IP fee calculator 2020

The free online calculator of IP insurance premiums will help you calculate the amount of contributions to the funds for IP for yourself in 2020 and earlier to the nearest penny, including for less than a year.

IP insurance premiums 2020

The amount of insurance premiums IP 2020

In 2020, individual entrepreneurs' insurance premiums for themselves are:

1% of income over 300 thousand rubles. This payment to the FIU must be paid no later than April 1, 2021.

in the FIU: 32448 rubles. + 1%

in FFOMS: 8426 rubles.

The amount of insurance premiums IP 2019

In 2019, individual entrepreneurs' insurance premiums for themselves amounted to:

1% of income over 300 thousand rubles. This payment to the FIU must be paid no later than April 1, 2020.

The fund breakdown looks like this:

in the FIU: 29354 rubles. + 1%

in FFOMS: 6884 rubles.

The amount of insurance premiums IP 2018

In 2018, individual entrepreneurs' insurance premiums for themselves amounted to:

1% of income over 300 thousand rubles. This payment to the FIU must be paid no later than April 1, 2019.

The fund breakdown looks like this:

in the FIU: 26545 rubles. + 1%

in FFOMS: 5840 rubles.

The amount of insurance premiums IP 2017

In 2017, individual entrepreneurs' insurance premiums for themselves amounted to:

1% of income over 300 thousand rubles. This payment to the FIU had to be paid no later than April 1, 2018.

The fund breakdown looks like this:

in the FIU: 23,400 rubles. + 1%

in FFOMS: 4590 rubles.

Insurance premiums CBC PFR IP 2020

When paying contributions for 2018-2020, new BCCs must be indicated in the payments:

182 1 02 02140 06 1110 160 - insurance premiums in a fixed amount.

182 1 02 02140 06 1110 160 - insurance premiums 1% of income over 300 thousand rubles.

182 1 02 02103 08 1013 160 - contributions to the FFOMS.

Leave your comments and suggestions for improving this article in the comments.

Insurance premiums are obligatory payments for pension, medical and social insurance of employees and individual entrepreneurs. Since 2017, control over the calculation and payment of contributions has again been transferred to the Federal Tax Service, which until 2010 was already collecting such payments under the name UST (unified social tax).

A new chapter 34 has been introduced to the Tax Code, which regulates the calculation and payment of contributions for:

- compulsory pension insurance;

- compulsory health insurance;

- social insurance in case of temporary disability and maternity.

It is no longer necessary to pay these types of contributions to the funds, but to your tax office. Injury contributions for employees remained in the introduction of the Social Insurance Fund, nothing has changed with regard to them.

Among the payers of insurance premiums listed in Chapter 34 of the Tax Code of the Russian Federation, individual entrepreneurs are also named. An individual entrepreneur has a dual status - as an individual and as a business entity. An individual entrepreneur is his own employer, therefore the obligation to provide himself with a pension and health insurance falls on him.

Who should pay insurance premiums

The procedure for calculating and paying mandatory insurance premiums causes a lot of controversy. Entrepreneurs who do not conduct activities or do not receive profit from it believe that the payment of mandatory insurance premiums in such situations is not justified. The state proceeds from the fact that a person who continues to be listed in the state register of individual entrepreneurs, despite the lack of activity or profit from it, has his own reasons. Relatively speaking, no one prevents him, due to lack of income, to stop doing business, deregister, and, if necessary, register again.

Judicial instances, including higher ones, always indicate that the obligation to pay insurance premiums arises for an individual entrepreneur from the moment he acquires such status and is not related to the actual implementation of activities and receipt of income.

Calculation of insurance premiums for individual entrepreneurs

An individual entrepreneur is obliged to pay insurance premiums for himself all the time while he has the status of a business entity, with the exception of grace periods for non-payment.

Article 430 of the Tax Code of the Russian Federation allows individual entrepreneurs not to pay insurance premiums for mandatory pension and medical insurance if they are temporarily not operating in the following cases:

- passing military service by conscription, caring for a child under one and a half years old, a disabled child, a disabled person of the 1st group, elderly people over 80 years old;

- living with a spouse - a military man under a contract in the absence of employment opportunities for a total of up to five years;

- living abroad with a spouse sent to the diplomatic missions and consulates of the Russian Federation (also no more than five years).

The absence of activity during such periods must be documented, and the suspension of the payment of contributions must be submitted to your IFTS.

If an individual entrepreneur is entitled to a benefit, but continues to receive income from entrepreneurial activity, then he must pay insurance premiums on a general basis.

And now the most important thing - what amounts of mandatory IP contributions are we talking about? For himself in 2019, an individual entrepreneur must transfer payments only for mandatory pension and medical insurance. The transfer of social insurance contributions to receive sick leave and maternity payments is made by the IP on a voluntary basis.

IP insurance premiums in 2019 no longer depend on the size of the minimum wage (minimum wage), but are fixed amounts approved by the Government:

- Contributions for compulsory health insurance (CHI) - 6 884 rubles per year.

- Contributions for compulsory pension insurance (MPI) are partially differentiated and consist of a fixed amount of 29 354 rubles and an additional fee.

- An additional contribution is paid if the income of the individual entrepreneur is more than 300 thousand rubles per year. It is calculated as 1% from the amount of income exceeding this limit.

Insurance premium calculator for 2019:

It is necessary to pay insurance premiums in the amount of: - p.

The payout is made up of:

✐Example ▼

Suppose that an entrepreneur received income in the amount of 1,200,000 rubles in 2019. Calculate the amount of IP insurance premiums payable:

- pension insurance contributions will be calculated as follows: 29,354 + ((1,200,000 - 300,000) * 1%) = 38,354 rubles.

- health insurance contributions will remain at the same level and amount to 6,884 rubles at any income level.

Total: the total amount of insurance premiums for yourself in this example is 45,238 rubles.

An upper limit on the amount of contributions to the OPS has also been introduced - in 2019 this amount cannot exceed the figure of 234,832 rubles.

The above formulas showed the calculation of the cost of a full insurance year, but if the entrepreneur was not registered at the beginning of the year or ceased operations before its end, then all calculated amounts are proportionally reduced. In these cases, only full months and calendar days (with an incomplete month) in which a person had the status of an entrepreneur should be taken into account.

Let's summarize:

- In 2019, individual entrepreneur contributions for themselves with an annual income not exceeding 300 thousand rubles, including in the absence of activity or profit from it, will amount to 36,238 rubles, based on: 29,354 rubles of contributions to the OPS plus 6,884 rubles of contributions to compulsory medical insurance .

- If the amount of income exceeds 300 thousand rubles, then the amount payable will be 36,238 rubles plus 1% of income exceeding 300 thousand rubles.

What is considered income when calculating insurance premiums

The determination of income for calculating IP contributions depends on

- - sales income and non-operating income excluding expenses, including when applying

In our service, you can absolutely free of charge prepare a notification of the transition to the simplified tax system for individual entrepreneurs (relevant for 2019):

- on - imputed income, calculated taking into account the basic profitability, physical indicator and coefficients;

- na - potential annual income, on the basis of which the cost of the patent is calculated;

- on - income taken into account for tax purposes, without deducting expenses;

- on - income received from entrepreneurial activity, .

If an individual entrepreneur combines tax regimes, then incomes from different regimes are summed up.

To choose the most profitable taxation system specifically for your business, we recommend using the free advice of professionals who will help you choose a regime with minimal payments.

Deadlines for payment of insurance premiums

The entrepreneur must pay insurance premiums for himself in terms of income not exceeding 300 thousand rubles (that is, the amount of 36,238 rubles) before December 31 of the current year. At the same time, it is worth taking the opportunity to reduce, in some cases, the amount of accrued taxes by making insurance premiums on a quarterly basis, which will be discussed in more detail in the examples.

Please note: there is no such thing as "insurance premiums for IP for the quarter." The main thing is to pay the entire amount of 36,238 rubles by December 31 of the current year in any installments and at any time. The breakdown of the specified amount into four equal parts is used only for conditional examples.

For example, if on the simplified tax system you do not expect income in the first and (or) second quarter, then there is no point in rushing to pay contributions. It may be better for you to pay 3/4 or even the entire annual amount in the third or fourth quarter, when significant income is expected. And vice versa - if the main income is expected only at the beginning or middle of the year, then the main amount of contributions must be paid in the same quarter.

The essence of the opportunity to reduce the accrued single tax is that in the quarter in which a significant advance tax payment is expected, you can take into account the amount of insurance premiums paid in the same quarter. In this case, the contributions must be transferred before you calculate the amount of the single tax payable.

As for UTII, there is no concept of zero declarations for imputed tax for it. If you are a payer of this tax, then the lack of income will not be a reason for not paying it. You will still have to pay the imputed tax calculated according to a special formula at the end of the quarter based on the quarterly declaration. For just and it will be reasonable to pay insurance premiums every quarter in equal installments, if the quarterly amount of imputed income does not change.

An additional amount equal to 1% of annual income exceeding 300 thousand rubles must be transferred before July 1, 2020 (previously, the deadline was until April 1 of the year following the reporting year). But if the limit is already exceeded at the beginning or middle of the year, then these additional contributions can be made earlier, because. they can also be taken into account when calculating taxes. The same rule applies here - tax reduction due to contributions paid in the same quarter before tax payable is calculated.

Insurance premiums for individual entrepreneurs with employees

Becoming an employer, in addition to contributions for himself, the entrepreneur must pay insurance premiums for his employees.

In general, the amount of insurance premiums for employees under employment contracts is 30% of all payments in their favor (except for those that are not subject to taxation for this purpose) and consist of:

- contributions for compulsory pension insurance of employees of the OPS - 22%;

- compulsory social insurance contributions OSS - 2.9%;

- contributions for compulsory health insurance CHI - 5.1%.

Additionally, a contribution is paid to the FSS for compulsory insurance against industrial accidents and occupational diseases - from 0.2% to 8.5%. According to civil law contracts, the remuneration to the contractor is subject to mandatory insurance premiums for the compulsory health insurance (22%) and compulsory medical insurance (5.1%), and the need for social insurance contributions must be provided for by contractual terms.

After the amount of the amounts paid to the employee from the beginning of the year exceeds the maximum value of the base for calculating insurance premiums (in 2019 it is 1,150,000 rubles), the payment rates for the OPS are reduced to 10%. The maximum value of the base for calculating insurance premiums for OSS in 2019 is 865,000 rubles, after which contributions for sick leave and maternity are not accrued.

Unlike individual entrepreneur contributions for oneself, insurance premiums for employees must be paid monthly, no later than the 15th day of the month following the settlement month.

If you need help in choosing the types of activities that involve the lowest insurance premiums for employees, we advise you to use the free consultation of our specialists.

Interestingly, an entrepreneur has the right to be an employee of another individual entrepreneur, but cannot draw up a work book for himself. At the same time, the insurance premiums paid for him, as for an employee, do not exempt the individual entrepreneur from paying contributions for himself.

How to reduce the amount of taxes payable through insurance premiums

One of the advantages when choosing the organizational and legal form of an individual entrepreneur, in comparison with an LLC, is the ability to reduce the accrued tax on the transferred insurance premiums. The amounts of possible tax reductions payable will differ depending on the tax regime chosen and the availability of employees.

Important: the amounts of insurance premiums for individual entrepreneurs, calculated above, cannot be reduced, but in some cases, due to the contributions paid, it is possible to reduce the amount of taxes themselves.

It is possible to reduce the accrued tax itself only on the regimes of the simplified tax system "Income" and UTII, and to reduce the tax base, i.e. the amount with which the tax will be calculated can be used on the simplified tax system “Income minus expenses”, unified agricultural tax and on the OSNO. Entrepreneurs working only on the patent system, without combining regimes, cannot reduce the cost of a patent by the amount of insurance premiums. This applies to individual entrepreneur contributions both for themselves and for employees.

Our experts can help you choose the most favorable tax regime and suggest how to reduce insurance premiums correctly.

IP contributions to the simplified tax system with the object of taxation "Income"

Entrepreneurs in this mode, who do not have employees, have the right to reduce the accrued single tax by the entire amount of contributions paid (Article 346.21 of the Tax Code of the Russian Federation). This does not need to be notified to the tax authorities, but it is necessary to reflect the paid contributions in the Book of Accounting for Income and Expenses and in the annual tax return under the simplified tax system. Let's look at some simplified examples.

✐Example ▼

1. An individual entrepreneur using the USN "Income" tax system and working independently received an annual income of 380,000 rubles. The calculated tax amounted to 22,800 rubles. (380,000 * 6%).During the year, 36,238 rubles were paid. insurance premiums, i.e. only a fixed amount (an additional contribution of 1% of income over 300,000 rubles will be transferred by the IP until July 1 of the next year). The entire amount of the single tax can be reduced by the contributions paid, so there will be no tax payable at the end of the year at all (22,800 - 36,238<0).

2. The same entrepreneur received annual income in the amount of 700,000 rubles. The accrued single tax amounted to 42,000 rubles (700,000 * 6%), and the contributions paid quarterly during the year - 40,238 rubles, at the rate of (36,238 + 4,000 ((700,000 - 300,000) * 1%) .The amount of tax payable will be only (42 000 - 40 238) = 1 762 rubles.

3. If an entrepreneur uses hired labor in this mode, then he has the right to reduce the accrued single tax at the expense of the amounts of contributions paid (while taking into account contributions for himself and for employees) by no more than 50%.

The IP discussed above with an annual income of 700,000 rubles. has two employees and paid 80,000 rubles as contributions for himself and for them.The accrued single tax will amount to 42,000 rubles. (700,000 * 6%), while it can only be reduced by 50% if there are employees, i.e. for 21,000 rubles. The remaining 21,000 rubles. single tax must be transferred to the budget.

Contributions of an individual entrepreneur using UTII

Individual entrepreneurs on UTII without employees can reduce the tax on the entire amount of contributions paid in the same quarter (Article 346.32 of the Tax Code of the Russian Federation). If hired labor is used, then until 2017 it was allowed to take into account only contributions paid for employees, and in the amount of not more than 50% of the tax. But in 2019, the procedure for reducing the quarterly tax on UTII due to contributions is exactly the same as on the simplified tax system Income, i.e. Individual entrepreneurs have the right to take into account the contributions paid for themselves.

When using taxation in the form of UTII, the tax is calculated for each quarter separately. In the quarter in which wage labor was not used, the tax can be reduced to 100%. And in the quarter when hired workers were involved, the tax is reduced only to 50%. Thus, an important condition for reducing the tax payable on the simplified tax system "Income" and UTII is the transfer of contributions quarterly and before the tax itself is paid.

Individual entrepreneur contributions when combining the simplified tax system and UTII

When combining such regimes, it is necessary to pay attention to the workers employed in these types of activities. If there are no employees in the “simplified” activity, but in the “imputed” one they are accepted into the state, then the STS tax can be reduced by individual entrepreneur contributions for themselves, and the UTII tax can only be reduced to 50% by the amount of contributions transferred for employees (Letter of the Ministry of Finance No. 03-11-11/130 of 04/03/2013).

And, conversely, in the absence of employees on UTII, individual entrepreneur contributions for themselves can be attributed to a reduction in the “imputed” tax, and the “simplified” tax can be reduced to 50% by the amount of contributions for employees (clarifications of the Ministry of Finance No. 03-11-11 / 15001 dated 04/29/2013).

According to Art. 346.18 of the Tax Code, when combining special regimes, taxpayers must keep separate records of income and expenses, which can be quite complicated and require contact with specialists.

Individual entrepreneur contributions when combining the simplified tax system and a patent

It has already been said above that entrepreneurs on the patent taxation system cannot reduce its cost by the amount of contributions. In the case of combining the simplified tax system and a patent, an entrepreneur who does not have employees can reduce the amount of a single tax on simplified activities by the entire amount of insurance premiums paid for himself (letter of the Federal Tax Service of Russia dated February 28, 2014 No. GD-4-3 / [email protected]).

IP on the simplified tax system "Income minus expenses"

Entrepreneurs in this mode take into account the contributions paid in expenses, thereby reducing the tax base for calculating the single tax. In expenses, you can take into account both individual entrepreneur contributions for themselves and contributions for employees. They cannot reduce the tax payable itself, so the saved amounts will be less than on the simplified tax system “Income”.

IP on the general taxation system

These entrepreneurs include the paid contributions in their expenses and, thus, reduce the amount of income from which personal income tax will be charged.

IP reporting on insurance premiums

An individual entrepreneur who does not have employees should not submit reports on the payment of insurance premiums for himself. In 2019, an individual entrepreneur - an employer must submit the following reports, which reflect the amounts of contributions transferred for their employees:

- in the Pension Fund on a monthly basis, according to the form - no later than the 15th day of the month following the reporting month;

- in the FSS quarterly in the form - no later than the 20th day of the month following the reporting quarter;

- in the IFTS quarterly in the form - no later than the end of the next month after the end of the reporting quarter;

- in the IFTS quarterly in the form - no later than the 30th day of the next month after the end of the reporting quarter;

- in the IFTS once a year in the form 2-NDFL - no later than April 1 for the previous year.

Responsibility of individual entrepreneurs for non-payment of insurance premiums

In 2019, the following sanctions are provided for failure to submit reports and late payment of insurance premiums:

- Failure to submit the calculation within the prescribed period - 5% of the amount of contributions not paid on time, payable, for each full or incomplete month from the day set for its submission, but not more than 30% of the amount and not less than 1000 rubles (Article 119 (1 ) Tax Code of the Russian Federation).

- Gross violation of accounting rules, resulting in an underestimation of the base for calculating insurance premiums - 20% of the amount of unpaid insurance premiums, but not less than 40,000 rubles (Article 120 (3) of the Tax Code of the Russian Federation).

- Non-payment or incomplete payment of insurance premiums as a result of understating the base of their calculation, other incorrect calculation of insurance premiums or other illegal actions (inaction) - 20% of the unpaid amount of insurance premiums (Article 122 (1) of the Tax Code of the Russian Federation).

- Deliberate non-payment or incomplete payment of premiums - 40% of the unpaid amount of insurance premiums (Article 122 (3) of the Tax Code of the Russian Federation).

- Failure to submit within the prescribed period or submission of incomplete or false information of personalized reporting to the FIU - 500 rubles in respect of each insured person (Article 17 No. 27-FZ)

If you want to avoid unfortunate financial losses, you need, first of all, to properly organize bookkeeping. So that you can try the option of outsourcing accounting without any material risks and decide whether it suits you, we, together with 1C, are ready to provide our users month of free accounting services.

2020

The IP contribution no longer depends on the minimum wage and is determined for 3 years in advance: 2018, 2019, 2020 - 32,385, 36,238, 40,874 rubles. (Federal Law No. 335-FZ of November 27, 2017).

2019

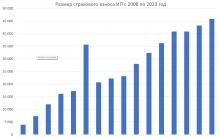

| 2008 3 864 rub. | year 2009 RUB 7,274.4 | 2010 RUB 12,002.76 | 2011 RUB 16,159.56 | year 2012 RUB 17,208.25 |

year 2013 RUB 35,664.66 |

year 2014 RUB 20,727.53 (+1% of income) |

The website provides a full calculation of the fixed payment of the IP (insurance premium) for 2008-2020 to the Pension Fund of the Russian Federation.

Select reporting year:

the three-year limitation period does not apply to the FIU! For such contributions, the requirement for payment is presented "no later than three months from the date of detection of arrears" (Article 70 of the Tax Code of the Russian Federation). Arrears can be identified for any period.

Dates

Select reporting period:

You need to select a reporting period. If this year an individual entrepreneur was registered or closes, you need an incomplete period. Also, by selecting an incomplete period, you can calculate the monthly payment:

The first day of IP registration is taken into account inclusive (Article 430, Clause 3 of the Tax Code of the Russian Federation). Those. according to the law, if registration, for example, is on the 15th, then it is necessary to count the insurance premiums of individual entrepreneurs starting from the 15th, inclusive.

Contributions for individual entrepreneurs have always been paid and are being paid with kopecks (Article 431, Clause 5 of the Tax Code of the Russian Federation).

Result..Total must be paid:

You can also calculate individual entrepreneur contributions and generate receipts / payments.

Reduction of taxes for individual entrepreneurs on contributions

| tax regime | Entrepreneurs working without employees | Entrepreneurs working with employees | Base |

|---|---|---|---|

| USN (object of taxation "income") | You can reduce the single tax by the entire amount of paid insurance premiums in a fixed amount | You can reduce the single tax by no more than 50 percent. Contributions paid by the entrepreneur for hired employees and for own insurance are accepted for deduction. | sub. 1 p. 3.1 art. 346.21 of the Tax Code of the Russian Federation |

| Payment for the year can be used: for 1 quarter - no more than 1/4, for half a year - no more than 1/2, for 9 months - no more than 3/4 of the annual amount of contributions, for the year - the entire amount of insurance premiums of individual entrepreneurs. See USN calculator + declaration For many, it is difficult to calculate the simplified tax system together with the PFR deduction and divide it by quarters. Use this automated simplification form in Excel (xls). In the form, 2017 is already ready with an additional IP insurance premium. |

|||

| STS (object of taxation "income minus expenses") | You can reduce your income by the entire amount of paid insurance premiums. | paragraph 4 of Art. 346.21 and sub. 7 p. 1 art. 346.16 of the Tax Code of the Russian Federation | |

| UTII | You can reduce the single tax by the entire amount of paid insurance premiums in a fixed amount | UTII can be reduced by no more than 50 percent. The contributions paid by the entrepreneur for employees, benefits and for their own insurance are accepted for deduction (from 13 to 17 years old, it was impossible to reduce their contributions with employees) | sub. 1 p. 2 art. 346.32 of the Tax Code of the Russian Federation |

| Patent | The value of the patent does not decrease | Art. 346.48 and 346.50 of the Russian Tax Code | |

| BASIC | Individual entrepreneurs on OSNO have the right to include a fixed payment in the composition of personal income tax expenses | NK Art. 221 | |

2018, 2019 and 2020

In 2018 RUB 32,385 (+15.7%)

In 2019 RUB 36,238(+11.9%)

In 2020 RUB 40,874(+12.8%)

The amount of insurance premiums is now directly spelled out in the tax code. And even 3 years ahead - for 2018-2020.

Article 430 of the Tax Code of the Russian Federation (as amended by Federal Law of November 27, 2017 N 335-FZ):

a) point 1 shall be stated in the following wording:

"1. The payers specified in subparagraph 2 of paragraph 1 of Article 419 of this Code shall pay:

1) insurance premiums for compulsory pension insurance in the amount determined in the following order, unless otherwise provided by this article:

if the amount of the payer's income for the billing period does not exceed 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period of 2018, 29,354 rubles for the billing period of 2019, 32,448 rubles for the billing period of 2020;

if the payer's income for the billing period exceeds 300,000 rubles - in a fixed amount of 26,545 rubles for the billing period of 2018 (29,354 rubles for the billing period of 2019, 32,448 rubles for the billing period of 2020) plus 1.0 percent of the payer's income exceeding 300,000 rubles for the billing period.

At the same time, the amount of insurance premiums for mandatory pension insurance for the billing period cannot be more than eight times the fixed amount of insurance premiums for mandatory pension insurance established by the second paragraph of this subparagraph;

2) insurance premiums for compulsory health insurance in a fixed amount of 5,840 rubles for the billing period of 2018, 6,884 rubles for the billing period of 2019 and 8,426 rubles for the billing period of 2020.";

Additional interest

If you are on OSNO or STS, then you pay an additional percentage on income. If you are on PSN or UTII, be sure to check out the table below (then it is not paid from real income).

In 2020, the contribution will be: 40,874 rubles (pay before December 25). With income from 300,000 rubles (cumulative total for the year), you will need to pay an additional plus 1% (pay before July 1) from the difference (total income - 300,000 rubles), but not more than based on 8 minimum wages (for the PFR ). Those. the maximum payment will be: 8 * 32,448 = 259,584 rubles (in 2020).

In 2019, the contribution will be: 36,238 rubles (pay before December 25). With income from 300,000 rubles (cumulative total for the year), you will need to pay an additional plus 1% (pay before July 1) from the difference (total income - 300,000 rubles), but not more than based on 8 minimum wages (for the PFR ). Those. the maximum payment will be: 8 * 29,354 = 234,832 rubles (in 2019).

In 2018, the contribution will be: 32,385 rubles (pay before December 25). With income from 300,000 rubles (cumulative total for the year), you will need to pay an additional plus 1% (pay before July 1) from the difference (total income - 300,000 rubles), but not more than based on 8 minimum wages (for the PFR ). Those. the maximum payment will be: 8 * 26,545 = 212,360 rubles (in 2018).

In 2017, the contribution will be: 7,500 rubles * 12 * (26% (PFR) + 5.1% (FOMS)) = 27,990 rubles (pay before December 25). With income from 300,000 rubles (cumulative total for the year), you will need to pay an additional plus 1% (pay before July 1) from the difference (total income - 300,000 rubles), but not more than based on 8 minimum wages (for the PFR ). Those. the maximum payment will be: 8 * minimum wage * 12 * 26% = 187,200 rubles (in 2017).

Those who are late with reporting (to the tax office) also had to pay contributions to the FIU based on 8 minimum wages (until 2017). Since 2017, this norm has been canceled (letter of the Federal Tax Service of Russia dated September 13, 2017 No. BS-4-11 / [email protected]). And in July 2017, they even announced an "amnesty" for those who were late in reporting for 2014-2016, the maximum fine would be removed (see application) (PFR letter dated July 10, 2017 No. NP-30-26 / 9994).

For an additional 1% in the PFR (it only goes to the insurance part, it is not needed in the FFOMS): there are 2 options for the USN "Income"

1) Transfer 1% by December 31, 2018 and reduce the USN tax for 2018 (See Letter of the Ministry of Finance dated February 21, 2014 N 03-11-11 / 7511)

2) Transfer 1% in the period from January 1 to July 1, 2019 and reduce the USN tax for 2019 (See Letter of the Ministry of Finance dated January 23, 2017 No. 03-11-11 / 3029)

You can not read the dispute below, because. The Ministry of Finance issued the Letter of the Ministry of Finance of Russia No. 03-11-09/71357 dated 07.12.2015, in which it withdrew the letter of the Ministry of Finance of Russia dated 06.10.15 No. 03-11-09/57011. And now, at all levels, they believe that it is POSSIBLE to reduce this 1% of the simplified tax system.

Shocking news: in the letter of the Ministry of Finance of Russia dated 06.10.15 No. 03-11-09 / 57011 it is said that this 1% is not a fixed contribution at all and is not entitled to reduce the USN IP tax on it. I remind you that the position of the Ministry of Finance (especially such a windy one) is not a legislative act. Let's look at future jurisprudence. There is also a letter from the Federal Tax Service of Russia dated January 16, 2015 N GD-4-3 / 330, where the position is expressed that it is possible to reduce this 1%.

In 212-FZ, article 14 p.1. It is explicitly stated that this 1% is a fixed contribution, the position of the Ministry of Finance, expressed in the letter of the Ministry of Finance of Russia dated 06.10.15 No. 03-11-09 / 57011, contradicts this law:

1. Payers of insurance premiums specified in Clause 2 of Part 1 of Article 5 of this Federal Law shall pay the corresponding insurance premiums to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund in fixed amounts determined in accordance with Parts 1.1 and 1.2 of this Article.

1.1. The amount of the insurance premium for compulsory pension insurance is determined in the following order, unless otherwise provided by this article:

1) in the event that the amount of income of the payer of insurance premiums for the billing period does not exceed 300,000 rubles, - in a fixed amount, determined as the product of the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the insurance tariff contributions to the Pension Fund of the Russian Federation, established by clause 1 of part 2 of Article 12 of this Federal Law, increased by 12 times;

2) in the event that the amount of income of the payer of insurance premiums for the billing period exceeds 300,000 rubles - in a fixed amount, determined as the product of the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the rate of insurance premiums to the Pension Fund of the Russian Federation, established by Clause 1 of Part 2 of Article 12 of this Federal Law, increased by 12 times, plus 1.0 percent of the amount of the insurance contribution payer's income exceeding 300,000 rubles for the billing period. In this case, the amount of insurance premiums cannot exceed the amount determined as the product of eight times the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the rate of insurance premiums to the Pension Fund of the Russian Federation, established by paragraph 1 of part 2 of Article 12 of this Federal Law, magnified 12 times.

I also draw your attention to:

Article 75

8. Penalties shall not be accrued on the amount of arrears that a taxpayer (fee payer, tax agent) has incurred as a result of his fulfillment of written explanations on the procedure for calculating, paying a tax (fee) or on other issues of applying the legislation on taxes and fees given to him or an unspecified to a circle of persons by a financial, tax or other authorized body of state power (an authorized official of this body) within its competence (the indicated circumstances are established if there is an appropriate document of this body, which, in meaning and content, relates to the tax (reporting) periods for which the arrears were formed, regardless of the date of issuance of such a document), and (or) as a result of the implementation by the taxpayer (payer of the fee, tax agent) of the reasoned opinion of the tax authority sent to it in the course of tax monitoring.

Article 111

3) implementation by a taxpayer (payer of a fee, tax agent) of written explanations on the procedure for calculating, paying a tax (fee) or on other issues of applying the legislation on taxes and fees given to him or an indefinite circle of persons by a financial, tax or other authorized body of state power (authorized by an official of this body) within its competence (the said circumstances are established in the presence of an appropriate document of this body, in the sense and content relating to the tax periods in which the tax offense was committed, regardless of the date of publication of such a document), and (or) the taxpayer fee payer, tax agent) of a reasoned opinion of the tax authority sent to it in the course of tax monitoring.

You can refer to three such explanations. They are higher.

With UTII, this 1% can be paid until the end of the quarter and then reduce UTII.

Table according to which an additional 1% is calculated (under various tax regimes)|

Tax regime |

Where is the income |

||

|---|---|---|---|

|

Reason: Part 8 of Article 14 of the Federal Law of July 24, 2009 No. 212-FZ as amended by Federal Law of July 23, 2013 No. 237-FZ. If you use two or three systems (for example, simplified tax system + UTII), then the income from these systems must be taken in total for all systems. |

|||

|

(business income) |

Income subject to income tax. Calculated in accordance with Article 227 of the Tax Code of the Russian Federation However, costs can be accounted for based on this. Also, when calculating income for calculating 1%, professional tax deductions can be taken into account (Letter of the Ministry of Finance of Russia dated May 26, 2017 N 03-15-05 / 32399) |

Declaration 3-NDFL; clause 3.1. Sheet B. In this case, expenses are not taken into account. |

|

|

Income subject to the Single Tax. Calculated in accordance with Article 346.15 of the Tax Code of the Russian Federation The latest letters indicate that 1% of additional contributions should be considered only from income (letter of the Ministry of Finance dated February 12, 2018 No. 03-15-07 / 8369) (letter of the Federal Tax Service dated February 21, 2018 No. Federal Tax Service of January 21, 2019 No. BS-4-11/799. |

For many, it is difficult to calculate the USN tax along with the PFR deduction. Use this automated simplification form in Excel. The form has all the years, taking into account the additional contribution of IP. For earlier years, there is also - in the same place. |

||

|

patent system |

Potential income. Calculated in accordance with Articles 346.47 and 346.51 of the Tax Code of the Russian Federation |

Income from which the cost of a patent is calculated. In this case, expenses are not taken into account. |

|

|

Implied income. Calculated in accordance with Article 346.29 of the Tax Code of the Russian Federation |

The result of column 4 of the Book of income and expenses. In this case, expenses are not taken into account. |

||

If the IP was closed and opened in the same year?

Then the periods are considered separately, as unrelated. Those. for one period, a deduction of 300 tr is given. and for the second period of work of the IP, they also give a deduction of 300 tr (Letter of the Ministry of Finance dated February 6, 2018 No. 03-15-07 / 6781). However, we do not recommend using this loophole on purpose. You will receive a maximum of 3000 r, minus all duties, and then 1500 r. Time and nerves to spend ten times more.

An example of income is 1,000,000 rubles. 27,990 rubles: pay before December 25, 2017 (this is with any income). Plus 1% of the difference (1,000,000 - 300,000) = 7,000 rubles to pay additionally before July 1, 2018 for the insurance part of the PFR.

Constitutional Court ruling

Its essence is that individual entrepreneurs on OSNO, when calculating an additional contribution (1% percent of income) to the Pension Fund, can take into account expenses. Prior to this, individual entrepreneurs on any system calculated an additional contribution from their income. The decision applies only to individual entrepreneurs on OSNO, however, individual entrepreneurs in other systems can also refer to it, proving their case through the court.

Reporting

The payment term in the pension is from January 1 to December 31 of the reporting year. The deadline for paying an additional 1% is from January 1 of the current year to April 1 (from 2018 (for 2017) - until July 1) of the next year.

You can pay the fee in instalments. For example, with UTII you need (with the simplified tax system it is desirable) to pay quarterly in order to deduct from the tax.

In case of non-payment of the IP payment to the FIU on time, it is provided fine in the amount of 1/300 multiplied by the refinancing rate per day. Penalty calculator

Since 2012, the individual entrepreneur has not submitted reports to the FIU (except for the heads of peasant farms). For 2010 there was RSV-2, formerly ADV-11.

Payment

KBK

Why is the BCC of a conventional PFR and in order to exceed 300 tr. match with 2017? We have been paying for one BCC since 2017 - they are the same (letter of the Ministry of Finance dated 04/07/2017 No. 02-05-10 / 21007).

The KBC's are right here.

On February 22, 2018, a new BCC was introduced for payments over 1% of insurance premiums - 182 1 02 02140 06 1210 160 (order No. 255n dated December 27, 2017). However, later it was canceled (order No. 35n dated February 28, 2018). For an additional percentage, the BCF does not change.

| Payment type | Until 2017 (for any year - 2016, 2015, etc.) | After 2017 (for any year - 2017, 2018, 2019, etc.) |

|---|---|---|

| Insurance premiums for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 182 1 02 02140 06 1100 160 | 182 1 02 02140 06 1110 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation from incomes exceeding 300,000 rubles. | 182 1 02 02140 06 1200 160 | 182 1 02 02140 06 1110 160 |

| Insurance premiums for health insurance of individual entrepreneurs for themselves in the FFOMS in a fixed amount (based on the minimum wage) | 182 1 02 02103 08 1011 160 | 182 1 02 02103 08 1013 160 |

How long to keep payments? Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law of July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia of August 25 .2010 N 558)

Ways

There are four ways:

Video

I invite you to watch my short video about the IP insurance premium.

Right not to pay

This right exists only with zero income for the year, so there is almost no sense from it.

Since 2017, the right not to pay contributions has been retained. However, it is regulated by other laws.

Since 2013, you can not pay fixed contributions for the following periods:

However, if no business activity was carried out in the above periods (parts 6-7 of article 14 of Law 212-FZ), it is necessary to submit documents confirming the absence of activity in the indicated periods. Those. all the conditions above must be, and also the income must be zero. In this case, it is easier to close the IP.

If I am employed?

You are obliged to pay individual entrepreneur contributions to the FIU even if the employer pays contributions for you under an employment or civil law contract. This issue is not controversial from a legislative point of view and the chances of challenging it in court are zero. See Letter of the Ministry of Finance of Russia dated February 19, 2019 No. 03-15-05/10358.

It does not make sense to pay voluntary contributions to the FSS IP if you are employed.

How to calculate taxes and insurance premiums is stipulated in the Tax Code. Chapter 34 explains the procedure for deriving contribution obligations for compulsory types of insurance for individuals. The injury contribution does not fall within the sphere of influence of the Tax Code of the Russian Federation, it remained under the jurisdiction of the FSS. Contributors are:

- Employers represented by companies or individual entrepreneurs. They calculate liabilities to the budget from the earnings of hired personnel, taking into account the upper limits of taxation of contributions. To compare the amount of income with the limits, the total salary accrued to a person since the beginning of the current year is taken.

- Individual entrepreneurs who pay contributions for themselves. For them, in 2018, fixed tariffs are provided, which are fixed by Art. 430 of the Tax Code of the Russian Federation.

How to calculate insurance premiums

In 2018, for insurance premiums, there is no link between the amount of payment and the value of the minimum wage. When accruing pension obligations, two tariffs are applied:

- if the income of the entrepreneur at the end of the year did not exceed the limit equal to 300,000 rubles, then you only need to pay a fixed rate of 26,545 rubles. (the value of this indicator will be increased next year);

- if the total income of the IP turned out to be more than the legally stipulated limit according to the results of the annual interval, you must pay a fixed amount and an additional 1% of the excess amount.

There is a maximum limit for pension contributions - it is 8 fixed amounts of payments in force in the reporting period. That is, in 2018, the entrepreneur will pay no more than 212,360 rubles for pension insurance. (8 x 26545). For medical insurance, the tariff is 5840 rubles.

How to calculate insurance premiums if a private merchant did not work all year - the answer is given in paragraphs 3-5 of Art. 430 of the Tax Code of the Russian Federation. Fixed payments for an incomplete billing period are displayed in proportion to the number of months during which the IP actually worked. The calculation is based on calendar months, the countdown starts from the month in which the entrepreneur registered the start of business activities.

In situations where the billing period turned out to be incomplete due to the termination of commercial activities by the entrepreneur, when deriving the length of hours worked, the months are taken into account by the calendar month in which the record of termination of activity appeared in the USRIP database. If the individual entrepreneur is not registered from the beginning of the year and there is an incomplete month in the billing period, the amount of contributions for the partially worked monthly interval is determined in proportion to the number of days worked in calendar terms. The calculation should take into account the dates when the entrepreneur registered with the Federal Tax Service, when he officially ceased operations.

Examples of calculating contributions if the IP was not registered from the beginning of the year

Suppose an entrepreneur registered with the Federal Tax Service on March 1, 2018 and worked until the end of the year. Only full months are present in the calculation interval. A fixed payment of contributions must be withdrawn for 10 months of 2018:

- For pension insurance. First, the amount of the contribution per one calendar month is calculated - 2212.08 rubles. (26545/12). At the next stage, the final value of the contribution for hours worked in 2018 is calculated - 22,120.80 rubles. (2212.08 * 10).

- For medical insurance. The monthly contribution is 486.67 rubles. (5840 / 12), for the incompletely worked out year 2018, you have to pay 4866.70 rubles. (486.67 * 10).

How to calculate taxes and contributions if there is an incomplete calendar month in the billing period? For example, an individual entrepreneur registered in March, but not on the 1st day, but on the 12th. In this situation, there will be 9 full months, and 1 incomplete month (March). For March, you need to make a calculation by day. The final calculations will be as follows:

- For pension insurance. For 9 months you have to pay 19,908.75 rubles. (26,545 / 12 x 9). For March, the amount of 1427.15 rubles is subject to payment. (26 545 / 12 / 31 x (31 - 11)). The total amount of pension contributions is 21,335.90 rubles. (1427.15 + 19908.75).

- For medical insurance. For 9 months, payment is subject to 4380 rubles. (5840 / 12 x 9). March commitments for contributions amount to 313.98 rubles. (5480 / 12 / 31 x (31-11)). The total amount is 4693.98 rubles. (4380 + 313.98).

IP insurance premiums in 2017

From the moment of obtaining their status, individual entrepreneurs are required to transfer contributions to their own pension and health insurance. This is the only category of citizens in Russia that does it on its own.

For all employees, deductions to extra-budgetary funds are made by the employer. This amount is not withheld from the employee's salary (like personal income tax 13%), but is paid from the company's own funds in excess of the salary.

An individual entrepreneur is not an employee, he does not pay himself a salary. As his income is the profit received from entrepreneurial activity. It is not the basis for calculating the amount of contributions to the FIU. Therefore, a special accrual procedure applies to entrepreneurs.

An individual entrepreneur is not an employee, he does not pay himself a salary. As his income is the profit received from entrepreneurial activity. It is not the basis for calculating the amount of contributions to the FIU. Therefore, a special accrual procedure applies to entrepreneurs.

Since 2014, contributions to the PFR consist of two parts: fixed and paid from incomes over 300,000 rubles.

With regard to the fixed part of insurance premiums, there are 2 most important rules:

- They begin to accrue from the moment of registration of IP.

- They must be paid to all entrepreneurs without exception, regardless of whether they were operating or not. Many individual entrepreneurs mistakenly believe that since they did not manage to get their first profit, then they are not required to pay contributions. In fact, the lack of income or losses do not relieve from the obligation to make contributions to off-budget funds.

The basis for calculating fixed pension taxes for entrepreneurs is the minimum wage for the current year. In this case, we are talking about the federal minimum wage, which is the same for all Russian regions. Every year, the government indexes the minimum wage, which leads to an increase in the amount of contributions to the PFR.

The rate for paying pension payments for individual entrepreneurs is 26% in the PFR and 5.1% in the MHIF. If the MHIF establishes a single tariff for employees and the self-employed population, then in the Pension Fund of the Russian Federation it is higher for individual entrepreneurs than for employees (for them, contributions are charged at a rate of 22%). Pension contributions are no longer divided into funded and insurance parts, as there is a moratorium on the funded component.

For the whole of 2016, entrepreneurs must pay 23,153.33 rubles. (of which 3,796.85 rubles - in the MHIF, and the rest - in the Pension Fund) and another 1% of income over 300 thousand rubles. As a result, each IP will pay its own amount of contributions, which will directly depend on the success of entrepreneurial activity. Additional contributions are transferred only to the Pension Fund.

For the whole of 2016, entrepreneurs must pay 23,153.33 rubles. (of which 3,796.85 rubles - in the MHIF, and the rest - in the Pension Fund) and another 1% of income over 300 thousand rubles. As a result, each IP will pay its own amount of contributions, which will directly depend on the success of entrepreneurial activity. Additional contributions are transferred only to the Pension Fund.

For example, an individual entrepreneur earned 1.5 million rubles in 2016. He must transfer to the FIU 23,153.33 rubles. and 12,000 rubles. additionally from excess income (1500000-300000) * 1%)).

It should be understood that the income is the entire profit of the entrepreneur for the year without reducing the costs incurred. This is true for STS-income, STS-income-expenses and OSNO. For “imputation” and “patent”, the possible, or imputed, income is involved in the calculation.

If an entrepreneur combines several taxation systems, then the income received under each of them must be added up.

Legislators also provided for a limit on insurance premiums, more than which individual entrepreneurs will not pay in any case. In 2016, it is 158,648.69 rubles. The specified maximum value of deductions will have to be paid by businessmen who do not submit a tax return by the due date. Therefore, it is important to report to the Federal Tax Service on time.

Until December 31, 2016, entrepreneurs need to pay a fixed part of taxes, for the additional part, the deadline is set for April 1, 2017.

Back to index

Partial year insurance premiums

The procedure for calculating IP insurance premiums for an incomplete year is relevant for the following categories of businessmen:

The procedure for calculating IP insurance premiums for an incomplete year is relevant for the following categories of businessmen:

- those who opened their business not from the beginning of the year;

- having a temporary exemption from paying contributions (for the period of parental leave, military service, for the period of caring for a disabled child, etc.);

- when the IP is closed in the middle of the year.

In the above situations, payments are calculated in proportion to the number of days (months) during which business activities were carried out.

The calculation of insurance premiums for individual entrepreneurs for an incomplete year can be divided into 2 stages:

- For fully worked calendar months, the calculation is carried out according to the formula: minimum wage * 26% (or 5.1% for FFOMS) * number of full months.

- For incomplete months, you need to divide the number of days worked by the total number of days in the month and multiply this value by the tariff and the minimum wage.

In 2016, the minimum wage is 6204 rubles. Despite the fact that since July 2016 the minimum wage has been indexed to 7500 rubles, pension contributions are calculated according to the value in force at the beginning of the year: 6204 rubles.

Based on the indicated value, every month the entrepreneur must transfer 1613.04 (6204 * 26%) to the FIU and 316.40 rubles. (6204 * 5.1%) in the FFOMS.

Let's give an example of calculating insurance premiums for individual entrepreneurs for an incomplete year. For example, citizen Ivanov received the status of an entrepreneur on March 12, 2016. The number of fully worked months is 9. During this period, Ivanov will have to transfer 14,517.36 rubles. (9 * 6024 * 26%) in the FIU and 2747.36 rubles. (9*6204*5.1%) in the MHIF. The payment calculation for March will look like this: 6204*19/31*26%+6204*19/31*5.1%. This means that the amount payable for March will be 988.64 + 193.93 = 1182.57 rubles.

Additional deductions do not depend on the number of months worked by the individual entrepreneur, but only on the amount of revenue received.

It is worth noting that the Pension Fund usually sends ready-made payments to entrepreneurs with the amount indicated in them for payment. In some FTS, receipts are issued along with documents for registration of individual entrepreneurs. Therefore, the entrepreneur does not need to make independent calculations.

USN: changing the object of taxation

How to switch to STS from the general taxation system

How to switch to STS from the general taxation system

How to change the phone number associated with a Sberbank card

MasterCard Gold from Sberbank: advantages and disadvantages of a gold card