For many companies, especially those that are just starting out, the issue of loss carry forward may be relevant.

Loss carry forward is regulated Art. 283 ch. 25 of the Tax Code of the Russian Federation, according to which the tax base in the current tax period can be reduced by a part of the amount or by the entire amount of losses incurred in previous periods. At the same time, the taxpayer has the right to carry forward the loss for the future within 10 years following the tax period in which this loss was received. If the loss has not been carried forward to the next year, it may be carried forward in whole or in part to the year following it. In accordance with the Letter of the Ministry of Finance of the Russian Federation dated March 20, 2007 No. 03-03-08/1/170, the transfer of losses is possible both at the end of the tax and at the end of the reporting period.

In this article, we will consider the procedure for carrying forward losses in the program "1C: Accounting 8.2" in organizations using PBU 18/02“Accounting for corporate income tax calculations”.

In a programme "1C: Accounting 8.2" the transfer of losses of past years to the future is carried out using a manual operation by entering a document (Menu→Operations→Manually entered transactions), which includes the following postings:

- DT 09 by type "Deferred expenses" - CT 09 by type “Loss of the current period” by the amount of the loss multiplied by the income tax rate. We do not fill in the amounts of NU, PR, BP.

- DT 97.21"Future spending" - CT 99.01.1."Profits and losses on activities with a basic system of taxation." The amount of NU is equal to the sum of the loss on debit and credit. The amount of BP is equal to the amount of loss minus debit and credit. The amounts of BU and PR are not filled.

The income tax return will show the loss and zero income tax.

In the Profit and Loss Statement (Form 2), line 2300 “Loss before tax” will show the same amount of loss as in the declaration. The net profit figure in Form 2 (line 2400) will be equal to the amount of the loss before tax, reduced by the amount of the deferred tax asset.

If there is profit in the subsequent tax or reporting periods when performing a scheduled operation "Write-off of losses of previous years" the program will generate the wiring DT 99.01.1 - CT 97.21 the amount of losses from previous years.

As a result of a regulatory operation "Calculation of income tax" income tax will be reduced by the amount of the deferred tax asset, which will be reflected by the program using a transaction DT 68.04.2"Calculation of income tax" - CT 09"Deferred tax liabilities" by type "Deferred expenses".

In the income tax return, the tax base (Sheet 02, page 120) will be reduced by the amount of the credit turnover of account 97.21. NU (p. 150 App. 4 to Sheet 02).

In form 2 in line 2400, the net profit indicator will be shown as the difference between the financial result from the activities of the enterprise (line 2300) and the conditional income tax expense.

Consider the above procedure on a specific situation.

Suppose, at the end of 2011, the organization received a loss in the amount of 10 000 rub. As of January 1, 2012, we have a deferred tax asset in the amount of RUB 2,000. ( 10 000 x income tax rate 20% ).

To carry forward losses to the future, perform the following steps.

1) In the directory "Expenses of future periods" we add a new element of expenses "Losses of 2011" and fill it in, as shown in fig. 1. Details Check and Subconto do not need to be specified.

Rice. 1. Sample filling in the RBP element for the transfer of losses of past years to the future

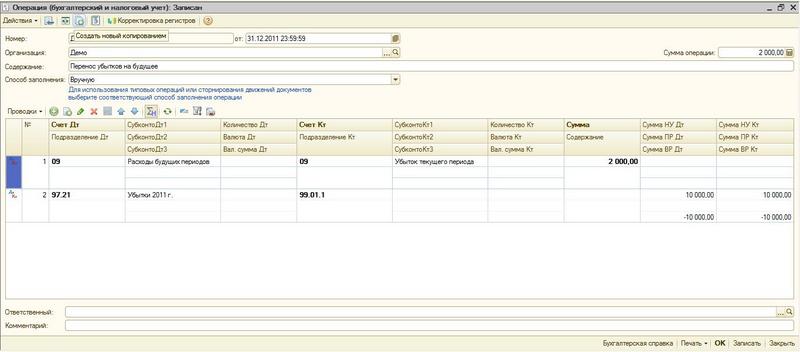

2) As of 31.12.2011 BEFORE THE REGULATION OPERATION "BALANCE REFORMATION" by entering a document "Operation (accounting and tax accounting)"(Menu → Operations → Operations entered manually) we record the following postings (Fig. 2.):

Rice. 2. A sample of filling out the document "Operation (accounting and tax accounting)"

As a subconto to account 97.21, we select the previously created element of deferred expenses “Losses in 2011”. DIVISION UNDER 97.21 ACCOUNT IS NOT COMPLETED.

3) We carry out the routine operation " Balance Reformation".

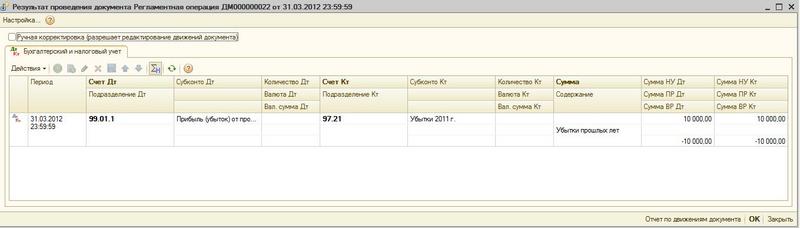

In case of receiving in the 1st quarter of 2012 a profit of 10,000 rubles. the loss of previous years will be automatically written off by a scheduled operation "Write-off of losses of previous years", which in turn will be reflected by the wiring DT 99.01.1 - CT 97.21(Fig. 3).

Rice. 3. The result of the procedural operation "Write-off of losses of previous years"

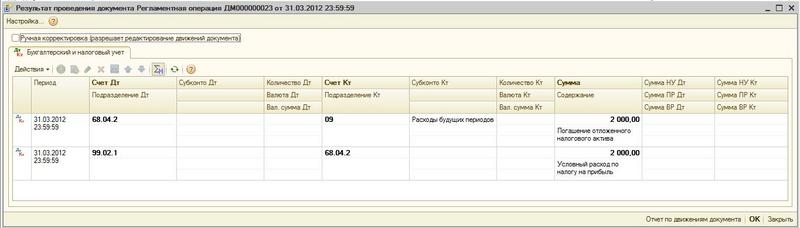

In the absence of a loss in 2011, the income tax payable would have been 2,000 rubles. This is reflected in the wiring. DT 99.02.1 - CT 68.04.2(Fig. 4). But given the 2011 loss, the current income tax would be zero.

Rice. 4. Posting of the scheduled operation "Calculation of income tax"

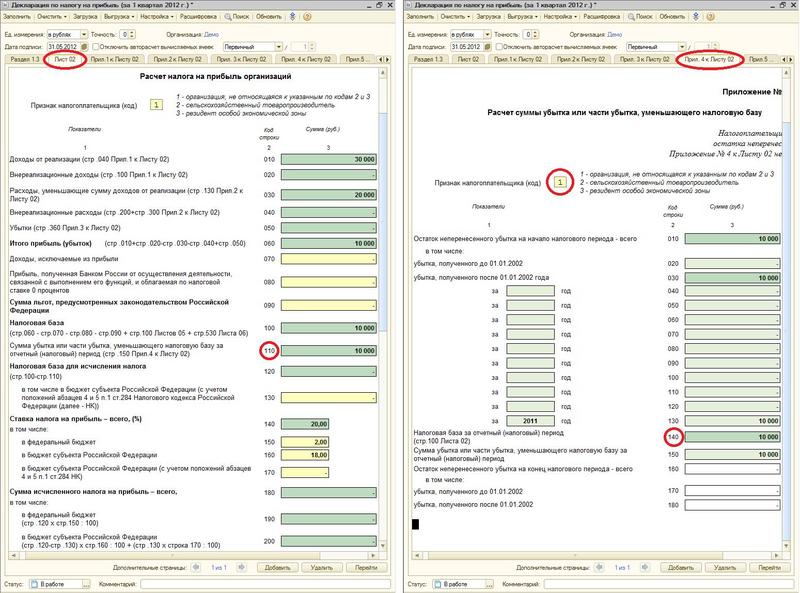

When generating an income tax return, Appendix 4 to Sheet 02 will automatically fill in pages 130 and 150. For auto-completion of page 110 of Sheet 02 and page 140 of Appendix 4 to Sheet 02, you must fill out the sign (code) of the taxpayer in Appendix 4 to Sheet 02. (Fig. 5)

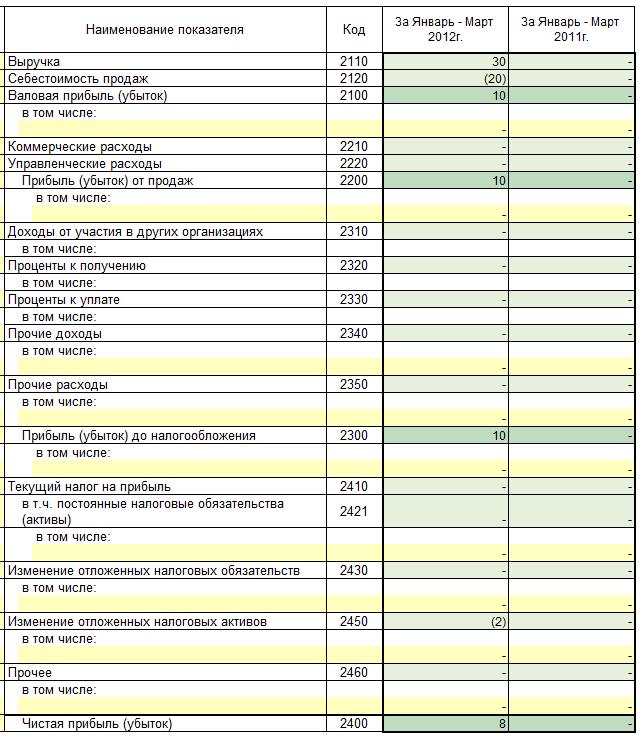

In the Profit and Loss Statement, profit before tax in the 1st quarter of 2012 will be indicated in the amount of 10,000, the change in deferred tax assets minus 2,000. Thus, net profit will be equal to 8,000 rubles. (Fig. 6).

Rice. 6. Profit and loss statement for the 1st quarter of 2012

In this article, we have considered the simplest example. In practice, there are often cases when losses of several tax periods are carried forward into the future. In addition, these losses may not be carried forward in full, but in part.

In a typical program "1C: Accounting 8.2" to understand the situation, taking into account the losses of previous years, it is necessary to generate three reports: turnover balance sheets for accounts 99.01 and 97.21 and an analysis of account 68.04.2, which is not very convenient.

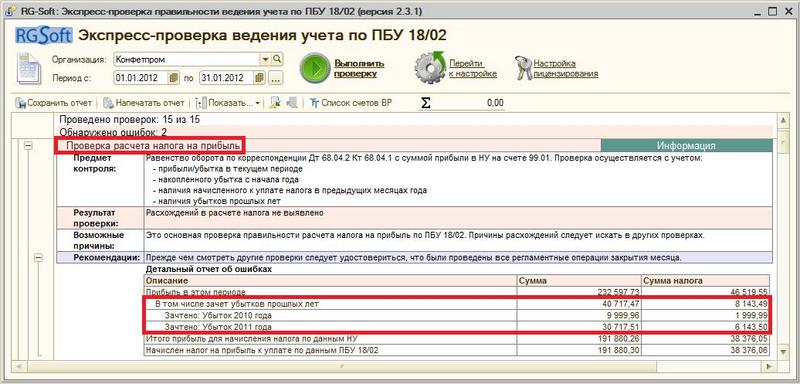

By means of a software product developed by RG-Soft specialists « RG-Soft:Express check of accounting according to RAS 18/02" information on accounting for losses of previous years can be obtained "in one click". This information is displayed in one table in the context of losses in different years (Fig. 7).

Rice. 7. An example of displaying information on accounting for losses of previous years in the software product "RG-Soft: Express check of accounting according to RAS 18/02"

Transfer of losses to the future in 1C: Accounting 8

Sample certificate of no debt

Issuance of money for a business trip in cash and on a card

payroll taxes

Preferential pension: who is entitled, how to get