Experts of the service tell about whether personal income tax and insurance contributions are taxed on the amount of material assistance in connection with the birth of a child, as well as documents substantiating this payment. Legal advice GARANT Svetlana Ovchinnikova and Maxim Zolotykh.

By order of the head, the employee is paid financial assistance in connection with the birth of a child in the amount of 19,000 rubles. Is this material assistance taxed by insurance premiums and personal income tax? Should an employee provide a certificate from the wife’s place of work containing information on the receipt (non-receipt) of similar assistance by her and on the amount of this assistance?

The payment of material assistance to employees does not depend on the quantity and quality of work performed and is not related to the fulfillment of labor functions by the employee, therefore, does not apply to remuneration. Material assistance to employees can be paid on the basis of the order of the head or application of the employee of the organization, signed by the head. The organization is entitled to provide for the cases, conditions and procedure for payment of material assistance to employees in a collective agreement (art. 41 Labor Code of the Russian Federation) and (or) in the local regulatory acts of the employer.

Contributions for compulsory social insurance in the PFR, MHIF and FSS of the Russian Federation

According to h. 1 tbsp. 7 Federal Law of July 24, 2009 N 212-ФЗ (hereinafter - Law N 212-ФЗ) the object of taxation of insurance premiums for payers of insurance premiums is recognized as payments and other fees accrued by them in favor of individuals in the framework of labor relations and civil contracts, the subject which is the performance of work, the provision of services, as well as under copyright contracts, agreements on the alienation of exclusive rights, license contracts.

Article 9 of Law No. 212-FZ defines a list of payments and benefits for which insurance premiums are not charged. Among such payments are the sums of one-time financial assistance provided by payers of insurance premiums to employees (parents, adoptive parents, guardians) at the birth of a child, paid during the first year after his birth, but not more than 50,000 rubles for each child (n. 3 h. 1 Article nine Law N 212-ФЗ). The first year of life ends on the eve of the child’s birthday (section 3, Art. 4 Law N 212-ФЗ).

If financial assistance in connection with the birth of a child is paid after one year after his birth, the organization paying the insurance premiums has the right to applyclause 11 h. 1 Article nine Law N 212-ФЗ, on the basis of which the amount of material assistance provided by employers to their employees, not exceeding 4000 rubles, is not taxed. per employee for the billing period (see also letter Ministry of Health and Social Development of Russia dated 05.04.2010 N 5905-17).

Thus, in the situation under consideration, the entire amount of material assistance (19,000 rubles) will not be subject to insurance contributions to the PFR, MHIF and the FSS of the Russian Federation if it is paid within the first year after the birth of the child.

If such assistance was paid by the employer after one year after the birth of the baby, then for an amount exceeding 4000 rubles, it is necessary to charge insurance premiums.

Accident and sickness insurance contributions

In accordance withart. 20.1 Federal Law of 24.07.1998 N 125-ФЗ "On Compulsory Social Insurance against Occupational Accidents and Occupational Diseases" (hereinafter - the Law N 125-ФЗ) the object of taxation is insurance premiums and other benefits paid by policyholders in favor of the insured within labor relations and civil law contracts, if in accordance with the civil law contract the policyholder is obliged to pay insurance contributions to the insurer. The base for calculating insurance premiums is defined as the sum of these payments and other fees accrued by policyholders in favor of the insured, with the exception of the amounts indicated in art. 20.2 Law N 125-ФЗ.

Note that the object of taxation of insurance contributions for compulsory social insurance from NS and PZ and the base for their accrual completely coincide with the object of taxation and the base for calculation of contributions for compulsory social insurance provided by Law N 212-FZ (art. 20.1 Law N 125-ФЗ). According to p. 3 p. 1 art. 20.2 Laws N 125-ФЗ are not subject to insurance contributions: for insurance from the National Assembly and PZ the amount of one-time financial assistance provided by the insurers to employees at the birth of a child, paid during the first year after his birth, but in the amount of not more than 50,000 rubles.

In addition, the amount of material assistance provided by employers to their employees, not exceeding 4,000 rubles, is not subject to insurance contributions. per employee for the billing period (p. 12 p. 1 art. 20.2 Law N 125-ФЗ). That is (as in the case of insurance contributions for compulsory social insurance), if material assistance in connection with the birth of a child is paid after one year after his birth, such assistance is not taxed only in the amount of 4000 rubles, and the amount exceeding 4000 rub. is subject to assessments of contributions from insurance of the National Assembly and PZ.

Personal income tax

Based clause 1, Article 209 The Tax Code of the Russian Federation, the object of taxation of personal income tax, in particular, is recognized income received by a taxpayer (individual) from sources in the Russian Federation. When determining the tax base for personal income tax, all taxpayer income received by him in both cash and in kind (clause 1, Article 210 Tax Code of the Russian Federation).

By virtue of clause 1, Article 226 Tax Code of the Russian Federation organizations from which or as a result of relations with which the taxpayer received income are required to calculate, withhold from the taxpayer and pay the tax amount to the budget. According to section 4, Art. 226 The Tax Code of the Russian Federation tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income when they are actually paid.

Income not subject to taxation (exempt from taxation) is listed in Art. 217 of the Tax Code. According tosection 8, Art. 217 The Tax Code of the Russian Federation is not subject to taxation of lump sum payments (including in the form of material assistance) made by employers to employees at the birth of a child during the first year after his birth, but in the amount of not more than 50,000 rubles. From the amount of material assistance exceeding 50,000 rubles, personal income tax is withheld in the general manner. The provisions of this paragraph shall also apply to income received by the taxpayer in kind (letter The Ministry of Finance of Russia dated 09.08.2010 N 03-04-06 / 6-175).

In accordance withsection 28, Art. 217 The Tax Code of the Russian Federation exempted from taxation of income not exceeding 4,000 rubles for the tax period received by employees in the form of material assistance provided by employers.

Given the norms chapters 23 Tax Code of the Russian Federation, upon payment of material assistance to an employee in connection with the birth of a child in the amount of 19,000 rubles during the first year after his birth, this amount is exempt from personal income tax.

Payment of material assistance in connection with the birth of a child, made by the organization after one year after the birth of the child, is not subject to personal income tax only in the range of 4000 rubles.

Documents that serve as the basis for the payment of material assistance

Material assistance can be paid on the basis of the order of the head or application of an employee of the organization, with the resolution of the head.

The order for the payment of material assistance, as a rule, indicates:

Surname, name and patronymic of the person receiving assistance;

The reason for the payment of material assistance;

The amount of material assistance.

A copy of the birth certificate of the child is attached to these documents.

On the issue of the need for an employee to provide a certificate from the wife’s place of work containing information on the receipt (non-receipt) of material assistance in connection with the birth of a child and on the amount of this assistance, we note the following. In letters of the Ministry of Finance of Russiadated 12.26.2012 N 03-04-06 / 6-367, dated 01.25.2012 N 03-04-05 / 8-67 explained that from the normsection 8, Art. 217 The Tax Code of the Russian Federation implies that one-time financial assistance at the birth of a child, provided in an amount not exceeding 50,000 rubles, to one of their parents or to two parents on the basis of a total amount of 50,000 rubles is not subject to personal income tax.

Thus, the Ministry of Finance of Russia has consistently adhered to the point of view according to which the exemption from personal income tax on personal assistance in the amount of 50,000 rubles can be applied to a particular child only once, while either one of the parents or both of them can take advantage of the benefit 50,000 rubles (see also letters from the Ministry of Finance of Russiafrom 01.07.2013 N 03-04-06 / 24978, dated 01.16.2013 N 03-04-05 / 10-26).

However, the above statement of the Ministry of Finance of Russia does not seem entirely correct. After all, the norms of the Tax Code of the Russian Federation do not indicate that to take advantage of the privilege provided forsection 8, Art. 217 The Tax Code of the Russian Federation, the taxpayer with whom the child was born, can only on condition that the second parent did not take advantage of this benefit. The tax legislation does not contain any requirements for confirmation by the second parent of the fact of non-receipt of the corresponding material assistance.

Representatives of the Ministry of Finance of Russia ina letter dated 07.12.2012 N 03-04-06 / 8-346 also note that special provisions establishing the right of the employer in calculating material assistance exempted from personal income tax, require the submission of a certificate of form 2-personal income tax "Certificate of personal income for the year 20__" from the place of work of the other parent, in NK RF is not contained. At the same time, since when an employee of an organization receives financial assistance, the responsibility for the correct withholding of personal income tax is assigned to the Tax Code of the organization that is a tax agent, then to confirm the fact of receipt or non-receipt of such assistance by one of the parents, the organization’s requirement to provide information on personal income in form 2 Personal income tax seems reasonable.

If an employee of an organization does not provide information on receipt of the specified material assistance by another parent who is an employee of another organization, then the organization has the right to independently request the necessary information from another organization.

In case of impossibility to submit information onform 2-personal income tax due to circumstances beyond the control of the individual (for example, the other parent does not work), the organization can be exempted from taxation on the basis of the relevant application signed by the other parent regarding the non-receipt of the specified payment.

IN a letter The Ministry of Finance of Russia dated 01.07.2013 N 03-04-06 / 24978 also says that one of the parents can be used to confirm the fact of receiving (not receiving) financial assistanceform 2-personal income taxcontaining data on income paid to an individual by his employer for the period during the first year after the birth of the child. In addition, to confirm the absence of labor relations with one of the parents, the data of his work book, as well as relevant certificates issued by the employment service authorities, can be used.

Regarding the situation under consideration,reading the above explanations of the Ministry of Finance of Russia, as well as the lack of judicial practice, we believe that in order to avoid tax risks it is advisable for the organization to ensure the availability of documents confirming the fact of receipt (non-receipt) by the wife of the employee of material assistance provided section 8, Art. 217 Tax Code of the Russian Federation.

The texts of the documents mentioned in the experts' response can be found in the reference legal system GUARANTEE. Despite the fact that the current legislation provides for a certain level of social guarantees provided to working women and men when a child appears in the family, many employers also practice providing additional payments of material assistance at work for the birth of a child. However, this issue has a rather opaque legal regulation. Therefore, how financial assistance is paid at the birth of a child from the employer, how it can be received and whether it is necessary to provide it, should be known to all parties to the labor relationship.

Despite the fact that the current legislation provides for a certain level of social guarantees provided to working women and men when a child appears in the family, many employers also practice providing additional payments of material assistance at work for the birth of a child. However, this issue has a rather opaque legal regulation. Therefore, how financial assistance is paid at the birth of a child from the employer, how it can be received and whether it is necessary to provide it, should be known to all parties to the labor relationship.

What is material assistance at birth - legislation

Material assistance in modern labor and tax law means measures of social protection of workers, carried out by employers on a voluntary basis. Including financial assistance may be provided at the birth of a child - many employers use this practice to reward employees. In legislation, the concept of material assistance is reflected only in the Tax Code, namely in its following articles governing taxation and the calculation of insurance premiums:

- Art. 217 of the Tax Code.

- Art. 270 Tax Code of the Russian Federation.

- Art. 422 of the Tax Code.

It is imperative to distinguish between financial assistance to an employee at the birth of a child and maternity benefits. In particular, maternity payments are a form of compulsory state support, although partially paid by the employer himself - subsequently, all his expenses are compensated from the FSS. In the case of material assistance, the state does not compensate for it, but provides for the possibility of exempting it from taxation.

The main thing that should be understood by both employees and the employer is that financial assistance at the birth of a child is purely voluntary. No normative acts, laws of the federal and local level can oblige to make such payments - they are established only by the normative acts of the enterprise, as well as the entire procedure for their calculation, size and other calculations.

But if the payment of mother aid for a child was due to a collective agreement, an employment contract, or other internal documents then rejectionits provision may be considered a violation of labor legislation and entail the responsibility of the employee.

How to get financial assistance for having a baby

To receive financial assistance for the birth of a child at work, the employee or employee must write a statement addressed to the employer. Moreover, material assistance of this type should be provided for by local regulatory acts of the enterprise. In addition, these regulations, most often expressed as a separate provision, may also provide for a strictly defined procedure for the provision of such payments, restrictions, a list of necessary documents from the employee and other conditions for accruing it.

Employees have the right to contact the employer if they need material assistance in any case, even if it is not provided for by any written documents. However, in such a situation, the tax authorities may suspect that this payment is not social, but has an encouraging or selective nature, which will not allow taxation of the indicated amounts.

Direct accrual of material assistance is carried out exclusively after the head sends the appropriate order to the accounting department on its provision. At the same time, employers have the right to provide material assistance for a child not only in cash, but also in kind - company products, essentials, children's toys, trips, payment of treatment bills or other means. However, in any case, this assistance should have a cash equivalent in order to calculate its size in subsequent reporting.

Taxation of material assistance from an employer to employees per child

The legislation provides for certain restrictions on the amount of tax-free material assistance. In particular, its total size, not related to the specific circumstances of the accrual, can be no more than 4 thousand rubles a year - many employers use this mechanism to provide financial assistance for employees on vacation.

However, having a baby is an exception.

So, the existing legislative regulations suggest that material assistance issued by the employer during the first year from the moment of the birth of the baby or his adoption may not be taxed up to the amount of 50 thousand rubles. However, it should be borne in mind that such an amount can be paid only in the first year from the moment of birth or adoption, and only to one parent. The control of this fact can be ensured by the tax service when checking the reports for each of the parents, and in this case, it is the parents, and not the employer, who will be involved in tax evasion.

Any amounts above that will be taxed in the usual manner. Insurance fees for financial assistance are levied on a common basis in the same way as personal income tax. That is, if the amount of assistance was not more than 4 thousand rubles, or not more than 50 thousand rubles for the birth of a child, or if assistance was given in connection with the death of an employee, his relative, either in an emergency or after a terrorist act - contributions it does not accrue.

Both his immediate parents and other relatives can receive material assistance for a child, depending on the standards established in the organization — in this case, everything depends on the established principles for calculating it. In addition, financial assistance for treating a child, if necessary, including expensive, can also be a separate option for providing these payments.

The tax-free limit affects only one child. That is, at the birth of several children, for example, twins or triplets, the size of tax-free material assistance increases at the rate of 50 thousand rubles for each baby. At the same time, some employers may specifically establish the procedure for providing financial assistance, for example, only in the case of twins or triplets, but not at the birth of one child, in order to provide assistance to parents faced with increased workload.

The procedure for payment and the amount of material assistance from the employer at the birth of a child in 2019 is set by the company independently. Both parents can get help. When calculating, it is important to consider the limits that apply to personal income tax and contributions. In 2019, tax authorities take a new approach to taxing these amounts.

Who can receive material assistance at the birth of a child in 2019

Mom help can get both mom and dad baby. And this is possible if both parents are employees of the same employer. The fact is that companies, at their discretion, compile a list of employees who are entitled to receive payments, as well as their size.

The conditions for the payment of material assistance and its types, as a rule, are established in a labor, collective agreement or local regulatory act. For example, employees of the Federal Communications Agency are given assistance in the amount of two minimum wages (clause 12 of the Regulation approved by Order of the Russian Telecommunications Agency dated 08.11.2016 No. 244).

Answers Oleg the Good,

head of Income Tax Division, Organizations of the Tax Department

and customs policy of the Ministry of Finance of Russia

Material assistance can be issued at the expense of retained earnings of the current year or previous years. Allow the founders (participants, shareholders) of the organization to use the retained earnings of previous years to pay material assistance. If you give financial assistance to an employee or a member of his family at the expense of the current year’s profit, then permission of the organization’s owners is not required. The company first decides from what means the help is issued, and then draws up documents. The composition of the securities that will have to be issued for payment depends on the choice.

What documents to provide for help

To receive the payment, provide the birth certificate of the child and a statement requesting money. In it reflect the reason for the financial assistance and bank details where the accountant needs to transfer money. This is true if you want to receive funds in non-cash form.

Ready-made sample documents for help

Ready-made sample documents for help

Experts prepared forms and sample documents that draw up accountants for employee benefits, including material assistance. For example, you can download:

- Statement of the employee on the provision of financial assistance to him

Sample application for financial assistance at the birth of a child in 2019

In order to receive help at the birth or adoption of a child, the employee writes a statement in any form. A copy of the birth certificate of the child or documents on his adoption are attached to the application.

In general, documents confirming the need for material assistance are not necessary. Enough employee statements. However, the payment at birth of a child within the limit is not subject to personal income tax and contributions. Therefore, it is important to confirm that it is needed for the newborn.

Sample application for help

If the company management considers it possible to provide material assistance, the manager will issue an order. It indicates the amount of payment.

Personal Income Taxes and Birth Contributions

Consider when and in what amount to withhold taxes and contributions from material assistance.

Personal income tax. The non-taxable limit of maternal care at the birth of a child is 50,000 rubles. It applies to each parent, and not both of them together. Employers can pay employee assistance in the amount of 50,000 rubles for a child without having to pay personal income tax. And if both parents work in the company, then give out 50,000 rubles without tax deduction. to each.

According to the code, a one-time payment in the amount of 50,000 rubles is exempted from personal income tax that employers issue to employees in connection with the birth of a child during the first year of his life (Clause 8, Article 217 of the Tax Code of the Russian Federation). But how to determine this limit is not clearly stated. Previously, officials believed that it concerns both parents (letters of the Ministry of Finance of Russia dated December 26, 2012 No. 03-04-06 / 6-367, Federal Tax Service of Russia dated April 2, 2013 No. ED-17-3 / 36).

This approach was disadvantageous to neither the company nor the employees. If only one parent worked in the organization, then the accountant needed to find out whether he received the second help in his organization, how much, whether that employer withheld the tax. For parents, who generally received more than 50,000 rubles, it was safer to withhold tax on excess.

The Ministry of Finance explained what to do with insurance premiums for material support of former employees. Officials considered a situation where a company transfers monthly payments to an employee who has retired and resigned. As the Ministry of Finance advises

Insurance premiums. The accountant should not withhold contributions from material assistance at the birth of the child that was given to both parents within the limit of 50,000 rubles. Moreover, the limit is considered for each parent separately (letter of the Ministry of Finance of Russia dated May 16, 2017 No. 03-15-06 / 29546).

Officials considered a situation where both parents work in the same company. They had a baby, so the organization listed financial assistance for everyone. It is not necessary to charge contributions for such a payment if two conditions are fulfilled simultaneously: the amount does not exceed 50,000 rubles. and it was paid during the first year after the birth of the child (subparagraph 3, paragraph 1, article 422 of the Tax Code).

The appearance of children in the family is a joyful event in the life of every person. Even if it is associated with serious material costs: both before and after. Any help to parents, guardians and adoptive parents in such a situation would not be superfluous. Moreover, both parents can get it.

Such material assistance does not apply to remuneration, because it does not bear either a stimulating or compensatory nature, but is aimed at targeted support for the employee in a special life situation. Let us consider how financial assistance is made when a child is born from an employer.

One-time mother assistance is provided to employees with:

- birth;

- adoption;

- establishing custody.

The opinion of lawmakers on determining the personal income tax base and insurance premiums from such income has its own peculiarity.

Taxation

From the point of view of taxation, material assistance is considered as economic benefit, which means it is taxed (Articles 208, 209, 210 of the Tax Code). However, the social nature of the target income made it possible to exempt from taxation certain types of maternal care, or its individual amounts within the established limit. We wrote about this in the article.

When financial assistance is accrued at the birth of a child, taxation allows you to exclude from the personal income tax base the amount of up to 50,000 rubles. for each of the children (Clause 8, Article 217 of the Tax Code). This limit is exempt from personal income tax during the first year from the date of birth (adoption, adoption). Moreover, the maximum allowable amount of 50,000 is set for each parent. Officials adhere to this opinion (letter of the Ministry of Finance of the Russian Federation of 08/07/2017 No. 03-04-06 / 50382). Recall that previously the limit was set on both parents.

Order of the Federal Tax Service of the Russian Federation of September 10, 2015 No. MMV-7-11 / [email protected] establishes special codes of income and deductions, they are reflected in the reporting forms for personal income tax:

- income code 2762 - the amount of lump-sum material assistance provided by the employer;

- deduction code 508 - deduction from the amount of help.

These codes should be indicated in the reporting forms: certificate 2-PIT and.

Insurance premiums

Insurance contributions are taxed on payments and other remunerations that are made in accordance with labor legislation in favor of individuals who are subject to compulsory insurance (Article 20.1 125-ФЗ and Article 420 of the Tax Code). Maternity assistance at the birth of a child in 2019, in terms of insurance premiums, is considered in the same way as in determining the base of personal income tax. The targeted nature of such material support allows it to be excluded from the amount for calculating contributions, but also within the limit of 50,000 rubles for each of the children during the year (paragraph 3 of article 20.2 125-FZ and paragraph 3 of article 422 of the Tax Code of the Russian Federation).

Registration at the employer

Consider the procedure for processing documents to provide employees with such material assistance.

Step 1. The employee draws up an application for financial assistance at the birth of a child in the name of the head of the organization.

Step 2. Applies documents:

- reference and birth certificate issued by the civil registry office (each);

- extract from the decision to establish guardianship (a copy of the adopted court decision on adoption, a copy of the agreement on the transfer of one or more children for foster care).

Step 3. On the basis of the application, the head of the organization issues an administrative document (order) on the appointment of assistance in the specified amount.

Step 4. The order with the applications is transferred to the accounting department to complete the calculation. If the amount of assistance is within the limit (50 000 rubles for each), then no obligations to calculate contributions and personal income tax arise. If the amount is more than the limit, then the personal income tax and insurance premiums must be charged from the excess amount.

Pay special attention to the period for which the payment is scheduled! The right to a tax-free limit of 50,000 rubles can be exercised only during the first year after the appearance of children in the family.

Step 5. After calculations, the accounting department generates a payment document. If the organization has adopted a non-cash form of payment of remuneration, material assistance is transferred to the employee’s card. If cash payments are applied, a cash register order is issued.

Material assistance at the birth of a child in 2018 can be paid not only by the state, but also by the employer. In the article, we will consider in detail the order of registration of material assistance, a sample application for its payment, reflection in accounting, as well as taxation of assistance with insurance contributions and personal income tax.

Varieties of material assistance

The main financial assistance at the birth of a child is provided by the state, such payments are mandatory. In addition, there are optional payments, which include financial assistance paid to young parents by employers.

In addition, payments can be one-time or monthly. Another division of payments can be considered based on the source of payment, that is, federal and regional.

Government payments

On maternity leave, the expectant mother leaves at the 30th week, in connection with which she is issued a sick leave. Payments due to expectant mother:

- The allowance for registration in a antenatal clinic up to 12 weeks of pregnancy, the amount from February 1, 2018 is 632.76 rubles;

- A lump sum payment for the birth of a child. A young mother receives such a benefit after discharge from the hospital. She laid, regardless of whether the mother worked before pregnancy, or not. Since 2018, the amount of such payment is 16,873.54 rubles;

To apply for birth benefits, you will have to submit the following documents:

- Statement;

- Certificate that the second parent did not receive such an allowance;

- Certificate from the registry office;

- Birth certificate (copy and original);

- Passports of father and mother (copies and originals).

Important! Since 2018, young parents can receive a monthly payment for the birth of their first child up to 1.5 years. It is paid from the regional budget, and its size depends on the cost of living.

From January 1, 2018, a new payment is also provided. It is provided in accordance with the law “On monthly payments to families with children” and is paid monthly to a young family with the birth of their first child up to 1.5 years of age. The amount of payment will depend on the subsistence minimum established in the region of residence in the second quarter of the year preceding the year of applying for it. It will amount to approximately 10 523 rubles in 2018.

Material assistance from the employer

Depending on the organization, a young mother may receive help from her employer. Sometimes this is provided for by company policy, and in some cases, an employee may ask for help on her own initiative. But it should be remembered that the employer is not required to satisfy the request of his employee.

Important! Material assistance in organizations may be provided for in a collective agreement, or the employee may ask for such assistance.

If the company provides for the payment of maternal assistance at birth to employees of children, then this should be spelled out in a collective agreement.

Application for help from the employer

There are no special requirements for the application from the employee, you can write it in free form. The statement may be as follows: “In connection with the birth of a child in my family, I ask you to provide me with financial assistance. I am enclosing a copy of the birth certificate of the child. ” Instead of a birth certificate, you can attach a certificate from the registry office. Confirming the birth of your child to the employer is certainly not required. This is necessary more for tax, assistance work within a certain limit is exempt from personal income tax and insurance premiums.

Young parents can also count on mother aid when adopting a child. In this case, adoption is written in the application as a basis, and an adoption document is attached.

As an example, we give a sample application from an employee for payment of material assistance.

Personal income tax and insurance contributions with assistance

The same conditions apply to the assessment of maternal care insurance premiums. A limit of 50,000 rubles is set for each child. Such payment is one-off, which implies that it is paid on the basis of one order, although there may be several payments. 50 000 rubles is a limit calculated for two parents. In addition, in order for mother aid not to be paid insurance premiums, it must be paid before the child is 1 year old.

Important! In order that material assistance is not taxed by insurance premiums and personal income tax, its size should not exceed 50,000 rubles.

Documents required to receive help

For the release of material assistance from personal income tax, the payment should not exceed 50,000 rubles, taking into account payment to two parents. If both father and mother work for one employer, then it will not be a problem to determine the amount of payment. But if they work in different companies, the employer has the right to demand confirmation that the second parent did not receive material assistance. To do this, you can request a certificate 2-NDFL, or if the second parent is not employed, then the work book.

But to demand it or not, the employer decides on his own. Sometimes two signatures of both parents in a statement are enough.

Accounting

The employer can direct the profit of past years or the current year to the payment of material assistance. The entries will be as follows:

D84 K73 (76) - paid help to the employee from the profit of previous years;

Retained earnings for the provision of material assistance can be directed only if there is a corresponding permission of the founders (shareholders or participants), which was adopted at the general meeting.

D91.2 K73 (76) - the help was paid to the employee from the profit of the current year.

When paying out of the profit of the current year, permission from the founders is not required. The decision in this case, the leader takes on his own. In this case, an appropriate decree is issued, signed by the head.

The issue of material assistance is reflected in the following wiring:

Matp Assistance Order

After the founders have decided to pay material assistance, this should be recorded in writing. After making such a decision, the manager issues an order (See also article ⇒). Here is a sample of the order of the head for the payment of material assistance.

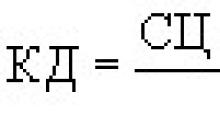

How to calculate the average annual value of fixed assets?

Socio-economic and domestic political development of the country

Signs of a postindustrial society, general characteristics and basic types What are the characteristics of a postindustrial society? Analyze the data

2 what are the objects of accounting

Map from the Pridonskaya microdistrict to Voronezh