Going on paid leave is the privilege of an official employee. Every six months he gets the opportunity to leave work for a period of fourteen days and rest. If vacation days are not exhausted in the half year, they are transferred to the subsequent rest from work. It is also possible to use together, if this possibility is previously agreed with the authorities. It happens that an employee cannot go on vacation for a long time, respectively, does not receive the due vacation funds. In such a situation, a moment arises when the employing organization becomes obliged to pay compensation to the employee for vacation days not used by him. But is the company obliged to pay personal income tax on compensation for unused vacation?

To provide compensation to an employee who has invested the available professional knowledge in improving the welfare of the company and its development, sooner or later every company becomes obliged.

This obligation arises in two cases:

- if the accumulated period of vacation not taken off by the employee exceeded 28 days in quantity and the employee does not intend to use it;

- if the employee has decided to dismiss or has been fired.

In the first case, only those employees who have been granted extended, basic leave or have been given an additional period can exchange weekends for money.

Compensation for leave without dismissal

An organization can pay compensation for a vacation exceeding 28 days accumulated by an employee only by decision of the management team. Only in special situations can an employee take advantage of this opportunity, since by law he is obliged to take the granted holidays, otherwise the employer's organization will be under the threat of punishment.

The availability of additional leave is another mandatory condition. Without it, under no circumstances issuance of monetary compensation can not be carried out. The provision of such an allowance for rest days is made to individual employees whose day is not standardized, and they work more than they are supposed to, according to the law and the capabilities of the human body. Usually, the additional leave is about five days.

The employer company does not always have the right to indulge the employee's request and replace the vacation with a cash payment. There are certain categories of citizens, the list of which is indicated in the Labor Code of the country, who must necessarily rest for the prescribed time period.

Table 1. Who cannot replace vacation with monetary compensation?

| Category of citizens | |

|---|---|

| future mothers |

| Persons under the age of majority |

| Employees of enterprises operating in harmful or even hazardous conditions for health |

| Workers who were exposed to radiation in the Chernobyl disaster |

Keep in mind, for those people who spend their working days in conditions hazardous to health, the replacement of vacation with money is meant only for days exceeding the minimum of a week. That is, if an employee received 10 vacation days, 7 of them remain intact, while the other 3 are compensated.

As for the payments on the income tax of an individual, they also apply to compensation for vacations that are not taken off, which the hard worker-employee receives. According to the Tax Code of the country, a whole list of non-calculable incomes of officially working citizens is defined, but such compensation is not listed within it.

In addition, when paying the amount of income tax, a working employee is also obliged to lose a part of the vacation pay that goes to insurance premiums, the amount of which is determined by the tax legislation of the country at the federal level.

Compensation for vacation upon dismissal is paid to employees for all vacations used by them, regardless of the reason for terminating the contract. That is, when calculating compensation, it is necessary to take into account not only unused basic, but also additional vacations.

Vacation compensation upon dismissal personal income tax

Compensation for the vacation of an employee who applied for dismissal or was reduced as a result of the decision of the head is possible only if he had an unused part of it. For example, having the required 28 days, the employee used only a week. The remaining 21 days are compensated upon dismissal by the issuance of cash.

Often employees are afraid that they will not receive vacation funds from the employer and go to the trick. They write an application for vacation, and then for dismissal and take off the time they are supposed to work without working off, also receiving vacation pay.

You should not be afraid if you are officially employed, because in the end, in any case, you will receive the amount of vacation pay due to you. Those who receive wages in an envelope cannot even qualify for a full vacation period, as they depend on the mood of the employer and other factors.

The amount of compensation paid to a departing employee for a vacation that was not used by him is taken into account by the organization's accounting department as company expenses. This is especially important for firms operating on a specialized simplified taxation system and paying tax on net profit.

As for the taxation of the holiday pay compensation received by the employee with the tax on the income of an individual, it is carried out in full, in accordance with the law, while the amount of deductions also includes insurance fees.

Video - Compensation for unused annual leave

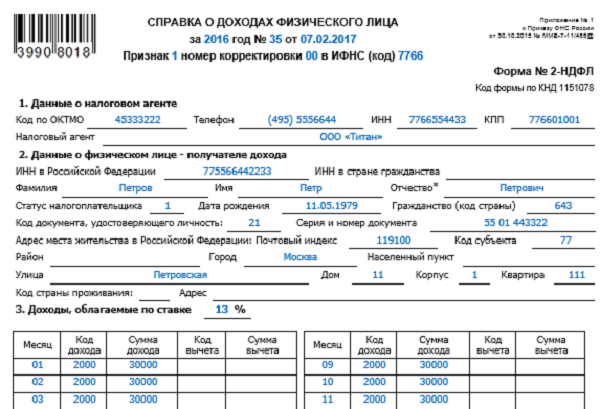

Reflection of compensation for unused vacation in the 2-NDFL certificate

Regardless of which taxation system was chosen by the organization in which you are an employee, initially, the employer will be required to calculate personal income tax from your compensation for vacation, as we said above.

This means that the ongoing payment of funds and the calculation of a certain amount from it in favor of the state treasury will need to be declared in the 2-NDFL certificate.

- submitted by the employer to the tax office;

- contains information on all payments to the employee;

- taxes calculated from payments for the employee;

- provided to the person for whom the certificate is being submitted, tax deductions.

The correct execution of this document is a guarantee of trouble-free interaction with the Federal Tax Service, to which you provide the reports being prepared, therefore, you need to correctly perform some points that cause some doubts among inexperienced accountants. Let's take a look at them in the list below.

1. Since this amount of money is not a payment for those labor duties that were assigned to you in accordance with the employment contract concluded with the organization, its official payment should not take place on the last day of the current monthly period, and not on the date determined by the day of dismissal. The day that will have to be reflected in 2-personal income tax corresponds to the actual payment. In other words, the number on which the employee will be paid the money must be indicated in the certificate.

Pay attention to a very important point: the tax on the income of an individual must be transferred to the state treasury no later than the specified day of payment of funds. Keep this in mind when determining a specific date.

2. If compensation is made for unused vacation associated with dismissal, it is necessary not to forget to calculate insurance premiums for the following categories:

- pension;

- social;

- medical;

- from accidents;

- from occupational diseases.

The accrual of contributions is also reflected in the 2-NDFL certificate, and is carried out in the usual manner, with which you, by the nature of your activity, are familiar.

3. When an employee is dismissed and he receives compensation for non-vacation leave, it is necessary to indicate the corresponding income code in the 2-NDFL certificate. Income code - a sequence of numbers characterizing a particular cash payment. There are a huge number of them, each for a specific occasion. At the same time, to reflect vacation compensation in the 2-NDFL certificate, it is necessary to use the presented sequence: 4800 . This designation categorizes the payment as “other income”.

As you can see, there were not so many rules in practice. Of course, in order to correctly fill out the certificate we are interested in, it is also necessary to enter into it information about the wages paid to the employee, from which tax fees are also calculated. In addition, for registration of 2-personal income tax it is necessary:

- have an education in the field of accounting;

- be able to draw up a certificate 2-NDFL;

- have the skills to calculate tax collections;

- know tax laws, etc.

If you work in your specialty, no questions should arise with the requirements presented, and you can easily reflect compensation for unused vacation in 2-personal income tax.

Summing up

Compensation for unused vacation is due to employees who have worked for a long time without rest or are leaving their current job, while many other circumstances are important that make receiving this compensation possible. In both cases, the employer organization will be responsible for deducting the tax on the income of an individual, so employees have nothing to worry about. Companies, on the other hand, must have accountants with a decent level of knowledge in their staff so that they carry out the transfer operation correctly, making accounting entries in the right sequences.

Transfer of losses to the future in 1C: Accounting 8

Sample certificate of no debt

Issuance of money for a business trip in cash and on a card

payroll taxes

Preferential pension: who is entitled, how to get