Question to the auditor

The organization makes gifts to employees, each time concluding a gift agreement, so the value of gifts does not impose insurance premiums on pension, medical and social (in case of disability and maternity) insurance. In addition, when sent on a business trip, the employee receives a daily allowance within the limits established by law, for which contributions are also not charged. Do these amounts need to be reflected in the calculation of insurance premiums?

Payments made in favor of an individual are not subject to insurance premiums for compulsory pension, medical and social insurance in case of temporary incapacity for work on two grounds.

- The payment does not apply to the object of taxation by contributions, established in Art. clause 1 of Art. 420 of the Tax Code of the Russian Federation.

Such payments include payments under civil law contracts, the subject of which is the transfer of ownership or other property rights to property. For example, these are contracts of lease, gift, purchase and sale. The exception is copyright agreements and agreements on the alienation of copyright. - The payment refers to the object of taxation by contributions, but is exempt from taxation by virtue of Art. 422 of the Tax Code of the Russian Federation.

Such payments include, in particular, the amount of material assistance in the amount established by law, the amount of various state benefits, daily allowances within the norms, other compensation for expenses incurred, etc.

Thus, payments that are subject to insurance premiums, but are exempted from their accrual by virtue of Art. 422 of the Tax Code of the Russian Federation, must be reflected in section 1 of the calculation of insurance premiums. The daily allowance within the norms refers to just such payments, since they are not subject to insurance premiums in accordance with paragraphs. 2 p. 1 and p. 2 of Art. 422 of the Tax Code of the Russian Federation.

As for payments that are not subject to insurance premiums, they are not indicated in the calculation of insurance premiums at all. The amount of the gift is a type of civil law contract, according to which the ownership of the thing is transferred to the employee. Consequently, this transaction is not subject to insurance contributions for pension medical and social insurance and is not indicated in the calculation of insurance contributions.

How to reflect compensation from the FSS in the RSV?

According to the results of the reporting or billing period, it may turn out that the amount of expenses incurred by the insured for the payment of benefits at the expense of the Social Insurance Fund exceeded the total amount of compulsory social insurance contributions assessed in case of temporary disability and in connection with maternity. The resulting difference can either be offset against the upcoming social insurance payments, or reimbursed by the territorial body of the FSS (clause 9 of article 431 of the Tax Code of the Russian Federation). And where is the compensation from the FSS reflected in the RSV?

The procedure for filling out the RSV when reimbursing from the FSS 2018

How to reflect the reimbursement of expenses from the FSS in the RSV is indicated in the Procedure for filling out the Calculation for insurance premiums (Appendix No. 2 to the Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11 / [email protected]).

The amounts of the employer's expenses reimbursed by the territorial bodies of the FSS for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity are indicated in line 080 "Reimbursed by the FSS of expenses for payment of insurance coverage" of Appendix No. 2 to Section 1 of the RSV (clause 11.14 of the Procedure, approved by Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11 / [email protected]).

The amounts of benefits received from the FSS are given on line 080 with the following details:

- from the beginning of the calendar year;

- for the last 3 months;

- for the 1st, 2nd and 3rd months of the last three months.

It is important to keep in mind that in the RSV for the current year, it is necessary to show any reimbursement of benefits from the FSS that was received this year, even if this is reimbursed for the expenses of the previous year.

Accordingly, the indicator of line 090 of Appendix No. 2 to Section 1 will be determined as follows (clause 11.15 of the Procedure approved by Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11 / [email protected], Letter of the Federal Tax Service dated 23.08.2017 No. BS-4-11 / [email protected]):

Line 090 = Line 060 - Line 070 + Line 080

In this case, in line 090, the indicator is always reflected in a positive value. In the field "Sign" you will need to specify:

- “1” - “the amount of insurance premiums payable to the budget”, if the amount calculated according to the above formula is ≥0;

- "2" - "the amount of excess of the costs incurred by the payer for the payment of insurance coverage over the calculated insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity", if the amount according to the formula

Sample filling out RSV with reimbursement from the FSS

We gave an example of filling in the RSV in ours. Reimbursement of expenses from the FSS when filling out the RSV will only affect the reflection of information in Appendix No. 2 to Section 1 of the RSV. The reimbursement of expenses from the FSS will not affect the procedure for filling out other sheets, sections, subsections and attachments.

How to show the compensation from the FSS in the RSV, we will present it on the conditional Appendix No. 2 to Section 1 of the RSV for the 1st half of 2018.

Calculation of insurance premiums: complexities of filling

For the first time, insurers will have to submit a calculation of insurance premiums on 05/02/2017. When filling out a new form, accountants have various questions. For example, is there a need for a zero calculation, how to reflect sick leave and reimbursement of benefits from the Social Insurance Fund, etc. In this article, we will give answers to the most common questions on filling out the calculation.

Calculation presentation order

Calculation of insurance premiums is submitted to the Federal Tax Service every three months: based on the results of the first quarter, half a year, 9 months and a year.

The last day for sending the calculation is the 30th day of the month following the reporting period. Due to holidays and weekends, reporting deadlines are shifted.

You can hand over the calculation in two ways (clause 10 of article 431 of the Tax Code of the Russian Federation):

- in electronic form, if the number of employees is 26 or more people;

- on paper with no more than 25 people.

If during the reporting period the organization had payments in favor of individuals, it is necessary to submit to the Federal Tax Service a title page, section 1, subsections 1.1 and 1.2, appendix 1 and appendix 2 to section 1, section 3. The remaining sheets are filled out in the presence of certain circumstances (payment of benefits from the FSS, contributions at an additional tariff, etc.).

How to reflect maternity and unpaid leave

In the calculation of insurance premiums, data on all insured persons should be reflected.

Also, the policyholder must indicate in field 001 of Appendix 2 the sign of insurance payments for compulsory social insurance in case of temporary disability and in connection with motherhood.

There are two signs in total:

"1" - direct payments of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity by the territorial body of the Social Insurance Fund to the insured person. That is, the status "1" is given with the participation of the company in the pilot project of the FSS.

"2" - offset system of payments of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity by the territorial body of the Social Insurance Fund to the payer. This status is set when the policyholder independently calculates sick leave and they are offset with the assessed premiums.

How to reflect a refund from the FSS

If the FSS reimburses the insured, the amount of the reimbursement must be reflected in the new calculation of insurance premiums. According to the Order of the Federal Tax Service of Russia dated 10.10.2016 N ММВ-7-11 / [email protected] the amounts of the payer's expenses reimbursed by the territorial bodies of the FSS for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with motherhood are reflected in line 080 of Appendix 2 of Section 1 of the calculation.

Since the new calculation of insurance premiums has been submitted since 2017, it is logical to assume that benefits paid in the current year for the periods up to 2017 are not included in the calculation. The procedure for filling out the calculation (clause 11.14) states that on line 080 it is necessary to indicate the amount of funds reimbursed by the FSS:

- from the beginning of the billing period - from 01/01/2017;

- for the last three months of the reporting (settlement) period;

- for each of the last three months of the reporting (settlement) period.

If, in the first quarter of 2017, the company's current account received reimbursement of benefits for 2016, it is better to clarify the procedure for reflecting such payments with the Federal Tax Service.

Zero calculation of contributions

If the payer of insurance premiums in a specific reporting period does not operate and does not make payments to individuals, he is obliged to submit a calculation of insurance premiums to the tax office.

Thus, the policyholder declares that there are no payments to individuals and that there are no insurance premiums.

Failure to submit zero reporting is subject to a fine of 1,000 rubles. The Ministry of Finance of Russia warned about this in a letter dated March 24, 2017 No. 03-15-07 / 17273.

Be sure to fill out the title page as part of the zero report, section 1, subsections 1.1 and 1.2, appendix 1 and appendix 2 to section 1. If the company has employees, but no payments were made to them in the reporting period, you must also complete section 3.

Calculation of contributions must be submitted every quarter. The deadline for submitting the report is no later than the 30th day of the month following the reporting period (clause 7 of article 431 of the Tax Code of the Russian Federation). The reporting periods are 1 quarter, half a year and 9 months (Article 423 of the Tax Code of the Russian Federation).The reporting campaign for the half of 2017 showed that accountants make many mistakes in filling out the calculation of insurance premiums. This article is about the most common mistakes. The article also describes how to prevent mistakes and thereby minimize the receipt of a fine from the Federal Tax Service Inspectorate.

Error 1 - they did not reflect in Section 3 of the Calculation of employees on maternity leave or parental leave.

To the composition of the calculation of insurance premiums in accordance with the Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11 / [email protected] included section 3 “Personalized information about the insured persons”. This section is mandatory for all payers of insurance premiums.

Insured persons for the purposes of compulsory pension, health insurance and social insurance are persons working under an employment contract (clause 1 of article 7 of the Federal Law of December 15, 2001 No. 167-FZ, clause 1 of article 10 of the Federal Law of 29.11.2010 No. 326 -FZ, clause 1 of article 2 of the Federal Law of December 29, 2006 No. 255-FZ).

If employees are not accrued wages, only subsection 3.1 will need to be filled in on it, because in the absence of data on the amount of payments and other remunerations accrued in favor of individuals for the last 3 months of the reporting (settlement) period, subsection 3.2 of section 3 is no longer completed (p. 22.2 The procedure for filling out, approved by Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11 / [email protected]). Employees who are on parental leave under 1.5 or 3 years of age, as well as maternity leave during the reporting quarter, must be reflected in Section 3 of the Calculation - “Personalized information about the insured persons”. According to these employees, it is necessary to fill out subsections 3.1

Subsection 3.2 of Section 3 Calculation for such employees is not completed. As stated in clause 22.2 of the Rules, in the personalized information about the insured persons, in which there is no data on the amount of payments and other benefits accrued in favor of an individual for the last three months of the reporting (settlement) period, subsection 3.2 of section 3 is not completed.

Error 2 - vacation pay for October, but paid in September was not reflected in the Calculation for 9 months.

Organizations accrue vacation pay until the employee goes on vacation, and vacation pay must be paid at least 3 days (calendar) before the onset of vacation. It so happens that an employee goes on vacation from the first day (1.10), then he needs to calculate and pay vacation pay in September.

Accordingly, the accountant must calculate and pay vacation pay at the end of September, as well as reflect the vacation pay in the taxable base for calculating insurance premiums for 9 months. To do this, reflect the contributions from them in the total amounts of section 1. The amounts of insurance premiums from vacation pay will fall into the data on lines 030, 033, 050 and 053 of Section 1.

Error 3 - the amount of contributions for each employee does not coincide with the amount charged for the company as a whole

The data reflected in section 1 in terms of assessments of contributions for the company as a whole must match the information in section 3, with information on assessed contributions for each employee (insured person).

Clause 7 of Art. 431 of the Tax Code directly indicates this control ratio. It will not be possible to hand over such a calculation, but even if the report is accepted with this violation, then with a probability of 100% the tax authorities will send a request for clarification and correction of errors.

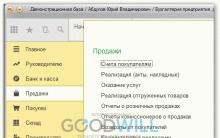

The mistake often lies in the fact that the program rounds up kopecks - for each employee the amounts are reflected with kopecks, respectively, in the final form, a different amount is obtained. It is necessary to pay attention to this and try to identify these errors yourself. The easiest option is to check the calculation through the "Legal entity taxpayer".

Error 4 - in Appendices 3 and 4 of the Calculations, they reflected the payment for the sick leave for the first three days

Payments for social security purposes, this also applies to sick leave payments, they must also be reflected in the calculation. In the event of an employee's illness, the employer pays for the first three days of illness at his own expense. Accordingly, these amounts should not be included in the calculation. If these amounts are reflected in the calculation, then the company will underestimate the amount of current payments for insurance premiums. As a result, this error will lead to violations and fines.

Accordingly, you will have to pay additional social insurance contributions in case of temporary disability and in connection with motherhood.

The calculation with this error will pass the control ratios and there will be no formal problems with the tax office upon receipt. But at the entrance of a desk audit, the supervisory authorities will reveal this error, and the inspection will send the organization a demand for the payment of arrears, as well as a demand for the payment of penalties.

Error 5 - the organization did not reflect non-taxable payments

Not reflecting payments that are not subject to taxation in the calculation is dangerous for the company and can lead to a fine under Article 120 of the Tax Code of the Russian Federation for gross violations of the rules for accounting for income and expenses.

Mistake number 6 - the data on SNILS for the organization and the inspection do not match

When transferring data from the FIU to the Federal Tax Service, problems arose with information on individuals. It happens that the data of the organization and the tax office in terms of compliance with SNILS and the full name of the employee do not match. Calculation with such an error will not work, the control ratios will have to be corrected.

And since organizations often submit reports on the last day, you can get fined in accordance with Art. 119 of the Tax Code of the Russian Federation - at least 1000 rubles and a possible blocking of the account for being late with the delivery of the payment.

If the data in the organization is correct and coincides with the data provided by the employees, and the calculation is still not sent, then there is an error in the information in the inspection. To do this, it is necessary to conduct a reconciliation with the inspection about the name and surname. and SNILS employees.

To minimize this error, it is recommended that you first check SNILS in the organization, and then check with the controllers. This will save the organization from unnecessary fines.

Error 7 - only the paid salary for employees was reflected in the calculation, but they forgot to reflect the accrued one.

The fact of payment of salaries for the purposes of the RSV is not important, since insurance premiums are calculated from the payments that are accrued.

For example, an advance (payment for the first half of the month) for September was paid in September, and the final payroll was transferred to employees in October, then the entire amount of contributions from the September salary must be reflected in the calculation of contributions.

The amount of contributions from the September salary will fall into the data on lines 030, 033, 050 and 053 of Section 1.

If this is not done, then the tax authorities will consider that the organization deliberately underestimates the base for insurance premiums. And this can lead to the accrual of fines or you will have to submit an updated calculation, pay arrears, penalties and a fine.

Error 8 - information about the participant - the general director was not reflected in Section 3 of the calculation.

Information about the only founder, who is also the general director of the organization, must be shown in the calculation, even if the director does not receive a salary. All employees of the organization are an insured person, even if it is a member general director.

Accordingly, regardless of whether he was paid a salary, then for the director, fill out section 3 and include it in the number of insured employees (clauses 22.1-22.36 of the Procedure approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / 551.

Even if the organization does not conduct activities and does not charge salaries, then the calculation must still be submitted with zero indicators. Failure to submit the calculation will result in a fine.

The composition of the zero calculation is as follows:

title page,

section 1,

subsections 1.1 and 1.2 of Appendix 1 to Section 1,

Appendix 2 to Section 1 and Section 3 (letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11 / 6940).

In the letter of the Ministry of Finance of Russia dated March 24, 2017 No. 03-15-07 / 17273, the financial department reported that the Tax Code does not provide for exemption from the obligation of the payer of insurance premiums to submit Calculations in the event that the organization does not carry out financial and economic activities.

Submitting Calculations with zero indicators, the payer declares to the tax authority that in a specific reporting period there are no payments and remunerations in favor of individuals who are subject to insurance premiums, and, accordingly, that there are no insurance premiums payable for the same reporting period. If you do not pass the zero calculation of insurance premiums, then the employer faces a fine (the minimum amount of which is set at 1000 rubles).

Thus, if the payer of insurance premiums does not have payments in favor of individuals during a particular settlement (reporting) period, the payer is obliged to submit a Calculation with zero indicators to the tax authority in due time.

Error 9 - the employer does not have information about the SNILS or TIN of the employee

If the organization does not reflect the employee (insured person) in the SNILS calculation, then with a probability of 100% the inspection will not accept such a calculation.

It is very easy to solve this problem - you need to get SNILS. Refer the employee to the FIU branch of his place of residence. The employee will receive the SNILS number on the day of contact. The employer can independently apply to the FIU, but in this case, the result will have to wait 5 working days.

If the organization does not reflect the insured person's TIN in the calculation, then the calculation will take place, since such an element (TIN) is optional.

Now let's turn to the Procedure for filling out the calculation of insurance premiums, approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / 551. This document, among other things, defines the conditions for the mandatory presence of the TIN of individuals as part of the calculation.

Thus, it turns out that the official regulatory documents stipulate that the TIN of an individual is indicated in the calculation of insurance premiums only if available. If an individual does not have a TIN, then it is not necessary to indicate the taxpayer identification number in the calculation of contributions.

But field inspectors may think differently.

In this article, we examined the most common mistakes made by organizations in previous reporting periods. Knowing this, you can minimize your risks, while preparing the calculation, check these aspects again. Spend time, but get rid of fines from the tax authorities, as well as from receiving requests from the inspectorate to provide explanations or submit revised calculations. For each described error, the inspectors often set requirements.

The line "Indication of payments" is an innovation in Appendix 2 of the calculation of insurance premiums. Initially, its appearance was associated with the transfer of reporting on insurance premiums to the Federal Tax Service. Until now, many employees of companies responsible for reporting have difficulty in what sign of payments in the calculation of insurance premiums to put: 1 or 2. We analyze what this parameter means and how to fill out this column.

What is the "Sign of payment"

Before deciding to fill out this line, you need to figure out what the "Payment attribute" is: this indicator refers to the system according to which payments are made in the event of incapacity for work or the departure of an employee on maternity leave. Today there are 2 main mechanisms.

The first option is the credit type of payments. In this case, the entire company pays the disability benefit at once, and after the payment is made, the Social Insurance Fund compensates the employer for these costs in full.

The second option is direct payment (regions of the FSS pilot project). In this case, the Social Insurance Fund directly acts as a source of finance for payments for temporary disability or maternity, and the company's finances are not involved.

Direct payments are in the following cases:

- payment is made on sick leave (this also includes all cases of incapacity for work associated with pregnancy and childbirth);

- payments in connection with the registration of a woman at an early stage of pregnancy;

- childcare allowance up to 1.5 years old;

- payment of 4 days leave for the care of a disabled child to any of the parents.

Thus, in Appendix 2 for calculating insurance premiums, the indicator of payments is filled with the number "1" for direct payments and "2" - when using the credit system.

Last changes

Traditionally, a credit system of insurance payments has been used in Russia. In this case, the employing organization was responsible to the employee for the fulfillment of social security obligations. All sick leaves were paid from the company's funds, and only then the state, represented by the FSS, compensated these costs.

The difficult financial situation often led to the fact that the company was unable to meet its payment obligations in full. To compensate for these difficulties, a pilot project “Direct Payout” was launched. This happened in 2011.

Since this year, more and more new regions have been systematically connected to the program by means of additions to the Decree of the Government of the Russian Federation No. 294 of 04/21/2011.

REFERENCE

Initially, the general plan of the campaign provided for the transfer by 2021 of all regions of the country exclusively to the production of direct payments. However, on the basis of Resolution No. 1514, the expansion of the pilot project of direct payments from the FSS has been suspended.

As of today, it is possible to put the code “1” in the column “Sign of payment” only in the region that participates in the FSS program. A complete list of them participating in the program for 2018 can be found on our website at the link above.

As a result, policyholders can fill in the indicator of payments in the calculation of insurance premiums for 2018 with the number "1" in 33 regions.

Appendix 2 is a part of the ERSV, filled in for submission to the IFTS. It should be emphasized that an error in filling in the "Sign of payment" field will not result in a fine for a company or an employee. However, incorrectly filled positions will need to be redone and resubmitted. To avoid this, you need to clarify in advance whether your region is a member of the "Direct Payment" project and how to fill out this column.

The goods were destroyed by fire, do you need to recover VAT?

Accrual of penalties in 1c 8.3. Calculation of a fine: postings. Fines, penalties, forfeits under business contracts

Calculation of a fine for the wiring in 1s 8

Industrial revolution in Russia in the late 19th - early 20th centuries

The way to get help in vp what is it What is vp in the army