The formation of a special tax form in the form of a Book of income and expenses for individuals who are in the general taxation regime is a requirement by law, mandatory.

FILES

What is a document for?

The book of accounting for income and expenses (abbreviated as KUDiR) is necessary for calculating the tax base of individual entrepreneurs, on the basis of which the calculation of tax deductions for the period of the report will be made.

For each tax system where KUDiR is required, it will have its own characteristics. An IP located on a common system (OSNO) should be guided by the relevant requirements. Entrepreneurs at PSN and STS will fill out KUDiR differently.

REMEMBER! On the general taxation system, only individual entrepreneurs are required to conduct KUDiR; companies are exempted from this obligation.

How the book is formed

Filling out a book is not instantaneous. Entries into it are made gradually, during the period of the commission of a particular operation.

Confirmation of the information entered is the primary accounting documents that the IP must have in stock and be stored for a certain period of time (at least three years).

All figures in KUDiR are entered in ruble terms.

Features and general information about KUDiR

The book has a uniform form. It can be kept both in paper form, entering the necessary data by hand, and in electronic form.

If the book is kept in a computer, after the expiration of the accounting period it should be printed, numbered and stitched with thick thick thread. On the final page is put (if any) and a signature, as well as the number of pages. The book is then registered with the local tax authority.

In the case when the paper version of KUDiR is used, it is registered in the tax one before filling in.

The book includes six sections, which reflect all the income and expenses of IP generated during the reporting period. It should be noted that sections are filled out, depending on the direction of the individual entrepreneur.

In other words, information should be entered only in those KUDiR blocks that are relevant to the activities of individual entrepreneurs.

General requirements for filling KUDiR

If the book is not printed from electronic media, but is kept in paper form, it must be purchased. This must be done by the entrepreneur, according to the law. The requirements are as follows:

- chronological order of reflection of income and expenses;

- confirmation of their primary documents;

- completeness and continuity of accounting of data forming the tax base;

- numbering and lacing of sheets of a book, a signature certifying the number of sheets on the last page;

- correction is allowed by carefully striking through one line and assuring the correction with the signature of the IP and the date;

- KUDiR and accounting are carried out in parallel, one and the other necessarily;

- at the beginning of each new reporting period, a new Book should be opened;

- the completed KUDiR should be maintained for 4 years.

ATTENTION! If KUDiR is conducted in electronic version, which is permitted, it should be printed out and the same actions should be carried out with it as with paper.

KUDiR nuances on the basis of

For entrepreneurs at OSNO, completing KUDiR has a number of features.

- To account for the movement of funds, the cash method is used.

- If an individual entrepreneur conducts several types of activities at once, there is no need to start a separate book for each, you can take them into account in one KUDiR, but separately.

- KUDiR also includes information on the calculation of VAT.

Sample document

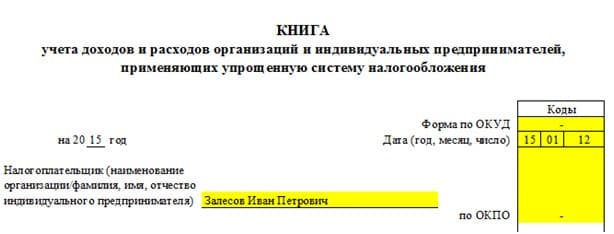

Information about individual entrepreneurs is entered at the beginning of the book, on the title page - this section should not cause difficulties, since this includes information from personal and constituent documents:

- address of residence;

- information about the tax authority where the taxpayer was registered;

- data from the certificate of registration, etc.

It also provides information about the bank where the individual account is opened and the cash desk number, if he uses it in his work. Then the entrepreneur puts his signature on the page and dates the form.

Filling section 1 KUDiR

This includes raw materials, semi-finished products and other inventory items, for the acquisition of which IP spent its funds. They need to be taken into account even if the expenses were made in the previous reporting period and the de facto arrival occurred in the current one.

Advances planned to be provided in future periods are also indicated here.

As expenses, the real costs that occurred in order to subsequently obtain financial benefits from business operations are taken into account.

It should be noted that the amount of financial expenses in the course of entrepreneurial activity is written off to expenses only on condition that the produced inventory items are realized. If on this part there are norms of expenses established by law, then accounting is carried out on the basis of them.

The first section contains several block tables. Blocks from 1-1 to 1-7 should be filled in by entrepreneurs who are employed in the manufacturing sector. Moreover, each block has two options, the first of which (version A) is used by entrepreneurs working with VAT, and the second (version B) is used by those who do not allocate VAT in their operations.

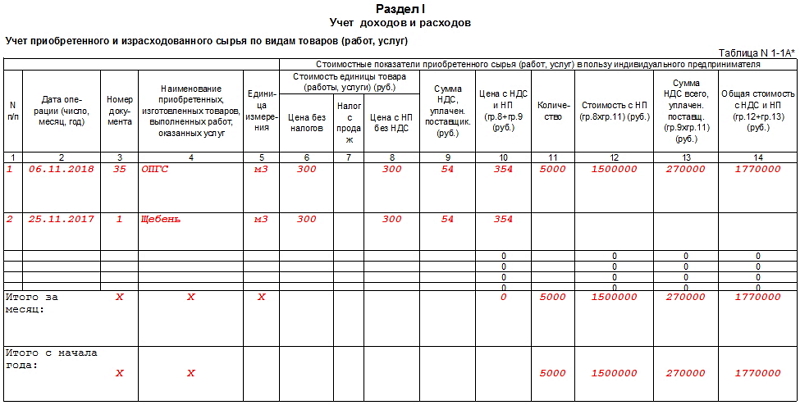

If you go in order, then the data on the raw materials purchased and expended during the operation of IP are entered in Table 1-1.

Semi-finished products (acquired and expended) for production needs are included in the cells of unit 1-2.

Lines of the block numbered 1-3 are designed to account for auxiliary raw materials and materials (purchased and used).

Block 1-4 contains other material costs, i.e. energy, water, fuel, etc. which were spent in the course of the IP.

Block 1-5 indicates the price of finished products that the FE issued for the period of the report, and also gives the cost of the work performed and services rendered during this time.

Blocks 1-6 and 1-7 show the result of production and sale of manufactured products at the time of completion and according to the results of the monthly period.

Filling section 2 KUDiR

The second section of KUDiR deals with depreciation of fixed assets, IBE and intangible assets.

Depreciation can only be calculated in relation to the property of the entrepreneur, which is bought for cash and is used to carry out his work. Intangible assets include all types of intellectual property (trademarks, electronic programs, databases, etc.) that IP uses in its activities. The rules for calculating depreciation are given in tables 3-1, 3-2, 3, 4-1, 4-2.

Filling section 5 KUDiR

The fifth section of the book provides a calculation of wages and taxes. The table given here is, in fact, a payroll statement and is formed separately for each month. It contains

- calculated income tax

- various other deductions,

- cash disbursement date

- and the signature of the employee in their receipt.

The table contains all types of payments, including the actual salary, material incentive payments, the price of goods issued in kind, etc.

Filling section 6 KUDiR

The sixth section of KUDiR allows you to determine the tax base. It is formed after a year (according to the calendar) and is the basis for filling out the 3-NDFL form.

Block 6-1 contains the income from the sales specified in table 1-7 and others. As expenses, data are given from blocks 1-7, 2-1, 2-2, 3-1, 4-1, 4-2, 5-1, 6-2.

Block 6-2 includes all expenses of individual entrepreneurs not shown in other blocks, including expenses for fire safety and security systems, travel expenses, fees for consulting, information and legal entities. services, Internet, telephone, expenses for household and repair needs, etc.

The last KUDiR block (6-3) contains the expenses made in the current period of the report, but the income from which will be taken into account in the coming period. These include seasonal property expenses, rental payments, etc.

Empty KUDIR

If for a specific reporting period the individual entrepreneur did not have any movement of funds, this does not mean that he should not pay attention to KUDiR. This situation obliges him to submit, along with other reports, to the tax “zero” Book. This means that you need to draw it up according to the usual requirements, just put down zeros in the graphs that display the actual movement of funds.

The coordination procedure is not legally prescribed. Therefore, you can submit your account book form to the inspection for certification with a cover letter. Before submitting the book, pre-arrange according to the general rules.

Make a book of accounting for income and expenses in a single copy. For each year, open a new account book. This follows from the provisions of paragraph 4 of the Procedure for recording income and expenses for entrepreneurs, as well as from paragraph 2 of the general requirements for the procedure for filling out the book of accounting.

Book Maintenance Methods

You can keep a book of accounting for income and expenses both on paper and in electronic form (paragraph 7 of the Procedure for recording income and expenses for entrepreneurs).

Depending on the form in which the book of accounting for income and expenses (paper or electronic) is kept, the procedure for its design varies.

If an entrepreneur keeps a record book on paper, before making entries in it, it is necessary:

- fill in the title page;

- sew and number pages. On the last page of a stitched and numbered book indicate the number of pages contained in it;

- assure the book to the tax office and seal it.

If an entrepreneur keeps an electronic book of records, then at the end of the tax period it should be:

- print;

- stitch, number the pages and indicate their number on the last page;

- assure the book to the tax office and seal it. To be certified by the tax inspectorate, the printed book must be submitted no later than the deadline for filing a tax return, that is, no later than April 30 of the year following the reporting one.

This follows from the provisions of paragraph 8 of the Procedure for recording income and expenses for entrepreneurs.

Responsibility

Attention: the absence of an income and expense book is an offense for which tax liability is provided for under article 120 of the Tax Code of the Russian Federation.

If the entrepreneur does not have a book of accounting for income and expenses - this is a gross violation of the rules for accounting for income, expenses and the object of taxation.

The amount of the fine for the entrepreneur will be:

- 10 000 rub. - if such a violation was committed during one tax period;

- 30 000 rub. - if the violation was committed during several tax periods.

If the violation led to an underestimation of the tax base, it will entail a fine of 20 percent of the amount of unpaid tax, but not less than 40,000 rubles.

This procedure is provided for in Article 120 of the Tax Code of the Russian Federation.

The composition of the book accounting

The book of accounting for income and expenses of an entrepreneur on the general taxation system consists of six sections:

Section I “Accounting for income and expenses”;

Section II "Calculation of depreciation of fixed assets";

Section III “Calculation of depreciation on low-value and wearing items not written off as of January 1, 2002”;

Section IV “Calculation of depreciation of intangible assets”;

Section V “Calculation of accrued (paid) in the form of remuneration of labor income and taxes withheld from them”;

Section VI “Determination of the tax base”.

Each section of the book of accounting consists of several tables. They need to be filled in if the entrepreneur carried out the operations for which reflection the corresponding tables are intended.

Recording

Record business transactions in the accounting book in chronological order based on the primary documents (paragraph 4 of the Procedure for recording income and expenses of entrepreneurs).

Record the income, expenses and business operations in rubles (paragraph 1, paragraph 5 of the Procedure for recording income and expenses of entrepreneurs). Income and expenses denominated in currencies should be taken into account in conjunction with income and expenses in rubles. They need to be recalculated at the official rate set by the Bank of Russia on the date of recognition of the corresponding income (on the date of actual expenditure) (paragraph 2, paragraph 5 of the Procedure for recording income and expenses of entrepreneurs).

Reflection of income and expenses

Reflect income and expenses in the book of account on the date of their actual payment. When showing income, do not reduce it by the amount of tax deduction. This follows from paragraphs 13 and 14 of the Procedure for recording income and expenses of entrepreneurs.

Revenues received as a result of offsetting mutual claims are reflected in the book of accounting as of the date of signing of the act of offsetting. The expenses incurred in connection with the set-off of mutual claims shall be reflected in the book of account on the same date (provided that at the time of signing the act other conditions for recognition of the expense are met). As of the date of signing the netting act, the obligations of the seller (contractor) and the buyer (customer) are repaid (Article 410 of the Civil Code of the Russian Federation).

Income from the sale of fixed assets and intangible assets is defined as the difference between the sale price and their residual value (paragraph 14 of the Procedure for recording income and expenses of entrepreneurs).

Section I completion

Section I consists of seven tables, six of which provide two options for filling them:

Table 1-1A “Accounting for purchased and consumed raw materials by type of goods (work, services)”;

Table 1-1B “Accounting for purchased and consumed raw materials by type of goods (work, services)”;

Table 1-2 "Accounting for the worked out and consumed semi-finished products by type of goods (work, services)";

Table 1-3A “Accounting for purchased and spent auxiliary raw materials and materials by type of goods (work, services)”;

Table 1-3B “Accounting for purchased and spent auxiliary raw materials and materials by type of goods (work, services)”;

Table 1-4A “Accounting for other material costs (including fuel, electricity, transportation services, etc.) and their distribution by type of activity”;

Table 1-4B “Accounting for other material costs (including fuel, electricity, transportation services, etc.) and their distribution by type of activity”;

Table 1-5A “Quantitatively-total accounting of consumed material resources for finished products by type of goods (work, services)”;

Table 1-5B “Quantitatively-total accounting of consumed material resources for manufactured finished products by type of goods (work, services)”;

Table 1-6A “Accounting for income and expenses by type of goods (work, services) at the time of their commission”;

Table 1-6B “Accounting for income and expenses by type of goods (work, services) at the time of their commission”;

Table 1-7A “Accounting for income and expenses for all types of goods (works, services) for the month”;

Table 1-7B “Accounting for income and expenses for all types of goods (works, services) for the month”.

Fill in the tables with the letter “A” if you carry out operations subject to VAT. Fill in the tables with the letter “B” for transactions that are not subject to VAT. If an entrepreneur carries out both VAT-taxed and tax-exempted operations, it is necessary to keep separate records of such operations and fill out, respectively, the tables with both the letter “A” and the letter “B”.

Fill Table 1-1 on the basis of primary documents on the acquisition of goods (works, services) used for the production of finished products (performance of work, rendering of services). In this table do not reflect the acquired material resources (fuel, electricity, transportation costs, etc.), which are to be reflected in table No. 1-4.

In table 1-2 reflect the operations for accounting for the developed and consumed semi-finished products by type of goods (work, services) from purchased and used raw materials, which were previously reflected in table No. 1-1.

Use Table 1-3 to account for purchased and spent auxiliary raw materials and materials by types of goods (works, services) that form the basis of finished products (works, services).

Material costs not shown in tables 1-1 and 1-3, indicate in table 1-4.

In table 1-5, form the total cost of finished products (work performed, services rendered) based on data from previous tables.

Table 1-6 reflect the income from entrepreneurial activity and the expenses associated with obtaining these incomes. The table is filled in at the moment of recognition of the corresponding income and expenses.

If the entrepreneur is engaged only in trade and does not form the cost of finished products (work performed, services rendered), fill out table 1-6 based on the data from tables 1-1 and 1-4.

Fill Table 1-7 at the end of each month based on the data shown in Table 1-6. This table defines the income and expenses of the current month, which are subsequently taken into account when calculating personal income tax.

Section II completion

Section II consists of two tables:

Table 2-1 "Calculation of depreciation of fixed assets directly used for business activities for the tax period of 200 __ year";

Table 2-2 “Calculation for the continuation of depreciation on fixed assets purchased before January 1, 2002 and used for entrepreneurial activity for the tax period of 200 ___ years”.

Both tables are designed to reflect the operations associated with the movement of fixed assets.

Data on fixed assets of the entrepreneur are reflected in section II of the book of accounting for income and expenses in a positional manner for each object separately. Make the initial entries in this section at the time of commissioning of the acquired (manufactured) fixed assets. Calculate the depreciation of fixed assets annually to be included in the expenses of the current year and display the balance to be written off in subsequent tax periods.

Such rules are contained in the General Requirements, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxation of Russia No. BG-3-04 / 430.

Section III completion

Section III includes one table:

Table 3 “Calculation for the continuation of depreciation on low-value and wearing items that were not written off as of January 1, 2002 for a tax period of 200 ___ years."

In this section, reflect depreciation and retirement of low-value and wearing items not written off as of January 1, 2002. The cost of the used items is repaid through depreciation in two stages: the first 50 percent of the initial cost is written off at the beginning of the use of the object, and the remaining 50 percent - at its disposal. The remaining 50 percent of the value of low-value and wearing items upon disposal is reflected in column 5 of table 3 of section III of the income and expense book.

Such rules are contained in the General Requirements, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxation of Russia No. BG-3-04 / 430.

Section IV completion

Section IV consists of two tables:

Table 4-1 “Calculation of depreciation of intangible assets directly used for entrepreneurial activity for the tax period of 20 __ year”;

Table 4-2 “Calculation for the continuation of depreciation on intangible assets acquired before January 1, 2002 and used for entrepreneurial activity for the tax period of 20 ___ years”.

This section is intended to reflect the movement of intangible assets. Make the initial entries in this section at the time you start using the acquired (created) intangible assets. Calculate the amortization of intangible assets annually for inclusion in the current year’s expenses and display the balance to be written off in subsequent tax periods.

Such rules are contained in the General Requirements, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxation of Russia No. BG-3-04 / 430.

Filling Section V

Section V includes one table:

Table 5 "Calculation of accrued (paid) in the form of remuneration of income and taxes withheld from them for 20 ___ years."

This section is intended to reflect operations related to the calculation and payment of salaries (bonuses, remuneration, etc.), as well as withholding personal income tax from these payments. Fill table 5 monthly.

Such rules are contained in the General Requirements, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxation of Russia No. BG-3-04 / 430.

Section VI completion

Section VI consists of three tables:

Table 6-1 “Determination of the tax base for personal income tax for the tax period of 20 __ year”;

Table 6-2 “Register of other expenses related to business activities for the tax period of 20 __ year”;

Table 6-3 “Register of expenses incurred in the reporting tax period, but related to income generation in the following tax periods”.

This section is a summary and is intended to summarize the information included in the previous sections of the book of accounting for income and expenses.

Fill in the line “Income from the sale of goods, work performed, services rendered” in table 6-1 on the basis of the data reflected in column 16 of table 1-7A and (or) column 15 of table 1-7B.

In the line “Other income” of table 6-1 indicate the size of other income, including the value of property received free of charge.

In the line “Total income” of table 6-1 reflect the total value of income received in the tax period. Transfer the amount of income reflected in this line to line 030 of sheet B of the declaration in form 3-NDFL.

Fill in the line “Material costs” based on the data reflected in column 10 of table 1-7A and (or) table 1-7B. Transfer the amount of material costs to line 050 of the sheet In the declaration according to form 3-NDFL.

In the line "Depreciation Amounts for Depreciable Property" reflect the depreciation calculated for the tax period on fixed assets and intangible assets based on the data in the tables of sections II, III, IV. Transfer the value of this line to line 060 of the sheet In the declaration according to form 3-NDFL.

In the line “Labor costs” reflect the accrued salary and remuneration in favor of the entrepreneur’s employees for the tax period on the basis of the data in section V. The value of this line should be transferred to line 070 of sheet In the declaration according to form 3-NDFL.

Fill in the line “Other expenses” based on the data from table No. 6-2. Transfer the value of this line to line 090 of the sheet In the declaration according to form 3-NDFL.

In the line “Total expenses” reflect the total value of all expenses of the entrepreneur, taken into account when calculating personal income tax for the tax period. Transfer the data of this line to line 040 of the sheet In the declaration according to form 3-NDFL.

Fill in the line “Expenses incurred in the reporting tax period but related to income generation in the following tax periods” based on the data in table 6-3.

Table 6-2 is used to decrypt other expenses incurred by the entrepreneur in the current tax period and taken into account in calculating personal income tax.

Table 6-3 reflect the expenses that are incurred in the current tax period and which will be recognized in subsequent tax periods (after receipt of the corresponding income).

Such rules are contained in the General Requirements, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxation of Russia No. BG-3-04 / 430.

An example of filling out an entrepreneur's income and expense book

A.A. Ivanov registered as an entrepreneur on October 28, 2014. He applies the general taxation system and is a VAT payer.

During 2014, he carried out the following business operations.

November 5 - acquisition of construction sand in the amount of 5000 cubic meters. m at a price of 354 rubles / cubic m, including VAT (18%) - 54 rubles.

November 22 - purchase of a computer (cost 49 560 rubles, including VAT - 7560 rubles) and putting it into operation. The useful life of the computer is 25 months.

November 25:

- sales of sand in the amount of 4000 cubic meters. m at a price of 531 rubles / cubic m, including VAT - 81 rubles;

- payment for sand delivery to the buyer - the amount of 177,000 rubles, including VAT - 27,000 rubles;

December 30th:

- salary payment Avdeeva - the amount of 17 452 rubles. (20,000 rubles. - (20,000 rubles. - 400 rubles.) × 13%);

- transfer of personal income tax from Avdeeva's salary - the amount of 2548 rubles. ((20,000 rubles - 400 rubles) × 13%);

- transfer of insurance premiums from Avdeeva's salary - the amount of 6800 rubles. (20 000 rub. × 34%);

- transfer of a fixed insurance payment from the entrepreneur's income - the amount of 2847 rubles. (4300 × 31.1% × (2 months + 4 days: 31 days). Ivanov does not pay voluntary contributions to the FSS of Russia;

- payment of a bank commission for maintaining a current account - the amount of 500 rubles.

December 31 - depreciation on the computer - the amount of 1680 rubles. (42 000 rub.: 25 months).

At the end of 2014, the entrepreneur filled income book an entrepreneur in the amount corresponding to the economic operations completed by him in 2014.

Note that one of the main responsibilities of private entrepreneurs, and not only applying the classical basic taxation system (OSNO), is the correct conduct of tax accounting. At what points in maintaining the Book of Accounting for Income and Expenses of Individual Entrepreneurs should focus, what data must be indicated without fail, and what cannot be reflected, how to correctly conduct KUDiR and how to fill out this document - we will examine the points with examples.

The book of income and expenses for individual entrepreneurs: is it mandatory to keep, regulatory requirements, for what is applied

The basic regulatory act regulating tax accounting of individual entrepreneurs registered in the state business register as individual entrepreneurs and applying the basic taxation regime (OSNO) is the procedure for accounting for individual income and expenses, approved by Order of the Ministry of Finance of the Russian Federation No. 86n dated August 13, 2002 (as amended by June 19, 2017).

The main requirement of the law is here: every merchant registered with the Unified State Register of Enterprises, from the moment it begins to carry out its activities, should reflect all business operations when conducting business in the Book of Income and Expense Accounting (KUDiR). The main goal of this action is the full control of the tax base (NB) by the fiscal regulator and, of course, by the entrepreneur himself.

In this case, the purpose of the Book of Recognition recognized 3 main goals:

- generalization;

- systematization;

- accumulation of data contained in the primary documents accepted for tax accounting.

But these are the key tasks of conducting KUDiR, which can be applied to any of the regimes, the exact purpose of the Accounting Book for IP on OSNO is to check the calculations of the tax base of the business for personal income tax.

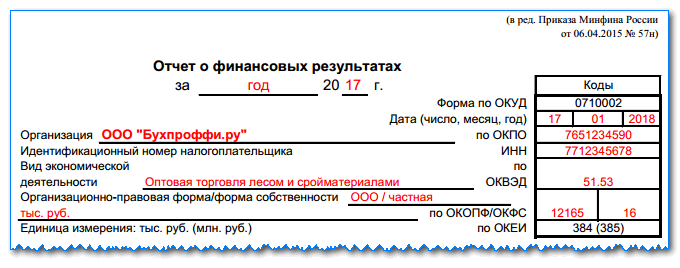

The final data of the IP on OSNO entered in KUDiR are transferred to the tax return for 3_NDFL

I note that when receiving feedback from entrepreneurs from the regions today, there is only one indisputable and disappointing conclusion: since the end of April 2018, total and unprecedented checks of small businesses have begun. Office checks based on the results of 2017 are conducted with special zeal. My girlfriend at this moment gives comments to the controllers on the thirty-eight points that arose during the verification of her tax return. Note: it is a simplist with a base of 6%, that is, everything should be quite simple there. Without exaggeration, I will say: every contract, s / invoice, every fiscal check is checked and analyzed by the tax authorities. And all the consultants on reporting IP speak with one voice: the situation with inspections and fiscal control will be aggravated every year. Gos. controllers need to collect taxes in the budget. Performing their KPIs, tax authorities will increasingly “tighten the screws” when checking reports, including the IP Tax Books.

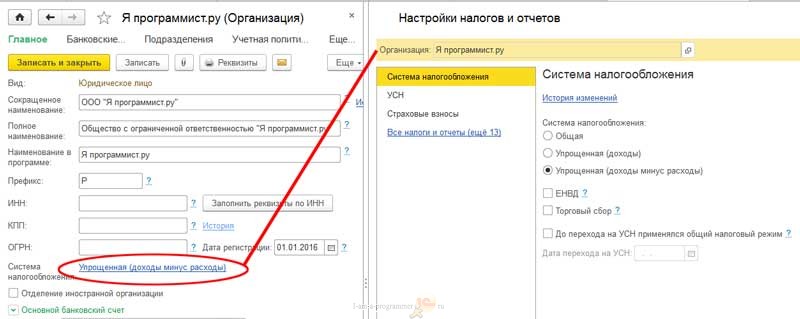

Ways of maintaining KUDiR for SP

In contrast to the preferential tax treatment regimes for business on the OSNO, tax specialists use a different approach to the registration of this document. So, if an entrepreneur, for example, in a simplified form, does not have to assure his KUDiR of the tax, then an individual entrepreneur who works under the general regime must register his book of accounts with the Federal Tax Service Inspectorate without fail.

As the regulatory requirements for tax accounting say: this register can be maintained both on paper and on a computer. The difference for IP is in the time of registration of the journal.

As controllers declare on their tax.ru portal, if a businessman plans to conduct KUDiR by hand, the steps in this case will be as follows:

- SP independently acquires or prints the Accounting Book using the template. You can download it in excel format for free from the Consultant Plus portal by clicking on the link.

KUDiR format approved by the Ministry of Finance can be downloaded for free at ConsultantPlus

- The printed document is laced with a harsh thread. All pages in it are numbered. The final page should contain the number of pages included in KUDiR. Initially, the entrepreneur puts on the last page the signature and seal of the IP (if any).

KUDIR can be purchased and handwritten

- Prior to commencement of commercial activity, the IP Book is presented to the IFTS at the place of registration of micro-business. Where it is certified by a tax inspector’s visa and is fixed with a seal of the department. The entrepreneur must do this personally (at least, the proxy who can bring KUDiR to the tax authorities, this is not discussed in the normative acts).

In the case when the merchant begins to keep his accounting tax register in electronic format, the Book is also registered without fail, only after it is printed on paper at the end of the tax period. The design of the last page, flashing and sighting is similar to the paper version. It is also checked and certified by the visa of the IFTS responsible person in the presence of the entrepreneur. Only after the end of the reporting calendar year.

In addition to the legalized formats of the Book of Accounting, an entrepreneur has the right to independently add certain indicators to the template established by law, taking into account the specific features of the business, but strictly in agreement with the tax authorities. And only if the individual entrepreneur is relieved of the duties of a VAT payer. In other cases, IP conducts standardized tax accounting.

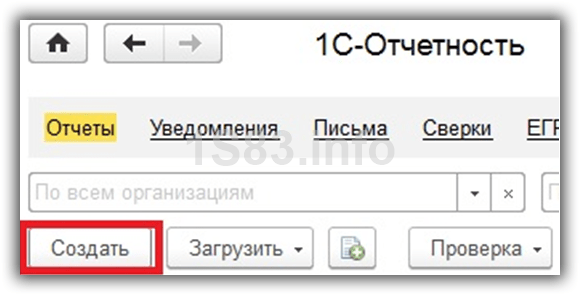

Thus, there are several ways to maintain the Book, and for these purposes, several programs have been developed to fill the KUDiR:

- you can fill in KUDiR by hand in an acquired journal or in printed form;

- execute and maintain the Book in excel format on a computer;

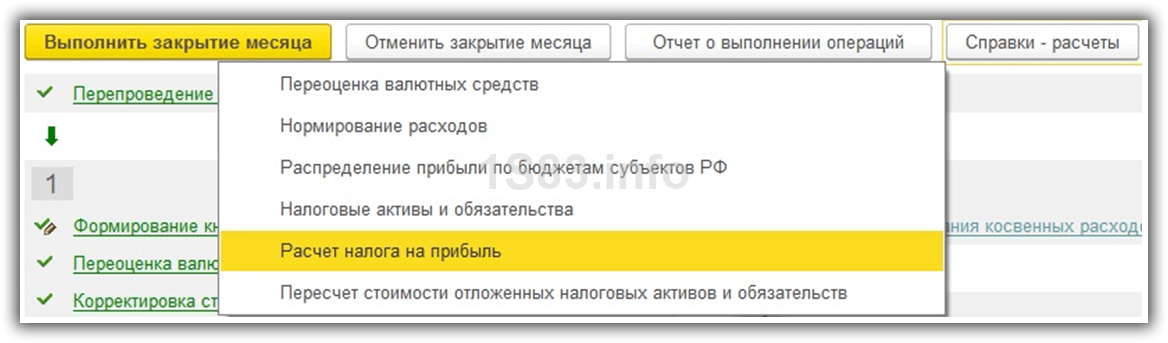

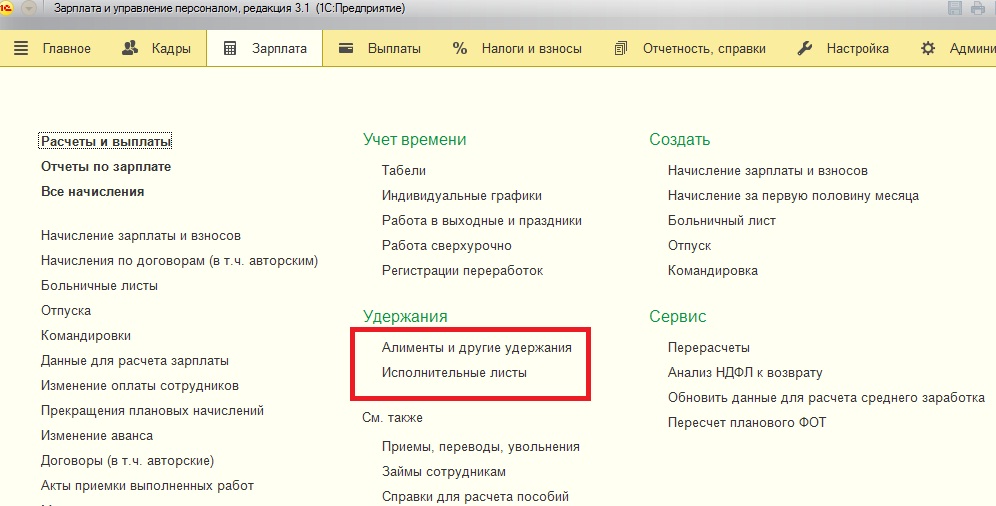

- companies that are engaged in programming for online accounting and tax accounting have developed special programs, for example, "" or "My business." Internet accounting ”, as well as 1C of various configurations.

An important requirement of tax accounting: when a businessman combines 2 or more tax regimes, each of them has its own book of accounting. How many modes a businessman uses - how many KUDiR he leads. The same procedure applies to tax periods: one reporting period - one fiscal register.

Video instruction: KUDiR, close the year

KUDiR filling procedure: basic rules and nuances of filling

It should be noted that manuals or regulations on the design of the Book of Accounting do not exist. For different types of business activities and, especially, for different tax systems, entering data into tables and sections is significantly different. Tax authorities only apply strict requirements to the full reflection of all transactions that affect the calculation of the tax base. In this connection, for OSNO it is obligatory to fully take into account all the income-expenditure activities of a private entrepreneur.

Consider the basic formal rules and subtleties of tax accounting in KUDiR for business in general mode:

- The main point is that only those operations that affect the calculation of the tax charge are recorded strictly in the register, if this or that profit or business expenses do not affect the tax figure, they are not indicated in the KUDiR.

- All data on both revenue and expenditure parts are entered on the day of operations, and without fail based solely on primary documents.

- It is logical that the numbers are put in chronological order. The register is maintained monthly and cumulatively, that is, in all sections the amount for the current month and the total amount from the beginning of the year are calculated.

- Please note that all cost indicators are affixed in rubles with copecks. Explaining why we focus on this, I want to note that in all the templates approved by the tax authorities, the formats do not work when entering data. For example, when entering data into excel in the income / expense columns, pennies have to be entered manually. Despite the fact that by setting the correct format and auto amounts, it would be possible to greatly simplify the life of small businesses, for some reason, the developers of KUDiR forms did not deign to take care of this. Therefore, before you begin to enter data in electronic form, it is better to immediately take care of the correct column formats. After all, setting everything up once, you can save a lot of time in the future. By the way, the same applies to sheet layout. The forms indicated by the Federal Tax Service of the Russian Federation show at a glance that they are not suitable for printing.

- All settlement entries are recorded in the Book only in rubles. If foreign exchange transactions take place according to the specifics of the business, the funds are translated at the exchange rate of the Central Bank of the Russian Federation at the time of their arrival or debiting from the current account of the individual entrepreneur.

- An important point is the adjustment in KUDiR, which is done by hand: so, if the IP needs to be changed in the Book, this is done with a mandatory signature next to the adjustment and the date. It is strictly forbidden to overwrite refinements and cover them with corrector. The inspector must always see which numbers have been corrected.

With regard to accounting, here it is necessary to say separately about the fundamental approaches to accounting for gross profit and fixing the costs of business for entrepreneurs:

- The book reflects the entire gross profit of the entrepreneur: everything that comes from counterparties, cash receipts and other credits, including property and other tangible assets transferred against the services provided or as a gift to the individual entrepreneur. Moreover, the profit from the sale of basic production assets and intangible assets is calculated according to the formula: the amount of proceeds from sales minus the residual value of the property or intangible assets (this is regulated in paragraph 14 of Chapter III of the “Accounting Procedure”).

- There is also a block of funds in accounting that cannot be classified as income of individual entrepreneurs, these include:

- Funds received from the Social Fund insurance, while reimbursing the expenses of IP on sick leave of its employees.

- All amounts that were mistakenly paid by partners and government agencies.

- Credit funds received by the entrepreneur to develop their business.

- Loan money issued by an entrepreneur that was returned to him by borrowers.

- If a businessman receives a salary, being employed.

- The income received from the sale of property of an individual entrepreneur who does not participate in business activities (real estate, for example).

- Accounting is carried out, as it sounds according to the slang of the tax authorities, on a cash basis: that is, only those material and cost indicators that reflect the actual full income under the contract are entered into fiscal accounting. Thus, if the products have already been shipped, and the funds have not been transferred to the business account of the individual entrepreneur, income is not included in the KUDiR. By the way, this also applies to costs. So, article 251 of the Tax Code of the Russian Federation stipulates that advances, security deposits and issued deposits are not included in tax accounting until the moment when the amount is fully repaid.

- Advance amounts returned to business partners are entered into the KUDiR with a negative value and reduce the tax base of IP on OSNO.

- The business expenses that will be taken into account do not include all the costs of the entrepreneur: the main requirement of the IFTS for expenses is that they must all be documented. The second thing to consider is that business costs should be financially justified, and should lead to future profits for the company. Common costs that can be taken into account in KUDiR include:

- Raw materials, consumables.

- Transport expenses.

- Rent

- VAT that is billed to business partners.

- Trading fee and all insurance premiums SP.

- The expenditure part of IP aimed at paying salaries to staff, bonuses, etc.

- You need to know that any costs of the merchant that do not lead to profit, cannot be indicated in KUDiR. This will be considered a violation.

- The fundamental point in tax accounting is primary accounting. The details of each fiscal document in KUDiR are indicated strictly according to the forms and requirements of the Ministry of Finance of the Russian Federation, only then can they be taken into account. The main that should be present in the details of the primary documents:

- The name of the document form.

- The date of its formation.

- If the documentation is issued from the legal. persons - the exact name of the LLC (according to the statutory documents), TIN of the enterprise.

- If the document was issued on behalf of the individual entrepreneur, his full name, number and date of issue of the registration form, TIN of the entrepreneur.

- If the receipt on the primary is executed from physical. persons, - full name, passport details, address of place of residence, TIN FL (if any) are indicated. This usually happens when an individual entrepreneur works in the field of tutoring, fitness or medicine.

- The name of the operation with units in physical and monetary terms.

- When inventory items are acquired or sold, a document must be attached to the invoice, as well as to the goods receipt, invoice, contract, etc., which would confirm the fact of payment for the goods. This closed list includes: a fiscal receipt, a receipt with a seal, a payment order (marked with a credit institution), a strict reporting document evidencing payment.

- Each primary accounting document must be endorsed by the individual entrepreneur (with the exception of fiscal checks).

- Note: it is forbidden to make changes to cash and bank and bank forms. If corrections are made to other types of primary organizations, each change must be endorsed by the responsible persons, the date of the adjustment must be on the adjustment.

- Moreover, keep in mind that the entrepreneur is required, upon the first request of the Federal Tax Service Inspectorate, to present all the primary registered in the register, that is, the entrepreneur must have it and keep it for a certain period of time: at least three years.

Algorithm and example of filling sections KUDiR

The book of accounting for income and expenses of a businessman in the main mode includes information about an individual entrepreneur, a page indicating the contents of the book and six sections:

- The cover of the Book of Accounting is a pure formality, but do not refuse to print it out and use it, at least in order to comply with the formalities.

Cover KUDIR IP

- The second page is the title page of the Book, which contains standard data: full name and TIN of the entrepreneur, IFTS code number, where microbusiness is registered, contact details and number of IP certificate. In addition, the types of entrepreneurial activity, license number, and CCP should be displayed in the title. In the final part of the page, the businessman puts his visa and fixes that he is familiar with the formal rules for maintaining the Book.

Information about IP is placed in the title page of KUDiR

- Page №3 - detailed content of the form listing all sections and tables that are in it.

- In subsection №1–1 - information on purchased and consumed raw materials for operational production activities of individual entrepreneurs.

Section I. Table No. 1–1 reflects the cost of raw materials.

- Subsection No. 1-2 contains data on semi-finished products.

- Subsection No. 1-3 - is intended for accounting auxiliary raw materials and additional. materials.

- Subsection No. 1-4 may contain both expenses for electricity, fuel, other resources providing micro-business, as well as transportation, etc.

Section I. Subsection No. 1–4 contains indicators on the expenditures of individual entrepreneurs on energy resources

- Table No. 1–5 forms the total result for the cost of goods produced, services rendered.

- Subsections No. 1–6 and 1–7 record the turnover of production and sale of IP products. This block is being maintained both at the current moment and according to the results of the month.

Section I. Subsection No. 1-6 reflects the accounting at the time of completion of work

- Section V is formed on the basis of the calculation of the salaries of IP employees and taxes paid from them. The section and its subsections are filled monthly. In fact, this section is the estimated business statement for all employee benefits.

Section I KUDiR reflects the accounting of actual costs: purchased raw materials, semi-finished products, etc. Here you need to understand that the sub-numbers 1–1–1–7 are executed only by IP-producers who have to spend on raw materials and consumables for running a private business. Moreover, the subsections under the letter A are conducted by merchants who allocate VAT when settling with counterparties and customers, and the subsections under the letter B fill in the IP exempted from this indirect tax. This block should reflect the entire income of the individual entrepreneur and the revenues that were actually received in a certain tax period (including the profit for which sales or services went before the receipt of funds). Advance payments are also included. If we consider page by page, the book of accounting includes indicators:

Sections II-IV record profits from the sale of fixed assets of IP, as well as the sale of intangible assets. Depreciation of all production assets is also shown here. It should be noted here that it is possible to take into account in KUDiR only those production assets that are acquired at the expense of individual funds and are used by him in business activities. The approach to the assessment of profit from the sale of fixed assets and intangible assets is preserved according to the formula: the cost of sales minus the residual price of business property. As for the initial cost of the OS, it is formed from the price paid upon purchase, plus delivery and commissioning. Intangible assets include, for example, the value of a trademark registered in micro-business, other intellectual property, inventive patents, etc. The procedure for settlement operations on depreciable property is given in subsections 3–1, 3–2, 3, 4–1, and 4– 2.

Section II addresses the calculation of depreciation of fixed assets and intangible assets

The final section is block VI, which defines the tax base of individual entrepreneurs. It is precisely these figures that pass the declaration of individual entrepreneurs in the general regime of 3-personal income tax. All data from previous sections and pages is summarized here. All profits and business expenses are reflected here.

Section VI KUDiR with the definition of the tax base of IP

Video: how to fill out the Book of Accounting for OSNO, USN, PSN

Responsibility for the absence of KUDiR during verification

If the tax authorities find that the Book of Records was not kept in the prescribed manner (or it was not there), and if serious errors are found, the individual entrepreneur threatens to fine from 10,000 to 30,000 ₽ (this is established in Articles 120 of the Tax Code and 15.11 of the Code of Administrative Offenses).

A business book of accountability is an important tool and commitment for micro-business. Maintaining a register implies following certain tax authorities' requirements, adhering to standards and a competent approach to protecting one's interests in fiscal accounting. At the same time, the tax inspector is not so strict in detecting errors (so far) in KUDiR, often the Book template is not a dogma, it can be corrected and modified (in certain situations).

For IP, accounting and reporting depends on the chosen taxation system. In this article, we consider the maintenance of the KUDiR IP based on OSNO. KUDIR is a book of accounting, one of the main elements of control over income and expenses. An individual entrepreneur is required to conduct it. The book is filled out strictly in accordance with the requirements of the current legislation of the Russian Federation.

What is KUDIR IP for?

KUDiR is recognized by the tax accounting register, although in it accounting and tax accounting are combined. The following data is reflected in the document:

- information on fixed assets and depreciation deductions;

- payroll and taxation;

- utilities and other expenses;

- taxation of business transactions with the identification of the difference, which is ultimately subject to personal income tax.

KUDIR IP is needed to form the tax base for personal income tax (PIT) for the tax period, which is considered a calendar year. An individual entrepreneur pays to the budget 13% of the calculated difference between income and expenses.

If at the end of the tax period the financial result is negative, i.e. There is a loss, then the tax is not paid. Also, the loss is not carried forward to the future tax period and is not covered by the profit of the following years.

Maintaining KUDIR on the basis of

KUDiR on OSNO is formed from the beginning of the tax period. The accounting book is kept either by the entrepreneur himself or by an accounting employee; they keep it for 4 years. Individual entrepreneurs provide an accounting book with 3-NDFL statements. Thus, KUDiR is leased to the tax office at the place of registration until April 30.

The magazine has a uniform form. However, the entrepreneur has the right to independently create a document form. Coordinate all conversions with the tax authority. If the developed version of the register is not agreed upon, then the tax one may not count book keeping.

KUDiR are in paper or electronic form. The book, issued in electronic form, is printed according to the results of the calendar year. It is also laced, numbered and signed. Do all this with the book, which was kept in paper form. Before, KUDiR was required to be certified by the tax inspectorate, with a paper book being certified before filling in, and an electronic one after printing. Now the law does not require certification procedures.

KUDiR reflects information on IP, the content of the document, as well as six sections. The type of tables and sections of the book depends on the type of activity of the organization. The document reflects all income and expense procedures. Here are the requirements for the person in charge of the book:

- verification of cash and non-cash funds;

- control over the payment to the supplier for each type of product sold per shift;

- the correct write-off of the cost of production as an expense that is made according to the FIFO method or at the average cost of a unit.

Entries in the book of account are carried out constantly on the basis of primary documents at the time of the transaction, i.e. on a cash basis. Business transactions are recorded in chronological order in ruble terms. In transactions in foreign currency, their value is converted at the Central Bank rate of the Russian Federation to rubles on the day of receipt or disposal of funds.

If errors occur in the KUDiR OSNO, they are corrected: they carefully cross out the incorrect information, justify it with the correct entry, certify it with the signature of the IP and indicate the date of the correction. The tax inspectorate may not accept KUDiR when submitting reports due to serious filling errors.

The procedure for filling KUDIR IP OSNO

Each section of the KUDIR IP OSNO includes many subitems, the completion of which is mandatory.

Title page includes information about the individual entrepreneur: full name, taxpayer identification number, address, information about the tax authority at the place of registration of the individual entrepreneur, data from the certificate of registration, bank details, as well as the signature of the individual entrepreneur, date and other data.

Section 1displays all income that was actually received in the tax period, including advances, as well as expenses actually incurred in this period. It reflects the raw materials, semi-finished products and other inventory items acquired by the IP for the subsequent extraction of financial benefits. Moreover, the costs of manufacturing products are written off to costs only in terms of sales. They can also be written off according to the rules established by the legislation of the Russian Federation.

Sections 2 - 4information on depreciation of fixed assets, low-value wearing items (IBE) and intangible assets is entered. The initial cost of fixed assets and intangible assets is determined based on the acquisition cost, delivery costs and commissioning of the property. Depreciation is charged to the expense only in the amount accrued for the tax period. Depreciation deductions are made only in respect of the IP's own property, i.e. which was purchased for a fee. Income from the sale of fixed assets and intangible assets is the difference between the value of the sale of property and its residual value.

Section 5devoted to payroll and taxes. The table in this section resembles a payroll, it is formed for each month. The table shows the following information:

- the amount of the calculated and paid wages;

- incentive and compensation payments;

- the value of goods that are issued as wages in kind;

- payments under copyright and civil law contracts;

- other payments;

- calculated personal income tax;

- other deductions;

- date of payment;

- signature in receipt.

Section 6 calculate the tax base for personal income tax, which is formed according to the results of the calendar year. On its basis, 3-personal income tax reporting is filled.

Zero KUDiR

If during the tax period the individual entrepreneur at OSNO did not have a single operation, then, together with other types of reporting, the FISC also submits zero KUDiR, i.e. in all columns of the book of accounting, which usually reflects the actual cash flow, zeros are put down.

Common mistakes when filling out KUDiR

Errors in filling out the book often contradict the legislation of the Russian Federation, lead to fines and require appropriate amendments:

- tax is reduced by no more than 50% due to the amount of insurance premiums paid;

- do not quarterly reflect insurance premiums;

- often confuse intangible assets with tangible ones.

Responsibility for violation of the order of conducting KUDIR

Gross violations of the requirements for accounting for income, expenses, and also the object of taxation are regulated by Article 120 of the Tax Code of the Russian Federation. The following types of fines are established:

10,000 rubles - a fine for a gross violation committed during one tax period;

30,000 rubles - a fine for the same act committed during more than one tax period;

20% of the amount of unpaid tax, but not less than 40,000 rubles - a fine for a violation that led to an understatement of the tax base.

Work in the cloud service for the small business Kontur. Accounting: there is a simple accounting, salary, taxes and reporting via the Internet. Work for free the first 14 days and find out about all the features of the service.

The book of accounting for income and expenses (KUDiR) business operations of individual entrepreneurs (IP) applying the general taxation system ( BASIC), is intended for calculating the tax base for personal income tax.

How to keep records of IP on OSNO? What should I pay special attention to when compiling my income and expense book in 2019? What data must it contain without fail and how to correctly enter the necessary information into KUDiR? Read more about this in our article below.

Section 1. Accounting for raw materials, semi-finished products and other material costs

This section reflects all income and receipts actually received in the tax period, even if goods were produced or services were provided earlier. This also includes advances received for the performance of work, services in the following periods.

Expenses include actually incurred expenses associated with the extraction of income from entrepreneurial activity. Material expenses are included in the expenses of the tax period in which the sale of goods, work, and services took place.

Tables 1-1, 1-2, 1-3, 1-4, 1-5, 1-6, 1-7 are filled in by entrepreneurs engaged in the production of goods, works and services. Each table is presented in two versions. Option A is used by entrepreneurs engaged in operations subject to VAT. Tables with the letter B are for individuals who do not allocate VAT in their operations.

- Table 1-1 records the data on purchased and consumed types of raw materials in the production of goods, works or services. Table 1-2 reflects the received and consumed semi-finished products by type of goods, work, services. Table 1-3 for accounting for purchased and spent auxiliary raw materials.

- Table 1-4 shows other material costs. These include: the cost of acquiring fuel, water, various types of energy used for technological needs, transportation costs.

- Table 1-5 forms the cost of finished products, work performed, services rendered.

- Tables 1-6, 1-7 reflect the result of production and sales of products at the time of completion and at the end of the month.

The cost of material costs in the manufacture of goods, works, services is debited to costs only in terms of goods, works, services sold. And if the norms of expenditures are established by law, then by the norms.

▼ Try our bank rate calculator: ▼

Move the “sliders”, open and select “Additional conditions” so that the Calculator selects the best offer for you to open a current account for you. Leave a request and the bank manager will call you back: he will advise on the tariff and reserve a current account.

Section II - IV. Depreciation of fixed assets, IBE and intangible assets

The income from the sale of fixed assets and intangible assets is the difference between the sale and residual value of the property.

Depreciation is charged to the amount accrued for the tax period. Depreciation is subject only to the entrepreneur’s own property, acquired for a fee and used in entrepreneurial activity.

The initial cost of fixed assets consists of the cost of acquisition and the cost of delivery and commissioning of property.

Intangible assets include intellectual property acquired or created by an entrepreneur, used in the production of goods, works, services for more than one year. These may be exclusive rights to an invention, trademark, computer program or database, know-how. The initial cost of intangible assets is formed in the same way as fixed assets. When creating an intangible asset by the entrepreneur himself, the initial cost is the cost of its manufacture and registration (obtaining a patent).

Signs of depreciable property and its classification as depreciation groups, read the article "depreciation groups".

The procedure for calculating depreciation is shown in tables 3-1, 3-2, 3, 4-1, 4-2.

Section V. Calculation of remuneration and taxes

Table 5 is filled out for each month separately when paying salaries or paying under contracts. The table includes:

- Amounts of accrued and paid wages.

- Compensatory and incentive payments.

- The cost of goods issued in kind.

- Payments under civil law contracts and copyright agreements.

- Other payments in accordance with the concluded agreement.

Table 5 is actually a payroll statement, as it includes the calculated income tax, other deductions, the date of payment, and the receipt.

Section VI. Determination of the tax base

Table 6-1 is completed at the end of the calendar year and is used to calculate personal income tax and fill out form 3-NDFL.

It takes into account income from sales from tables 1-7 and other incomes (including those received free of charge). The costs include the results of tables 1-7 (material costs), tables 2-1, 2-2, 3-1, 4-1, 4-2 (depreciation charges), tables 5-1 (labor costs), tables 6-2 (other expenses).

Other expenses (table 6-2) include expenses not included in other sections related to entrepreneurial activity:

- Amounts of taxes and fees paid established by law (except for personal income tax).

- Property protection and fire safety expenses.

- Lease (leasing) payments in case of availability of such property.

- Travel expenses within the normal range.

- Payment of information, consulting, legal services.

- Stationery, postal, telephone expenses, payment for communication services (including Internet and email).

- The cost of acquiring computer programs and databases.

- Costs of repair of fixed assets.

- Advertising expenses and other expenses related to the implementation of entrepreneurial activity.

Table 6-3 shows the expenses of the current tax period, the income for which will be received in the following tax periods. These may be seasonal expenses.

Thus, the book of income and expenses of IP on OSNO is filled. If you still have questions about the topic, ask them in the comments: we will promptly answer them.

Book of income and expenses of IP on OSNO updated: April 24, 2019 Posted by: All for SP

How to fill out individual information

What does wiring d 60 mean

We draw up the correct act of reconciliation

Accounting for finished products and goods according to the new chart of accounts

What is KUDiR and how to fill it in?