ATTENTION: a similar article on 1C ZUP 2.5 -

Hello dear visitors. Today we continue to analyze the accounting features in ZUP 8.3 and in the next publication from a series of articles with step by step description work in ZUP 3.1 (3.0) for beginners(the whole series of articles is available) we will talk about the basics of calculating salaries in the program and preparing data for this calculation. Let's look at specific examples of how the document “ Payroll and Contributions ” the salary will be automatically calculated taking into account the established planned accruals, work schedules, deductions and absences of employees. We also analyze the features of calculating hours worked and calculating salaries based on formulas specified in the types of calculations.

✅

✅

From 01.10.2016 we will hire an employee - S. Sidorov. In the document Recruitment the employee must specify the schedule of work according to which he will work, and assign planned accruals. They will be automatically charged monthly (or at different intervals) when calculating salaries in the document “Payroll and Contributions”. In PMZ 2.5, planned accruals were accrued exclusively monthly, and in the PMZ program version 3, it became possible to assign planned accruals that will be paid, for example, once a year or once a quarter. This frequency is determined in the settings of a specific charge. In more detail about the differences between ZUP 2.5 and ZUP 3.1 (3.0) I wrote in a series of articles:

So, in our example, on the “Main” tab, set the employee work schedule - Five days. It is on the basis of the schedule when calculating the salary that the rate of time will be determined and the time worked out by crowding out. The standard time in October according to the Pyatidnevka schedule is 21 days / 168 hours.

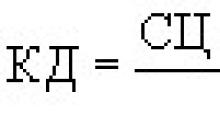

On the tab "Pay" assign the employee the planned accrual - Hourly rate billing, and set the hourly rate indicator - 300 rubles. In the settings for this type of accrual ( Payment at the hourly rate)indicated that this accrual is performed Monthlyand the calculation will be made according to the following formula: Tariff Rates Hour * Time Hours. We have already indicated the hourly tariff rate for the employee, and the time in hours is actually the number of hours worked by the employee per month. Their program will be determined automatically by the method of extrusion in the document at the final calculation, i.e. hours of his absence (sick leave, business trip, vacation, etc.) are excluded from the norm of time according to the employee’s schedule.

In order for the type of accrual to be available in the program Hourly rate billing it is necessary in the section Settings - Salary Calculation - link Setting the composition of charges and deductions to check the box Apply hourly pay. In more detail about all the settings in this section I talked about in the article.

At the same time, 10.10.2016, two more employees are hired by our organization. Register their admission in one document Hiring a List(Section Personnel - Journal of Documents Receptions, Transfers, Layoffs). Now we will consider each employee individually, what settings we set for them when hiring.

Employee Ivanov A.M. appointed as in the previous example a work schedule - Five daysbut the planned accrual - Salary paymentin the amount of 30,000 rubles per month.

In the settings of the type of accrual “Payment by salary” it is established that this view accruals performed Monthly and will be calculated by the formula. We indicated the salary, this is an amount of 30,000 rubles, the share of part-time work (the number of bets an employee arranges) is 1, because Our employee is accepted full time. Time in days is actually the number of days worked per month (it is also determined automatically by the program by the method of crowding out, as in the previous example, only in days), the rate of days is determined from the employee’s work schedule.

The second employee - N. Petrov set a work schedule Five days, type of planned accrual - Salary payment (per hour).

Let's open the accrual type settings Salary payment (per hour) - this accrual will be performed Monthly and calculated by the formula Salary * Time in Hours / Rate of Hours.The difference between this type of accrual from the previous one, only that the proportion is calculated not in days, but in hours.

We will analyze a more detailed calculation in the program using the formulas for each employee a bit later using a specific example when filling out a document Payroll and Contributions per month, but for now, we’ll continue to make necessary information for payroll.

What documents in ZUP 3.1 (3.0) introduce planned accruals for employees?

✅

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-checking of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

By the condition of the example, employee Sidorov S.A. from 10.17.2016 another type of planned accrual is assigned - Bonus percentage from his salary. What document in the program ZUP3.1 (3.0) reflect this fact? There are several options, we will analyze each of them and decide which is better to apply in our case. All these documents in the program are available in the section. The salary -document journal Change employee pay.

- Document HR translation.

So, open the magazine Change employee pay and create a document HR translation.We will select an employee from the proposed list and indicate the date of October 17, 2016, from which a new charge is assigned. On the tab “Remuneration”, check the box Change accruals, click the "Add" button and enter the new kind accruals in this example this is Bonus percentage(10 %).

This document also provides for other possibilities, such as transferring an employee to another unit or position / staff unit, transferring to another work schedule, changing the right to leave, changing the way the advance payment is calculated. That is, it provides a sufficiently large functionality and it is not advisable to use it only to enter a new type of planned charge. You can use this document if we need the printed form Translation Order (T-5). In our example, the document HR translation will not be used.

- Document Pay change.

Consider another option. Choose from the magazine Change employee paydocument Change in pay. In the same way, we indicate the date of change 10/17/2016, select our employee from the proposed list, then select the check box Change accruals and clicking on the “Add” button, we will introduce a new charge Bonus percentage. Accrual Hourly rate billingassigned by the document Employment is loaded here automatically after selecting an employee. Using the “Cancel” button, you can cancel any of the assigned charges. (specifically in our example this is not required). Document Feature Pay change is that it is intended to add or cancel planned charges only for one employee.

- Document Change in planned accruals.

In the program ZUP 3.1 (3.0) a document is also available Change in planned accruals to enter or cancel random setplanned accruals for arbitrary amount employees.

- The document.

This document is for input only one planned accrual but for arbitrary number of employees. In the field “Accrual" indicate the type of accrual, which must be assigned, Bonus percentage, Date of appointment - 10/17/2016, then click on the "Selection" button and select Sidorova S.A. Document Feature Purpose of planned accrualis that we can assign an Accounting Account (a way of reflecting salaries in accounting) for a given accrual (Premium percentage) for a given employee. In our example, we will not use this feature.

So, we examined several documents in the program with the help of which an employee can add a new type of planned accrual. In our example, the most logical way to use the document Pay change,because we have only one employee, one new planned charge and other working conditions, we do not change this employee (work schedule, position, unit, etc.).

Draw a document Change in pay.

Assignment of Planned Holds

✅ Workshop "Lifehacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s zup 3.1:

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-checking of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

Now consider what documents in 1C ZUP 3.1 (3.0)employees are assigned planned deductions. From the section "Salary" - in the journal Alimony and other deductions create a document Performance list. Retention on the writ of execution, we will appoint Petrova N.S. from 10.10.2016, choosing it from the proposed list of employees. We indicate that the calculation will be made as a percentage (15%) of the employee’s earnings, “Recipient” - MS Petrova In the settings of this document, you can also specify the method of calculating a fixed amount or share of earnings, indicate whether sick leave is taken into account for calculating the base, and through which payment agent to transfer child support.

Document Performance listdoes not accrue anything, but only registers the conditions for calculating deduction. The calculation of the assigned deduction will be made monthly when calculating the salary in the document Payroll and Contributions(on the tab “Holds”), and a little later we will analyze it with you.

For operational work, our organization uses cellular communications, but it has a certain spending limit. For employees who exceed this limit, a certain amount must be deducted from the salary. In order for us to register this deduction in the program, open the “Settings” section and create a new deduction type in the deductions journal: Retention for cellular communication (over the limit). In the settings we’ll indicate “Retention Assignment” - Deduction of other transactions, “Retention in progress” - Monthly, “Type of salary operation” - Withholding on other operations with employeesretention rate - The result is entered in a fixed amount..

It is worth noting that the view that we assigned in the previous example is installed by default in the program, so we did not have to create it .

After we record (the button “Record and close”) a new type of deduction, in the journal Alimony and other permanent deductionsthere will be an opportunity to create a document. So, we will create a document, we will choose an employee, for example, A. Ivanov, from whom from 10.10.2016 to 10.31.2016 it is necessary to withhold 200 rubles for using cellular communication in excess of the established norm. Document Other operations retentioncalculates nothing, but only registers the fact of this deduction. Withholding itself will be done in the document Payroll and Contributions upon accrual salary for October.

In our examples, we indicated to employees such types of retention as Executive Holdand Hold on other operations.In the program 1C ZUP 3.1 (3.0) it is possible to also assign:

- Loan repayment deductions,

- Withholding union dues,

- Voluntary Retention pension contributions to a state and non-state pension fund,

- Deductions in favor of third parties.

Now we will not consider all these documents, I think this is the topic of a separate article (stay tuned for publications, we will try to consider this issue)

Registration of inter-settlement documents in ZUP 3.1 (3.0)

By the condition of the example, employee Ivanov A.M. got sick. An employee provided us with a sick leave on 10/28/2016. We will fill out an inter-settlement document Sick leave (section “Personnel” or “Salary” - the sick-leave journal), we indicate the accrual month October 2016, the reason for the disability is (01,02,10,11) Disease or injury (except for injuries at work) and the period of exemption from work from 20.10. on 10/27.

To determine the percentage of payment, it is also necessary to enter the employee's seniority. In detail about how and in what documents, to enter these data, I talked about

The sick leave document is a personnel-settlement document, it immediately calculates personal income tax and the amount payable at the expense of the employer and the Social Insurance Fund. Draw a document.

Fill out one more document - (Salary section). Employee Petrov N.S. worked on October 15 for 4 hours. On schedule Five daysto the appointed employee when applying for a job is a day off, i.e. employee, worked in excess of the monthly norm. Document Work on weekends and holidays the fact of work on the day off is recorded, and the calculation for days / hours worked on the day off will be done in the document Payroll and Contributionsfor October.

The final payroll calculation in the document “Payroll and Contributions”

So, we have entered all the necessary data for calculating the salary. Open the document Payroll and Contributions(Salary section), indicate the month of accrual October, click the "Fill" button. The program will automatically add all employees hired who have time worked. Now let's see how the program 1C ZUP 3.1 (3.0) accruals, deductions, contributions and personal income tax are calculated taking into account the personnel records and inter-settlement documents entered by us.

We analyze the accrued wages of each employee individually. In order for us to see the calculation in detail, press the button “Show calculation details”.

- Sidorov S.A. was accepted into the organization 01.10.2016, he was assigned the planned charge Hourly rate billing, hourly tariff rate - 300 rubles. The employee had no absences for a month, i.e. he worked out 168 hours in full (in October, the time norm according to the Pyatidnevka schedule was 21 days / 168 hours). As a result, payment at the hourly rate in October amounted to 50,400 rubles (300 * 168 - according to the formula Tariff Rates Hour * Time Hours). Bonus percentageappointed to the employee not from the beginning of the month, but from 10/17/2016, i.e. not the entire amount of 50,400 rubles is taken into the calculation base, but only for the 88 hours worked in the period from 17.10 to 31.10. Calculation - 88 * 300 \u003d 26400 rubles. We set the percentage of the premium - 10%, which means 26400 * 10/100 \u003d 2640 rubles. The calculation is correct.

- Ivanov A.M. hired on 10.10.2016, he was assigned a five-day work schedule and planned accrual Salary paymentin the amount of 30,000 rubles . In October, he worked only 10 days, because was on sick leave from 10.10 to 10.27. The calculation was made according to the formula Salary * Proportion of Part-time Work * Time in Days / Rate Days - 30,000 * 1 * 10/21 \u003d 14,285.71 rubles. Also, this employee was assigned a deduction for cellular communication (over the limit), on the tab “Holds” we see the amount of 200 rubles, which was indicated in the document Hold on other operations.

In order to make sure how much the employee actually worked, we will generate a report Report card. In the section Personnel - Salary Reports - open Timesheet (T-13), we indicate the necessary period from 01.10 to 31.10, we will choose Ivanov A.M. and click the "Generate" button. Indeed, we see in the report card the time of the disease - 8 days and the time of Appearance - 10 days. It is for these 10 days that the calculation was completed.

- Petrov N.S. scheduled accrual Salary payment (per hour) in the amount of 30,000 rubles. The employee worked in October only 128 hours on a five-day schedule, as hired from 10.10. The calculation is made according to the formula Salary * Time in Hours / Clock Rate -30000 * 128/168 \u003d 22857.14 rubles.

Also Petrov N.S. worked 4 hours on his day off, which are paid in double size. In order to pay for these hours, the program automatically determines the cost of the hour. In this example, the cost of an hour is calculated as follows: 30,000 (Salary) / 168 (standard time on the employee’s schedule) \u003d 178.57143 rubles.

Accordingly, the payment for work on a day off is 178.57143 (cost of an hour) * 4 (hours of work) * 2 (payment in double size) \u003d 1428.57 rubles.

It is worth noting that the method of recalculating the employee’s tariff rate in the cost of an hour (day) is determined by the program settings in the Settings - Payroll section. Besides “Norms of time according to the schedule of the employee” can also be used "The average monthly number of hours (days) in a month"or "The rate of time on the production calendar".

Also on the tab “Holds” the program for this employee calculated Writ retention. The calculation base was determined as follows - 22857.14 (salary payment (per hour)) + 1428.57 (work payment on holidays and weekends) - 3157.1423 (personal income tax) \u003d 21128.71 rubles. The deduction from wages is calculated from the amount remaining after deduction of taxes ( the federal law dated 02.10.2007 No. 229-ФЗ “On Enforcement Proceedings”). In our example, the calculation method in the document Performance list we indicated the percentage (15%) of earnings. So, 21128.71 * 15/100 \u003d 3169.31 rubles. The calculation is correct.

In the document Payroll and Contributionson the tab "personal income tax" immediately calculated tax on personal income. For employee Ivanov A.M. part of personal income tax was calculated, as we recall in the document Sick leave. Also in the program ZUP 3.1 (3.0), contributions are immediately considered, which we can see on the Contributions tab, which is distinctive feature from the program ZUP 2.5, there it was necessary to introduce a separate document for the calculation of contributions. I spoke in detail about the differences between the ZUP 3.1 (3.0) program and the ZUP 2.5 in.

Thus the document Payroll and Contributions is the result, it collects all personnel changes, changes in planned accruals / deductions and planned indicators, all deviations from work schedules, absenteeism, all inter-calculation accruals and takes them into account in the final calculation. Therefore, this document must be entered last in the chain of settlement documents in 1C ZUP 3.1 (3.0).

The correct maintenance of personnel data in the 1C: ZUP program is very important. Otherwise, you will encounter frequent errors in documents and reports, for example when. Many reports from this program are submitted to regulatory authorities and errors are inappropriate here.

In this step-by-step instruction, we will consider in detail the process of hiring an employee in 1C 8.3 ZUP revision 3.1.

In this example, we use the demo version of the program and perform all the steps under account Head of Human Resources. Depending on the rights available to the user, this functionality may have a different location or may not be available at all.

We’ll go to the home page and click on the “New Employee” hyperlink.

In the directory card that opens, select an organization.

Remember that in the program there is an algorithm for breaking this field into separate details: last name, first name and middle name. He separates them from each other by spaces. In the case of a double surname, it must be indicated with a dash without spaces.

There are three hyperlinks to the right of the full name field:

Personal data, information about education, family, work, insurance are filled in by appropriate hyperlinks at the top of the form. If necessary, you can also attach a file to the employee’s card, for example, with his photo or scan copies of documents.

When you have entered all the necessary data, click “Record and Close”.

Reference book “Individuals”

After creating an employee in the program 1C 8.3 ZUP, a new individual was automatically created. This guide is located in the "Personnel" section.

An individual and an employee are two different things. An individual may not be an employee.

For one element of the directory of individuals, several employees may exist. This is because the person can work in the company not only at the main place of work. He may have several contracts, for example, the main, part-time and GPC.

This mechanism is implemented so that, in accordance with the legislation of the personal income tax, the total for all places of work for one individual is considered. The remaining calculations are carried out separately.

For example, an employee works in our organization and this is his main place of work. Also periodically transferred to him cash under the GPC agreement. Personal income tax should be accrued total (summarized under both agreements). Charges will be made separately. The program will have one individual and two employees.

In this regard, it is very important to control the absence of duplicates in the directory of individuals. Otherwise, undesirable consequences with incorrect calculations and with tax authorities. In addition, tax deductions are tied specifically to an individual.

In order to avoid these situations when filling in data (for example, TIN) in the employee’s card, if the program finds an individual with the same data, she will issue a corresponding message.

If duplicates of individuals appear, contact the program administrator so that he will combine the cards with personal data with special processing.

Document “Employment”

We brought in a new employee in the program. Now we proceed directly to the hiring of an employee. You can do this in 1C ZUP 8.3 on the home page, in the employee’s card, or through the “Personnel” menu.

In our example, we will accept an employee from the start page, as those who are not hired are clearly displayed there, which is quite convenient.

To do this, select the created employee in the corresponding table and right-click. In the context menu, select the “Apply for a job” item.

In the document that opens, some fields are filled in automatically. Correct them if necessary, as well as indicate the unit and position.

If you fill out, then wages will be substituted from it. Let's go to the corresponding tab. That's right, the accrual was filled from the position of the staff list. These data can be adjusted.

If you do not maintain a staffing table, the “Payment” tab must be filled in manually.

Hello dear blog readers. In this article I will answer the question what is 1C ZUP 8.2 and what tasks this software product can solve. I will briefly collect all the information that was presented in a series of publications devoted to the review core opportunities software product “1C: Salary and HR Management”. Let me remind you that this series includes seven articles:

What is 1C ZUP

✅

✅

✅

1C ZUP - 1C: Salary and Personnel Management ( HRM - Human Resources Management) - a software product of 1C, designed to automate the accounting of personnel data, payroll and the formation of regulated and other reporting. The program takes into account the requirements of the law, and the configuration is regularly updated when the legislation changes.

The most popular edition of the program to date 1C ZUP 8.2 edition 2.5. She is the successor of the software product. 1C Salary And Personnel 7.7, which is still used in many organizations and even large factories. Final release released recently new edition 1C ZUP edition 3.0.

The program 1C ZUP has three delivery options:

- 1C: Salary and HR 8. The basic version (only 2 550 rub.) - in one database only one organization can be maintained; only one user can work with the database at a time; it is impossible to modify the functionality, since the configuration is closed;

- 1C: Salary and HR Management 8 PROF - allows you to maintain multiple organizations in one information base; several users can work simultaneously with the database; the configuration is open for editing, so you can refine the functionality;

- 1C: Salary and HR Management 8 CORP.

Personnel accounting

✅ Workshop "Lifehacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s zup 3.1:

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-checking of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

The software product 1C ZUP offers a full range of objects for maintaining personnel records: documents “ Employment ”,“ Personnel transfer ”,“ Dismissal ”,“ Vacation ”,“ Business trips ”,“ Absenteeism and illness ”. The program also offers services that allow you to track the rest of the holidaysto lead staffing tablekeeping a history of his changes. The program allows you to print "Employment contract", reports on staffing, on staff movements, cards T-2, T-3, T-4 and other (Read more about reports in the article:). The program also allows you to conduct military registration and print out the regulated forms of military registration (form No. 11, 18, 6).

Payroll

For payroll, a wide functionality is provided. The main documents for calculation, “Absenteeism”, “Payment according to average earnings”, “Registration of one-time charges / deductions”, “Payment of holidays and weekends”, “Payment of overtime hours”, “Registration of downtime”, “Calculation of dismissal”, “Vacation” child care ”,“ Employee bonuses ”,“ Payroll ”.

“Settlement sheets”, “Settlement sheet”, “Set of accrued salaries”, “Time sheet”, “Debt structure” and others. Read more about reports.

The payroll registration documents also include the payroll registration documents: “Salary payable”, “ Payment order"," Consumable cash warrant"," Deposit "," Payment of depositors. " Read the main article about paying salaries.

Taxes and Contributions

✅ Workshop "Lifehacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s zup 3.1:

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-checking of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

Accounting

Formed postings can be uploaded to accounting program using a special service or print using the report “Reflection of wages in regulated accounting”.

FIU

This section of the program contains everything related to preparation individual information for pension fund. The main thing here is the workplace. "Preparation of data for transmission to the FIU."In March 2014, the 1C: Salary and Personnel Management software update was released, in which the workplace has undergone significant changes. You can read about these innovations in the article.

That's all for today! I am glad that you are reading my blog. Soon there will be new interesting materials.

To be the first to know about new publications, subscribe to my blog updates:

Instructions for maintaining personnel records in the program 1C 8.3 Accounting 3.0

The main operations are:

- recruitment

- payroll calculation and calculation

- payroll payroll

A clean configuration was taken to take all the steps, from hiring an employee to paying salaries.

Also consider what settings will need to be made and for what. We will begin our review with them.

Configuring the 1C subsystem - Salary and personnel

The main salary settings in 1C Accounting are made in the "Main" menu, then the link "Accounting Parameters".

Select the tab “Salary and personnel”:

- We indicate that we will keep records in this program. The availability of some settings, documents, and the appearance of the interface depend on this choice. The choice “in the external program” implies keeping records of salaries not in 1C Accounting 8.3, but in 1C ZUP 8.3 or 8.2.

- We will keep records for each employee. With this setting, the 70th account will have a sub-account “Payroll employees”.

- We’ll indicate with a flag that we will take into account sick leave, holidays and executive documents. This function is available only for organizations with no more than 60 employees. If there are more employees, the account should be kept in the 1C program: “Salary and personnel management”.

- Personnel records in 1C Accounting 8.3 will be full.

- We will leave the checkbox for automatic document recalculation by default for the time being; it does not affect the calculations, only on the usability. We will return to him later, when we will pay salaries.

More detailed salary accounting settings are in the menu “Salary and personnel” in the section “Directories and settings”:

We will leave these default settings, for our review this will be enough. And we won’t be able to consider the specifics of each organization’s accounting.

The only thing we will do in this section is to create the position “Administrator” in the directory “Positions”. We will need it when hiring an employee.

Payroll to an employee in 1C

Before accruing employee salary, you need to make sure that he is hired by the organization. If you have not yet accepted him, follow the instructions below - Employee hiring in 1C 8.3.

To create an accrual document, go to the link "All accruals" in the "Salary" section. In the document journal, click "Create" and select "Payroll" in the drop-down list.

We fill in the details of the caps:

- Organization

- Subdivision

- Month for which accruals are made

After that, click the "Fill" button.

In our tabular section, the Sazonov adopted last month should appear. The salary is calculated according to his salary, therefore his salary will appear in the “Result” column. If he did not work out a full month, the result can be adjusted.

Unfortunately, there is no timesheet for 1C: “Enterprise accounting”.

As you can see, in the tabular part of the document 1C 8.3 there are five tabs.

The tab “Employee” displays general information.

Tab "Charges". Here we can see the type of accrual to the employee, edit the days and hours that he worked. And of course, adjust the amount of charges.

If the employee has deductions, for example on minor child, they should also be reflected in this tab.

In this example, there are no deductions, only personal income tax is taken from the employee. Therefore, skip the tab “Holds” and leave everything as it is. Let's go to the personal income tax tab:

It can be seen that the standard 13% of personal income tax is retained.

Let's go to the tab "Contributions":

The figure shows what went where. And accordingly, the total amount of deductions.

The accrual is done, now click "Post and Close."

Salary payment in 1C 8.3 Accounting

The next step is salary payment.

We will assume that the salary is issued through the bank. We go to the menu 1C "Salary and personnel", then click on the link "Bank statement" to the list of statements. Click "Create." In the window for creating a new document that opens, fill out the details of the header:

- Indicate month

- Subdivision

- Organization, if there are several

To fill in the tabular part, click the "Fill" button:

It should turn out as shown in the figure.

We carry out the document, print out the statement and issue the salary.

Based on materials: programmist1s.ru

This Instruction can also be used for ZUP (if you do not pay attention to some little things related to the budget configuration). The first few pages are described here (I can’t insert the pictures in the text), so the rest can be seen in the Word file.

Instructions for working with the program

1C: Salary and Personnel of a budget institution

Initial settings

If you were transferring data from version 7.7, then the main directories have already been transferred to the program: departments, positions, employees, personal accounts, work schedules and personnel information. It remains only to check everything and, if necessary, edit it. Particular attention should be paid to the handbook. Postsbecause many reports, when compiling, rely on this reference book, including and the new ZP Education Report.

Here should be fig. 1

Reference " Divisions"does not require special comments. Designed for" conditional sorting "of employees. Important! If in 7-ke it was not important whether an employee was “attached” to any unit or not, then in 8-ke this “attachment” is MANDATORY !!!

Here should be fig. 2

P.S. Without special neednot you need to select the "Separate unit" checkboxes.

Reference " Staffing"you can not touch it and do it at your leisure.

Next step, we’re looking through the "Staff".

There should be rice

The figure shows that ALL employees filled in the column "Unit". In the "Advance" column, you can pre-specify the amount of the advance.

Important!!! If an employee, in addition to the main position, occupies one or more positions on internal part-time job, then in order to avoid confusion when entering the details for payroll and the correct formation statistical reportingIt is recommended that each position held be reflected separately !!!

Reference " Individuals ". In this directory, each individual (employee) should be entered ONLY ONCE !!! This directory is used to generate individual information in the FIU and 2NDFL certificates and other reports.

Here should be fig. 3

The "personal income tax" button can be used to enter and adjust standard tax deductions, and the button " Labor activity "used to enter the experience for calculating sick leave, surcharges for long service etc. The employee address is entered in the standard way using the address classifier.

Important! If, when calculating sick leave, the program did not correctly determine the employee's seniority and, accordingly, the percentage of payment, then it is necessary to adjust the seniority as described below.

Entry of length of service to employees (for sick leave and / or extra pay for length of service)

To do this, open the directory "Individuals", select the desired employee, open, click the " Labor activity "and clicking right mouse button on the tabular part “General experience” we add a new line in which we choose the type of experience and indicate the reference date

Important! To calculate the allowance for the length of service, you must also configure the directory "Length of service": in the main menu, select Payroll - Set up payroll - Scale of experience. Click the "Add" button and enter the first record.

P.S. Namely a line with the code 000000001 or with a name starting with the word Service, used in Billing to calculate the premium.

In short, wherever there are large gaps, there should be drawings!

If more than one Seniority Scale is used in your organization, then enter the required number of Seniority Scales and use your created Calculation Types to calculate the premium; use the capabilities of the sample configuration.

Enter Permanent Charge / Hold to employees.

These are the types of calculation such as Method. Literature, Professional contributions, etc., i.e. which are not included in the tariffing. We introduce the document "Entry of permanent accrual or deduction" and it is very desirable to set a logical end date

The next important step is to fill out / adjust employee work schedules. On the tab "Institution" or "Personnel Accounting", click on the "Schedules" and in the list that opens, just click on the selected Schedule.

If necessary, place the cursor on the desired day of the month and edit the number of working hours. When everything suits, click "OK" to save.

If the salary of employees is transferred to the Bank, it may be necessary to enter personal accounts of employees. To do this, on the tab "Payroll" select "Applications for opening personal accounts", using the "Add" button, enter a new document

Payroll(in version 8.2 )

The rules for payroll are no different from the standard ones, i.e. deviations are first introduced: sick leave, absenteeism, absenteeism, average payment, etc. Then the document “Payroll to employees” is introduced, it is calculated and posted. After the "approval" of the Code is calculated insurance premiums and other contributions to budget funds. The transfer of taxes and the payment of wages to employees. Well, now in more detail about everything and with specific examples.

The task: to accrue the salary for the organization for the month of May, therefore, in all documents created, you need to set the Month of accrual "May". In May, it is necessary for one employee to accrue study leave, one regular employee starting on May 27 and several employees go on vacation from June 1 (they need to accrue leave after accruing salaries for May). We introduce the document "Accrual of vacation":

To accrue study leave, uncheck the box with " Annual leave"and put on" Extra vacation". Choose the type of vacation, set the date and click the button" Calculate ". The tab" Calculation of average earnings "is the same as in version 7.7, and on the tab" Payment "you can see / edit the calculated amounts of vacation pay and personal income tax.

Also an interesting “Reflection in Accounting” button:

Important! The figures clearly show that in the document "Accrual of leave" the full accrual of vacation pay has been made, with this amount personal income tax has been withheld here and the distribution by IF is visible.

Using the "Print" button you can get the necessary printed forms.

Similarly, we charge the usual next vacation:

On the tab "Payment" you can see how the program has laid out the accrual of vacation pay and personal income tax by period.

How to calculate the average annual value of fixed assets?

Socio-economic and domestic political development of the country

Signs of a postindustrial society, general characteristics and basic types What are the characteristics of a postindustrial society? Analyze the data

2 what are the objects of accounting

Map from the Pridonskaya microdistrict to Voronezh