount of loss of previous years can be confirmed by the results of a previous field tax audit (see, for example, Resolution of the FAS UO of June 1, 2011 in case No. F09-2789 / 11-C3).

Some issues related to the transfer of losses.

On the possibility of transferring losses during the transition to the simplified taxation system and vice versa.

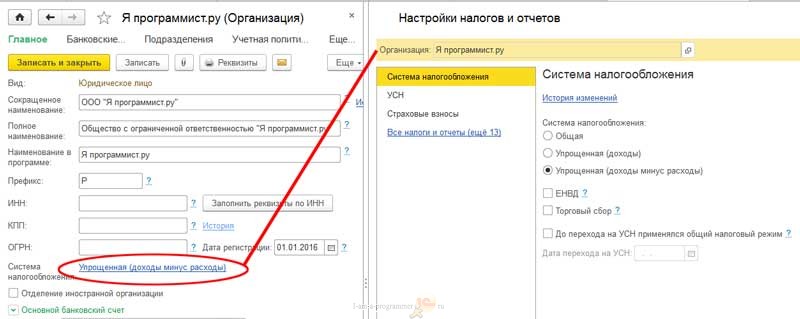

It should be noted that the loss incurred by the taxpayer within the framework of the general taxation system is not accepted upon transition to the standard taxation system. Thus, a taxpayer applying a simplified taxation system with an object of taxation “income minus expenses” is not entitled to reduce the tax base paid in connection with the use of this taxation system.

Losses incurred during the periods of application of the OSNO can be accounted for the purposes of taxation of profits after the organization returns to the general regime with the simplified tax system, taking into account the provisions of 283 of the Tax Code of the Russian Federation. This conclusion follows from the Letter of the Ministry of Finance of Russia dated 10.25.2010 No. 03-03-06 / 1/657.

For example, if you switch from OSNO to USNO from January 1, 2017, an organization is not entitled to reduce the 2017 base by the amount of loss received in 2016 when using OSNO.

If from 01.01.2018 she returns to the general system, then starting from this period she can take into account losses incurred before switching to the simplified tax system.

If the tax base is determined by the calculation method.

An interesting, in our opinion, situation was recently considered by ASU ASO in Decree dated 12.01.2017 No. F02-6973 / 2016 in case No. A19-16924 / 2015.

When conducting an on-site tax audit, the organization was not able to submit primary documents confirming the correctness of tax calculation for the audited period. In this regard, the income tax base was determined by the IFTS by the calculation method on the basis of paragraph 7 of Art. 31 of the Tax Code. Moreover, in the periods preceding the audited period, the organization received a loss. The tax authorities refused to reduce the base determined by calculation by the amount of losses. Arbitrators in this matter supported the tax authorities.

Starting from 2017, losses incurred in 2007 and later can be transferred to an unlimited number of subsequent tax periods, and profits for the reporting (tax) periods of 2017-2020 can be reduced by no more than 50 percent by the amount of losses from previous tax periods. About how these changes are supported in the program “1C: Accounting 8” version 3.0 for BUKH.1C told experts 1C.

Federal Law No. 401-FZ of November 30, 2016 amended Article 283 of the Tax Code of the Russian Federation, which regulates the procedure for transferring losses to the future. Please note that the concept of “transfer of losses to the future” is used only for profit tax purposes, as in accountingaccounting the procedure for accounting for losses is different.

Procedure for recording losses ...

... in accounting

First of all, in accounting, it is necessary to distinguish between the concepts of “net profit (loss)” and “retained earnings (uncovered loss)”, since these indicators are generated on different accounting accounts and have different meanings. Back in 2002, the Ministry of Finance of Russia drew attention to this in a letter dated 23.08.2002 No. 04-02-06 / 3/60, and since then nothing has changed.

According to the instructions for applying the chart of accounts of financial and economic activities of the organization, approved. by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (hereinafter referred to as the Instructions for the Application of the Chart of Accounts), the net profit (loss) indicator is formed on the balance account 99 “Profit and loss” and represents the final financial result of the organization’s activities for the reporting period.

The credit balance of account 99 at the end of the year indicates the presence of net profit, and the debit balance indicates the presence of net loss.

At the end of the reporting year, when preparing the annual financial statements, account 99 is closed. At the same time, the final entry of December, which is part of the accounting procedure - balance sheet reformation, the balance of account 99 is written off to account 84 “Retained earnings (uncovered loss)”:

- the amount of net profit is written off to the credit of account 84.01 “Profit to be distributed”;

- the amount of net loss is debited to account 84.02 “Loss to be covered”.

Thus, the balance sheet account 84 summarizes the information on the presence and movement of the amounts of retained earnings (uncovered loss).

Retained earnings are expended by decision of the owners of the company. For example, they can direct it to dividends, to increase the authorized capital, as well as to cover losses of previous years. The loss of past years can be written off not only due to retained earnings, but also due to reserve capital, if it was created.

... in tax accounting

The loss is the negative difference between income and expenses (taken into account for tax purposes) received by the taxpayer in the reporting (tax) period. The tax base is recognized equal to zero in that reporting (tax) period when the loss is received (paragraph 8 of article 274 of the Tax Code of the Russian Federation).

If the loss was received at the end of the year, then in accordance with the provisions of Article 283 of the Tax Code of the Russian Federation (as amended by Federal Law dated 30.11.2016 No. 401-ФЗ), taxable profit of any of the following reporting (tax) periods can be reduced by the entire amount of the resulting loss or by part of this amount (transfer loss to the future).

In this case, the following features should be considered:

- it is impossible to transfer the future loss for certain types of activities taxed at the rate of 0% (paragraph 1 of article 283 of the Tax Code of the Russian Federation);

- loss not carried forward to the next year may be transferred in whole or in part to the following years;

- profits earned for the reporting (tax) periods of 2017-2020 cannot be reduced by the amount of losses of previous tax periods by more than 50%. The restriction does not apply to tax bases to which reduced income tax rates apply. Such special rates are set for certain types of organizations, for example, for participants in regional investment projects; for participants in special economic zones (SEZ); organizations that have received the resident status of the territory of priority social and economic development, etc. (Clause 2.1 of Article 283 of the Tax Code of the Russian Federation);

- losses of several previous tax periods are transferred in the order in which they are incurred;

- the taxpayer is required to keep documents confirming the amount of loss incurred during the entire transfer period.

... subject to the provisions of PBU 18/02

The amount of income tax, which is determined on the basis of accounting profit (loss), is the contingent expense (contingent income) for income tax. Such conditional expense (conditional income) is reflected in accounting regardless of the amount of taxable profit (loss) (paragraph 20 of PBU 18/02 “Accounting for income tax settlements”, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, hereinafter - PBU 18/02).

According to the Instructions for the application of the Chart of Accounts, in case of loss according to accounting data, conditional income should be accrued, which is reflected on the credit of account 99.02.2 “Contingent income tax” in correspondence with the debit of account 68.04.2 “Calculation of income tax”. A loss carried forward, not used to reduce income tax in the reporting period, but which will be accepted for tax purposes in subsequent reporting periods, leads to the formation of a deductible temporary difference. The deductible temporary difference, in turn, leads to the formation of deferred income tax (deferred tax asset - hereinafter referred to as ITA), which should reduce the amount of income tax in subsequent reporting periods. At the same time, the organization recognizes IT only if it is probable that it will receive taxable profit in subsequent reporting periods (paragraphs 11, 14 of PBU 18/02).

IT is reflected in the debit of account 09 “Deferred tax assets” in correspondence with the credit of the account 68.04.2. As the loss is transferred and its amount is reflected in the income tax declaration, the deductible temporary difference decreases (until full repayment), and the corresponding amount is written off by debit account 68.04.2 in correspondence with the credit of account 09 (paragraph 17 of PBU 18 / 02, Instructions for the application of the Chart of Accounts).

Accounting for losses of previous yearsin "1C: Accounting 8" (rev. 3.0)

The procedure for accounting for losses of past years in the program "1C: Accounting 8" edition 3.0 is carried out in two stages:

1. Transfer of loss of the current period to deferred expenses.

2. Write-off of losses of previous years.

The operation to transfer the loss of the current period to deferred expenses (BPO) is performed manually using the document Operation (section Operations - Manual Entries) The purpose of this operation is to ensure automatic loss cancellation in the future. For this, a deferred expense mechanism is used that is well known to program users. The tax loss of the current year, which is recorded on the debit of account 99.01.1 “Profits and losses on activities with the main taxation system”, must be transferred to debit of account 97.21 “Deferred expenses” with the type of expense Previous years losses. For taxpayers applying the provisions of PBU 18/02, an additional adjustment to the analysis of deferred tax assets recorded on account 09 is required.

This manual operation is recorded on the last day of the year before the balance sheet reformation. If the loss transfer to the BPO is not reflected in the accounting system, the program will detect this situation and remind the user about it. In January of the following year, when performing a routine operation Profit tax calculationincluded in the processing Closing month, a message will be displayed on the screen that the loss of the previous year was not transferred. Processing is interrupted, and until the user generates a loss transfer operation, he will not be able to move on.

Meanwhile, the transfer of losses to the future is a taxpayer’s right, and not an obligation (paragraph 1 of article 283 of the Tax Code of the Russian Federation). But what if, for some reason, the taxpayer does not want to exercise this right?

In this case, you still have to create a manual operation, but in the form of a directory element Future expenses you just don’t need to indicate the date the loss was written off. In the future, at any time, you can open the desired entry (section Directories - deferred expenses) and fill in the field Charged from:if the user changes his mind and wants to reduce the profits by losses of previous years, starting from the specified date.

Losses from previous years are automatically included in expenses that reduce the income tax base when performing routine operations Write-off of losses of previous years. The amount of write-offs of losses is calculated only if, at the time of the routine operation according to the tax accounting data on account 97.21 “deferred expenses” with the type of expense bulls of past years the debit balance is listed. Write-off is made to the debit of account 99.01.1 in accordance with the data specified in the directory Future expenses.

Starting from 2017, losses incurred in 2007 and later can be carried forward to an unlimited number of subsequent tax periods, and profits for reporting (tax) periods 2017-2020. can be reduced by the amount of losses of previous tax periods by no more than 50%. This change is supported in the 1C: Accounting 8 program starting from version 3.0.45.20.

To remove the ten-year restriction established in the program for “old” losses (received from 2007 to 2015), it is enough to open the corresponding directory entries Future expenses and clear the field Charged by:.

As for the participants of regional investment projects, participants in the SEZ, etc., for such organizations that apply reduced tax rates, automatic deduction of losses according to the rules of Article 283 of the Tax Code of the Russian Federation in “1C: Accounting 8” is not supported.

Consider how in the program "1C: Accounting 8" (rev. 3.0), losses are transferred to the future, taking into account the latest changes in tax legislation.

Example 1

Reflection of the amount of loss in accounting

To identify the amount of tax loss in 2016, which the taxpayer is entitled to transfer to the future, you must first perform all regulatory operations for December 2016, included in the processing Closing month.

The amount of loss will be reflected, for example, in Help-calculating income taxif in the report settings you set tax accounting data as indicators.

You can analyze the tax accounting data for account 99 for 2016 using one of the standard reports from the section Reports, eg Account analysis. If you cancel the scheduled operation Reformation balancethen report Account Analysis on account 99 will be more visual: a debit balance of 5 million rubles. indicates a loss (Fig. 1).

In the tax return on corporate profit tax for 2016 (approved by order of the Federal Tax Service of Russia No. MMV-7-3 / 572 @ dated 19.10.2016, hereinafter referred to as the Federal Tax Service Order), this amount of loss is reflected:

- with a minus sign in Sheet 02 on line 100 “Tax base”;

- in Appendix No. 4 to Sheet 02 with a minus sign on line 140 “The tax base for the reporting (tax) period” and with a plus sign on line 160 “The balance of the loss transferred at the end of the tax period - total”.

Since the organization applies the provisions of PBU 18/02, when performing routine operations Profit tax calculation for December 2016, a deferred tax asset (ОНА) is recognized and an accounting entry is generated:

Debit 09 by type of asset "Loss of the current period" Credit 68.04.2 - in the amount of SHE (1 000 000,00 rub. \u003d 5 000 000,00 x 20%).

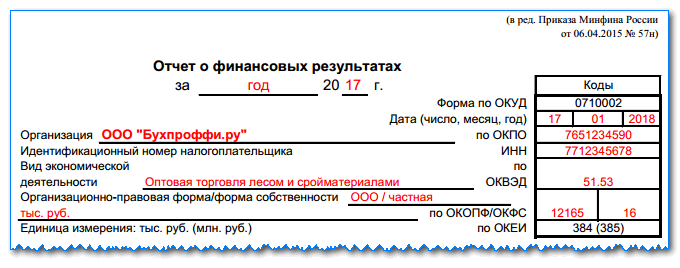

The report on financial results in line 2300 reflects the amount of loss according to accounting data: 5,000 thousand rubles. with a minus sign (a negative value is indicated in brackets). Pay attentionthat this amount may not coincide with the tax loss. The amount of recognized deferred tax asset in the amount of 1,000 thousand rubles. reflected in line 2450 “Change in deferred tax assets” and reduces the amount of loss. Thus, the indicator 2400 “Net profit (loss)” reflects the amount of the adjusted loss in the amount of 4,000 thousand rubles. with a minus sign. The recorded deferred tax asset will further reduce the income tax base.

In the first section of the asset of the balance sheet “Non-current assets”, the amount of the deferred tax asset in the amount of 1,000 thousand rubles. reflected in line 1180 “Deferred tax assets”.

In the third section of the Capital and Reserves liability, the amount of uncovered loss for 2016 is reflected in the total amount under line 1370 “Retained earnings (uncovered loss)”. If the organization at the beginning of the year did not have retained earnings (uncovered loss) of previous years and dividends were not distributed during the year, then the value of line 1370 should be equal to the value of line 2400 of the statement of financial results (see the Instructions for the application of the Chart of Accounts).

Transfer loss of the current period for the future

In order for the loss incurred in 2016 to be further taken into account automatically in the 1C: Accounting 8 program (rev. 3.0), it is necessary to transfer it to deferred expenses. Create a document Operation 12/31/2016 (Fig. 2).

In the document form, to create a new transaction, click Add and enter correspondence on the debit of account 97.21 “Deferred expenses” and the credit of account 99.01.1 “Profit and loss on activities with the basic taxation system”. Since the loss is not carried forward in accounting, the field Amount leave empty, while filling in special resources for tax accounting purposes:

The amount of NU Dt 97.21 and the amount of NU Kt 99.01.1 - in the amount of loss (5,000,000.00 rubles); The amount of BP Dt 97.21 and the amount of BP Kt 99.01.1 - for the taxable temporary difference (-5,000,000.00 rubles).

In the form of a directory item Future expenses The following information must be provided:

- future expense name, e.g. 2016 loss;

- type of BPO for tax accounting purposes - Previous years losses (selected from a predefined directory Types of expenses (OU));

- the amount of loss (5,000,000.00 rubles) is indicated for reference, since the amount of the balance according to the accounting and tax records is used to write off the BPO;

- cost recognition method - In a special order;

- loss transfer start date is the first day of the year following the year the loss was received, that is, 01.01.2017;

- we do not indicate the end date, since now the restriction on the term for transferring losses has been lifted;

- write-offs and analytics are not required.

Transfer of loss to the future means that in the future it is planned to reduce the tax base. In accounting, such a reduction in the tax base will occur due to the write-off of the deferred tax asset. Since at the time of transfer of loss in a manual operation reflected temporary differences in the valuation of the asset Future expenses, then for this type of asset in accounting, it is necessary to reflect the occurrence of IT using posting:

Debit 09 for the asset type “Deferred expenses” Credit 09 for the asset type “Loss of the current period” - for the amount of SHE (1 000 000,00 rub.).

Pay attentionthat the operation to transfer losses to the BPO should be entered after the final processing Closing month for December.

After saving the manual operation, re-enter the form Closing month and perform the following sequence of operations:

- Re-documenting per month - choose a team Skip operation;

- Reformation balance - choose a team Perform an operation.

If it becomes necessary to close the month again, then the manual loss transfer operation should be canceled (flagged for deletion). After the final closing of the month, you need to uncheck the manual operation deletion (reflect it again) and re-carry out the reformation of the balance sheet without re-documenting.

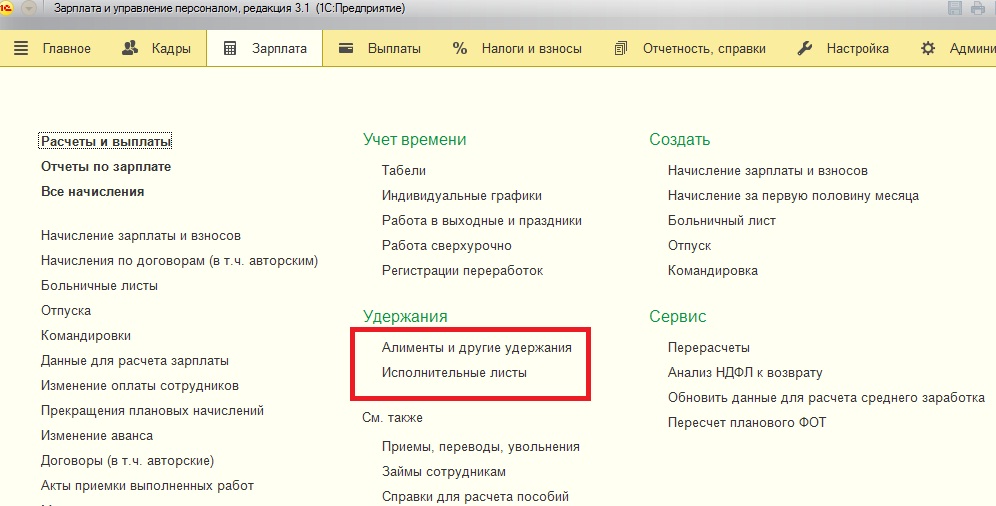

Write-off of losses of previous years

From January 2017 to processing Closing month scheduled operation Write-off of losses of previous yearsduring which the program reduces the profit of the current month by the amount of losses of previous tax periods according to the updated norms of Article 283 of the Tax Code of the Russian Federation, that is, by no more than 50%.

The result of the decrease in profit is reflected in the special resources of the accounting register:

Amount NU Dt 99.01.1 and Amount NU Kt 97.21 - for the amount of write-off of loss; The amount of BP Dt 99.01.1 and the amount of BP Kt 97.21 - for taxable temporary difference.

If there is no profit in the current month, then the document will still be created, but will not have register movements. If a loss is received in the current month, then the write-off amount is restored, and in the indicated resources the amount of write-off of the loss is reversed.

According to the conditions of Example 1, the organization “TF Mega” in the I quarter of 2017 received a profit of RUB 1,000,000.00.

Half of this amount can be reduced by the amount of losses of previous tax periods.

Perform the closing of the month for March 2017 and form Help-calculation of write-offs of losses of previous years (the certificate is formed on an accrual basis from the beginning of the year). In column 4 for March 2017, the amount of 500,000 rubles will be indicated as the amount of loss included in the decrease in profit. (fig. 3).

During routine operation Profit tax calculation the amount of income tax will be reduced by writing off the deferred tax asset, which is reflected by the posting:

Debit 68.04.2 Credit 09 by type of asset “deferred expenses”

In total, for this type of asset for the first quarter it was written off in the amount of 100,000.00 rubles. (500,000.00 x 20%).

Consider how the income tax return for the 1st quarter of 2017 is filled out. The following indicators are automatically reflected in Appendix No. 4 to Sheet 02 (Fig. 4):

|

Line of Appendix No. 4 to Sheet 02 of the income tax declaration for the I quarter of 2017 |

Data |

|

Non-transferred loss of 2016 (5,000,000 rubles), the same amount is shown on line 010 in the total amount of the balance of the non-transferred loss at the beginning of the tax period |

|

|

The tax base for the reporting period (1 000 000 rub.) |

|

|

The amount of part of the loss that reduces the tax base. This includes the credit turnover of account 97.21 with the form “Losses of past years” (500,000 rubles) |

|

|

The balance of the loss carried forward at the end of the tax period (4,500,000 rubles) |

From line 150 of Appendix No. 4 to Sheet 02 of the declaration, the amount of part of the loss that reduces the tax base is transferred to line 110 of Sheet 02 of the report. The tax base for tax calculation (p. 120) will be reduced by this amount, which will amount to 500,000 rubles. (1,000,000 - 500,000).

Filling out a profit statement for interim reporting periods

Despite the fact that the taxpayer has the right to transfer the loss to the future in any reporting period (paragraph 1 of Article 283 of the Tax Code of the Russian Federation), Appendix No. 4 to Sheet 02 is included in the declaration only for the I quarter and the tax period (paragraph 1.1 of the Order of the Federal Tax Service ) Accordingly, Appendix No. 4 to Sheet 02, as well as line 110 of Sheet 02 of the declaration for six months and for 9 months, is not completed in the program. In this case, the algorithm for writing off losses does not change. How, then, to fill out a declaration under the terms of Example 1?

The answer to this question is given by paragraph 5.5 of the Order of the Federal Tax Service, according to which, in declarations on income tax for interim reporting periods, line 110 of Sheet 02 is determined based on the data:

- lines 160 of Appendix No. 4 of the declaration for the previous tax period;

- lines 010 of Appendix No. 4 of the declaration for the first quarter of the current tax period;

- line 100 of Sheet 02 for the reporting period for which the declaration is drawn up.

In practice, this means the following: line 110 needs to be filled in manually on the basis of tax accounting data, while the remaining indicators of Sheet 02 are automatically filled.

So, for the six months of 2017, the credit turnover of account 97.21 with the form Previous years losses according to tax accounting is 1 000 000 rubles. The same amount is shown in column 4. Help-calculation of write-offs of losses of previous years for June 2017 as the amount of loss included in the decrease in profit. Thus, in line 110 of Sheet 02 of the half-year declaration, you need to enter the value: 1,000,000. The tax base for tax calculation (page 120) will be reduced by this amount, which will amount to 1,000,000 rubles. (2,000,000 - 1,000,000).

For 9 months of 2017, the credit turnover of account 97.21 with the form Previous years losses according to tax accounting is 1,500,000 rubles. The same amount is shown in column 4. Help-calculation of write-offs of losses of previous years for September 2017. In line 110 of Sheet 02 of the declaration for 9 months, the value is entered manually: 1,500,000.

The tax base indicator for calculating income tax (p. 120) will be 1,500,000 rubles. (3,000,000 - 1,500,000).

Reflection of losses in the annual reporting of the organization

Perform the closing of the month for December 2017. According to tax accounting data, the amount of loss, taken into account in the decrease in profit for 2017, amounts to 2,000,000 rubles, and the balance of the non-transferred loss at the end of 2017 is 3,000,000.00 rubles.

According to the accounting data for 2017, it was written off with the type of asset Current period loss in the amount of 400,000.00 rubles. (2,000,000.00 x 20%).

Now we will form and fill out the income tax return for 2017. The following indicators are automatically reflected in Appendix No. 4 to Sheet 02:

From line 150 of Appendix No. 4 to Sheet 02, the amount of part of the loss that reduces the tax base is transferred to line 110 of Sheet 02 of the declaration. The tax base for tax calculation (p. 120) will be reduced by this amount, which will amount to 2,000,000 rubles. (4,000,000 - 2,000,000).

We will create and fill out the financial statements for 2017. The report on financial results automatically reflects indicators:

In the first section of the asset of the balance sheet “Non-current assets” the amount of the deferred tax asset in the amount of 600 thousand rubles. reflected in line 1180 “Deferred tax assets”. In the third section of the “Capital and reserves” liabilities, the retained earnings of 2017 are reflected in the total amount under line 1370 “Retained earnings (uncovered loss)”.

Reflection of loss in accounting - postings on it require special attention of the accountant. This procedure affects the amount of income tax not only the current, but also subsequent periods. This article will expand on this topic in detail.

How is the financial result reflected - postings

Loss in accounting (hereinafter - BU) is determined at the end of the reporting period by comparing the costs incurred and the proceeds received. The financial result (profit or loss) is obtained from the sum of the results of the usual types of activity for the enterprise and other income and disposals. To fix the financial results, the chart of accounts (approved by order of the Ministry of Finance of the Russian Federation No. 94n of October 31, 2000) provides for account 99 “Profit and loss”. During the financial year, the periods for which interim reporting is generated are closed and the following entries are made:

|

Description |

||

|

Profit for ordinary activities is shown (if the turnover in Qt 90.1 is greater than the sum of the turnover in Dt 90.2, 90.3, etc.) |

||

|

A loss is shown for ordinary activities (if the turnover in CT 90.1 is less than the sum of the turnover in Dt 90.2, 90.3, etc.) |

||

|

The profit on other activities is shown (if the turnover in CT 91.1 is greater than the turnover in Dt 91.2) |

||

|

The loss on other activities is shown (if the turnover in CT 91.1 is less than the turnover in Dt 91.2) |

Note that the reflection of the facts of financial and economic activity in all sub-accounts of accounts 90 and 91 is carried out continuously during the year, on an accrual basis. And only during the balance sheet reformation at the end of the year they are reset to zero by postings Dt 90.1 Kt 90.9, Dt 90.9 Kt 90.2 (90.3). For account 91, the reformation is carried out similarly. Accordingly, the accountant does nothing with the loss incurred at the end of the interim reporting periods - the financial results are simply accumulated on account 99. But at the end of the year, the accumulated balance on account 99 is included in retained earnings or uncovered loss by postings:

Loss accounting and tax loss - postings

When according to the data of accounting and tax accounting (hereinafter referred to as NU) profit is obtained and both values \u200b\u200bare equal, then there are no difficulties in calculating and recording income tax (hereinafter - NP). If in one of the accounting systems - BU or NU - one financial result was obtained, and in the other - different, then when closing the period, attention should be paid to PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114н. In our article, we consider cases with the occurrence of discrepancies in loss in the accounting and financial statements.

For the obligation to use PBU 18/02, see the article "PBU 18/02 - who should apply and who not?" .

According to Art. 283 of the Tax Code of the Russian Federation, an organization has the right to transfer losses incurred in the current tax period to the future, that is, to reduce the NP base by the amount of these losses in subsequent periods in whole or in part.

Read more about tax loss.

Therefore, even if in the current period the financial results for accounting and accounting are equal, then in subsequent periods, ceteris paribus, accounting and tax profit will differ, thus, a deductible temporary difference will arise (paragraph 11 of PBU 18/02). Note that the loss transfer rule only works for the tax period (year), it does not apply to loss for the reporting period.

Consider 3 cases of loss and related transactions.

Equal loss in accounting and financial statements

According to paragraph 20 of PBU 18/02, after the accountant determines the financial result according to the accounting data, he must calculate and reflect the conditional income or expense for NP. This must be done because the tax loss for the reporting period is nullified (Clause 8, Article 274 of the Tax Code of the Russian Federation), and the financial result for accounting remains unchanged. The amount is calculated by multiplying the accounting loss by the NP rate and reflected by the posting:

- Dt 68 Kt 99 - the amount of contingent income tax income.

- Dt 09 Kt 68 - SHE.

Thus, if a loss is recorded in NU and BU, then account 68, subaccount “NP” will have a zero balance, and the declaration for payment will also reflect 0. In this case, the difference between 0 on NU and the amount of loss on the BU should be reflected in accounting (form SHE).

About accounting rules SHE read in the article “Accounting for income tax calculations” .

Loss in OU, profit in BU

If there was a loss in NU, but profit in NU, then NU expenses were higher or less income, which means that in the current period should be reflected deferred tax liabilities (ONO) for taxable temporary differences or permanent tax assets (PNA) with constant differences . At the end of the period, the accountant reflects the notional expense for the NP, which is offset by previous postings on IT or PNA, thereby bringing the current NP to 0.

Consider this situation by example.

Example

In Kaleidoscope LLC, profit on the basis of profit is 250 thousand rubles, and a loss on the basis of profit is 500 thousand rubles. The difference arose in connection with the cancellation of the depreciation premium for the new fixed asset by Kaleidoscope - 350 thousand rubles. (IT). Also, Kaleidoscope LLC received equipment free of charge from the founder - an individual who has a share in the authorized capital equal to 70%. The cost of equipment amounted to 400 thousand rubles. In the BU this income is reflected as other income, in the NU it is not recognized as taxable income (subparagraph 11 clause 1 of article 251 of the Tax Code of the Russian Federation). In the accounting of Kaleidoscope LLC, the following entries were made:

|

Amount, thousand rubles |

Description |

||

|

70 (350 × 20%) |

Shown IT on depreciation premium |

||

|

80 (400 × 20%) |

PNA shown for equipment received free of charge |

||

|

90.9 (91.9) |

Defined profit according to BU |

||

|

50 (250 × 20%) |

Defined NP contingency |

||

|

100 (500 × 20%) |

Defined IT tax loss |

On account 68, at the end of the period, a zero balance is formed, which corresponds to the value of the NP according to OU, because there was a loss. Accordingly, the tax is 0.

About whether the accountant should worry, waiting for tax inspections, if a loss is shown in the tax return, read the article “What are the implications of reflecting a loss in the income tax return?” .

The following situation assumes that the expenses in the accounting unit were higher or the incomes were lower than in the NU, therefore the loss this time was formed in the NI, and the profit - in the NU.

Loss in profit, profit in profit

In this situation, in the current period, there were deductible temporary differences that led to the reflection of IT, and / or permanent differences, as a result of which a permanent tax liability (POP) was shown. Consider an example.

Example

In LLC “Carousel” profit on NU equals 150 thousand rubles., Loss on BU - 300 thousand rubles. Previously, an entity recognized IT for a loss carried forward; the amount of the transferred loss is 400 thousand rubles. In the current tax period, OOO Karusel may pay off part of the loss in the amount of 150 thousand rubles. due to the profit received in the NU. In addition, in the current year, a temporary difference occurred in the accounting of LLC “Karusel” due to excess depreciation amounts on BU for depreciation amounts on NU by 450 thousand rubles. In accounting, LLC “Carousel” made the following:

|

Amount, thousand rubles |

Description |

||

|

90 (450 × 0.2) |

SHE is shown for the difference in depreciation amounts |

||

|

30 (150 × 0.2) |

Written off SHE on the repaid loss |

||

|

90.9 (91.9) |

Defined loss according to BU |

||

|

60 (300 × 20%) |

Defined conditional income for NP |

Thus, the turnover on the debit of account 68 is 90 thousand rubles. and for the loan - 90 thousand rubles, that is, the current NP is 0 rubles. According to the NP declaration, the tax amount for the year is also equal to 0, since the tax profit was zeroed due to the repayment of the loss of previous years.

Redemption of loss carried forward

In the previous example, we saw what happens to IT accrued on the amount of tax loss that the organization decides to transfer to the future. If the organization in NU makes a profit, then it has the right to repay the loss transferred to the future for the amount of this profit. Repayment can be done in parts in different periods or in full. At the same time, it is written off for such a loss: Dt 68 Ct 09.

ABOUTTAKE ATTENTION!Taxlesiontoleratedon thefutureaccording tonormsst. 283 NKRFandfromconsideringlimitations .

Summary

If there is a loss in accounting or tax accounting, you must remember that in this case you can not do without the use of PBU 18/02. This provision governs the accounting of permanent and temporary differences, which lead to different financial results in the accounting and financial statements. In addition, in PBU 18/02 it is established that the loss carried forward to the future received in OU is also a temporary difference.

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

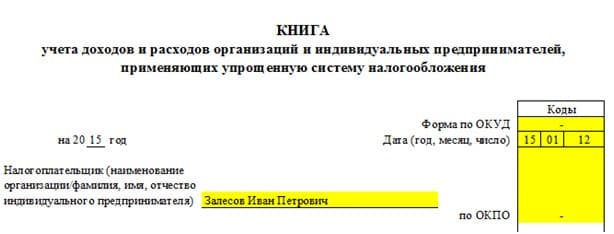

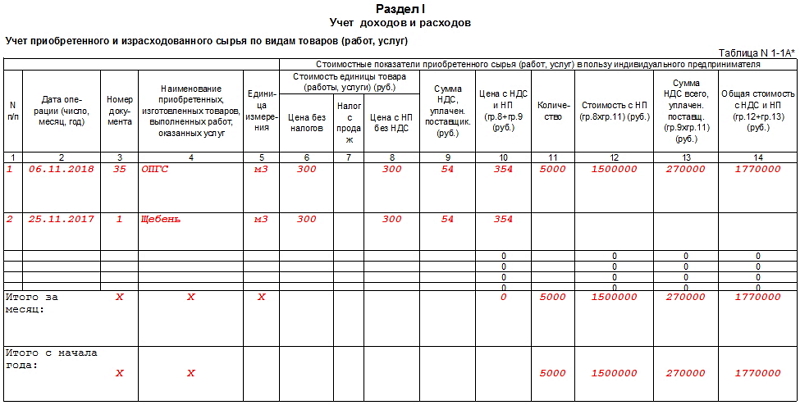

What is KUDiR and how to fill it in?