Consider the step-by-step instructions for conducting, accrual and payment of sick leave benefits in 1C 8.3 ZUP 3.1.

Suppose that an employee of the Kron – Ts company Balzer German Eduardovich fell ill. In the event that the period of his sick leave turned out to be rolling from month to month, he should have issued a failure to appear for an unexplained reason. This is done so that during the next days of absence, nothing will be charged to him.

If the employee went to work, but did not immediately provide a sick leave, you can issue an exit for an unexplained reason. When he brings the sick-list, then you should start reflecting and calculating it in the program.

You can make a sick leave in 1C: ZUP using the Salary menu.

First of all, in the heading of the document, we indicate that this sick leave for September 2017 is for the employee Balzer G. E., who works in the organization Kron-Ts.

On the tab "Main" indicates the period of the disease. Let's say our employee suffered a disease from September 18 to September 28, 2917. Below we indicate the reason. Please note that the payout amount may vary depending on the reason. In our case, this will be a common disease, and the accrued amount will directly depend on the length of service and the average wage. Balzer G. E.

Please note that in the figure above, the program informs us that our employee has not completed an experience. This is urgently necessary to fix, because otherwise, in the calculations with a high probability there may be an error as a result. You can do this by clicking on the appropriate hyperlink.

You will see a window with the experience setting for this employee. Make all the necessary settings and click on the "OK" button. In our case, the Experience Beltser G. E. was 7 years, 7 months and 24 days. It remains to hold a sick leave in 1C ZUP 8.3 and go to the next step.

Sick leave calculation

Since in our case the usual disease was chosen, the amount of the final payment directly depends on the length of service and average earnings. In some cases, average earnings need to be adjusted.

For example, an employee goes on sick leave after a long parental leave. In accordance with applicable law, in such cases, at the request of the employee, the billing period may be postponed. By default, it is set as the two previous years.

To change the average earnings, click on the green pencil to the right of the corresponding field.

In the window that opens, you can not only change the billing period, but also adjust the income received for certain months. In addition, this form gives you the opportunity to add help from your previous job.

The calculation of the sickness benefit is done on the “Payment” tab of the “Sick leave” document.

We indicate that the benefit will be paid for the entire period of the disease from September 18 to September 28, 2017. Please note that the percentage of payment was set automatically based on the specified experience. In cases where the employee's insurance experience is less than 5 years, the percentage will be 60. From 5 to 8 years - 80%, and over 8 years - 100%.

In our case, the experience of Balzer G.E. was 7 years, so the percentage of payment will be 80%. For simplicity, we will not introduce any restrictions or benefits.

Due to the fact that the period of illness of our employee was 11 days, two lines automatically appeared in the tabular section on the “Charged” tab. The first 3 days are paid at the expense of the employer, that is, our organization. All the remaining 8 days are paid by the FSS.

By the way! In the near future in 1C ZUP there will be an opportunity to accept sick leave in electronic form.

Sick pay

We proceed to payroll employee Balzer G. E. for September, part of which he was on sick leave. We filled in all the data automatically. In the figure below you can see that the amount of time worked is 9 days less than normal. The program automatically calculated the period of the disease minus days off.

Immediately pay wages through the cashier. It includes both accrued wages and sick leave included in the program. Total payment came out 45 476.60 rubles.

In the payroll for employee Balzer G.E. for September 2017, you can see three lines in the accruals. It reflects wages, the amount of sick leave payment at the expense of our organization and at the expense of the Social Insurance Fund.

By the numerous requests of specialists who keep records of personnel and salaries in the configuration 1C 8.3 ZUP 3.0, from release 3.0.23 it became possible to generate a pay sheet in 1C not only for an individual, but also for the employee as a whole. This is convenient when the same person works in an organization in several positions. For example, he was hired for the main position and still works part-time for another.

Now it can be seen in one pay slip:

There are two ways to print a pay sheet in the program:

- directly calling the desired report;

- from the document. "

Let's start looking in order.

Report 1C “Settlement Leaflet”

Oddly enough (despite the presence of the menu "Reporting, inquiries"), the report is located in the "Main" menu. Next, click on the “Salary Reports” link. A window with a choice of reports will open:

Get 267 1C video lessons for free:

The previous “Settlement sheet” also remained under the name “Settlement sheet broken down by jobs."

Another pleasant moment appeared. Now you can organize the distribution of settlement sheets. This is done using the "More" button:

There are two main ways to invoke the printed form of the payroll:

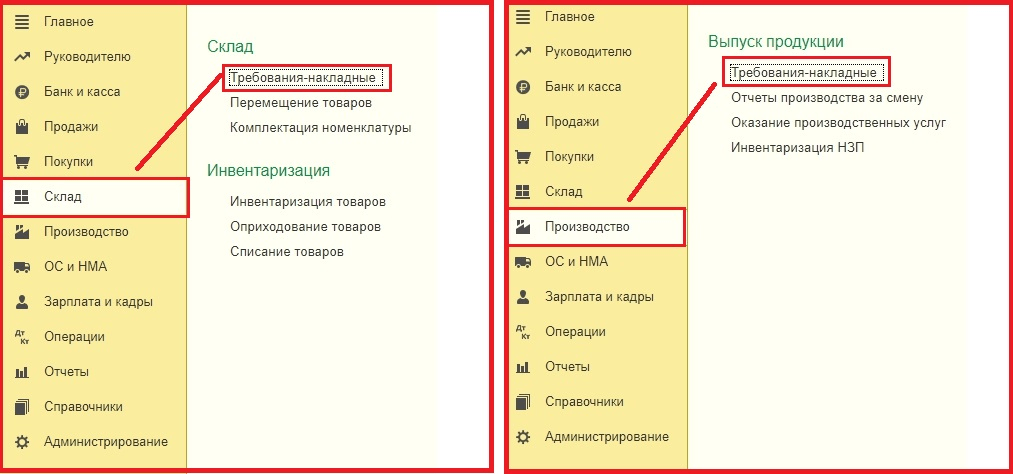

1. From the document Payroll and Contributions: Salary menu - Payroll and Contributions. A pay slip from the pay document is usually formed to control the correctness of payroll. You can generate payrolls for a group of employees. To do this, in the form of a list of documents Payroll, you need to select (with a simple mouse click on the desired line, while holding down the Ctrl key) several employees and click the Settlement sheet button above the tabular part of the document:

2. From the Salary menu - Salary reports - Settlement sheet:

It is possible to break the formation of sheets by units and set the period. For the report, there are two options for the formation of a settlement sheet - Settlement sheet and Settlement sheet for jobs:

The difference between these two options is that the pay slip forms a single pay slip for all the employee’s workplaces. For example, in basic and concurrently. This option is the main one in the program 1C ZUP rev.3.

A pay slip with a breakdown by jobs forms a separate pay slip for each workplace of an organization’s employee (for example, the main place and part-time job).

Consider an example: for an employee Chuk N.A., the main place is the chief accountant, a part-time job for the position of deputy director is framed.

We choose the option - Settlement sheet with a breakdown by jobs. Click on the Settings button:

In the settings, you can mark with a tick only those employee positions for which we want to display settlement sheets:

In this case, we will receive accruals only at the main place of work Chuk N.A. (without part-time job), in the position of chief accountant:

What are the options for setting the printed form of the payroll is in the program 1C ZUP 8.3

By the button Settings or More - Settings we can adjust the amount of information displayed in the payment sheet:

Most of the settings are clear from the name, but let’s explain a few:

- Display features of the calculation of personal income tax - the total taxable income and the amount of deductions provided from the beginning of the year are displayed;

- To detail payments by statements - the list of statements on which salaries were paid is displayed (including advance payment);

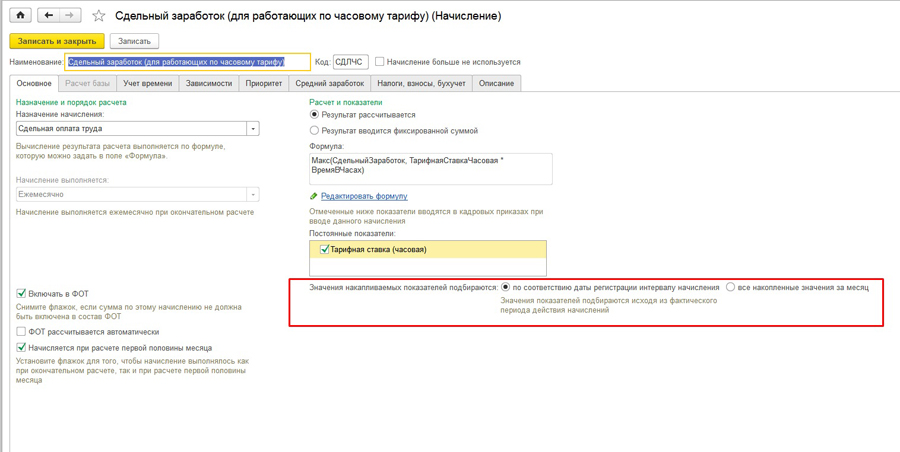

- Display accrual indicators - displays the size of the salary, district coefficient, rates when performing piecework, etc .;

- Insurance contributions to the FIU - the total insurance premiums to the FIU for the billing period are displayed.

Please also pay attention to the fact that according to our example, accruals Chuk N.A. are displayed in the settlement sheet (main form) both in the main place of work and in part-time work as deputy. directors, in contrast to the above-considered version of the Settlement Leaflet, broken down by workplace, with selection by position:

If you clear the checkmark for all settings flags, the information in the printed form of the sheet will be minimal:

How to add a column for an employee to confirm receipt of a payment slip

The obligation to notify the employee of the size of accruals, deductions, compensation for delayed salaries, the amount of salaries payable is fixed in the Labor Code of the Russian Federation (Article 136).

Therefore, in order to avoid Rostrud’s claims and to obtain evidence in labor disputes with employees, the employer needs to receive a worker’s signature confirming the fact that a pay slip was issued. You can do this in one of the following ways:

- Add a column in the payroll or pay slip;

- Obtain an employee’s signature for consent to receive leaflets by e-mail;

- Start a special register of issued settlement sheets.

Let's consider step by step how easy it is to create a column directly in the pay slip for signing on confirmation of receipt of the slip by the employee.

Step 1. We will form a settlement sheet and use the More button - Go to the layouts of printing forms:

You can also go to the layouts in the Administration - Printed Forms, Reports and Processing section, using the Layout of Printed Forms hyperlink.

Step 2 Choose the layout of the printed form Settlement sheet (custom):

Step 3 Open the layout For viewing and editing. Add at the top the inscription Leaflet received:

Select the area of \u200b\u200bthe inserted text. Right-click on the context menu, select the menu command Combine. Save the changes by clicking the Write and close button:

Now, if we again form the Settlement sheet in 1C ZUP 8.3, we will see a place for signature in the receipt of the sheet:

How to configure the distribution of settlement sheets in 1C ZUP 8.3

Let’s take a step-by-step look at how you can organize the sending of pay slip to employees by email.

Step 1. We set up (if not already configured) an email account with which we will send leaflets and other types of emails. The account is configured in the Administration - Organizer section. You must enter an email address. mail and password:

In more detail how to configure mail in 1C 8.3 ZUP for sending documents and letters is discussed in our video tutorial:

Step 2 We’ll check whether individuals have entered email addresses. Let's open the card for individuals: Personnel - Individuals:

If not entered, then fill out the email address in the Email field on the Addresses and Phones tab:

- “Send”: A report for each recipient;

- “Recipients”: Individuals;

- In the table “Reports” we select the Settlement sheet by the button Select;

- In the settings, set the selection Employee Equals [Recipient]. [Recipient] is set by the button Specify the recipient of the distribution;

- On the Advanced tab, define the format for sending the report (xls, .pdf ...):

Step 4 On the Delivery tab (e-mail), we select the employees (individuals) hyperlink to the “Indicate recipients” hyperlink to whom we will send the settlement sheets:

Timely issuance of checklists will not only help employees to navigate the correctness of remuneration payments, but also protect the employer, as it acts as evidence of expenses and as a means of reducing the statute of limitations in employee claims for salaries. Claims may be submitted by employees within 3 months from the receipt of the payment slip. But if the pay slip was not issued, then the claim period will be counted from the moment when the employee found out about the violation of the correct calculations, for example, upon dismissal.

The procedure for issuing settlement sheets

Important! It is necessary to approve the form of the Settlement sheet by one of the documents: an application to the accounting policy or a local regulatory act, for example, an order.

In the approved form of the leaflet should indicate:

- The date the application began;

- Designate an extradition officer;

- Describe the procedure for issuing if the salary is transferred to the card.

Keep in mind the protection of personal data. Settlement sheets are issued or distributed, with the consent of the employee, to the recipient personally, without access to the sheets of other individuals.

When paying a salary, the employer must notify each employee of its components, the amount of deductions, as well as the total amount payable. There is no regulated form of the pay slip. It is approved by the order of the employer taking into account the opinion of the representative body of employees (for example, a trade union). Eexperts 1C tell, toin the program “1C: Salary and Human Resource Management 8”, version 3, create a pay slip for the employee.

Issue of a settlement slip

In accordance with article 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify in writing each employee:

- on the components of the wages due to him for the relevant period;

- on the amounts of other amounts accrued to him (including monetary compensation for violation by the employer of the deadline for the payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee);

- on the size and basis of the deductions made;

- about the total amount payable.

The unified form of the payment sheet has not been established. The form of the pay slip is approved by the order of the employer taking into account the opinion of the representative body of employees (for example, the trade union) in the manner prescribed by Article 372 of the Labor Code of the Russian Federation (part 2 of article 136 of the Labor Code of the Russian Federation, paragraph 3 of the letter of Rostrud dated 08.12.2008 No. 2742-6-1 ) The sheet is submitted in paper or electronic form (letter of the Ministry of Labor of Russia dated 02.21.2017 No. 14-1 / OOG-1560). It is issued or distributed with the consent of the employee personally to the recipient (without access by unauthorized persons).

According to the law, payroll sheets are issued upon payment of salaries, and salaries are paid 2 times a month. Also, the employee going on vacation is paid vacation pay. The letter of Rostrud dated December 24, 2007 No. 5277-6-1 indicates that it is enough to issue leaflets only when the second part of the salary is paid (usually at the end of the month), including for employees who have gone on vacation. The sheets will contain information on the total amount payable.

If an employee leaves, the pay slip must be issued on the day of dismissal. Despite the fact that legislation does not provide for confirmation of the issuance of slips to employees, this is necessary in order to confirm the fact of notifying employees during inspections of various bodies, as well as during court proceedings. This can be done in many ways. For example, to develop a journal for issuing settlement sheets or in the settlement sheet itself, add an additional line where employees put their signature.

Settlement sheet in “1C: ZUP 8” (rev. 3)

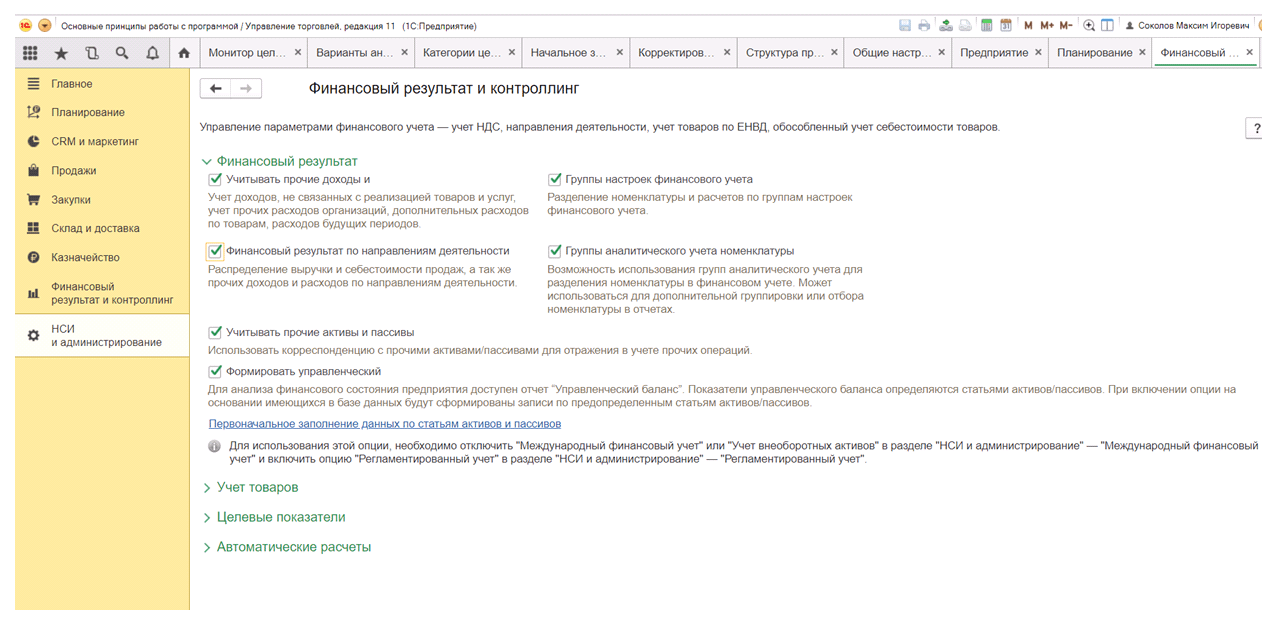

For accruals, deductions, payments registered in the program, it is possible to form a pay slip, which is prepared using reports Settlement Leafletor (fig. 1). The reports are distinguished by the output of information for employees working in the organization at the same time at the main place of work and in part-time work:

- in the report Settlement Leaflet - one common pay slip is displayed with all accruals and deductions of the employee at the main place of work and internal part-time (Fig. 2);

- in the report Work sheet by job - several settlement sheets: a separate settlement sheet for the main place of work and a separate part-time.

Fig. one

Fig. 2

Formation Settlement sheet comes from the section Salary - Salary Reports - Payroll or section Highlights - Salary Reports - Payroll.

In field Period indicates the period for which it is necessary to generate a report (Fig. 1). Next, set the flag Organization and select the organization for which you want to form a pay slip.

Flag Divide by unit set if it is necessary to display a report by department. Then press the button To form. If it is necessary to generate a leaflet for a specific employee or group of employees, the flag is set Employee and the necessary employee (s) is selected from the list.

The required report is selected using the button Select another report or save a new one. (Settlement Leaflet or Work sheet by job) (Fig. 1). By default, one common pay sheet is displayed for all workplaces of the employee.

As a result, a settlement sheet (s) will be formed (Fig. 2). Above in printed form of the pay slip are reflected: name of organization; subdivision; for which month a leaflet; what organization; FULL NAME. employee his personnel number; position; salary. In field To payoff indicates the total amount payable to the employee.

The tabular part of the report consists of several sections. In section Accrued The total amount of charges and their list are indicated:

In section Held The total amount of deductions and their list are indicated:

In section Paid indicates the total amount of payments and their list, taking into account all deductions. Details of the payout according to the statements when setting the flag are also indicated. Detail payouts by statement (button Settings).

In the program “1C: ZUP 8” of edition 3, you can take into account payments in reports not by the month for which they were made, but by the date of payment. In the shape of Additional settings (section Settings - Additional settings) By default, the switch is set to Monthly payroll. So, if the salary for March was paid on 04/05/2018, then in the pay sheet for March this payment will be taken into account (Fig. 2). If you set the switch to According to accounting, then the payment of the March salary will be taken into account in the April sheet.

The debt of the employer to the employee remaining at the beginning and the end is automatically reflected in the fields Enterprise Debt at the Beginning and Enterprise debt at the end. If the employee owes to the employer, fields appear Worker's duty to start and Employee debt at the end.

In field Insurance contributions to the FIU The information on the insurance contributions calculated for the employee for mandatory pension insurance for the month is indicated. This field appears if the flag is set. Display information on assessed contributions by the FIU (button Settings).

The amount of taxable income from the beginning of the year is indicated in the field Total taxable income. Also, if there are deductions, the presented tax deductions for the month are indicated (when setting the flag Display the features of the calculation of personal income tax by button Settings).

By button Print Report Resultyou can print out settlement sheets, as well as create a list of settlement sheets from this report.

The program “1C: Salary and personnel management 8” of edition 3 allows you to display your full name on the pay slip. employee subject to change. For example, an employee changed his last name in April 2018. If you generate settlement sheets for periods before the last name is changed, then by default the last name will be new in them.

In order to change this situation, in the section Administration - Printable Forms, reports and processing - Layouts of printing forms should find a layout Settlement leaflet (customizable). After opening the layout, set the switch to To view and edit. Then you need to change the layout.

In addition, using this layout, you can create a column in the pay slip for the signature of the employee confirming receipt of this document. To do this, add in the layout the inscription "Leaflet received." Selecting the area of \u200b\u200bthe inserted text, right-click to select the command Combinethen press the button Write down and close.

In the report Settlement Leafletopen settings in advanced mode on the tab Structurefind grouping Employee, Position at the end of the period, add fields to it Full Name and click on the buttons Finish editing and Close and shape.

As a result, checklists with the old and new surnames will be formed, and also a place for the signature of the employee will appear. To save the modified report, click on the button Choose another report option or save a new one - Save report option. This will open a special form Saving a report variant, in field Name The new name of the report is indicated. In order for the report to be available to all users, click on the button To all users and on the button Save.

You can also form the printed form of the settlement sheet from the document Payroll and Contributions(section Salary - Payroll and Contributions).

A pay slip is issued to the employees of the organization upon payment of wages. It contains complete information about all charges and deductions for the billing period. Also on the sheet is the salary debt to the employee at the beginning and end of the month. How to form a settlement slip in 1C 8.3 read in this article.

The payroll includes all accruals for the employee.

- salary;

- prizes

- bonuses;

- compensation;

- sick leave.

For each charge in the sheet, the days worked and hours are visible. It also indicates the withholding personal income tax and the amount due for extradition. Thus, the pay slip provides the employee with full information about his salary.

The pay slip does not have a unified form. 1C developed its own form, consisting of a header and 3 sections:

- Accrued

- Held

- Paid

The title indicates:

- name of the document "Settlement Leaflet";

- period of the pay slip (for which month);

- Name of employee

- personnel number of the employee;

- the name of your organization

- the unit in which the employee works;

- employee position

- his salary.

Separate columns indicate salary arrears at the beginning and end of the period. Optionally, information on assessed contributions to the pension fund can be displayed on the pay slip. Where to find the payment slip in 1C 8.3 and how to generate and print it in 4 steps, read on.

How to create in the BukhSoft program

pay slip

Step 1. Go to 1C 8.3. Accounting in the reports of the “Salary” section.

Go to the section “Salary and personnel” (1) and click on the link “Salary reports” (2). The payroll report window opens.

Step 2. Fill in the basic details in the payment slip in 1C 8.3

In the pay slip indicate:

- your organization (1);

- employee (2). If you want to generate payroll sheets for all employees, uncheck the box next to the “Employee” field (3);

- the start and end date of the period (4).

If you check the box next to the “Break down into divisions” field (5), then the settlement sheets will be grouped by divisions. To fill out the form, click the “Generate” button (6). The data on the employee will appear in the leaflet.

The sheet contains information:

- accrued salary (7);

- the number of paid working days for salary (8);

- withholding personal income tax (9);

- the amount payable "on hand" (10).

How to display information on assessed contributions to the pension fund in the pay sheet in the next step.

How to display information on assessed contributions to the pension fund in the pay sheet in the next step.

Step 3. Set up a payment sheet “for you” in 1C 8.3

If necessary, you can customize the payment sheet to your needs. For example, add to it information about contributions to the pension fund. You can also create a new report that will reflect the information you need. For example, create separate payroll sheets for the director and chief accountant.

Add information on pension contributions to the payroll

Click on the “Settings” button (1) in the payment sheet. The settings window will open.

In the window that opens, check the box “Display information on assessed contributions of the FIU” (2). Next, click the “Close and Form” button (3).

Now, the payroll sheet displays information on contributions to the pension fund withheld from salaries for the payroll month (4).

Create and save a new report “Settlement sheets by managers”

Go to the settings window, as in the previous section. Check the box next to the “Position” field (1). Next, click on the “Selection” link (2) and select from the directory of positions you need, for example, “General Director” and “Chief Accountant”. Click on them with the mouse. These posts will appear in the window below (3). Click the “Close and Generate” button (4) to generate a new report. Settlement sheets for two selected positions will open.

You can save any settings to use them in future work. For this, 1C 8.3 provides the ability to save various report options. To save your setting in a separate report, click the button (5) and click on the link “Save report option” (6). A window will open for saving a new version of the settlement sheet.

In the window that opens, in the "Name" field (7), write the name of your new report, for example, "Settlement sheets for senior staff." To save the report, click the “Save” button (8). New report saved.

Now you can see the created report in the list of personnel reports (9).

Step 4. Print settlement sheets

Click on the printer icon (1) to print the bill.

How to reset registers in 1s 8

3 print material report

Handbook "Ways to reflect salaries in regulated accounting

Filling OKVED in reporting

Inventory turnover