In the coming 2017, the scheme for registration and, of course, sick leave payment will remain without any significant changes.

The temporary disability benefit is calculated and then paid by the accountant, taking into account the following subtleties ...

Payment of sick leave in 2017 - general provisions

To date, the regulatory framework regulates the following grounds for issuing a sick leave to an employee:

- The onset of pregnancy.

- Quarantine.

- Necessary treatment in a sanatorium.

- Installation of a prosthesis.

- The presence of injuries / diseases that led to temporary disability.

In 2017, the sick leave is still issued in accordance with the established procedure:

- Inspection by a specialist (required!). On it, the doctor must confirm the basis for issuing a sick / sheet.

- Issuance of a medical certificate by a doctor, opened from the date of contacting a specialist.

What is the duration of sick leave?

It all depends on the specific parameters. The maximum period for which sick leave can be issued, as you know, is equal to 30 days.

- After 1st visit the sick doctor issues sick leave for a shorter period - a maximum of 10 days.

- Further, the period of validity can be extended, according to the results of the follow-up visit.

Also worth noting that the sick leave can be extended by a special commission for a longer period - up to 12 months (in case of severe consequences of an injury or illness).

The maximum periods for sick leave, determined by the current regulations:

- In case of disability- 5 months.

- In case of pregnancy- 140 days.

- When caring for a sick child– 30-60 days.

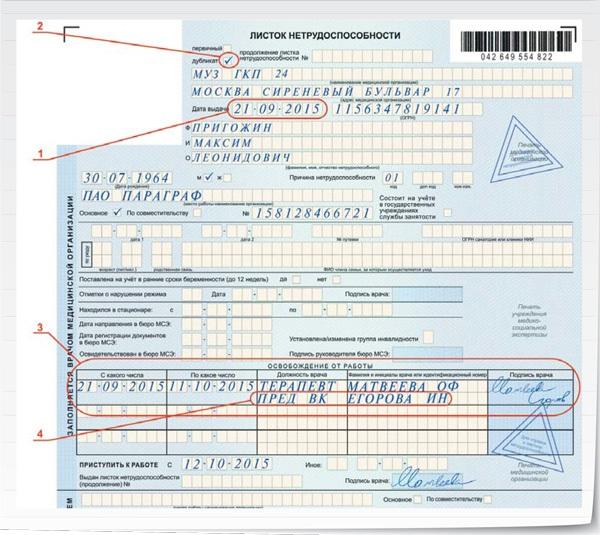

Features of registration of sick leave in 2017

In the coming year, the sheet will be paid from the following sources:

- For the first 3 days- funded by the employer.

- Starting from day 4- from the FSS.

In the case of a sick leave on the basis of caring for a baby financing is carried out exclusively from the FSS.

An employee will not be able to issue a sick leave if ...

- The hospital regime established by the rules was violated.

- The sick leave was issued by the employee after the illness ended.

- The employee was removed from his duties.

- The employee performed actions contrary to the relevant permissions.

- The employee was injured while committing illegal acts.

- The work of the employee proceeds within the framework of the concluded contract.

Sick leave in 2017 - the nuances of calculations and payments to an employee

The algorithm for calculating sick leave next year will be as follows:

- Fixing the total salary of an employee received by him within the last 2 years.

- Calculation of average daily earnings (note - the total income is divided by 730 days or by 731 if the year is a leap year).

- The result is multiplied by the number of working days , that the employee spent on sick leave.

The application of the seniority coefficient is carried out according to the following scheme:

- No more than 1 minimum wage(note - for each month of sick leave) - if the experience does not exceed 6 months.

- K-0.6- if the experience is 3-5 years.

- K-0.8- if the experience is 6-8 years.

- K-1.0– if the experience exceeds 8 years.

It is worth noting that maximum payout amount employee during the year is 270450 p. Payment cannot exceed this amount.

How to calculate sick leave - calculation example

- For 2 years - 2015 and 2016 - Petrova earned 860,000 rubles.

- Petrova's work experience is 9 years.

- The term for which Petrova's sick leave was issued was 10 days.

Calculation formula:

2015 has 365 days, 2016 has 366 days (leap year).

Hence…

860000: 731 days x 10 x 1 = 11,764.71 rubles.

This will be the amount of the payment that Petrova is obliged to issue immediately after her return from sick leave, along with her salary.

Important: From the amount of payment, according to the law, personal income tax will be withheld.

And a few more important points that you need to know about when calculating sick leave in 2017:

- In case of injury directly at work or if the employee suffered an occupational disease, the amount of the sick leave payment will be equal to 270,000 rubles.

- Illness while on vacation Also a reason to see a doctor. In this case, the sick leave for the employee will be opened from the 1st day of going to work. Or it can be postponed to another day, according to an agreement with the employer.

- When working collaboratively (note - when working in several organizations at once) employee has the right to apply for sick leave in all companies in which he works.

- If less than 30 days have passed between the termination of the contract and the illness of the employee , sick leave is issued with a coefficient of K-0.6 of the average earnings.

Site site thanks you for your attention to the article! We would love it if you share your feedback and tips in the comments below.

Transfer of losses to the future in 1C: Accounting 8

Sample certificate of no debt

Issuance of money for a business trip in cash and on a card

payroll taxes

Preferential pension: who is entitled, how to get