The chart of accounts and the Instructions for its use to summarize information on income that is received (accrued) in one reporting period, but relates to future reporting periods, is intended for the passive synthetic account 98 “Income for future periods” (). We will tell you what is taken into account in this account in our consultation.

Accounting for fixed assets and other property received free of charge

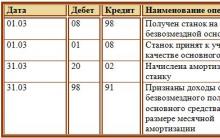

Objects of fixed assets received by an organization under a gift agreement (free of charge) are reflected at market value at the time of acceptance for accounting as part of investments in non-current assets as deferred income (clause 29 of Order of the Ministry of Finance dated October 13, 2003 No. 91n, Letter of the Ministry of Finance dated September 17. 2012 No. 07-02-06/223, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 08 “Investments in non-current assets” - Credit of account 98

During the useful life of the received object, future income is included in other income of the current period:

Debit account 86 “Targeted financing” - Credit account 98

Debit of account 98 – Credit of account 91 “Other income and expenses”

If budget funds are received to finance current expenses, then the posting of Debit to Account 86 – Credit to Account 98 is made, for example, at the time the inventory is accepted for accounting. And when they are released into production or for other purposes, future income is written off: Debit account 98 – Credit account 91.

Deferred income under a leasing agreement

For the case when, under the terms of the leasing agreement, the property is recorded on the balance sheet of the lessee, the difference between the total amount of lease payments and the cost of the leased property is reflected in the lessor’s accounting as follows (clause 4 of Appendix No. 1

Debit of account 76 “Settlements with various debtors and creditors” - Credit of account 98

At the time of receipt of the lease payment, the portion of future income attributable to it is written off as follows (clause 6 of Appendix No. 1 to Order of the Ministry of Finance dated February 17, 1997 No. 15):

Debit account 98 – Credit account 90 “Sales”

Deferred income in the balance sheet

In the balance sheet, the credit balance of account 98 as of the reporting date is reflected in line 1530 “Deferred income” (

Account 98 “Deferred Income” is intended to summarize information on income received (accrued) in the reporting period, but relating to future reporting periods, as well as upcoming receipts of debt for shortfalls identified in the reporting period for previous years, and the differences between the amount subject to recovery from the guilty parties, and the value of the valuables accepted for accounting when shortages and damage are identified.

Sub-accounts can be opened to account 98 “Deferred income”:

98-1 "Income received for future periods",

98-2 "Gratuitous receipts",

98-3 “Upcoming debt receipts for shortfalls identified in previous years”,

98-4 “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables”, etc.

Subaccount 98-1 “Income received for future periods” takes into account the movement of income received in the reporting period, but relating to future reporting periods: rent or apartment payments, utility bills, revenue for freight transportation, for passenger transportation on a monthly basis and quarterly tickets, subscription fees for the use of communication facilities, etc.

Cash accounts or settlements with debtors and creditors reflect the amounts of income relating to future reporting periods, and debit accounts reflect the amounts of income transferred to the corresponding accounts upon the onset of the reporting period to which these incomes relate.

Analytical accounting for subaccount 98-1 “Income received on account of future periods” is carried out for each type of income.

Subaccount 98-2 “Gratuitous receipts” takes into account the value of assets received by the organization free of charge.

On the credit of account 98 “Deferred income” in correspondence with abacus 08“Investments in non-current assets” and others reflect the market value of assets received free of charge, and in correspondence with score 86“Targeted financing” is the amount of budget funds allocated by a commercial organization to finance expenses. Amounts recorded on account 98 “Deferred income” are written off from this account on credit accounts 91"Other income and expenses":

for fixed assets received free of charge - as depreciation is calculated;

for other material assets received free of charge - as production costs (sales costs) are written off to accounts.

Analytical accounting for subaccount 98-2 “Gratuitous receipts” is maintained for each gratuitous receipt of valuables.

Subaccount 98-3 “Upcoming debt receipts for shortfalls identified in previous years” takes into account the movement of upcoming debt receipts for shortfalls identified in the reporting period for previous years.

On the credit of account 98 “Deferred income” in correspondence with score 94“Shortages and losses from damage to valuables” reflect the amounts of shortages of valuables identified in previous reporting periods (before the reporting year), found guilty by persons, or amounts awarded for recovery by the court. At the same time, these amounts are credited score 94"Shortages and losses from damage to valuables" in correspondence with score 73“Settlements with personnel for other operations” (sub-account “Settlements for compensation of material damage”).

As the debt for shortfalls is repaid, the account “Settlements with personnel for other operations” is credited in correspondence with the cash accounts while simultaneously reflecting the amounts received on the loan accounts 91“Other income and expenses” (profits of previous years identified in the reporting year) and the debit of account 98 “Deferred income”.

Subaccount 98-4 “The difference between the amount to be recovered from the guilty persons and the cost of shortages of valuables” takes into account the difference between the amount recovered from the guilty persons for missing material and other valuables and the value listed in the organization’s accounting records.

On the credit of account 98 “Deferred income” in correspondence with score 73“Settlements with personnel for other operations” (sub-account “Settlements for compensation of material damage”) reflects the difference between the amount to be recovered from the guilty parties and the cost of shortages of valuables. As the debt registered under count 73“Settlements with personnel for other operations”, the corresponding amounts of the difference are written off from account 98 “Deferred income” on credit accounts 91"Other income and expenses."

Account 98 "Deferred income"

corresponds with accounts

| by debit | on loan |

|

68 Calculations for taxes and fees 90 Sales 91 Other income and expenses |

08 Investments in non-current assets 50 Cashier 51 Current accounts 52 Currency accounts 55 Special bank accounts 58 Financial investments 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 86 Targeted financing 91 Other income and expenses 94 Shortages and losses from damage to valuables |

Application of the chart of accounts: account 98

- Deferred income in the communications sector

Account 98 is intended for deferred income. It summarizes information: about income received (accrued) in the reporting period... on the credit of account 98. As we can see, there is a regulatory framework for accounting for deferred income,... 98-1 “Income "received for deferred periods" takes into account the movement of income received in the reporting period... the example does not include an account for deferred income. There is no need... accounting for subaccount 98-1 “Income received for future periods” is carried out according to...

- How to take into account the costs of developing a store design

reporting period, but relating to future reporting periods, the Chart of Accounts provides for account 98 “Deferred Income”. A one-time lump sum payment applies to the entire period... the composition of deferred income: Debit 62 (76) Credit 98 - the lump sum payment is reflected in deferred income...

- Inseparable improvements. Accounting and tax accounting for the lessor

Additional equipment by the tenant OS 08 98-2 60,000 Act... 60,000 rub. / 20 months) 98-2 91-1 3,000 ... non-current assets in correspondence with the deferred income account. As depreciation accrues... it is reflected as follows: Debit 08 Credit 98, sub-account "Gratuitous receipts&... 98, sub-account "Gratuitous receipts", Credit 91-1 - other income is recognized... improvements made by the tenant 08 98-2 1 200,000 Act... the amount of depreciation accrued on them 98-2 91-1 6 ...

- Accounting in the MCP when returning fixed assets purchased at the expense of a subsidy to the founder

Retained earnings. By offering the indicated correspondence of accounts, the Ministry of Finance emphasizes that the organization has... costs); Debit 98 Credit 91-1 - income is recognized in the part received... option, account 91 “Other income and expenses” is used, and income and expenses... of additional capital for other income. The balance of account 83 (in the form of a difference... was recognized as part of deferred income with gradual inclusion in income as depreciation proceeds... other expenses, and the balance of deferred income - for other...

- Changes in annual financial statements

Decrease in income in the reporting period. Such data is reflected in the debit turnover of account 0 ... 104 94 000 – 0 104 98 000), 0 106 11 000 ... 94 000 – 0 104 98 000) and account 0 114 00 000 ... for account 0 401 50 000 “Future expenses” that have arisen during the reporting period. Indicator... debit turnover on the account 0 401 40 000 “Deferred income”, formed during the reporting... period. Indicator of excess debit turnover...

- Updated annual accounting reporting forms

510 Account balance 0 401 40 000 “Deferred income” 520 Account balance 0 401 60 ... for accounts: – 0 401 40 000 “Deferred income”; – 0 401 50 000 “Deferred expenses... 94 000 – 0 104 98 000), account 0 114 00 000 (... debit turnover on account 0 401 40 000 “Deferred income”, formed for ... reporting period. Indicator of excess of debit...

- Further changes have been made to Instruction No. 157n

... ;157n, account 0 401 40 000 “Deferred income” is intended to... reflect the amounts of income accrued (received) in the reporting period, but... of a current nature to organizations 206,98,000 Calculations for advances... current nature to organizations 208,98,000 Settlements with accountable... organizations of a current nature 302,98,000 Settlements for other...

- Changes to Instruction No. 174n. New accounting entries for budget accounting

98,000 “Other fixed assets – property in concession.” Changes in the chart of accounts... non-financial assets" Account credit 0 401 40 182 "Deferred income from gratuitous rights... for income from operating leases" Account credit 2 401 40 121 "Deferred income from... operating leases" Accrual income from... » Account credit 2,401 40,122 “Deferred income from financial leases” Income from compensation...

- Inseparable improvements were made with the consent of the lessor and are transferred free of charge: accounting at the end of the contract

Tenant. The procedure for reflecting in the lessor's accounting accounts the received inseparable... cost of improvements is included in deferred income, and accrued depreciation relates... the following transactions: Debit 08 Credit 98 - inseparable improvements are taken into account... depreciation; Debit 98-2 Credit 91, subaccount “Other income” - ... if in the period between the date of the last ... January 1 of the year, which is the tax period * (1). The legislation does not provide for special...

- An organization donated a fixed asset to another organization: legal and tax aspects

Not recognized as interdependent, as well as income (profit, revenue) received by persons... depreciation bonus is included in the expenses of the reporting (tax) period, which is directly established... receipt of property is taken into account as part of deferred income on account 98, subaccount " Gratuitous receipts... - depreciation is accrued; Debit 98 Credit 91, subaccount "Other income" - monthly... depreciation is charged as part of other income, part of the cost of gratuitous received...

- “Standard” requirements for accounting for events after the reporting date

Commercial organizations, for example PBU 7/98 “Events after the reporting date”)

How to open a current account in VTB24 for legal entities VTB 24 do not want to close the account

Demographic situation in developed countries

The emergence and evolution of money

Remote conclusion of a loan agreement

Friedman, Milton - biography