At the time of opening their business, entrepreneurs register with the tax authorities and begin to transfer taxes and contributions to the state, determined by the taxation scheme they have chosen. For many entrepreneurs, a situation arises when, for various reasons, it is necessary to stop their activities for a long time. When an entrepreneur does not work, he does not receive income. This raises reasonable questions: “IP does not operate, what taxes to pay? If an individual entrepreneur has no income, do I need to pay taxes? Even in the event of a temporary cessation of activity, that is, if the entrepreneur plans to resume business, say, for several months or years?”

The need to transfer taxes depends on the taxation system chosen by the individual entrepreneur. In some taxation systems, certain types of taxes are paid even in the absence of activity. But the filing of tax returns with the IFTS is mandatory, in any case, whether the activity is carried out or not.

The decisive conditions for the payment of taxes are: the factor due to which the activity is suspended, and the amount of time allotted for such a break. In some cases, transfers can be avoided. This article will consider all types of payments, analyze the need to pay them to the state: “Do I need to pay tax if the individual entrepreneur does not operate?”

Pension payments

For all individual entrepreneurs, without exception, with any taxation system, fixed payments to the pension fund of the Russian Federation are mandatory. They are also called "payments for themselves." The legislation establishes the amount of such payments, which is indexed annually. They begin to list them from the moment the IP registered, and end after the liquidation of the IP.

The amount of payments in the PF is the same for any entrepreneur. The type of activity and interruptions associated with it also do not affect these payments. In the event of a temporary stoppage of activities, the payment will still need to be transferred.

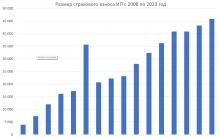

The amount of contributions to the pension fund for individual entrepreneurs has a clear dependence on the amount of their income for the year. This amount is calculated based on the minimum wage established by law at the beginning of the current year, in 2017 it is equal to 7,500 rubles. PF contributions account for 26% of the annual minimum wage. In 2017, if the income for the year is no more than 300 thousand rubles, then the amount of the pension contribution will be 23,400 rubles. If the income of an individual entrepreneur for the year overcomes the mark of 300 thousand rubles, then 1% of the excess amount is also paid, but not more than 163,800 rubles. Terms of payment of contributions: for the main payment - no later than 31.12.2017, for the additional - until 01.04.2018.

Avoiding the transfer of pension contributions will not work completely. But for the period of suspension of activities in a number of situations listed below, this is possible. These options are:

- Call service. The following documents confirm the right to remove the obligation to pay contributions: a military ID with service marks, a certificate from the military commissariat, a work book, tax returns confirming that there is no commercial activity. All this is provided to the pension inspector in the Pension Fund.

- Caring for a child up to 1.5 years. Either parent has the right to take care of a child: either the mother or the father. If the family has 2 or more children under 1.5 years old, then the period of parental leave is extended until each of them reaches this age. Supporting documents can be birth certificates of children, certificates from the housing department on family composition, certificates from the Social Insurance Fund or social protection authorities, tax returns confirming that there is no activity.

- Caring for a disabled person of the 1st group, a disabled child or a person who has reached the age of 80. The pension inspector is provided with the following exemption documents: certificates of disability, birth certificates of persons being cared for, certificates from the housing department on family composition and tax returns confirming that there is no commercial activity.

In 2006, I registered as an individual entrepreneur. During 2006-2008 conducted business activities, paid taxes, contributions and submitted reports. In 2008, he got a job under an employment contract in a commercial organization and was no longer engaged in entrepreneurial activities; accordingly, he did not submit personal income tax returns and did not pay contributions. Should the tax inspectorate remove me from the register as an individual entrepreneur due to my failure to carry out activities and failure to submit reports? Now the bailiffs came to me with a writ of execution on the recovery of arrears on contributions. I did not receive any demands from the Pension Fund for their payment. Is it legal to collect arrears from me on contributions? What responsibility threatens me for failure to submit reports and non-payment of insurance premiums?

Question from www.site

Termination of activity must be registered

The procedure for losing the status of an individual entrepreneur is regulated by the norms of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” (hereinafter - Law No. 129-FZ). This law does not contain provisions that allow tax authorities to deregister a citizen as an individual entrepreneur if he does not conduct entrepreneurial activities and fails to submit reports. For such reasons, tax authorities can exclude only a legal entity from the register (Article 21.1 of Law No. 129-FZ).

Termination of activities as an individual entrepreneur requires state registration (Article 22.3 of Law No. 129-FZ). Until this procedure is completed, a citizen is considered an individual entrepreneur, regardless of whether he actually conducts entrepreneurial activities or not.

In order to remove the status of an entrepreneur, you need to submit the following documents to the tax authority at the place of registration of the IP:

application in the form No. P26001, approved by order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6 / [email protected](subparagraph “a”, paragraph 1, article 22.3 of Law No. 129-FZ);

a document confirming the payment of the state duty (subparagraph “b”, paragraph 1, article 22.3 of Law No. 129-FZ). Its size is 160 rubles. (signature 7, clause 1, article 333.33 of the Tax Code of the Russian Federation);

a document confirming the submission of information to the territorial body of the FIU in accordance with subpara. 1-8 p. 2 art. 6, paragraph 2 of Art. 11 of the Federal Law of 01.04.96 No. 27-FZ “On Individual (Personalized) Accounting in the System of Compulsory Pension Insurance” and Part 4 of Art. 9 of the Federal Law of April 30, 2008 No. 56-FZ “On additional insurance premiums for funded pensions and state support for the formation of pension savings” (subparagraph “c”, paragraph 1 of article 22.3 of Law No. 129-FZ). If the document is not submitted by the applicant, the information contained in it is requested by the tax authorities to the FIU upon an interdepartmental request.

The tax authority, within five working days from the date of submission of the above documents, removes the status of an entrepreneur from an individual by making an appropriate entry in the USRIP (clauses 8, 9, article 22.3 of Law No. 129-FZ).

Contribution arrears

An individual entrepreneur is obliged to pay insurance premiums from the moment he acquires the status of an individual entrepreneur and until the moment he is excluded from the USRIP, regardless of whether he conducts business activities or not (letters of the Ministry of Labor of Russia dated 06/28/2016 No. 17-4 / OOG-995, dated 08/07/2015 No. 17-4/OOG-1133). At the same time, the fact of working under an employment contract in an organization does not matter, since in this case a citizen is an insured person for two reasons - as an individual entrepreneur and as an employee (resolution of the Arbitration Court of the Volga-Vyatka District dated December 23, 2015 No. Ф01-5231 / 2015). Thus, for the period from 2008 to the present, the IP had to pay insurance premiums.

The collection of arrears on contributions from individual entrepreneurs is carried out in the manner prescribed by Art. 19 and 20 of the Federal Law of July 24, 2009 No. 212-FZ "On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund" (hereinafter - Law No. 212-FZ). It includes three successive stages: issuing a demand for the payment of contributions, foreclosing funds on IP accounts, and collecting at the expense of IP property. The request for the payment of contributions can be sent to the IP by registered mail. In this case, it is considered received after six days from the date of sending a registered letter (part 7 of article 22 of Law No. 212-FZ). Therefore, if the fund sent a demand by registered mail, it is considered delivered, even if the individual entrepreneur did not actually receive it. The request specifies the period by which the arrears must be paid. Not later than two months after the expiration of this period, the fund forecloses on the funds of the individual entrepreneur on his bank accounts (part 5 of article 19 of Law No. 212-FZ). In case of insufficiency or absence of funds in the accounts of the individual entrepreneur or in the absence of information about these accounts, the fund has the right to collect insurance premiums at the expense of other property of the individual entrepreneur (part 14 of article 19 of Law No. 212-FZ). In this case, the head of the fund sends the bailiff - executor a resolution on the collection of contributions for execution in the manner prescribed by Federal Law No. 229-FZ of October 2, 2007 "On Enforcement Proceedings" (part 2 of article 20 of Law No. 212-FZ). Thus, the collection of insurance premiums under the executive document is justified.

It should be borne in mind that for non-payment of insurance premiums, a fine of 20% of the unpaid amount is provided (part 1 of article 7 of Law No. 212-FZ). Entrepreneurs who do not make payments to individuals do not submit any reports to the FIU. This follows from the provisions of Part 5 of Art. 16 of Law No. 212-FZ. Therefore, there are no penalties for failure to report to IP.

Tax sanctions

As for tax reporting, an individual entrepreneur must submit declarations to the tax authority for those taxes for which he is a taxpayer (subclause 4, clause 1, article 23 of the Tax Code of the Russian Federation). For failure to fulfill this obligation, a fine is provided in the amount of 5% of the tax amount not paid within the prescribed period on the basis of the declaration for each full or incomplete month from the date set for its submission, but not more than 30% of the specified amount and not less than 1000 rubles. (Article 119 of the Tax Code of the Russian Federation). The absence of the amount of tax payable according to the corresponding declaration does not exempt from the said liability. In this case, the fine is subject to collection in the minimum amount - 1000 rubles. (clause 18 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Individual entrepreneurship is registered, but the business itself is not conducted? This happens. But what about reports in this case? We answer immediately - reports must be submitted, no matter what. Moreover, until such time as an individual has the status of an individual entrepreneur.

Initially, we recall that all individual entrepreneurs pay fixed fees for themselves. This obligation does not depend on the applicable taxation regime, nor on whether economic activity is carried out or not.

Reporting of an IP-simplifier, if no activity was carried out

A tax return under the simplified taxation system is submitted to the tax office in the same form and within the same time frame as usual, that is until April 30 inclusive. But a zero report is submitted, in which instead of digital indicators there are only dashes.

Judge for yourself, how should the tax authorities find out that an individual entrepreneur did not submit a declaration and did not pay taxes just because he did not run a business? Maybe the entrepreneur works "in the shadows", and impudently ignores the obligation to submit reports and pay taxes.

Do not confuse IP reporting “without activity” and “without income”, these are different concepts. You can operate and incur expenses, but not receive income. In this case, an individual entrepreneur on the simplified tax system with an object of taxation "income minus expenses" will have a declaration not zero, but with indicators.

Moreover, it is necessary to form and systematically maintain the Book of Accounting for Income and Expenses, even if it will be with zero indicators. Having KUDiR in hand, an entrepreneur can present it at any time at the request of the tax authorities.

IP reporting without activities on the general taxation system

3-personal income tax and value added tax declarations must be submitted without fail and within the usual timeframes:

3-NDFL - until April 30 inclusive;

for VAT - until the 25th day of the month following the reporting quarter.

The book of accounting for income and expenses must also be formed in a general manner.

We emphasize that tax declarations for value added tax are accepted only in electronic form according to the TCS, even if they are zero. For those individual entrepreneurs who did not conduct business at all, i.e. has not carried out a single transaction on the current account, it is possible not to bother with electronic sending of reports. You can fill out a single simplified declaration, and it can be sent in any convenient form: electronic or paper. Remember that a single declaration for individual entrepreneurs on OSNO replaces only VAT reporting, so the obligation to submit 3-NDFL will not go anywhere.

By the way, IP reporting on the simplified tax system without income and account movements, if desired, can also be replaced with a single simplified declaration, however, there is not much point in this. The labor costs for filling out a single simplified declaration and the usual zeroing according to the simplified tax system are approximately the same, but at the same time, the EUD must be submitted strictly on time until January 20, and there is time for zeroing until April 30.

IP reports on the "imputation", if economic activity is not carried out

The unified tax on imputed income does not provide for zero declarations. Therefore, simply disappearing from the view of the tax authorities will not work. Declarations must be with a physical indicator and the tax will be the same as if the activity was carried out.

In this case, it is best for a substitute who does not conduct entrepreneurial activity to write a statement about its termination and take the risk of switching to another taxation regime until better times.

Reporting of an individual entrepreneur who does not conduct business

Employers are considered a special category of individual entrepreneurs, to whom the state imposes increased requirements. Whether work was carried out or not, whether there were incomes and whether wages were paid - all this does not affect the obligation to report on insurance premiums and employees as long as there is at least one valid employment contract with an employee.

Therefore, even if the individual entrepreneur does not carry out economic activities, he must provide the following reporting documents:

information on the average headcount in the Federal Tax Service;

calculation of insurance premiums in the Federal Tax Service;

SZV-M, SZV-experience and ODV-1 in the FIU;

4-FSS for accident insurance in the FSS.

The only thing that will not be on the list in the absence of activities and payments to employees (if they were on unpaid leave in the reporting period) is these are 2-personal income tax and 6-personal income tax.

Clients of the online accounting department "Enterfin" are not afraid of reports and never miss the deadlines for their submission, because our system provides everything for maximum convenience in tax reporting. Register on the site right now to appreciate all the benefits of working with us!

Opened an individual entrepreneur, but did not work, do I have to pay taxes? It all depends on what system of taxation the entrepreneur used before the circumstances arose. On the general regime and the "simplified" one can avoid settlements with the budget for income received, on UTII and a patent - no. You will have to pay insurance premiums for yourself to the FIU until the IP is removed from the register. The article provides options for resolving the situation.

How to suspend the activity of an individual entrepreneur legally

In business practice, there are circumstances when a citizen who conducts entrepreneurial activities without forming a legal entity no longer needs to do business, for example, during his vacation.

First of all, a businessman has a desire to officially suspend activities by writing an application to the tax authority. He hopes that if the individual entrepreneur does not operate, then there will be no obligations for payments to the budget and the Pension Fund.

If the enterprise did not work, the tax legislation allows individual entrepreneurs not to pay taxes when using tax regimes, where the amount of tax depends on the amount of income. Insurance premiums that an individual pays for himself are mandatory for payment while registration is valid. We will cover this in more detail in the following chapters.

You can find an acceptable solution in two directions:

- Select OSNO or STS as the tax regime, if possible in the near future. The object of taxation (income or income minus expenses) does not matter here: the enterprise did not work, there was no revenue, and there is nothing to charge taxes for the reporting period - they can not be paid. In this case, the entrepreneur remains obliged to submit zero declarations and pay insurance premiums “for himself”. How to do it? Unfortunately, the transition to a "simplified" system from another system is possible only at the end of the calendar year, so you must either wait until January 1, or use the path described in the next paragraph.

- Close IP. The most convenient option. You will have to submit reports, pay taxes and insurance premiums in the amount corresponding to the period for which the IP did not work. The law does not prohibit arbitrarily often to close and re-register business. The main thing is to pay the accrued taxes and fees in a timely and correct manner.

To close, you must submit an application to the IFTS, where the IP was registered, and attach a receipt for payment of the state duty to it.

Social contributions

Regardless of whether the individual entrepreneur works in the chosen profile and what taxation system he preferred, contributions must be paid to the Pension Fund and the FSS. These fees are paid only for themselves if the entrepreneur did not have employees in the reporting period. This is a significant difference from an organization that is not obliged to pay them if it does not work and does not maintain a staff.

- BASIC. When using the general regime, two types of taxes are calculated - VAT and personal income tax. The first one should be charged if there is a realization. In the absence of value added, this budgetary payment is no longer necessary. Income tax is calculated on the difference between income and expenses. When an individual entrepreneur does not conduct business, he does not receive income, and he has no expenses. That is, there is no object of taxation here. As a result, there are no obligations to transfer mandatory payments to the budget. However, at the end of the year, the businessman must file a declaration with zero indicators.

- USN. Here the situation is identical and the tax is calculated depending on income or on the difference between revenue and expenses. In both cases, due to lack of activity, there is also no object of taxation, that is, there is nothing to replenish the budget from. But it is necessary to report - once a year, according to the simplified tax system.

- ENVD. The essence of this regime is that reporting and paying taxes here do not depend on revenue. Budget payments are calculated from the estimated income, which is established by regulations at the federal and regional levels. It is possible to avoid paying it if you write an application for deregistration as an "imputation" payer. If you do not choose another system instead, the taxpayer automatically switches to the OSNO and, without working, will pay only “his” insurance premiums (see item 1 of the list).

- PSN. This tax regime allows you to register the right to work in a certain area for a short period - from a month to a year. However, the expiration of a patent does not automatically mean that taxes do not have to be paid.

In case of non-renewal of the PSN, the entrepreneur will be required to report under the general system. The first paragraph of this list describes how the situation will develop in these circumstances.

Other taxes

In addition to budget payments directly related to commercial activities, there are a number of taxes that are indirectly related to business, but impose obligations on a businessman.

In addition to budget payments directly related to commercial activities, there are a number of taxes that are indirectly related to business, but impose obligations on a businessman.

Consider what individual entrepreneurs should do if they do not conduct activities, but the object of taxation is present.

A citizen who owns real estate in the territory of the Russian Federation is obliged to pay the corresponding tax. The inspection takes information about the number of objects in the property from the database of the cadastral chamber, calculates the budget payment and sends a notification to the address of the place of residence. The message contains the amounts to be paid and the deadlines for the transfer of money.

However, this procedure is provided only for those citizens who do not have a personal account on the website of the Federal Tax Service. If such a service is activated, then notifications are published in electronic form and are not sent to the home address.

But for an individual with the status of an individual entrepreneur, some features are provided. A citizen's property can be used in business. And then it is not taken from him. In order to achieve preferences, persons engaged in commercial activities must notify the tax authorities of this fact by attaching documentary evidence.

In other words, if the activity is not openly conducted, or there is an intention to suspend it for a while, one must be prepared for the fact that property tax will begin to be levied on real estate. That is, the opposite situation will arise, when the official stoppage of commercial work entails an increase in the tax burden.

Pensioners do not pay real estate tax, but this applies only to housing, outbuildings and garages. This exemption does not apply to businesses.

Vehicles owned by an individual are subject to the relevant tax. The tax authorities calculate the budget payment themselves, then sending a notice to the home address with the amount payable and deadlines for payment. If a citizen has a personal account on the website of the Tax Service, he receives a notification in electronic form, and not by mail, as before.

Vehicles owned by an individual are subject to the relevant tax. The tax authorities calculate the budget payment themselves, then sending a notice to the home address with the amount payable and deadlines for payment. If a citizen has a personal account on the website of the Tax Service, he receives a notification in electronic form, and not by mail, as before.

If citizens are not individual entrepreneurs, this does not cancel the obligation of a citizen to pay transport tax in a timely manner and in full. On the contrary, entrepreneurs who use cars in business also have some resources to reduce the amount of payment. They can attribute all maintenance and repair costs to expenses and thereby reduce the tax base, even fees for Platon.

If the vehicle was purchased for commercial purposes, the best course of action is to sell it if the activity is suspended.

Land tax

Individuals owning land plots are required to pay the appropriate tax. The size of this budget payment strongly depends not on the purpose for which it is used, but on the category in which the object is put by regional legislators. The value of the tax rate depends on this - the minimum for personal plots, agricultural land and the maximum for industrial or commercial areas.

In this area, a situation is created in which the amount of the final tax does not depend. If you want to suspend the activity of an individual entrepreneur and avoid the tax burden, the best way out is to sell commercial land or rent it out. However, in this case, an individual will have to file an annual 3-NDFL declaration, where they reflect the income received and still pay income tax.

As a result, the suspension of IP status is impossible. It is only possible to use tax regimes under which the absence of activity allows making settlements with the budget only for such taxes as property, transport and land taxes. But it is not exempt from the obligation to pay contributions. But the best way out would be to write an application to the Federal Tax Service with a request to remove it from the register. In the future, you can register again. The law does not limit the number of attempts.

Reading 10 min. Views 118 Published on 05/27/2018

In order to organize their own business, an entrepreneur needs to register with the tax service and choose a tax payment scheme. From this moment, the entrepreneur is obliged to make tax payments, according to the chosen regime. However, there are times when company executives are faced with the need to stop the work of the company for a certain period. In this case, the firm does not generate income, which raises the question of how to pay taxes. Below we propose to talk about whether it is necessary to pay tax if the individual entrepreneur does not operate.

An individual entrepreneur is not a legal entity, but an ordinary individual, but with the right to conduct entrepreneurial activities

The procedure for paying taxes in case of temporary suspension of the company's activities

Is it necessary to make tax payments during a temporary freeze on the activities of an individual entrepreneur? The answer to this question is closely related to the chosen tax regime. It should be noted separately that some regimes imply the mandatory payment of taxes even in situations where an individual entrepreneur has no income. The same should be said about the financial statements that are transmitted to representatives of the Federal Tax Service.

There are a number of specific factors that play an important role in the question of the need to pay taxes. One of these factors is the reason for the suspension of the company. In addition, it is necessary to take into account the period during which the work of the company will be frozen. In some situations, an entrepreneur can legally refuse to pay taxes. Below we propose to consider mandatory payments and various taxation regimes.

Pension Fund

Payments to the Pension Fund of the Russian Federation are mandatory for every company registered as an individual entrepreneur. It should be mentioned separately that this tax is payable even if the company has no staff. In the people, this type of tax payment is called "paying for yourself." The current legislation establishes a fixed rate of payment to the Pension Fund. It should also be said that the rate is indexed annually. The first payment is transferred to the Pension Fund at the time of registration of the IP. The last payment is made at the stage of closing the company.

As mentioned above, the amount of payment is established by law. The amount of the payment does not depend on such criteria as the choice of the company's field of activity or lack of income. This means that in case of temporary freezing of IP, the entrepreneur will need to transfer a certain amount to the PF on a monthly basis.

Every entrepreneur must know that the size of the contribution to the PF is closely related to the level of profit of the company for the reporting year. The amount of the payment is determined on the basis of the minimum wage. In two thousand and seventeen, the amount of the pension contribution was 7,500 rubles.

It is important to note that the contribution to the Pension Fund is twenty-six percent of the annual minimum wage.

You will have to pay insurance premiums for yourself to the FIU until the moment when the individual entrepreneur is removed from the register

You will have to pay insurance premiums for yourself to the FIU until the moment when the individual entrepreneur is removed from the register When the amount of income received by the entrepreneur during the reporting year is 300,000 rubles, the amount of payment is 23,400 rubles. In a situation where the amount of income exceeds the above figure, an additional percentage is added to the total amount. According to the established rules, the entrepreneur must transfer the main payment by December 31 of the reporting year, and the additional payment by April 1 of the year following the reporting year.

It is important to pay attention to the fact that it is almost impossible to avoid a contribution to the PF. However, there are a number of situations in which an entrepreneur can receive a temporary exemption from paying this tax:

- Military service- in order to be able to temporarily exempt from payments to the Pension Fund, you will need to provide a number of documents. First of all, you will need a military ID containing the appropriate mark, as well as a certificate from the military registration and enlistment office. Next, you will need to obtain an extract from the tax service confirming the absence of commercial activity for the specified period. The final document is the work book of the IP owner. All of the above documents are transferred to the representative of the Pension Fund.

- Maternity leave- according to the current legislation, not only the mother, but also the father of the child can take leave to care for a newborn. In the event that the entrepreneur has several children under the age of one and a half years, the duration of the vacation is extended until the youngest of the children reaches the age of eighteen months. As supporting documents, a child's birth certificate, certificates obtained from the Social Security Fund or certificates from the housing department can be used. In addition, you will need to provide the Pension Fund with an extract from the tax office, which confirms the freezing of the IP for this period of time.

- Care for pensioners (over 80 years old) and the disabled. In order to be able to temporarily stop payments to the Pension Fund, the entrepreneur must provide a certificate of disability of the person who will be cared for. The standard package of documents includes a tax return, as well as an extract from the housing department about family members.

It is important to note that there are several other legal ways to stop paying the tax in question. This right is granted to the spouses of military personnel located in those regions where there is no possibility of employment. A similar right is also granted to spouses of diplomats temporarily residing abroad.

Compulsory Medical Insurance Fund

IP does not operate, what taxes to pay? According to the established rules, each person registered in the status of an individual entrepreneur is obliged to transfer money to the account of the Compulsory Medical Insurance Fund. It should also be mentioned that the index of these payments changes annually, and the amount of the contribution itself is interconnected with the minimum wage. In 2017, the contribution to this institution was 5.1 percent. From this we can conclude that the individual entrepreneur needs to transfer to this organization an amount equal to 4,590 rubles.

It is important to pay attention to the fact that according to the current rules, the entrepreneur is given the opportunity to transfer both the full payment and the division of this amount over several months. You can get the opportunity to avoid these payments only in those situations that were listed above.

If the enterprise did not work, the tax legislation allows individual entrepreneurs not to pay taxes when using tax regimes where the amount of tax depends on the amount of income

If the enterprise did not work, the tax legislation allows individual entrepreneurs not to pay taxes when using tax regimes where the amount of tax depends on the amount of income Standard tax treatment

The OSNO (General System of Taxation) regime includes personal income tax (PIT) and value added tax (VAT). It is important to pay attention to the fact that under this regime, the entrepreneur does not need to make payments during the suspension of the IP. It is quite easy to explain this fact. Value added tax is payable on the sale of manufactured products or the provision of services. When a company is frozen, the entrepreneur does not sell his products, which allows you to temporarily stop paying VAT.

The lack of activity of an individual entrepreneur is also one of the reasons for refusing to pay personal income tax, since the company does not have an income item.

In order to obtain legal grounds for tax exemption, you will need to fill out a simplified declaration form. This document is drawn up only once during the reporting period and contains all tax payments that comply with the general regime. It should be noted that before the introduction of new rules, the entrepreneur had to fill in zero declarations, for each payment separately.

Simplified tax payment regime

The current legislative program allows IP owners to choose one of several special tax payment regimes. Among them, the simplified taxation system (USNO) should be highlighted. By choosing this system, the merchant relieves himself of the obligations associated with the payment of property tax, personal income and value added. In this case, the IP owner is obliged to make a single payment to the tax service. There are two types of tax base. In the first option, the tax is based on the amount of income of the individual entrepreneur. In the second method, the amount of the tax base is calculated based on the difference between the item of income and expense.

If an individual entrepreneur has no income, do I need to pay taxes? When choosing this system, the entrepreneur needs to fill out a zero declaration form and transfer it to a representative of the tax service. This document can be transferred either personally into the hands or through an official authorized representative. In addition, you can send the form by registered mail, attaching an inventory of the attached documents. It is allowed to transfer documents in electronic form, certified by electronic digital seal.

Regardless of whether the individual entrepreneur works according to the chosen profile and what taxation system he preferred, contributions to the Pension Fund and the Social Insurance Fund must be paid

Regardless of whether the individual entrepreneur works according to the chosen profile and what taxation system he preferred, contributions to the Pension Fund and the Social Insurance Fund must be paid Single tax on imputed income

The current legislation provides a list of areas of activity that correspond to the UTII regime (single tax on imputed income). It is important to pay attention to the fact that the introduction of this system is carried out by regional self-government bodies. It should also be said that in order to switch to this system, an individual entrepreneur must meet a number of strict criteria. In the event that the entrepreneur chooses an "imputation", then throughout the entire period of the activity of the IP, it is necessary to make appropriate payments.

Among the advantages of this system, the absence of payments related to the income of individuals should be highlighted. When suspending the activities of the company, the entrepreneur must quarterly submit a zero declaration to the tax service. Thanks to this step, it becomes possible to legally waive the obligation to pay taxes.

Property tax

“IP is open, but there is no activity, what taxes to pay?” This question worries many entrepreneurs. Especially often, this question is devoted to property tax. According to the current rules, the following types of property are subject to taxation:

- land;

- real estate objects;

- vehicles.

This tax must be paid from the moment the asset is acquired. It is important to pay attention to the fact that even in the event of suspension of the company's activities, the entrepreneur must make payments under this article.

The tax service annually assesses the tax on property values of individual entrepreneurs. You can get exemption from this tax by choosing one of the special tax regimes. It is important to note that the entrepreneur will still need to pay real estate tax, the amount of which is calculated based on the cadastral value of the asset. It should also be said that the procedure and amount of payments are established by local governments. The last day of tax payment is December 1 of the year following the reporting year.

The IFTS is responsible for calculating transport taxes. It is important to note that in this case, individual entrepreneurs are not granted preferential treatment. This means that the entrepreneur undertakes to pay the IFTS a certain amount, the amount of which does not depend on the chosen tax regime. It should also be said that this duty is paid even at the time of freezing the company. The date of assignment of liabilities is the date of acquisition of the asset. The amount of taxation is based on the engine power of the vehicle. The last day for making the payment in question is October 1 of the year following the reporting one.

The taxation system is the procedure for calculating and paying tax

The taxation system is the procedure for calculating and paying tax Individual entrepreneurs are not granted exemption from land tax payments. These obligations are imposed on individual entrepreneurs, regardless of the fact of conducting commercial activities. This fact is explained by the fact that the lease of land is considered as one of the activities. Annually, the IFTS sends notifications to entrepreneurs, which indicate the amount of tax payments. The last payment date is December 1st.

Conclusion

In this article, we examined the procedure for paying taxes in the event of a temporary suspension of business activities. Summing up all of the above, we can conclude that it is impossible to completely avoid paying taxes. At the stage of freezing the company, the entrepreneur should analyze in detail the prospects for the development of his own business. In some cases, liquidation of IP is the only way to avoid additional costs.

In contact with

USN: changing the object of taxation

How to switch to STS from the general taxation system

How to switch to STS from the general taxation system

How to change the phone number associated with a Sberbank card

MasterCard Gold from Sberbank: advantages and disadvantages of a gold card