Protection bank cards Sberbank

The popularity of cashless payments in the world is growing every day. And this is not surprising - credit card payments are more convenient and secure than cash payments. No need to carry large amounts money and beware of robbery, a plastic card takes up a minimum of space in your wallet, many stores provide additional bonuses for cashless payment. And these are just some of the benefits of using bank cards.

Banks provide reliable insurance to protect funds on customers' bank cards and constantly improve the level of protection, which makes cards a reliable way to store funds. Currently, Sberbank Russian Federation in collaboration with Alfa Insurance, they offer perhaps the most advanced program to protect cards from hacking. Protection of Sberbank bank cards from illegal withdrawal of funds by fraudsters, as well as from illegal deductions of amounts from the cardholder’s account

Alfa insurance, one of the most reliable and stable companies in the insurance market, provides Sberbank customers with comprehensive insurance coverage for a bank card - new development, which helps not only save money, but also return it to the card holder in case of occurrence insured event.

Who will benefit from this product? Which case is considered insurance? Advantages and disadvantages of the program. Ways of registration. Algorithm of actions upon occurrence of an insured event. We will consider all these issues in the article.

- global protection throughout the year.

The insured card allows you to pay safely in any store in the world (including online stores). Provides safe payment in cafes, beauty salons and other institutions located anywhere in the world; allows you to use the services of any ATM without fear of scammers (it is important to remember banking commission for withdrawing funds at terminals of other banks).

- insurance against the most popular fraudulent actions in relation to other people's bank cards.

The protection program helps you secure your calculations and save money, if an attempt is made to withdraw funds, by third parties (when stealing a card, PIN, counterfeiting a card, finding out its details); loss of the card or its damage, as well as in case of robbery or capture of the card by an ATM; theft of cash received by the cardholder at an ATM (provided that two hours have not passed since the receipt of funds).

Advantages of Sberbank Bank Card Insurance Program

Integrated insurance program convenient, first of all, by the simplicity of the conclusion - having issued one policy, you will insure any banking visa cards and MasterCard, no matter how many cards you own. The policy will also apply to all cards supplementing them, regardless of the time they are issued. The only exceptions are premium cards.

An important factor is also considered the ratio of the cost of the service and the quality of its execution. The amount of insurance premiums varies from seven hundred to three thousand five hundred and ten rubles and depends on the amount of insurance payments.

You can conclude an agreement and apply for a policy in all branches of Sberbank, as well as in the Sberbank system - online. The procedure is simple and does not take much time.

The company offers three insurance programs, of which the cardholder has the right to independently settle on the most convenient and beneficial for himself.

Speed \u200b\u200bof payments in the event of an insurance situation.

Program disadvantages card insurance of Sberbank

The owners plastic cards already appreciated the convenience and benefits of using the protection program, but also noted a number of shortcomings. You can avoid inconvenience by carefully observing the rules for using the policy. Otherwise, the cost of its acquisition may increase.

If it is proved that the holder has lost money through his own fault, he will be refused payment of insurance. Also, payments will not be made if the client is not able to present a policy and receipts confirming the payment of insurance. All documents are provided in their original form. Copies are not accepted.

To avoid loss of funds due to negligence, it is enough to follow basic safety measures:

- the card must be stored in a place inaccessible to third parties. A bag or purse should not be ignored, especially in crowded places;

- the security code cannot be kept with the card, it must not be communicated to strangers;

- when withdrawing money from an ATM, it is necessary to inspect it, close the keyboard while typing a PIN code; It is not recommended to withdraw funds in dimly lit places, enter card data on unprotected portals:

- if an insured event occurs, you should immediately call the insurance company with a statement, as untimely treatment may also be a reason for refusing to pay insurance.

Insurance policy cost

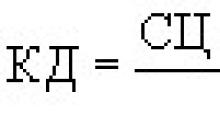

Sberbank of the Russian Federation has developed three insurance programs. The cost of insurance varies depending on the amount of payments.

- the cost of the policy is 700 rubles, the amount of payments in the event of an insured event is 30,000;

- the cost of the policy - 1710 rubles, the amount of payments in the event of an insured event - 120,000;

- the cost of the policy is 3,510 rubles; the amount of payments in the event of an insured event is 250,000.

The insurance contract is concluded for a year, the policy takes effect two weeks after the first payment of contributions.

How and where to buy a policy

You can conclude an insurance contract in several ways, choosing the most convenient for yourself.

- purchase of a policy at a branch of Sberbank. In the nearest branch of the bank you can conclude an agreement and make the first payment. Do not forget to save documents proving the fact of payment of contributions. Within a month after payment, you must provide information to the insurance company. You can do this by using the online resource alfastrah.ru or by calling the hotline.

- purchase of a policy online.

On the sberbankins.ru portal, fill out the registration form. The procedure is easy and intuitive: first of all, you should choose an insurance program, enter your personal data and click on the registration confirmation icon. A confirmation email will be sent to the email address indicated during registration, as well as a policy and rules for its use. You can also pay online insurance on the Internet portal or at any branch of Sberbank of the Russian Federation.

What to do in case of an insurance situation?

According to the rules, first of all, you should call the insurance company. Timely blocking of the card will help to save funds from the abduction. To block the card by phone, the operator must provide the following information:

- number insurance policy;

- contact number of the card holder;

- circumstances in which the insured event occurred.

The operator will record the information provided and say what documents must be collected to pay insurance.

After calling the insurance company, you should call the police and report what happened. This will help you subsequently confirm that the case is insurance.

Not later than three days should visit the office of the insurance company, and write a statement for payments. You should have the original insurance policy with you.

The package of documents required to obtain insurance includes:

- a bank statement containing information on the value of the issued card;

- Details of a bank account with a list of recent transactions;

- court decision to initiate or terminate the case;

- at the request of the company - others additional documents, confirming that the insured event has occurred, and there is no fault of the card holder in this situation.

The company considers the appeal of the insured person within ten days.

Plastic card and deposit insurance is a reliable way to protect your money. Convenience of applying for a policy and beneficial service helps to save money intact.

One of the programs offered to protect your money and payments is bank card insurance at Sberbank Insurance. The program applies only to plastic issued and serviced directly by Sberbank.

Benefits of obtaining bank card insurance coverage

Benefits of obtaining bank card insurance coverage Money insurance on a Sberbank card is offered for customers who actively use the product when paying via the Internet, remote services for transfers, withdrawing money through an ATM, paying for purchases, etc.

The list of insured risks when applying for a policy

The list of insured risks when applying for a policy The protection program covers the following risks:

- Possession of an extraneous payment instrument and PIN code (possibly with the use of violence) and their use for capturing the client’s money through an ATM.

- The receipt by outsiders of funds in the department when using a fake signature.

- Actions to fake or obtain information (skimming, phishing).

- Attackers receive cash from an ATM using fake plastic.

- Theft, robbery, loss of plastic, after which it was used by third parties.

- Accidental mechanical damage.

- Defective ATM, which led to the loss of plastic.

- Theft, theft, robbery of cash, which the client himself withdrew from an ATM.

A complete list of insurance risks covered by the policy

A complete list of insurance risks covered by the policy A bank card insurance policy at Sberbank involves the possibility of applying within two days after the event. Only under such conditions, the insurer considers the incident and makes a payment. In any case, it is necessary to report the incident by telephone immediately after the discovery of the incident (up to 12 hours). In this case, you will also need to collect supporting documentation.

Among the advantages of this type of insurance, we can single out the fearless use of ATMs of other institutions, conducting operations in the Internet space, and withdrawing money from ATMs.

The essence of the bank card insurance policy

The essence of the bank card insurance policy Card insurance

Having selected Sberbank card insurance, the cost of insurance is assigned based on the amount of coverage. She, in turn, is selected individually by the client himself, according to her own preferences, the status of the plastic, the activity in conducting online operations.

Three options for insurance coverage and premium size

Three options for insurance coverage and premium size Today, tariffs and the amount of insurance amounts depend on the method of registration of the policy.

When signing insurance at a bank branch, the client receives the following conditions:

- The amount of insurance is 120 thousand rubles - the cost of the policy is 1900 rubles.

- 250 thousand rubles - 3900 rubles.

- 350 thousand rubles - 5900 rubles.

If the policy is filled out through the bank’s website, then the client can choose one of the tariffs:

- The insurance amount is 30 thousand rubles - the cost of the policy is 700 rubles.

- 120 thousand rubles - 1710 rubles.

- 250 thousand rubles - 3510 rubles.

You can buy a policy for 1 year online

You can buy a policy for 1 year online Policy registration

Insurance can be issued at a branch or online on the bank's website. In the first option, the rule applies: insurance is assigned to a bank account, and all products that are connected to it, including additional ones, are subject to security. In addition, you can draw up one contract for all banking productsowned by customer.

Download file:

The following rules apply:

- Insurance is issued for one year.

- A similar procedure is valid for credit cards.

- For one policy, you can receive payments no more than three times.

- As payments are made, the amount of coverage is reduced in proportion to the amount paid.

- If the main card has expired, the contract provides risks for the rest.

- If only one card is insured, at the end of its validity period it is permissible to return insurance premiums in an amount equivalent to the difference between periods.

In Sberbank, card insurance is carried out sequentially: the client selects a program, enters into an agreement, pays a fee, receives a paper version of the policy.

When applying for a policy online, the client receives more favorable conditions

When applying for a policy online, the client receives more favorable conditions Policy activation

For the insurance to take effect, you need to connect it. Activation takes place independently and remotely - on the SK website. You must fill out the form: policy number, date of purchase, last name, code indicated on the issued certificate, phone number and e-mail. Activation occurs after checking the data and comparing them with the parameters entered into the database. This may take several minutes or a day or two.

Having chosen one of the options for insurance of Sberbank plastic cards, it is worth familiarizing yourself with the procedure for actions in case of an unforeseen situation. In any of these situations, you must take measures:

- Loss, theft, disappearance of a product for any reason.

- The card is damaged or demagnetized.

- Withdraw funds from the account without the participation of the client.

The procedure is prescribed by the instructions. It must be strictly observed, otherwise any reason may cause a failure. It would not be superfluous to first study customer reviews about bank card insurance at Sberbank so as not to make mistakes.

Step-by-step instructions on how to proceed in emergency situations:

- Call the Contact Center, report a problem and block the plastic. This can be done via SMS or through the Online Banking.

- Call the UK, name the policy number, explain what happened, receive instructions on further steps. A call must be made as soon as possible, otherwise it is fraught with failure.

- If a crime has occurred (theft, withdrawal of money without the knowledge of the client), contact the police.

- Visit the office of the insurance company, apply. It has been allocated 3 days since the incident.

- Collect a package of documents to confirm the case: an extract from Sberbank indicating the latest operations, a decision to institute criminal proceedings or termination, a court decision, information on the cost of manufacturing the product (requested by the bank).

- Wait for the decision to pay insurance.

What to do when illegally charged money from the card

What to do when illegally charged money from the card You can get insurance only after a positive response from IC Bank. At the same time, the company analyzes the submitted documents and checks the appropriateness of the payment.

If you have a credit card in Sberbank, insurance is the best way protect the money that is located on it. The policy provides for the most comprehensive set of insurance cases in which the policyholder will receive compensation from Sberbank Insurance IC, that is, will not suffer material damage.

Sberbank Credit Card Insurance

It should be noted that insurance Company offers the owner credit card Sberbank insurance of all cards it has, both credit cards and debit.

Possible risks

Insuring a credit card is convenient and profitable option protection, as a client of Sberbank receives insurance protection for whole line cases, namely:

- Theft / loss of the card itself;

- Unauthorized debit of funds by fraudsters using modern remote methods (skimming, phishing);

- Obtaining information about the PIN code and seizing the card itself by attackers directly from the owner under the threat of violence;

- Fakes (documents, signatures) that allowed unauthorized withdrawal money from the card;

- Robbery, robbery, as a result of which money withdrawn from an ATM was taken or a card was stolen;

- Mechanical damage to the card at the ATM, its demagnetization, malfunctions of the ATM / terminal.

As you can see, the list of insured events allows you to receive compensation in almost any case of illegal possession of a card or directly with money.

Policy Options

A digital bank card protection policy has the same strength as a paper counterpart.

For a Sberbank credit card, insurance is issued in the following options:

- Option 1: The total amount of insurance coverage / the cost of the annual policy is 30 thousand rubles / 700 rubles. respectively

- Option 2: 12 thousand rubles / 1,710 rubles .;

- Option 3: 250 thousand rubles / 3 510 rubles. The above calculations are valid for online registration.

To take out Sberbank credit card insurance, you can contact the Sberbank Insurance IC branch directly or use the Online Application. The remote method of applying for a policy is more profitable, since it involves significant discounts.

Actions for an insured event

If you have Sberbank credit card insurance and an insured event occurs (not earlier than 15 days after payment), your right:

- Contact the contact center;

- Carefully imbue with the order of actions provided for upon the occurrence of an insured event (see Appendix Procedure for actions);

- Fill out the application form (see Appendix Application);

- Store the necessary documents (see Appendix List of documents);

- Submit documents to the UK to receive compensation.

Conclusion

For Sberbank credit card holders, insurance will be a reliable guarantee of compensation in case of theft, loss, unauthorized debit of funds and other cases provided for in the policy. The compensation received will compensate for the damage caused by the attackers.

Bank card insurance in Sberbank is provided by a subsidiary of Sberbank. In order to protect your funds and make secure payments with a card, you must contact Sberbank Insurance.

Why do I need to insure money on a card account?

Let’s figure out what risks are included in the card insurance program? It is worth noting that Sberbank bank card insurance is designed for active users who cash out money through self-service systems, transfer them through third-party services, pay for purchases on foreign or domestic online platforms and perform other financial transactions.The card insurance program protects in the following situations:

- attackers get a card or receive information about a PIN code and cash out funds through ATMs;

- with the help of a forged signature, money is transferred or withdrawn in the cash register;

- fraudsters create a duplicate card and receive cash through ATMs;

- the card is lost, stolen, forcibly appropriated and used by strangers;

- using special devices, such as a skimmer, or online fraud, card information is read;

- the card remains in the faulty ATM;

- cash withdrawn by scammers, thieves;

- the card is not suitable for further use as a result of mechanical damage.

(downloads: 155)

View online file:

Card insurance program allows you to safely carry out online calculationscash out any financial organizations and carry out other operations.

Card cash insurance

If you want to insure funds on your card account, you should purchase a policy. Its cost is individual and depends on the size of the coating. You can independently choose the type of insurance, focusing on your card and needs.At the moment, there are such tariffs:

- for 30 000 rub. insurance is paid 700 rubles .;

- for 120 000 rub. - 1710 rubles .;

- for 250,000 rubles. - 3510 rub.

Policy registration

To purchase a policy and insure your money, you will need to visit the department. Bank card insurance at Sberbank is provided on favorable terms. It is also allowed to sign an agreement and combine all your card accounts.Insurance is provided on the following conditions:

- the policy is valid for a year;

- one policy assumes no more than three payments;

- each payout reduces coverage;

- if only one card is insured, it is possible to return insurance. Moreover, the value depends on the difference between the periods;

- if the card is no longer active, the policy continues to operate, protecting the money of other cards.

Insurance policy activation

For insurance to work, you need to activate it. All connection actions are performed by us independently. To do this, you must visit the official website of Sberbank Insurance and fill out a special form. The columns shall indicate: insurance number, date of acquisition, name of client, telephone number, email, code (it can be found on the document issued at the department).After filling out the form, you must wait until all the data has been verified. All the specified information is verified with the one stored in the database. This usually takes from 20 minutes to two to three days.

Procedure for applying for insurance

If an incident has occurred or the situation indicated above is as soon as possible:- contact Sberbank employees and block the card. You can visit the office, call in, use Online account or send SMS;

- dial the number of Sberbank Insurance and report the incident, indicating the number of the policy. Follow all instructions of the employee. You need to call immediately, otherwise the situation will not be considered;

- if there were criminal acts, write a statement at the police station;

- within 2-3 days, visit the office of Sberbank Insurance and apply;

- wait for consideration.

Despite the efforts made by Sberbank and others credit organizations, in order to protect their customers, they do not always succeed. Credit and debit card holders are still vulnerable. Fraudsters do not doze off, coming up with ways to steal money from accounts and technical methods of protection, they can not always stop them. You can insure a card, but again it is not clear whether there is credit card insurance? Let's try to figure it out, but at the same time we will see how you can insure your Sberbank card.

It is believed that only Sberbank debit cards can be insured, which the client constantly uses: receives a salary or pension on them, pays them in the store, etc. Indeed, most debit cards are designed for short-term storage of customer funds in order to spend them in the near future. If there is no money on the debit card, then you can’t withdraw anything from it, for this reason, fraudsters are only interested in cards with a positive balance.

By insuring a card with money, you, in fact, insure your savings. What about credit cards? Most often, on a Sberbank credit card owned by a client own money No, but there is a credit limit and this is even more dangerous. Suppose scammers somehow took 50,000 rubles from a credit card, half of it credit limit. The debt will completely fall on the cardholder’s shoulders. Only in very few cases, the police manage to expose the scammers and find the stolen funds, but this is the exception rather than the rule.

And what is the bottom line? A citizen who conscientiously used a credit card became a victim of scammers, and the bank, instead of taking the side of a good client, requires a debt from him.

You can get involved in litigation, but the judicial perspective in such cases is not the best.

Sberbank Insurance does not limit credit or debit card holders. Whatever card you own, you can purchase a protection policy for it. If you have several cards, then you can purchase a policy for each.

What are the risks?

So, are credit cards insured at Sberbank? We found out that they are insured, and the policy for them is purchased exactly the same as for debit card. However arises main question: what risks does this policy insure against? Maybe it’s not worth buying at all? The cardholder will receive compensation in a number of cases.

- If the card was used by attackers after theft, robbery or robbery.

- If the attackers withdrew the money from the card, having received data from the owner under the influence of threats and violence.

- If the attackers used a fake card with the details of the card of the insured person and received money on it.

- If the attackers obtained information from the card through phishing, skimming and similar actions, and then withdrew money from it.

- If the attackers stole from the cardholder the money withdrawn from the ATM within two hours. This refers not only to theft, but also robbery, robbery.

- If the card is damaged by a malfunctioning ATM or terminal.

- If the card is demagnetized or it was accidentally damaged.

The insurance policy does not provide for additional payments in case of death or disability of the cardholder of the victim of a crime. However, the insurance company may offer other products that will insure the life and health of a Sberbank client. Payouts on them are much larger.

Where and how to apply for a policy?

Currently, there are two ways to apply for a Card Protection policy. The first method involves a trip to the office of Sberbank Insurance with a passport and card information. A polite employee will issue a policy within 15 minutes that will protect your credit card for a year or more, at your discretion.

The second method involves online clearance through the Sberbank Insurance portal. This method is much more convenient and allows the client to resolve the issue without leaving home. How to apply for a policy online?

- Go to the website of Sberbank in the tab "Insure yourself and property" and select "Bank card insurance - apply online."

- On the page that appears, click the orange "Checkout Online" button.

- Going to the portal of "Sberbank Insurance", select the desired policy and click the orange "Apply" button.

- A page with personal data will appear, which you need to fill out, and then click the “Continue” button.

- At the last stage, you need to confirm the process of registration of the policy and print its electronic version.

That's all. You don’t have to go anywhere, but the policy is paid either from the card that you insure, or in any other convenient way.

An insured event occurred

If an accident happened and the insured event still catches up with you, do not despair, as soon as possible contact the office of IC Sberbank Insurance. Your appeal will be recorded by the employee, in some cases this is important. You will write a statement and listen to the instructions of the employee of the insurance company and bring him in the very near future necessary documents. The employee will provide a list of documents.

After providing all required documents and evidence, UK employees begin the process of reviewing the application for payment. The status of the solution can be found in personal account on the website of the insurance company. In obvious situations, a positive payment decision can be made within a few hours. By dialing 8 800 555 555 7, you can ask questions about your insurance. The same number should be called when an insured event occurs.

Insurance Payments

The level of insurance coverage of your credit card must match its credit limit. This is very valuable advice from professionals. The card protection policy is selected by maximum amount insurance payments. Today 4 options are offered:

- In the amount of 60 thousand rubles, its cost per year is 1161 rubles.

- In the amount of 120 thousand rubles, its cost per year is 1710 rubles.

- In the amount of 250 thousand rubles, its cost per year is 3510 rubles.

- In the amount of 350 thousand rubles, its cost per year is 5310 rubles.

We begin to choose. For example, you have a Sberbank credit card with a credit limit of 150 thousand rubles. Theoretically, attackers can withdraw most of the money from it, but they are unlikely to be able to empty it completely. It is most reasonable to order a policy for 120 thousand rubles, since a policy for 250 thousand covers much more than the credit limit. It would seem, well and good, that SK will not pay 120 thousand rubles, but 250.

Under the terms of the contract, the insurance company covers only the amount of actual damage, excluding non-pecuniary damage and lost profits. And this means that even if the attackers completely “clear” the credit card, the owner in best case will receive the amount that was lost from the card, and this is a maximum of 150 thousand rubles. The question is, why overpay 1800 rubles for more expensive insurance, if you still have no chance of getting the full amount? Right, no reason.

So, we have seen that it is easy to insure Sberbank’s credit card at Sberbank Insurance, a subsidiary insurance company. The conditions are quite favorable, and the policy is drawn up quickly and conveniently, without leaving home. It remains only to take advantage of the offer of the insurance company. Good luck

How to calculate the average annual value of fixed assets?

Socio-economic and domestic political development of the country

Signs of a postindustrial society, general characteristics and basic types What are the characteristics of a postindustrial society? Analyze the data

2 what are the objects of accounting

Map from the Pridonskaya microdistrict to Voronezh