For the convenience of studying the material, the article is divided into topics:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

All finished products, as a rule, are handed over to the warehouse on account of a financially responsible person. The exception is large-sized products and products that cannot be delivered to the warehouse for technical reasons and therefore are accepted by the customer organizations at the place of manufacture, assembly and assembly.

Products by type are divided into:

Gross - the total cost of finished finished products developed by the organization for the reporting period;

gross turnover (gross output) - the value of all products, semi-finished products, work performed and services rendered, including work in progress;

realized (sold) - gross output less deductions of finished goods, work in progress, semi-finished products, tools and spare parts of own production;

comparable - products that were produced by the organization in the previous reporting period;

incomparable - products that were produced for the first time in the reporting period.

Evaluation of finished products is currently carried out by:

Actual production cost - represents the sum of all costs associated with the manufacture of products (fully collected only on account 20 “Main production”);

normative or planned production costs - determine and separately take into account deviations of actual production costs for the reporting month from the planned (normative) cost price (deviations are detected on account 40 “Output of products (works, services)”);

accounting prices (wholesale, contractual, etc.) - the difference between the actual cost and the accounting price is separately taken into account. To date, this option for evaluating finished products has been the most common, but now in connection with sharp changes in pricing is less common;

selling prices and tariffs (excluding VAT and sales tax) - has the widest application;

incomplete (reduced) production cost (“direct costing” method) - is determined by actual costs excluding general business expenses.

To account for the availability and movement of finished products, 43 “Finished Products” is intended; the products to be delivered on the spot and not executed by the acceptance certificate remain in the work in progress and are not taken into account on the indicated account.

Synthetic accounting of finished products can be carried out in two versions: without using account 40 “Release of products (works, services)” and using account 40 “Release of products (works, services)”.

In the first case (without account 40), finished products are taken into account on account 43 “Finished products” at the actual production cost. At the same time, analytical accounting individual species finished products are reflected at discount prices, highlighting deviations of the actual cost of the cost of finished goods at discount prices.

Finished products transferred from production to the warehouse are recorded on account 43 “Finished products” at discount prices during the month.

In doing so, make an account:

Dt 43 "Finished products"

At the end of the month, the actual cost of capitalized finished products is calculated and the deviation of the actual cost of production from its value at discount prices is determined.

If the actual cost is greater than the discount price, then make an additional posting:

Dt 43 "Finished products"

Kt 20 "Main production".

When the actual cost of production is less than the discount price, the difference is written off using the “red reversal” method:

Dt 43 "Finished products"

Kt 20 "Main production".

In the case when the finished product is fully used in the organization itself, it is accounted for:

D-10 "Materials", 21 "Semi-finished products of their own production", etc.

Kt 20 "Main production". Account 43 “Finished goods” is not used in this case.

Finished products shipped or delivered locally are written off at discount prices, depending on the accepted method of accounting for the sale of products:

At the end of the month, the deviation of the actual cost of shipped (sold) products from its value at discount prices is determined and this deviation is reflected by additional posting or by the “red reversal” method:

Dt 45 “Goods shipped”, 90 “Sales”, subaccount “Cost of sales”

Kt 43 “Finished products”.

In the second case, when account 40 “Release of products (work, services)” is used to account for production costs, the synthetic accounting of finished products in account 43 “Finished products” is carried out at the normative or planned cost.

When transferring finished products from production to the warehouse within a month, an entry is made:

Dt 43 "Finished products"

At the end of the month, the calculated actual cost of finished goods is written off:

Kt 20 "Main production".

Account 40 “Output of products (works, services)” is active-passive. The debit of this account reflects the actual cost of production (works, services), and on a loan - the normative or planned cost. Comparing the debit and credit turnover of account 40 “Output of products (works, services)”, the deviation of the actual cost of production from the normative or planned is determined.

This deviation is written off:

Kt 40 “Release of products (works, services)”.

The excess of the actual cost of production over the normative or planned is written off by additional posting, and the savings are made using the red reversal method. Account 40 “Output of products (works, services)” is closed and has no balance at the end of the month.

The following is recorded on the finished (sold) finished products within a month at the standard or planned cost:

Dt 90 "Sales", subaccount "Cost of sales"

Kt 43 “Finished products”

Example. Synthetic accounting of finished products is carried out at the normative (planned) cost price, which is 12,000 rubles. At the end of the month, the actual cost of finished products in the amount of 10,000 rubles was determined. Products were sold within a month.

The following entries were made in accounting:

1. The finished products were capitalized at the warehouse at the normative (planned) cost price - Dt 43 “Finished products”

Kt 40 “Output of products (works, services)” - 12,000 rubles.

2. Written off sold finished products at the standard (planned) cost -

Dt 90 "Sales", subaccount "Cost of sales"

Kt 43 “Finished products” - 12,000 rubles.

3. At the end of the month, the actual production cost of the finished product is written off -

D-40 "Release of products (works, services)"

Kt 20 “Main production” - 10,000 rubles.

4. Written off the deviation of the actual production cost from the standard cost (saving) -

Dt 90 "Sales", subaccount "Cost of sales"

Kt 40 “Output of products (works, services)” - 2,000 rubles. ("Red reversal").

Accounting for finished products

Accounting for finished products is regulated by PBU 5/01 “Accounting for inventories”, approved by Order of the Ministry of Finance of Russia No. 44n, registered with the Ministry of Justice of Russia No. 2806.Organization Order accounting finished products based on PBU 5/01 are determined in guidelines approved by Order of the Ministry of Finance of the Russian Federation No. 119n, excerpts from which are given in this section.

Finished products - these are products and semi-finished products that are the product of the organization’s production process with complete processing (packaging), meeting applicable standards or approved technical specifications, accepted at the organization’s warehouse or by the customer.

The purpose of accounting for finished products is the timely and complete reflection on the accounts of accounting information on the release and shipment of finished products in the organization.

The main objectives of accounting for finished products are:

Correct and timely documentation of operations for the release, movement and dispensing of finished products in the organization's storage facilities;

control over the safety of finished products in storage and at all stages of movement;

monitoring the implementation of plans for the production and sale of finished products;

timely identification of unclaimed items of finished products with a view to their possible modernization or removal from production;

identification of the profitability of the entire range of finished products.

Finished products released must be transferred to the warehouse to the materially responsible person. Oversized products that cannot be delivered to the warehouse for technical reasons are accepted by the customer’s representative at the place of manufacture (release).

The release of finished products from production is made out by waybills, acceptance certificates, specifications and other primary accounting documents. A warehouse inventory card is started for products received at the warehouse, similar to materials accounting.

Planning and accounting of finished products are in physical and cost terms. If there are no questions with natural indicators, then several methods are used to determine the cost indicators (evaluation of finished products).

Consider the basic methods for assessing finished products:

At actual production cost. This method of evaluating the finished product is used in enterprises with single and small-scale production, as well as in the production of mass products of a small range;

at incomplete (reduced) production costs calculated at direct (actual) costs without general and general production costs. The technique can be applied in similar to the first method of production;

at the normative (planned) cost price. The planned cost is used to evaluate the manufactured nomenclature items of finished products. For the organization of the most informative accounting of finished products, it is recommended to determine the planned cost for each item position. A distinctive feature of this technique is the need to provide a separate account of deviations of the actual production cost of production from the planned or normative. Deviations should also be taken into account in the context of the nomenclature, but deviations can be taken into account for groups of finished products or for the organization as a whole. Thus, accounting for deviations in conjunction with the planned cost price allows you to determine the actual production cost of the finished product. Dignity this method evaluation of finished products is the organization of a unified evaluation system in planning and accounting, the implementation of operational accounting of the movement of finished products, the stability of accounting prices. The application of this assessment option is advisable in industries with mass and serial nature of production and with a large range of finished products;

at negotiated prices, sales prices and other types of prices. Contractual prices are used as solid accounting prices for products. Deviations of the actual production cost of production are taken into account similarly to the previous version of the assessment. The scope of this method for evaluating finished products also coincides with the previous option.

When creating accounting prices for each item, it is advisable to take into account the rule of the correct ratio of production costs, i.e. two nomenclature items with the same actual cost should have the same accounting value. This is necessary for the correct distribution of deviations (deviations are distributed in proportion to the book value) for each item of the manufactured products.

Thus, if accounting prices and deviations from the actual cost are reflected for each item, the use of selling prices as accounting is not entirely correct, because the ratio of sales prices does not always correspond to the ratio of the cost of production (products may have the same selling price and different cost).

The actual cost of finished goods depends on the methods of cost accounting and costing used in the organization.

Synthetic accounting of finished products

To account for the presence and movement of finished goods of a material nature at manufacturing enterprises, an active account 43 “Finished products” is used. Regardless of the assessment methodology, the output (receipt at the warehouse) of finished products manufactured for sale is reflected in the debit of account 43.

This section discusses the accounting of finished products of a material nature.

The output of such products can be divided by the purpose of its use as follows:

Realization of finished products;

general economic use (household equipment);

general industrial use (tools);

use in the further production cycle (semi-finished products).

Accounting schemes depend on the purpose of using the finished product and the valuation methodology used at the enterprise.

If an enterprise manufactures a small assortment of products for its own needs, it is advisable to keep records of incomplete (reduced) production costs and reflect the output (production) of products in the debit of account 10 “Materials” from the credit of expense accounts 23 “Auxiliary production”, 29 “Serving production economy ".

If the company carries out industrial production of a wide range of products for the purpose of their further sale, the active accounting account 43 “Finished products” is used to account for the availability and movement of finished products. Accounting in this case, it is advisable to keep at discount prices (planned cost, contract prices). This is due to the fact that at the time of production and sale of finished products, the actual production cost is still unknown and its calculation, as a rule, occurs in the next month after release (sale).

To reflect the production of finished products at discount prices, an active-passive account 40 “Production, work, services” is used. The output is reflected in the debit of account 43 from the credit of account 40 at discount prices (planned cost). By the time of formation of the actual production cost credit balance account 40 determines the standard cost of finished products. The actual cost is reflected in the debit of account 40 from the credit of accounts for cost accounting 20 “Main production”, 23 “Auxiliary production”, 29 “Serving production and economy”. Thus, the formed balance of account 40 determines the deviation of the actual production cost of output from the planned cost. The debit balance of account 40 indicates the excess of the actual cost over planned, the credit - the opposite. The deviation value determines the correctness of the methodology for calculating the planned cost of production at the enterprise, and its great value means errors in the planned calculations.

Further, the balance of account 40 is debited to account 43 (credit balance is reversed, debit is reflected in the usual manner). Account 43 should be divided into two subaccounts: 43.1 - finished products at planned cost; 43.2 - deviations of the actual cost from the planned. Organization analytical accounting on account 43 depends on the capabilities of the software used in the organization. If the software allows, on account 43 you can organize analytical accounting for stock items and lots of products. Then the deducted balance of account 40 is distributed according to the batches and nomenclature positions of finished products issued in the reporting period in proportion to the accounting prices. If technical capabilities do not allow, analytical accounting on account 43.2 can be omitted, and the balance of account 40 should be transferred to account 43.2 in one amount. The account 40 has no balance at the end of the month.

If the products released in the reporting period (for the billing month) were sold, partially or completely, the deviations should be redistributed in proportion to the balances and movements of the finished product. Thus, the deviations in the part of the sold products are reflected in the debit of account 90.2 “Cost of sales” from the credit of account 43. The balance of account 43 after the redistribution of deviations reflects the actual production cost of finished goods in the enterprise’s warehouse. In more detail: accounting for finished products.

If the company produces semi-finished products for further use in production processes, the accounting of these semi-finished products is carried out on account 21 "Semi-finished products of own production".

Products not formalized by the acceptance certificate remain as part of work in progress.

Finished Product Manufacturing

Production is the central link of the enterprise in which the final product is created with the desired consumer properties.An industrial enterprise is an independent business entity established in the manner prescribed by law for the production of products, performance of work and the provision of services in order to meet social needs and make a profit. It independently carries out its activities, manages its products, profit, remaining after taxes and other obligatory payments. The relations of the enterprise with other enterprises, organizations, institutions, state and municipal government bodies and citizens are regulated by law. The production process is a set of separate processes carried out to obtain from raw materials, materials, semi-finished products, components of tools, labor and consumer goods, as well as its parts.

Production is engaged in the materialization of scientific developments, the results of discoveries, inventions, the reproduction of material and spiritual wealth. The decisive role of the production of products, goods, and services consists in the most complete satisfaction of the needs of man and society as a whole with high-quality means of production, commodities, and other economic benefits of life support. Normally developing production should increase the pace of production, increase the material well-being of the people.

Production, solving the problem of output, at the same time solves the problem of spiritual goods, the development of the social sphere.

It is customary to attribute to the social sphere economic objects and processes, types of economic activity directly related to the way of life of people, consumption of material and spiritual wealth by the population, satisfaction of the needs of a person, family, collective and society as a whole. These are institutions of culture, medicine, art, science, education, etc., for which production creates a material and technical base.

The needs of people tend to increase the consumption of products in quantitative and qualitative terms, which encourages production to increase the output of products with enhanced consumer properties. Thus, consumption spurs production and excites the entire reproductive cycle, turns simple production into expanded.

The main factors of the continuously repeating process of reproduction of material goods include labor (labor), fixed production assets (fixed capital), material resources, scientific and information potential.

Personnel selection is one of the main problems of successful operation of the enterprise. The fate of the company depends on the quality of their work. The correct selection of employees and subsequently working with them can remove many potential problems and help create a favorable relationship between the leader and the team.

Daily work with personnel in the enterprise consists in assessing the need for personnel, hiring, training, monitoring, evaluating the quality of work of employees, managing them, planning personnel policies, and encouraging good work.

Incorrect determination of the need for personnel or selection of them can lead to their ineffective work, for example, because they are more suitable for another matter. You can recruit employees by acquaintance. This can give more insight into their abilities, attitude towards work, self-discipline, responsibility, loyalty and devotion. When hiring and working with personnel, legal requirements must be observed.

When assessing the quality of staff’s work, it is necessary to analyze their performance over a period, note successes, make comments on identified shortcomings, identify future tasks, give employees the opportunity to speak out based on the results of assessing the quality of their work, discuss any complaints or discipline issues.

Equally important is the choice of partners or business partners. This applies both to their personal qualities and to the assessment of their potential partnership and collectivist qualities in entrepreneurship. Underestimation and reappraisal can lead to the collapse of a case, company, loss of authority or problems with the criminal code.

Relationship with the state, financial system, specific representatives of the executive branch should be built on strict observance of legal norms.

Behavior in entrepreneurship should help to create and maintain their own image, credibility among consumers and business circles, increase the level of reputation of a reliable and honest partner. But it is always necessary to remember about trade secrets.

It is possible to avoid dishonesty of partners and business partners by first finding out information about them, their reputation in the business world, their transactions and transactions. It is equally important to draw up a contract correctly, including sanctions for non-fulfillment of mutual obligations.

Personnel are an essential part of the material and production base. They are directly related to the process of production, constitute industrial production personnel (PPP), which is composed of workers, specialists and maintenance personnel. The bulk of the RFP is workers. Under the influence of scientific and technological progress, structural changes are taking place in the distribution of workers and specialists by industry.

The category of workers includes workers directly involved in the manufacturing process of manufacturing products. In turn, workers are divided into main and auxiliary. The main workers are those who directly carry out manufacturing processes. The auxiliary ones include workers serving the technological processes of the main and auxiliary (manufacturing technological equipment, non-standard equipment, tools, etc.) production, as well as transport workers, electricians, lubricants, tool distributors, workers repairing various equipment.

The category of specialists consists of workers who perform the functions of management, technological and organizational-planning management of production (director, his deputies, shop managers and their deputies, department workers and workshop managers, craftsmen, designers, technologists, economists, planners, standard engineers, etc.), as well as personnel performing the functions of accounting, planning, supply, marketing, staffing, employees of administrative departments, workers engaged in consumer services for all employees (lifters, wardrobes, cleaners, etc.).

Mechanization and automation of production processes, equipment of production with new equipment change the nature of labor and increase the requirements for the qualifications of workers. In conditions market economy staffing requirements are growing. Only those workers and specialists who know their job can find a stable job, conscientiously treat their work, worry not only about their own, but also about the collective final results of the company. Fixed assets play an important role in ensuring the efficient operation of production. These are the means of production, its material basis. The economic essence of fixed assets consists in the fact that they do not lose their properties immediately, but gradually, therefore they completely recover their natural form through a series of production cycles.

The most important role in the production process is played by the means of labor: power machines and equipment, working machines and equipment, measuring and control devices, devices and laboratory equipment, computer equipment, and other machines and equipment. They, acting on the objects of labor, change their natural-material form and properties, ensure the uninterrupted flow of the technological process in regulated parameters. Given the role of machinery, equipment and other of the above tools in the production process, they are called the active part of the production apparatus. The passive part includes buildings, structures, transmission devices, vehicles, since they participate in the production process indirectly. Buildings and structures, for example, create conditions for the effective functioning of active tools.

For accounting and analysis of fixed assets, a system of indicators is used, the most important of which is capital productivity.

Material resources (objects of labor) - raw materials, materials, fuel, all types of energy, etc. - participate in the production cycle once, completely change their material-natural form and immediately completely transfer their value to the finished product. This is what economic substance objects of labor (revolving funds). In the cost of industrial production, revolving funds account for 70-90%. Improving their use can significantly reduce production costs.

Scientific and informational potential. Informational resources include scientific, technical and economic informationused or intended for use in the design of products, scientific and technological preparation of production and in the manufacture of products. Other production resources (objects of labor) may use exchange information, tools - price lists. Sources of scientific and technical information can be patent descriptions, industry scientific and technical journals, reference books, monographs.

Regulatory information is contained in the Civil Code of the Russian Federation, bulletins of normative acts of ministries and departments of the Russian Federation, documents of the Customs Cooperation Council, codes of civil and private law of foreign countries, international agreements and conventions, standards, technical requirements and conditions for the products of individual foreign countries.

The constant reproduction of production factors, taking into account the increasing requirements for their consumer value, is the driving force of a developing economy.

Finished products warehouse

Warehouse is one of the indispensable components of any production. The degree of organization of the warehouse directly affects the quality of products. Each enterprise has developed an individual approach to storage. The main functions of the finished goods warehouse (hereinafter referred to as the warehouse) are: reception of finished products by quantity, unloading from transport, storage in accordance with technological, fire-fighting, sanitary-technical and other standards from the moment it arrives at the warehouse until shipment. In addition, the warehouse carries out the selection of products from the storage location and picking it according to consumer properties, destinations based on documents. Also, finished goods are loaded from the warehouse by trunk transport (rail or road).For the finished goods warehouse are characteristic:

Short shelf life of products 1-10 days,

- shipment of goods by rail or road,

- rhythmic receipt of products at the warehouse, through internal transport of the enterprise, for example, such as: floor electric conveyor, overhead or floor conveyor, monorail.

An important role in the reliability of the transportation process is played by close organizational and technological relations of the warehouse with transport organizations. Since, in case of untimely supply of a vehicle for loading, the dispatch of finished products may be delayed. Which, in turn, can lead to a disruption in the delivery time and, if indicated in the contract, the imposition of penalties on the enterprise.

Due to the short shelf life of cargo, it is inappropriate to build warehouses above 8-12 meters and with developed storage areas. Of the greatest importance are the picking and preparation zones for sending transport lots and loading them into road or rail transport.

Warehouses for finished products are created both in the form of separate buildings, and in the complex. Separate warehouses are characteristic for bulk products. In warehouses with several bulk cargoes, separate stacks or other containers are provided, for example, bins, silos, silos for different types of cargoes. It is also possible to install dividing walls separating compartments for storing various goods. Dry mineral fertilizers and chemicals are stored in closed warehouse buildings, for example, from prefabricated reinforced concrete structures.

Sales of finished products

Consider the reflection of the sale of finished products, as the most common operation. The sale of finished products is carried out under a supply contract and is reflected similarly to the operations of the sale of goods.Accounting entries of this business transaction reflect the situation when the transfer of ownership of the finished product from the manufacturer to the buyer occurs at the time of shipment of the product.

Depending on the moment of calculation (payment) by the buyer for the products received, two options for the formation of accounting entries. The first version of the postings reflects the sale of finished products, in which the moment of payment occurs after the moment of shipment of the product. Moreover, the time of payment for products may occur much later than the time of shipment, which will lead to the occurrence of unpaid receivables from the manufacturer.

The second version of the postings reflects the sale of finished products, in which the moment of payment occurs before the shipment of the products. In this situation, the manufacturer has accounts payable to the buyer, which he repays by shipping products.

|

Account Dt |

Score CT |

Wiring Description |

Post Amount |

A document base |

|---|---|---|---|---|

|

1. Sales of finished products with payment after shipment (transfer) |

||||

|

Cost of finished products |

||||

|

Posting reflects revenue on the sale value of finished products with VAT |

Consignment note (form No. TORG-12) |

|||

|

The transaction reflects the amount of VAT on products sold |

Amount of VAT |

Consignment note (form No. TORG-12) |

||

|

The posting reflects the fact of repayment of debt for shipped products |

Selling value of finished products |

Bank statement |

||

|

2. Sales of finished products on a prepaid basis |

||||

|

Reflects the buyer’s prepayment for the finished product |

Prepayment amount |

Bank statement |

||

|

VAT is charged on advance payment |

Amount of VAT |

Payment order |

||

|

The posting reflects the shipment of finished products. The amount of cost depends on the methodology for assessing the finished product |

Cost of production |

Consignment note (form No. TORG-12) |

||

|

Reflects revenue on the sale value of finished products with VAT |

Selling value of finished products (amount with VAT) |

Consignment note (form No. TORG-12) |

||

|

Accrued amount of VAT on products sold |

Amount of VAT |

Consignment note (form No. TORG-12) |

||

|

The previously received prepayment is offset against the repayment of debts for shipped products. |

Prepayment amount |

Accounting reference calculation |

||

|

The VAT on the canceled prepayment is read. |

Amount of VAT |

Invoice |

||

Postings reflecting the operations of disposal of finished products under contracts of commission, barter, etc. similar to goods accounting

Cost of finished products

One of the main characteristics that economic analysis uses to identify the effectiveness of the enterprise is the cost of sales and finished products: that is why, knowing that such a cost is especially important.The cost price is the sum of the costs of cash, labor, natural, material resourcesspent on production, sales of products.

Cost includes costs associated with entrepreneurial activity; with the activities of the entrepreneur; with the manufacture and sale of certain products; which are documented.

Cost accounting takes place in the period in which they actually occur. It does not depend on when they will be paid.

Information on the cost of production for analysis can be obtained from the “report on financial results”, as well as from the Appendix to the annual balance sheet of the enterprise.

Cost is:

1. planned and actual, depending on the speed of formation;

2. shop, factory-wide, complete, depending on the inclusion of costs;

3. units or total volume of production, depending on the volume of production.

Methods for calculating the cost of production depends on the level of readiness of the product itself.

As for the object of costing, it is any specific type of product or work, service, all products of the enterprise.

These calculation objects can be measured:

In physical terms: pieces, tons, liters, kilograms, meters, etc .;

- in increased natural units. For example, twenty pairs of shoes;

- in conditional or conditionally natural meters. Here, the ratio of the studied indicator relative to generality is measured: the substance content is relative to one hundred percent of something .;

- in cost meters. For example, the cost of a ruble of finished goods;

- in labor meters, as the norm-hours;

- in conditional meters.

According to the efficiency of control, four types of cost accounting are distinguished: normative, incremental, custom, process.

The normative method involves pre-calculated costing for an individual product, tracking during the month changes in relation to the standard cost, accepting the actual costs and identifying the reasons for the deviation from the standards. After that, the actual cost is determined taking into account deviations from the standards (increase or decrease relative to the planned cost).

The process-based method is used in enterprises where mass production of one or more types of products is carried out, which is characterized by a short process time, in which there is no work in progress. The process-based method consists in the fact that direct and indirect costs for all items of the output of all products are taken into account. The average cost of one unit of product (or service, or work) is calculated by dividing production costs for the entire period (month) by the number of finished products for the same period (month). To effectively control production costs, the production process is divided into separate processes, which is why the method is also process-based. Some types of production are divided into several stages that the raw material goes through before becoming a finished product. Such stages are called redistributions, there may be several. Together they form the manufacturing process. Hence the name of the method - alternate.

The cost object with this method is redistribution. When this method is used, direct costs are referred to the current accounting for redistribution, and not for the category of product, service or work. This methodology is applied, despite the fact that in one redistribution several types of products can be obtained. In most cases, the object of cost accounting distinguish certain types of products or their groups, and not the entire volume of products.

When the order method is used, direct costs are calculated for the calculation items for individual orders. Orders are determined by a specific quantity of products of a certain type. The remaining expenses will be taken into account depending on the place of occurrence, on their purpose (destination), as well as by articles. They are taken into account in the cost of specific orders, according to the selected distribution base. The object of cost accounting for the custom method is a specific production order, after which the actual cost will be formed.

Work in progress includes all costs that occur during the execution of the order until its completion. After registering the order, it is accepted for work, after which numbers are assigned that are registered from the beginning of the year. These numbers will be his code. A copy of the notice that the order was opened is sent to the accounting department. In the accounting department, an accounting card is opened, in which the costs of this order will be recorded.

After production, the order will be closed. After that, the release of materials and the process of payroll to employees are terminated. The actual unit cost of the product will be determined after order completion by dividing the total costs by the number of products manufactured. This method allows you to understand what is the cost in a fairly universal expression.

Finished products

Quantitative accounting of finished products by type and storage location can be organized in two main ways: card and cardless. In the first method, grouping statements for posting products are compiled according to their types and storage locations. In the second method, daily (as a rule, using computers) compile revolving records of accounting for the release from production and the movement of finished products in warehouses and other storage places.The release of products from production both in the first and in the second method is made out by waybills, specifications, acceptance certificates, etc.

The following primary documents are used to account for finished products:

Delivery notes

- acts of acceptance of work (services),

- railway receipts,

- waybills,

- payment requirements-orders.

The production of finished products should be carried out under constant control by the accounting apparatus of the organization, since its uninterrupted flow from the production process implies the timeliness of the contractual relationship with customers, the organization of settlements with the budget, extra-budgetary funds, and employees of the organization.

After the product has passed the last stage of the production cycle, it is considered finished, and if it does not immediately go on sale, it is deposited with the materially responsible person (storekeeper).

The materially responsible person upon receipt of the finished product, signing in the document on the transfer of material assets (acts, invoices, etc.), leaves his second copy. When products are removed from the warehouse, two copies of invoices are drawn up by the accounting department, one of which is at the person who received the products, and the second remains in the warehouse. All movement of finished products should be reflected in the cards of warehouse accounting (f. No. M-17) or, which is more convenient with a large inventory of goods and materials, in the book of warehouse accounting (f. No. M-40). These documents reflect the income, expense and balance of each nomenclature of finished products.

At the end of the month, the financially responsible person draws up and submits to the accounting department a report on the movement of material assets, to which all the primary documents that are reflected in it are attached. Accounting for finished products by a financially responsible person is usually carried out in quantitative terms. The cost and totals are already indicated in the accounting department during processing material reports.

The actual movement of finished products in accounting is taken into account in production reports and reports on the movement of material values, on the basis of which organizations compile a statement of material assets, goods and containers. These statements are used in the future to fill out a journal order No. 10/2.

After reconciling all the data reflected in the primary documentation with the information presented in the accounting registers, the balance sheets are drawn up in the accounting department.

Posting of finished products, depending on their further use, can be done on account 10 “Materials” or on account 43 “Finished products”. At the expense of 10 “Materials” come in the event that it is precisely known about its further use for the needs of the economy. If the direction of use of the product is unknown, and also when the finished product is sent for sale, it is reflected in the active balance sheet account 43 “Finished products”.

PBU 5/01 establishes the rules for the formation of accounting information on finished products of the organization. PBU 5/01 provides for the following areas of evaluation of finished products:

1) evaluation of finished products upon receipt;

2) evaluation of finished products during their release into production, retirement.

The main difficulty associated with taking into account the finished product is due to the fact that when they bring it from the workshop to the warehouse, as a rule, no one knows and cannot know what the production cost of this product cost and, as a result, no one can say what it is actual cost. Therefore, during the reporting period, these products arrive and reflect their movement at accounting (planned or other) prices, and only after the actual cost of production is calculated, the previously recorded accounting estimate of the capitalized and, accordingly, already shipped products is clarified - brought to the actual .

Finished products during the reporting period can be evaluated using one of the following methods:

At actual production or reduced cost;

- according to the planned (normative) production cost;

- at wholesale prices;

- at free selling prices and tariffs including VAT;

- at free market prices.

This method is convenient to use in organizations with a limited range of serial products, when production and sales occur daily. The disadvantage of this method is the inaccuracy in determining production costs until the end of the reporting month.

The advantage of this method is the unity of assessment in the current accounting, in planning and reporting. However, if the planned cost price changes several times during the year, then you have to reevaluate the finished product, which is very time-consuming. If we take into account the commodity output at the average annual planned cost, then the accounting prices do not change during the year, but the cost of finished and sold products in the plan will not correspond to its value indicated in the monthly and quarterly reports.

Accounting for the availability and movement of finished products is carried out, as was noted above, on the active account 43 “Finished products”. This account is used by organizations of material production sectors.

On account 43, finished products can be accounted for both at actual production costs and at standard (planned) costs, including costs associated with the use of fixed assets, raw materials, materials, fuel, energy, labor, and other costs of production in the production process or at direct costs.

On account 43 "Finished goods" are not taken into account:

The cost of the work performed and the services rendered to the party (in fact, the costs are written off from the accounts of the cost of production directly to account 90 “Sales”);

- products to be delivered to customers on the spot and not executed by an acceptance certificate (remains as part of work in progress);

- finished products purchased for picking (the value of which is not included in the cost of production of the organization) or as goods for sale (goods are kept in the organization on account 41 “Goods”).

The debit of the account reflects the posting of finished goods (from production, return from customers, according to the results of the inventory), for the loan - its write-off as a result of shipment, shortages, and return to production (table 6.1).

When accounting for finished products on account 43 at the actual production cost in analytical accounting, the movement of its individual items can be reflected at accounting prices (planned cost, selling prices, etc.) with the deviation of the actual production cost of products from their value at accounting prices. Such deviations are taken into account for homogeneous groups of finished products that are formed by the organization based on the level of deviations of the actual production cost from the cost at the discount prices of individual products.

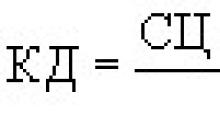

When writing off finished products from account 43, the sum of deviations of the actual production cost from the cost at the prices accepted in the analytical accounting related to these products is determined by the percentage calculated based on the ratio of deviations to the balance of finished products at the beginning of the reporting period and deviations for products received at warehouse during the reporting month, to the cost of this product at discount prices.

The deviations of the actual production cost of the finished product from its value at accounting prices related to the shipped and sold products are shown on the credit of account 43 and the debit of the corresponding accounts (45, 76, 79, 90) with an additional or reversal record, depending on whether whether they are cost overruns or savings.

In accounting, the release and sale of finished products can be carried out using (or without using) account 40 “Release of products (work, services)”, which is intended to summarize information about the manufactured products, delivered works and performed services for the reporting period.

Account 40 “Release of products (works, services)” reflects information on products released, works handed over to customers and services rendered for the reporting period, as well as deviations of the actual production cost of these products, works, services from the normative (planned) cost.

Accounting for finished products using this account is carried out at the standard cost. In this case, the finished products actually released and delivered to the warehouse during the month are evaluated at the standard (planned) cost and reflected on the credit of account 40 in correspondence with account 43. The sold products are reflected at the standard (planned) cost on the debit of account 90 and the credit of account 43 .

At the end of the month, account 40 generates information on products released from production (completed works, rendered services) in two estimates:

1) for debit - the actual production cost;

2) for a loan - standard (planned) cost price.

A comparison of the debit and credit turnover on account 40 reveals the deviation of the actual production cost from the standard (planned). The excess of the latter over the actual one is recorded by the reversal record for the debit of account 90 and the credit of account 40. The excess of the actual cost over the standard (planned) is reflected in the debit of account 90 and the credit of account 40 with an additional record.

Thus, the entire amount of deviations in the sale of finished products will be charged to financial results.

Account 40 “Output of products (works, services)” is closed monthly and does not have a balance at the reporting date.

If the finished products are kept without the use of account 40, then on account 43 “Finished products” the accounting is carried out at the actual cost. Moreover, in the analytical accounting of account 43 and in storage locations, the availability and movement of finished products are recorded at discount prices (actual cost or standard prices; other options are possible). If standard prices are applied, then to account for deviations of the actual cost of products from their value at discount prices to account 43 “Finished products”, a sub-account “Deviation of the actual cost of finished products from the discount price” is opened. Such deviations are recorded for homogeneous groups of finished products, which are formed by the organization on the basis of the level of deviations of the actual cost at the accepted prices of individual products.

The excess of the actual cost over the recorded value is reflected in the debit of the subaccount and the credit of the cost accounting accounts. If the actual cost is lower than the carrying amount, the difference is reflected in the reversal record.

This method is more suitable for single and small-scale production or for the production of mass products of a small range. In this case, the finished product in the warehouse is reflected on the basis of the cost of raw materials, semi-finished products, energy used in its production, accrued depreciation of equipment, workers' wages, etc. Moreover, the cost of components that are used in the production of products may vary, since prices are constantly growing, so different batches of finished products will be listed in stock at different prices.

Reflection in the accounting of operations for posting finished goods from production to the warehouse in this case, as a rule, does not cause problems - production costs are debited from account 20 “Main production” to account 43. At the same time, general production and general expenses are preliminary written off to account 20. In addition, the account 20 includes the cost of work and services of auxiliary production. In some cases, the cost of the work and services of the service industries and farms recorded in account 29 “Serving production and farms” may also be debited to account 20.

The balance of account 20 after the posting of finished products corresponds to the volume of work in progress.

An important requirement of PBU 1/98 is the requirement of prudence (in theory it is called the principle of conservatism); according to it, the accountant should show "greater readiness for recognition in accounting of expenses and liabilities than possible incomes and assets." This means that if the estimated selling price of the finished product falls below the actual cost, then the evaluation of the finished product must be performed at the selling (current market) prices. In the preparation of the balance sheet, the decrease in the cost of finished goods is reflected in accounting by accruing a reserve for the debit of account 91 “Other income and expenses” and the credit of account 14 “Reserve for reduction in the value of material assets”.

Subsequently, when the finished product is disposed of or if its current current is increased, the corresponding reserve amount is allocated to increase the financial result for the debit of account 14 and the credit of account 91.

Analytical accounting for account 43 is carried out according to storage locations and certain types of finished products in the context of brands, articles, models and other distinctive features. In addition, records should be kept for enlarged product groups: products of primary production, products made from waste, consumer goods, spare parts, etc.

Finished goods account

Account 43 "Finished products" is intended to summarize information on the availability and movement of finished products. This account is used by organizations engaged in industrial, agricultural and other production activities.Finished products purchased for picking (the cost of which is not included in the cost of production of the organization) or as goods for sale are recorded on account 41 “Goods”. The cost of work performed and services rendered on account 43 “Finished products” is not reflected, and the actual costs thereof as they are sold are deducted from the accounts of production costs to account 90 “Sales”.

Acceptance for accounting of finished products manufactured for sale, including products partially intended for the organization’s own needs, is reflected in the debit of account 43 "Finished products" in correspondence with accounts for the accounting of production costs or accounts 40 "Production (works, services). " If the finished product is completely sent for use in the organization itself, then it may not be accounted for on account 43 “Finished products”, but is recorded on account 10 “Materials” and other similar accounts, depending on the purpose of this product.

Upon recognition in accounting of the proceeds from the sale of finished products, its value is deducted from account 43 "Finished products" in the debit of account 90 "Sales".

If the revenue from the sale of shipped products for a certain time cannot be recognized in accounting (for example, when exporting products), then until the recognition of revenue, these products are recorded on account 45 "Goods shipped". In case of its actual shipment, a record is made on the credit of account 43 “Finished goods” in correspondence with account 45 “Goods shipped”.

When accounting for finished products on synthetic account 43 “Finished products” at actual production costs in analytical accounting, the movement of its individual items can be reflected at accounting prices (planned costs, selling prices, etc.) with the deviation of the actual production costs of products from their value at discount prices. Such deviations are taken into account for homogeneous groups of finished products that are formed by the organization based on the level of deviations of the actual production cost from the cost at the discount prices of individual products.

When writing off finished goods from account 43 “Finished goods”, the sum of deviations of the actual production cost from the cost at the prices accepted in the analytical accounting related to these products is determined by the percentage calculated based on the ratio of deviations to the balance of finished goods at the beginning of the reporting period and deviations for products received at the warehouse during the reporting month to the cost of these products at discount prices.

The deviations of the actual production cost of the finished product from its value at accounting prices related to the shipped and sold products are shown on the credit of account 43 “Finished products” and the debit of the respective accounts with an additional or reversal record, depending on whether they represent an overrun or a saving .

Analytical accounting of the account 43 "Finished goods" is carried out according to storage places and certain types of finished goods.

Account 43 "Finished goods" corresponds with the accounts:

|

debit |

on loan |

|

20 Main production |

10 Materials |

Sale of finished products

Sale of finished products refers to the normal activities of the organization.For accounting purposes, revenue from the sale of finished products is determined on the basis of the assumption of temporary certainty of facts. economic activity (i.e., on an accrual basis).

Finished products are considered to be sold (sold) at the time of their shipment to the buyer and the transfer of ownership of the products to him.

Finished products are sold by organizations at prices including value added tax.

When shipping (dispensing) finished goods, the amounts payable by the buyer are determined, a settlement document is drawn up and presented to him for payment.

The form of settlements for finished products shipped within the territory of the Russian Federation is established by the terms of the contract, however, as a rule, buyers pay for the finished products with payment orders.

When selling finished products, the ultimate goal is to identify the financial result from the operation to sell them on accounting accounts.

The financial result from sales of finished products is monthly revealed on account 90 “Sales”.

This account summarizes information on income and expenses associated with the sale of finished products, and forms a financial result for them.

On account 90 "Sales" are reflected:

Revenue from the sale of finished products (subaccount 90–1 “Revenue”);

cost of finished goods and costs of sale (sub-account 90–2 “Cost of sales”);

value added tax (subaccount 90-3 “Value Added Tax”);

excises - upon sale of excisable products (subaccount 90–4 “Excises”).

To identify the financial result (profit or loss) from the sale of products for the reporting month, subaccount 90–9 “Profit / loss from sales” is used.

The financial result from sales for the reporting month is determined by comparing the total debit turnover for sub-accounts 90–2 “Cost of sales”, 90–3 “Value added tax”, 90–4 “Excise taxes” and credit turnover for the sub-account 90–1 “Revenue”.

This financial result is monthly (in final turnovers) deducted from sub-account 90–9 “Profit / loss from sales” to account 99 “Profit and loss”, where the final financial result from all types of activities of the organization is generated.

In the general case, revenue is accepted for accounting in the amount calculated in monetary terms equal to the amount of receipt of cash and other property and / or the amount of receivables.

If the amount of the receipt covers only part of the revenue, then the revenue accepted for accounting is determined as the sum of the receipt and receivables (in the part not covered by the receipt).

In addition, regulatory following features determination of revenue from the sale of finished products:

When selling products on the terms of a commercial loan provided in the form of deferment and installment payment, the proceeds are taken to accounting in the full amount of receivables;

the amount of receipts and / or receivables under contracts providing for the fulfillment of obligations (payment) by non-monetary means is accepted for accounting at the cost of goods (values) received or receivable by the organization. The value of the goods (values) received or receivable by the organization is determined on the basis of the price at which, in comparable circumstances, the organization usually determines the cost of similar goods (values). If it is impossible to establish the value of the goods (valuables) entrusted by the organization, the amount of receipt and / or receivables is determined by the value of the products (goods) transferred or to be transferred by the organization. The cost of the products (goods) transferred or to be transferred by the organization is determined on the basis of the price at which, in comparable circumstances, the organization usually determines revenue in relation to similar products (goods);

the amount of receipts and / or receivables is determined taking into account all the discounts (capes) provided to the organization according to the contract.

Proceeds from the sale of products are recognized in accounting if the following conditions exist:

The organization has the right to receive this revenue arising from a specific contract or otherwise confirmed accordingly;

the amount of revenue can be determined;

there is confidence that as a result of a particular operation the organization will increase its economic benefits (there is confidence that the organization will receive payment in cash or another asset or there is no uncertainty regarding the receipt of payment or asset);

ownership of the product has passed from the organization to the buyer;

expenses that are incurred in connection with the receipt of income from the sale of products can be determined.

If in respect of cash and other assets received by the organization in payment, at least one of the above conditions is not fulfilled, then accounts payable are recognized in the accounting of the organization, and not revenue.

An entity may recognize in accounting revenue from the sale of products with a long manufacturing cycle as the product is ready or upon completion of the production as a whole.

The above norms apply to other ordinary activities of organizations, such as selling goods, performing work or providing services to outside legal entities or individuals.

Subject to all conditions, the proceeds from the sale of finished products are reflected in the debit of account 62 “Settlements with buyers and customers” and the credit of account 90 “Sales” (subaccount 90–1 “Revenue”).

Along with the formation of receivables for buyers, the following are included in the debit of the sales account:

Actual production cost of the shipped (dispensed) finished products;

value added tax;

sales costs to be debited to the sales account in accordance with the organization’s procedure for distributing sales costs;

The credit or debit balance of the sales account is credited to the financial statement.

The actual cost of finished goods is debited from account 43 “Finished products” to the debit of account 90 “Sales” (subaccount 90–2 “Cost of sales”).

At the same time, the debit of subaccount 90–3 “Value Added Tax” reflects VAT due to be received from the buyer of products.

If there are costs to sell, these amounts are written off in whole or in part to the debit of account 90 “Sales” (subaccount 90–2 “Cost of sales”).

Expenses for transportation of finished products made by third parties that are not payable by buyers of products are deducted from the credit of the settlement account in the debit of account 44 “Sales costs”.

In organizations engaged in industrial and other production activities, during partial deduction, the costs of packaging and transportation are subject to distribution (between separate types of shipped products monthly on the basis of their weight, volume, production cost or other relevant indicators).

All other expenses associated with the sale of products are fully debited monthly.

Depending on the adopted accounting policy, general business expenses reflected on account 26 “General business expenses” can be written off as conditionally constant directly into the debit of account 90 “Sales” (subaccount 90–2 “Cost of sales”).

Receipt of payment from the buyer of products is reflected in the debit of cash accounts, and when fulfilling obligations by non-monetary means - accounts with suppliers and contractors, in correspondence with the credit of the accounts for settlement accounts.

The procedure for the synthetic accounting of transactions for the sale of finished products (as well as goods, works, services) depends on the method of accounting for the sale of products chosen by the organization. Since this procedure is the same for the sale of finished goods, goods, work, services, in the future, when it comes to finished products, this will also mean goods, work, and services.

For organizations performing work or providing services, products shall be recognized as the work (services) performed (provided) by them for other organizations or individuals.

Tax aspects. Unlike accounting for profit tax purposes, organizations can determine the proceeds from the sale of finished products either at the time of shipment of the product and the presentation of settlement documents to the buyer (accrual method), or at the time of payment for the shipped product (cash method).

The chosen method of selling finished products or the procedure for recognizing income from the sale of finished products should be reflected in the accounting policies of the organization for tax purposes.

When choosing the accrual method, income (revenue) is recognized in the reporting (tax) period in which it occurred, regardless of the actual receipt of funds or other property (work, services) in payment for the shipped products.

When choosing the cash method, income (revenue) is recognized after the receipt of funds in bank accounts and / or in cash or after receipt of other property in payment for the shipped products.

Currently, for the purposes of taxation of profits, one main method of recognition of income from sales should be applied - the accrual method.

The exclusive right to use the cash method is only those organizations for which, on average, for four quarters of the reporting year, the proceeds from the sale of products excluding value added tax do not exceed one million rubles for each quarter.

In accordance with the Tax Code of the Russian Federation for organizations that have adopted an accrual recognition procedure for accounting purposes for tax purposes, the date of receipt of income is the date of sale of products (goods, works, services) regardless of the actual receipt of funds or other property (works, services) in their payment.

In accordance with the Tax Code of the Russian Federation for organizations that have adopted the accounting procedure for taxation purposes in accordance with the tax policy, the date of receipt of income is the day of receipt of funds to banks and / or cash registers, receipt of other property (work, services), and also repayment of debt to the organization in a different way.

For purposes tax accounting the costs associated with the sale of finished products are taken into account, that is, they can reduce the tax base when calculating income tax.

In other words, the organization has the right to reduce revenues from the sale of finished products by the amount of expenses directly related to its implementation (sale).

In relation to the finished product, these expenses include the actual cost of its manufacture and the costs associated with its sale (storage, transportation costs, etc.).

Profits from the sale of finished products are subject to income tax in the general manner at a rate of 24%.

Operations for the sale of finished products to customers are subject to value added tax.

The moment of determining the tax base for value added tax is the earliest of the following dates:

Day of shipment (transfer) of finished products (goods, works, services);

day of payment, partial payment on account of the upcoming deliveries of finished products, goods (work, services).

Moreover, if the moment of determining the tax base is the day of payment, partial payment of the upcoming deliveries of finished products, then on the day of shipment of finished products on account of the payment received earlier, of partial payment, the moment of determining the tax base also arises.

In other words, upon any receipt by the organization of payment, partial payment on account of the upcoming deliveries of finished products, the organization is obliged to charge value added tax and pay it to the budget.

Thus, all organizations must use the accrual method (as they are shipped) to determine when to determine the tax base for VAT.

In general the tax base when the organization sells finished products, it is determined as the value of these products, calculated on the basis of prices determined in accordance with Art. 40 of the Tax Code of the Russian Federation, including excise taxes (for excisable products) and without including VAT.

In accordance with Art. 40 of the Tax Code of the Russian Federation for the market price of finished products (goods), the price of finished products (goods) specified by the parties to the transaction is accepted. Unless proven otherwise, it is assumed that this price corresponds to the level of market prices.

When selling products on exchange of goods (barter) operations and selling products on a gratuitous basis, the VAT tax base is also defined as the value of the specified products, calculated on the basis of prices determined in accordance with Art. 40 of the Tax Code of the Russian Federation, including excise taxes (for excisable products) and without including VAT.

When the finished goods are shipped, the organization issues the invoice in two copies, the original invoice is transmitted to the buyer, and the second copy is registered in the organization’s sales book.

When the finished goods are shipped, VAT accrual is reflected in the debit of account 90 “Sales” (subaccount 90–3 “Value Added Tax”) in correspondence with the credit of account 68 “Calculations for taxes and fees” (subaccount 68–1 “Calculations for VAT”) .

For this case, operations for the sale of finished products (when writing off general business expenses as conditionally constant) are reflected in accounting by the following entries:

|

Offsetting accounts |

|||

|

Reflects the sale value of the shipped products according to settlement documents (including VAT) |

|||

|

Reflects the amount of VAT presented to the buyer of finished products |

|||

|

Written off the actual cost of shipped finished products |

|||

|

Charged to sales |

|||

|

Charged as semi-fixed expenses general business expenses |

|||

|

Reflected financial result (profit) from the sale of finished products (as part of the final financial result) |

|||

|

Payment received for products sold |

|||

In some cases stipulated by the concluded agreements, the organization may receive advance payment from the buyers, partial payment (advance payment) for the supply of finished products.

In accounting, the amounts of advances received are reflected in the credit of account 62 “Settlements with buyers and customers” (for example, sub-account 62–2 “Settlements for advances received”) in correspondence with the debit of cash accounts.

Amounts of advances received are recorded on subaccount 62–2 “Settlements on advances received” until the finished product is shipped to the buyer.

In accordance with paragraph 4 of Art. 164 N of the Russian Federation, upon receipt of payment, partial payment against upcoming deliveries of finished products, the amount of VAT should be determined by the calculation method. In these cases, the tax rate is defined as a percentage tax ratereferred to in paragraph 2 or paragraph 3 of Art. 164 of the Tax Code (respectively 10 and 18 percent), to the tax base, taken as 100 and increased by the corresponding amount of the tax rate. According to Art. 171 of the Tax Code of the Russian Federation, the amount of VAT calculated by the organization from the amounts of payment, partial payment received on account of the upcoming deliveries of finished products is deductible.

The accrual of VAT on advances received is recorded in the debit of account 62 “Settlements with buyers and customers” (sub-account 62–2 “Settlements on advances received”) in correspondence with account 68 “Settlements for taxes and fees” (sub-account 68– 1 “Calculations of value added tax”).

After the shipment of the finished product and presentation of the settlement documents to the buyer, the advances received are set off in settlements with the buyer of the finished product.

The offset of received advances is reflected in the debit of account 62 “Settlements with buyers and customers” (subaccount 62–2 “Settlements on advances received”) correspondence with the credit of account 62 “Settlements with buyers and customers” (for example, subaccount 62–1 “Settlements with buyers” to pay for products ”).

Simultaneously with offsetting the advance, the amount of VAT previously calculated from the advance received and transferred to the budget can be deducted.

The VAT deduction is reflected in the credit record of account 62 “Settlements with buyers and customers” (sub-account 62–2 “Settlements on advances received”) and the debit of account 68 “Settlements for taxes and fees” (sub-account 68–1 “Settlements for tax on Additional cost").

Upon receipt of advances against upcoming deliveries of finished products, the supplier draws up an invoice, which is recorded in the sales book.

This invoice is the basis for paying VAT to the budget based on the amount of the advance payment received.

Invoices issued and registered by sellers in the sales book upon receipt of advances against upcoming deliveries of products, then when goods are shipped against advances received, they are recorded in the purchase book indicating the corresponding amount of value added tax. The organization may present the amount of VAT indicated in the purchase book for deduction.

Finished product costs

The state regulates the composition and level of expenses included in the cost of production of enterprises, since the profit of the enterprise depends on the amount of costs, and, consequently, the amount of income tax.The following main types of costs are included in the cost of production:

1. the cost of preparation and development of production. These include: the costs of preparing work in the extractive industries (additional exploration of deposits, cleaning the territory, the construction of temporary access roads and roads), the costs of developing new enterprises, workshops, units (the cost of comprehensive testing under load of all equipment). This does not include the costs of preparing and mastering the production of new types of products, new technological processes, individual testing of certain types of machines;

2. costs directly related to the production of products due to the technology and organization of production, including the costs of monitoring production processes and the quality of products;

3. costs associated with inventions and rationalization (experimental and expert work, production of models and samples, organization of exhibitions, contests, payment of royalties);

4. The costs of servicing the production process (ensuring the production of materials, fuel, energy, tools); to maintain fixed assets in working condition; on the implementation of sanitary and hygienic requirements, cleanliness and order at the enterprise, fire and guard;

5. costs to ensure normal working conditions and safety measures (fencing machines, washbasins, shower disinfection chambers, provision of protective devices, protective clothing, etc.);

6. costs for the maintenance and operation of treatment facilities, filters, wastewater treatment;

7. costs associated with the management of production (with the maintenance of the management apparatus, transport services for the activities of management employees, expenses for business trips related to production activities; expenses for the maintenance of computer centers, signaling devices, payment for consultations, informative and audit services, as well as hospitality expenses );

8. costs associated with the training and retraining of personnel (payment of study leave, tuition fees under contracts);

9. payments stipulated by labor legislation for unworked time (vacation pay);

10. deductions to social insurance funds;

11. costs of marketing products (packaging, storage, transportation, advertising costs);

12. depreciation charges.

The Regulation on the composition of the costs of production and sales of products establishes a permanent list of economic elements in the cost of production:

Material costs;

- labor costs;

- deductions for social needs;

- depreciation of fixed assets;

- other expenses.

This list is the main for all PMR enterprises.

Material costs include the cost of raw materials and materials purchased on the side, purchased components, semi-finished products, fuel, purchased energy, natural raw materials (water charges). When determining material costs, it is important to evaluate the used material resources. From the cost of material resources included in the cost, the cost of returnable waste is deducted.

The total amount of the cost elements represents the production cost of production. If you add to it the commercial (non-manufacturing costs), it turns out the full cost of production.

Enterprises can make changes to the industry nomenclature of cost items in order to bring it closer to their own characteristics.

In practice, cost accounting for cost items is carried out for each workshop, for production and for the enterprise as a whole. Cost items compiled and the calculation of the unit cost of production. The resulting amount of costs for each item is divided by the amount of output for the corresponding period and the unit cost is determined by cost items.

More often enterprises produce several types of products. To compile the calculation of the cost of a unit of production (costing), some expenses are included in the cost of production directly (based on primary documents), and some types have to be distributed between products indirectly. The distribution method depends on the content of the expenses to be distributed.

Inclusion of material costs

The release of material resources from the warehouse is drawn up with limit-fence cards, requirements. According to primary documents, the consumption of materials for production is determined. The consumption of materials for production is the amount of materials released from the warehouse minus the return of materials not started by processing at the end of the month in the workshops. For materials that remained in the workshops at the end of the month not started for processing, an invoice for internal movement (return) on the last day of the month (D 10 - K 20) is drawn up. At the same time, a requirement is drawn up for the release of materials from the warehouse on the first day of the new month for which the materials are written off (D 20 - K 10).

Based on the primary documents on the consumption of materials, a statement of the distribution of materials in the directions of consumption is compiled. If materials are accounted for at discount prices, then a separate column shows the deviations of the actual cost of accounting prices.

When writing off materials used for production purposes, they are subject to distribution among the costing objects. The order of distribution of materials by type of product depends on the role that materials play in the process.

The basic materials used constitute direct costs and are accounted for by type of product on the basis of primary documents on their release into production. However, in some cases, several types of products are produced from the same material. In these cases, the need arises for the indirect distribution of basic materials by type of product. The following methods may be used for this.