Hello, dear readers of the financial magazine "site"! Today we’ll talk about investing in real estate.

From this publication you will learn:

- What are the advantages and disadvantages of this type of investment;

- Various options for real estate investments;

- Features of investment in construction;

- How to start investing with a small amount of free funds.

In addition, at the end of the article you will find answers to frequently asked questions.

The article will be liked and will be useful both for those who are just looking for ways to invest their own funds, and for experienced investors. Do not waste time, start reading. And perhaps in the near future you will take the first steps to a successful investment in real estate.

What are the main pros (+) and cons (-) of real estate investments, which real estate is best to invest your money in, what are the ways to profit from this type of investment - more on this and more

1. The pros and cons of real estate investments - the main advantages and disadvantages

Each adequate person thinks about profitable investments. It is important that the investment saves money from the harmful effects inflation. It is desirable that the invested funds work, bring additional income.

To achieve the above goals will help investment instruments used for a long time period. Moreover, it is important that they have minimal risk and are very promising. These are exactly what they are real estate investment .

The need for housing in humans arose many years ago and has survived to this day. She will not go anywhere in the future. Therefore real estate is always will be in demand, which means that it is great tool for investing.

Moreover, such investments are a perfectly acceptable option for doing business. To do this, it is not necessary to have huge sums of money. You can invest in real estate at the initial stage of construction. In addition, there is the opportunity to become a member of the housing cooperative by buying a share in it.

Like any other financial instrument, real estate investment has pros and minuses .

Among the advantages (+) of this type of investment are the following:

- real estate has high liquidity;

- for a long period, constant profitability, eg By renting out the purchased property, you can make a profit for many years;

- relative availability of investments;

- wide selection of options for investing.

Despite the significant advantages of real estate investments, they, like all existing investment options, are at risk.

The main disadvantages (-) of such investments are:

- demand for real estate is quite tangible depending on the economic situation in the country as a whole and in a particular region in particular;

- property prices are quite high;

- in small towns, real estate demand is quite low;

- high additional costs - utilities, repairs, taxes.

Moreover, there is an opportunity force majeure . It happens that the price of a property drops sharply due to insurmountable circumstances. for example , apartments in an ecologically clean area will become cheaper if they build a plant or a busy highway near. As a result, the investor not only does not earn anything, but it is also possible to lose part of the invested money.

To avoid most of the problems, it is important to spend before investing. preliminary analysis . During it, possible options for investing are compared and various factors and circumstances that can affect the value of real estate are studied.

Popular options where to invest

2. In which property is it profitable to invest money - 8 popular options + comparative table

Investment experts believe that real estate investments are much less risky than trading on the stock exchange, investing in startups and businesses. The explanation is simple: real estate is very rarely cheaper.

It is most profitable to invest in real estate in large cities. This is especially true for residential premises. In this case, a direct relationship is valid: the larger the city, the more profitable it is to invest in real estate. This fact is connected, first of all, with the difference in liquidity for it in different cities.

But it is important to understand that in each locality you can find your own suitable real estate for investment. To get the maximum profit, you should spend thorough analysis all existing directions and choose the most profitable of them.

Option 1. Residential Property

This option is most available. private investors. The risk of investment in residential real estate is minimal.

There are two ways to make money on the purchase of residential real estate:

- purchase for the purpose of subsequent resale at a higher cost;

- acquisition for renting out .

In any case, when buying an apartment, it is important to pay attention to the following criteria:

- location - in a prestigious, bedroom or student area, environmentally friendly, remote from the city center;

- floor plan, including the presence of a balcony, combined or separate bathroom;

- state - availability and quality of repair;

- infrastructure - how far are kindergartens, schools, clinics, public transport, shops.

In general, any, even seemingly insignificant criterion may be important for buyers:

- view from the window;

- floor;

- neighbors;

- contingent of the area of \u200b\u200blocation.

To buy an apartment (or another residential property) as profitable as possible, you will have to look for it independently without the help of a realtor. However, it is important to check the purity of the transaction. About how to do this in the primary and secondary housing markets, we described in the last issue.

Option 2. Commercial property

This option for more experienced investors. For such investments, both office and retail space of a small size, as well as buildings of a large area, designed to accommodate warehouses, supermarkets, production shops, are suitable.

Such premises are invariably quite in demand. A huge number of businessmen are looking for areas to conduct business and are ready to give their owner rent. Those who purchase commercial real estate, it remains to regularly make a profit on their investments.

Rent is a classic production option. The investor’s profit in this case does not depend on the time spent on work.

It is useful for an investor to know that when choosing commercial property as an investment object, it is required to have a sufficiently large sum of money. Contributions in this direction usually begin with five -seven million rubles.

Option 3. Land

For the acquisition of land requires a smaller amount of money than for the purchase of an apartment or commercial property.

There are a number of advantages of investing in land:

- minimum level of probability of fraud;

- no repairs required;

- lack of payment for utilities;

- the purchase procedure is easier than for other real estate;

- relatively low taxes;

- simple design;

- there is no need to resort to the help of realtors.

All land plots can be classified. for the purpose of use. For short term investments with minimal costs, the areas that are used are most suitable for construction . More long-term investments worth making in land intended for use in agriculture and industry .

But there is also limitations investing in land. Firstly, the state has tightened control over the use of land in accordance with its intended use. Besides, taxes on this type of property have recently been raised.

Option 4. Country real estate

Purchase of suburban real estate with a view to its further resale stably profitable occupation . This is especially true for large cities due to the fact that more and more often their residents are trying to settle down or have the opportunity to relax as far as possible from city noise and dirty air.

There are several options for investing in suburban real estate:

- acquisition of facilities under construction;

- investment in finished cottages;

- purchase of land intended for the construction of suburban real estate.

The prospect of investing in suburban real estate increases over time. But when choosing an object to buy, you should pay attention on its location, available infrastructure and communications. Other factors important for creating comfortable living conditions can be of great importance.

Option 5. Real estate under construction

Another investment option is to invest in real estate under construction (new buildings). Despite the fact that the riskiness of this option is slightly higher, but you can also get much big profit.

It is explained very simply. - a property under construction is much less than in the secondary market. Therefore, if you invest at the initial stage, after the construction is completed, the prices are likely to be significantly will grow . As a result, the investor will receive tangible profits.

Risks when investing in real estate under construction are most often associated with the developer. If it is unreliable, it rises risk occurrence of the following situations:

- untimely commissioning of the property;

- complete freezing of the construction site;

- in case of illegal construction or the absence of permits, a complete demolition of the structure is possible.

That is why, before investing in real estate under construction, the investor needs to conduct a thorough analysis of the developer.

It is important to study not only the company's reputation, but also the following characteristics:

- company lifetime;

- the number of completed and commissioned facilities;

- whether there were downtime during the construction process in the past, their duration and reasons.

Successive stages of investing in construction

5.3. How to invest in construction - 5 main stages

Any investor knows that investments according to a pre-prepared plan can increase profits and minimize the risk of investments. Investments should be carried out sequentially, in accordance with the developed strategy. Five stages of this process can be distinguished.

Stage 1. Choosing a developer

A mandatory and important event at the initial stage of investing in construction is developer analysis. It is important not only to find out the name of the developer, but also to clarify what his reputation is. Experts recommend investing only in those projects under construction, the construction of which is carried out by a well-known construction company in the city.

In the process of choosing a builder, it is important to consider:

- company reputation;

- how many facilities the company has already commissioned;

- feedback

- how experienced the company is in integrated construction;

- how many investors does the developer have;

- partnership with credit organizations (banks carefully choose with whom to cooperate, conduct a thorough analysis and do not interact with developers who have a dubious reputation);

- how carefully does the developer comply with the law (the main regulatory act is federal law 214 -FZ).

In Moscow and the Moscow Region, you can trust the following developers:

GK PIK - One of the largest developers in Russia. The company was founded in 1994, it successfully implements major construction projects throughout Russia. Focused on erection affordable housing. Over the years, it was built about 250 thousand apartments with an area of \u200b\u200b15 million square meters. m. It is one of the backbone enterprises in the Russian economy.

A101 Development - the company has built about 500 thousand square meters. m residential real estate, as well as more than 50 thousand - commercial. The developer is also building kindergartens and schoolsinteracting with the budget. Collaboration has been established with several large banks in the framework of mortgage lending programs. The developer is included in TOP-5 in the Moscow region and TOP-15 throughout Russia.

Capital group - A company that deals with the full cycle of construction activities from the analysis of land for construction to the decoration of finished real estate. Completed 71 projects, resulting in the construction of 7 million square meters. m. area. The company's facilities were named the best projects in Moscow and the Moscow region.

Stage 2. Choosing an investment object

Another important step in investing in real estate under construction is choosing the right object. The best place to start is from the area where housing demand is highest.

When choosing an object for attachments, it is important to consider the following parameters:

- infrastructure;

- the proximity of public transport and metro stations;

- other characteristics that affect the degree of comfort of living.

If you plan to invest in commercial real estate, you should think in advance about the ultimate goal of the investor. It will also be useful to draw up a professional business plan.

Stage 3. Negotiation

When the developer and the investment object are selected. Can we start negotiating. It is important to understand that in accordance with the laws of our country, it is impossible to register the rights to real estate under construction.

However, the investor has the right:

- draw up an equity agreement;

- join a building society;

- register an investment deposit;

- conclude a share contribution agreement.

Experts advise you to stop on an equity agreement.

In addition to the method of registering the agreement, the conditions for making funds are discussed. The main ones are the acquisition of by installments (payment by installments) and one-time deposit of funds, but other options are possible.

Stage 4. Study of documentation

All agreements concluded must comply with applicable law. It will be useful to check them with the help of an independent lawyer. Many people think that this is a waste of money. But saving on transactions is not advisable.

Stage 5. Conclusion of the contract

The final stage of the transaction is conclusion of an agreement. Before signing the final version of the agreement. It is important to carefully study all of its points.

In this case, you should pay attention to:

- when it is planned to finish construction;

- what are the conditions of termination;

- the price should be fixed, there should be no conditions on the basis of which it will change;

- fines in case of violation of the terms of the contract should be prescribed for each party;

- force majeure circumstances.

It is important to approach the acquisition of real estate under construction with the utmost care and responsibility. It is important to remember that there are risks that can be reduced by clearly observing the sequence of investment steps.

5.4. How to make money on investments in construction - TOP-3 working methods

The investor should know what methods of earning on the acquisition of real estate under construction are the safest and most proven.

Method 1. Rental

Earnings on the transfer of real estate for rent is long term investments. But this option is characterized by a stable level of profitability.

The payback period in this case exceeds five six years old. But do not forget that in any case the areas remain the property of the investor.

In large cities, there is a demand for rental of various types residential real estate : luxury apartments for a day, rooms located in sleeping areas, studios for young families and others.

If you take into account commercial real estate , it can be noted that the demand for it from entrepreneurs is also stably high. Especially popular in large cities are premises located in business and shopping centers. The only drawback of commercial space is the need for investment quite large sums of money.

For purchase apartments usually enough 1,5 -2,5 million rubles. If you plan to invest in commercial real estateapproximately 2-3 times large sum.

Method 2. Acquisition of an apartment under construction for sale after commissioning

If you buy real estate under construction for resale, you can pay back the invested funds quickly enough - already through 1 -2 of the year. The faster construction is completed, the more interesting it is for investors. Particularly successful investors in one year receive an income of 100 % of invested funds.

It is important to evaluate other possible options. You can make a quality repair in the finished apartment. As a result of such actions, its cost will increase by about a quarter.

Method 3. Participation in collective investments

Investors who are looking for the safest options for investing in real estate under construction can be advised cooperate with intermediaries . You can also become a member professional investment projectwithout buying real estate at all. To do this, it is enough to join a collective investment fund and receive income as a shareholder.

In Moscow and the region there are several reliable funds that invest in real estate. Including under construction:

E3 investment - here the minimum amount for entry is 100 thousand rubles. When profit is guaranteed at the level of 25-90 percent. All investments in the fund are insured. The investor can independently choose the payback period of the invested funds. from six months before two years old. Investors' funds are invested by professionals in highly liquid real estate, the investor is left to make a profit. This option is passive earnings with guaranteed profit and minimal risk. The company provides information support, as well as free advice to investors.

Sminex - the company invests in finished apartments, as well as objects at the construction stage. The company itself builds houses, as an additional service, investors receive renovation of apartments. In addition, the company takes care of finding tenants. The company builds cottages, residential buildings, commercial facilities. The indisputable advantage of the presented organization, experts call the focus on achieving high quality real estate under construction, as well as their safety during operation.

Thus, there are several ways to make money on real estate under construction. They differ not only in the level of profitability, but also in the efforts that will be required from the investor.

5.5. 4 main risks when investing in real estate under construction

Any investment carries a risk of loss of invested funds. To minimize the chance of loss, you should early to study what schemes scammers use in real estate, what should be afraid of when investing in construction.

Risk 1. Soap bubble

The first way to trick gullible investors is extremely simple. One-day companies sell to trusting investors myth , but not really under construction objects. All work on construction sites are carried out exclusively for eyes.

Often, such projects are organized and carried out with the help of various legal structures. As a result, transactions from the side look absolutely legal. However, as soon as the scammers collect a sufficient amount of money, they disappear with the contributions of investors.

The first way to identify a soap bubble - very low cost of real estate. The investor should compare prices with the average in the area in question. Too low a cost should alert.

It is also important to make sure that information about the developer is available in the official registry. It includes all existing construction companies. Therefore, if the company in question is not included in this list, it is not a real legal entity.

Risk 2. Bankruptcy of the developer

There are many reasons why a construction company may go bankrupt:

- ineffective management;

- misuse of funds;

- lack of finance;

- high costs.

Naturally, the lack of money affects not only the construction company itself, but also investors. In order not to encounter such a problem, choosing a developer, you should focus on large company, which has already commissioned a large number of constructed facilities.

Risk 3. Failure to comply with deadlines for real estate

Another trouble for investors in real estate under construction is construction failure . This risk is especially unpleasant for those who purchase real estate with the help of credit funds. The lender does not care when the property will be commissioned; it is important for him that all debts be repaid on time and with appropriate interest.

Specialists came to the conclusion that every day of failure to meet deadlines eats up 0,01 % of investor income. In percentage terms, this is a little. However, in terms of rubles decent amount, especially when commissioning is delayed for several months or even years.

Risk 4. Force majeure, as well as unpredictable changes in the real estate market

These circumstances can also lead to the loss of part of the funds by the investor. An example of force majeure is the onset of a prolonged economic crisis. As a result, real estate supply can significantly exceed demand. This circumstance leads to a significant reduction in property value - often 10 -20%. Even when the situation clears, investors will already lose some of their potential income.

Also an example of force majeure circumstances can serve natural disasters (forest fires, floods, earthquakes), wars, disasters at industrial enterprises. The only way to protect yourself from such risks is to real estate insurance.

Thus, like any type of investment, investments in real estate under construction are accompanied by various risks. Some of them can be minimized by conducting a thorough analysis in the process of selecting an object for acquisition. In other cases, insurance helps to avoid unpleasant consequences.

6. Practical recommendations for increasing profits from real estate investments

By investing in real estate under construction or finished, any investor seeks maximize total profit. You can do this using the methods below.

Recommendation 1. Make re-planning and coordinate (legalize) it

Redevelopment of a residential property - The simplest option that allows you to make housing more functional without changing its total area. If you carry out redevelopment activities correctly, you can increase the cost of an apartment or house 15-30%.

In this case, it is not necessary to carry out an uncoordinated redevelopment. All planned changes must be registered with the authorities dealing with these issues. Today it is an architectural department in BTIas well as the district administration.

It’s important to know that legislation prohibits some types of planning changes, eg , demolish load-bearing walls, as well as expand the kitchen due to living space, increasing its size by more than a quarter.

Recommendation 2. Attach additional areas

This option to increase the cost is available. for private houses and cottages. There you can build additional floors, convert attics into attics, build a balcony or a porch, and make other architectural changes.

Recommendation 3. Make a quality repair.

If you make a quality repair, the price of the apartment will increase approximately 15 -25%. The profit will be higher if the repairs are done on their own, investing only in the purchase of materials.

It is important to buy quality materials. Buyers may well distinguish good-quality consumables from cheap Chinese ones.

Recommendation 4. Convert residential real estate to commercial or vice versa

Having studied the demand for real estate in a particular area, you can transfer non-residential real estate into residential and vice versa. Profiting from the conversion of residential space into commercial is relevant for large cities, especially for business districts and walkable streets.

Thus, it is important not only to invest in real estate, but also to try to derive maximum profit from it. And how to do this, we described above.

Ways to invest in real estate with a small capital

7. How to invest in real estate with little capital - 3 real methods

Many believe that not having a large enough amount of money is an obstacle to real estate investment, but this is not so. Competent business people are able to do with minimal means, as well as attract additional amounts. There are several methods to do this.

Method 1. Borrowing

The most popular way to increase investment capital is loan processing to purchase real estate. Today, many banks provide such loans.

By the way, we talked about in one of the previous articles of our magazine.

The investor should take into account the fact that any borrowing involves payment percent. Therefore, in the analysis process, it is important to consider the additional costs. The planned income should cover the interest on the loan and provide profit.

For a loan should apply to large credit organizations with positive reputation.

It is not necessary to take a loan at interest. Many wealthy relatives give loans to loved ones at no extra charge.

Method 2. Attracting Co-Investors

Ideal option for investors who have insufficient capital, - unite . For those who carefully thought out the project and convince others of its effectiveness, there will be no problem finding partners.

Method 3. Choosing the right strategy

Any investor understands that competent investment planning is an important component of their success. Those with insufficient investment knowledge may be advised to seek the help of more experienced investors.

An example of high-quality support for beginners are various investment clubs. Such projects bring together investors who pass on their experience to beginners. Clubs conduct various classes - Courses and seminars, detailing private investment. Considerable attention is also given to real estate investments.

On the subject of real estate investing, the following issues are being studied:

- strategies;

- how to enter the world of investing with minimal capital;

- investments in various types of real estate;

- rent and sublease.

Thus, lack of capital is not an obstacle to investing. Any single-minded person will find ways to implement profitable investment.

8. The help of professionals when investing in real estate

Help from professionals there is no free. However she helps much increase the level of investment profitability.

Those investors who want to minimize the risksbut at the same time ensure a sufficiently high profit, you can be advised to collaborate with experts in the field of real estate investing.

In Russia, three companies working in this direction can be particularly distinguished:

E3 investment offers to invest for a long time in different types of real estate. This ensures a high level of income. Here is the minimum threshold for entry into the real estate market. Investors can deposit an amount of more than 100 thousand rubles.

Those who wish to invest in this company can immediately find out the level of expected profit. To do this, just use the calculator on her website.

Contributions to an investment company are highly reliable. All types of assets have three types of insurance.

Activo Offers access to the most liquid areas. Investment security is ensured through independent collective ownership. When investing funds from two million rubles, the company guarantees profit in the amount of 11,6 %.

An investor acquires real estate and transfers it to professionals. Each month the company gives its customers full reporting, and also guarantees the safety of invested funds.

Gordon rock Is a real estate agency represented on the international market. Investors, using the services of the company, can invest in hotels, commercial, as well as residential real estate located abroad.

The following services are also provided:

- purchase of hotel rooms, catering facilities, medical centers, mini-hotels;

- acquisition of real estate for persons of retirement age;

- investment in a ready-made business in several countries of the world;

- consultations and seminars on effective investment.

Thus, in order to invest in real estate, it is not necessary to possess large capital and significant knowledge. It is enough to turn to professionals for help.

9. Frequently Asked Questions (FAQ)

The subject of real estate investing is multifaceted and difficult to understand. Therefore, many investors have various questions on this topic. Especially it concerns newcomers . We will try to answer the most popular questions.

Question 1. Where is it more profitable to invest money: in real estate or in a bank for a deposit?

Often people without experience in investing, having an impressive amount of money, ask themselves what to do with it - to buy an apartment and rent it out or put it in a bank for a deposit?

Assume that an investor has 3 000 000 rubles. Consider both investment options.

- If you put money in a bank at 10% per annum, in 12 months you can earn 300 thousand rubles, if the terms of the deposit do not provide for capitalization. About how and how to calculate the contribution with replenishment and capitalization yourself, read in a separate article in our journal.

- Now suppose that an investor bought a one-room apartment in Moscow for the funds he has. Renting it out, he will receive 25 thousand rubles a month. As a result, over the year the same amount will come in 300 thousand rubles.

Comparing the two options, do not lose sight of the fact that in the case of a lease there are additional costs - for utility bills, taxes, repairs other. In addition, you will have to spend a significant amount of time searching for a suitable property, settling tenants.

It would seem that deposits are much more profitable than buying an apartment with subsequent rental. But this is not entirely true, analyzing the example, we did not take into account the presence of inflation. Depreciation of funds gradually eats up savings.

It is worth considering the important investment rule. - you can not trust the official data on the level of inflation. In fact, money depreciates much faster. It turns out that in the best case, the interest on the deposit will block inflation, but it is unlikely to be able to earn on such investments.

At the same time, property prices rarely fall. In the long run, its value is growing. Also, rental prices are constantly rising.

Thus, it turns out that when considering the short-term period on deposits, you can earn more. However, given the fact that apartments are becoming more expensive, it can be noted that real estate helps counter inflation more effectively.

Question 2. What real estate is more profitable to rent: residential or commercial?

Some investors purposefully analyze the real estate market in order to understand which objects to rent out more profitably - residential or commercial. In general, it is impossible to unequivocally answer this question, since there are commercial and financial risks in the market.

For large investors, usually preferred commercial real estate . Experts believe that such investments pay off much faster. However, due to their characteristics, they are more difficult for beginners.

Concerning residential real estate , it is beneficial to rent it out to those who received it without cash costs, for example, by inheritance or as a gift. When buying such a property, it will pay off for a very long time.

Worth understanding that investing in commercial real estate is rather risky. This is due to the fact that they are more affected by the situation in the country's economy, for example, the onset of the crisis period.

Investments in commercial real estate are subject to other types of risk that are difficult to account for. As a result, errors may be made in the process of calculating the required capital, which ultimately will lead to an increase in the likelihood of buying an object with low liquidity. Such investments may not only not make a profit but also entail significant losses .

However, speaking of financial relations, it can be noted that in the case of commercial real estate, they much more stablethan the owners of residential premises with their tenants. Making a lease for commercial real estate, the tenant is interested in maintaining it in good condition. This is due to the fact that it is the condition of the areas where the activity is carried out forms an opinion about the company among customers. Tenants rarely try to maintain it in the best possible condition.

A separate issue is the income received from the rental of various types of real estate. Everyone knows that when comparing premises of a similar size, commercial facilities bring a much higher income than residential.

Note! When buying a property, the investor must analyze what potential income will it bring . This is especially true of those objects that are already leased. The forecast of the profitability of the property at the time of its acquisition is quite possible.

Should also compare efforts required to manage multiple properties. Naturally, objects residential real estate (even if there are several of them and they are located in different ends of the city) it is much easier to manage than, for example trading areadivided into parts and leased to several businessmen. It is even more important that commercial real estate is leased for a much longer period than residential property.

Some investors will argue that today real estate management can be transferred to specialized organizations. But this again requires additional cash investments.

What conclusion can be drawn from here?

Thus, renting commercial real estate is more profitable. However, this requires an investor to make a significant investment of money and effort, as well as high-quality knowledge regarding the market conditions.

Investments in residential real estate are available to a wider group of investors. Money capital for this will require much less. At the same time, such real estate can become a source of almost passive stable income for a very long period of time.

But still, investors who have at least minimal experience in investing in real estate can be given important advice. Before making a choice in favor of any real estate object, it is worthwhile to conduct a thorough analysis of all possible options, paying attention to both residential and commercial real estate.

Question 3. How to buy real estate as cheap as possible?

It is unlikely that anyone will doubt that real estate is a profitable option for investing funds. Nevertheless, there are ways to significantly increase the bottom line. To do this, you can use the tips on how to buy real estate as cheaply as possible. With a good combination of circumstances, you can save about 30 % of the cost.

Consider the possible options:

1) We discussed in detail acquisition of real estate under construction . Such investments are profitable and have good profitability. However, the risk level in this case is much higher.

Unfortunately, it is possible that the construction of the house by the developer will not be completed on the appointed day. Moreover, there are cases when houses have not been commissioned for many years. In such situations, it is often unclear whether the construction work will be completed at all.

In most large cities there are several associations of deceived equity holders. These people, for various reasons - for personal needs or for the purpose of investing funds - bought apartments in houses under construction, but in the end stayed with nothing . Suing a construction company can be difficult, especially if it declares itself bankrupt.

2) Another option to reduce the amount of investment - acquisition of real estate without repair . The investor invests in finishing work, after which the price of real estate immediately rises. With a successful set of circumstances, conducting high-quality repairs using high-quality materials, you can quickly get about 15 % arrived.

3) Investors with experience in the real estate market are using even more interesting ways to save money on acquiring an investment. For example, many of them acquire property put up for auction for various reasons .

If companies are recognized, their creditors are interested in returning the money owed to them as soon as possible. Therefore, often bankrupt property is put up for auction at a very greatly reduced prices. About bidding and, we wrote a separate article.

4) In connection with the occurrence of a large number of defaults on mortgages and other types of secured loans, credit organizations often seize property from their customers, which was a guarantee of a refund under the contract. Such real estate is also sold at low prices, since banks are important in the speed of return of their own funds.

Where to look for such offers:

On the Internet you can find specialized sites on which information is collected on the sale of real estate objects confiscated from debtors, as well as seized as collateral. Often, investors here find very interesting options for investing.

In addition, information on the sale of collateral, as well as confiscated real estate of legal entities, is contained in the corresponding register for bankruptcy.

Question 4. What books on real estate investment should a beginner read?

Any questions related to the field of finance require people who deal with them with certain knowledge. Therefore, it is important to study specialized literature on topics of interest. Real estate investment is no exception.

Book 1.

Many professional investors believe that the best book on real estate investments was created by Robert Kiyosaki. It is called quite trivially - “Investments and Real Estate”.

Also in this work is a huge number of tips that do not lose their relevance, and other stories that professionals share with the reader.

Book 2.

This is the perfect book. for newbies in real estate investment. In an accessible form, it is described here, profitably and correctly.

This is the perfect book. for newbies in real estate investment. In an accessible form, it is described here, profitably and correctly.

The work contains detailed qualitatively structured instructions on what actions a beginner needs to perform.

Anyone who wants it, even without a financial education, will be able to extract a lot of useful information from the book, easily reading it.

Book 3.

This book is ideal for those who are a little familiar with investments. She will help to learn more about how to work with investment objects.

The reader will learn how to choose the most profitable property, how best to carry out work with a huge amount of necessary information and documents.

Of great importance in the work is given to how to maximize profit.

Book 4.

Instead, the work contains useful information on how to make investments in real estate without risking losing personal money.

In addition, it describes how to get good returns on such investments.

Book 5.

The book tells what there are ways other than resale for making money on real estate investments.

After reading, the investor begins to realize that making money through such activities can be done in a huge number of ways.

10. Conclusion + video on the topic

Thus, real estate investment is a promising way of passive income. It does not matter how much money the investor has. In today's world of investment, you can even start earning with small investments.

Nevertheless, it is important to constantly engage in self-education, try to find out the maximum of useful information.

That's all for today. Successful and profitable real estate investment for you!

If you have any questions or comments on the topic of publication, then leave them in the comments below.!

Real estate remains one of the most popular and easiest ways to invest money for Russians. Many believe that buying an apartment and renting it out is the best option for a possible investment. However, many ordinary people forget that it is not enough just to buy real estate in a big city, you need to be able to rent it out. Find potential customers who would regularly pay money. Indeed, otherwise your investments will not be able to pay off. Idle residential property is a liability, because you need to pay for utility bills and taxes from your own pocket, expenses for the repair and purchase of equipment, furniture - what profit is there?

How much money can I make by renting an apartment?

On average in Russia, you can earn about 5% per annum of its value from housing rental. The most profitable option is the delivery of an apartment in Krasnodar - about 8.5%. It turns out that the average apartment will pay off in about 15-18 years. Subsequently, you will receive a net profit. From these factors it follows that the rental of housing should be considered as a long-term investment with low profitability, but minimal risk.

In order for the acquired apartment to be profitable, it is necessary at the initial stage to seriously analyze the market. You do not need to hire a specialist or resort to the services of real estate agencies. Just follow our recommendations.

Subscribe to the site and you will learn how to earn online up to 24% per month, having only $ 10. A monthly detailed report of our investment portfolio, useful articles and life hacks that will make you richer!

It is necessary to acquire residential property in a large city

It would seem banal advice. After all, a simpleton understands that renting an apartment in Moscow or Samara will be much easier than in conditional Mikhailovsk. However, some citizens manage to buy housing in the same city where they themselves live. In the hope of receiving passive income, as they say, without departing from the cash register. As a result, they buy cheap real estate and in the future experience difficulties with making profit from it.

Three factors accompany this:

1. The larger the population of the city in which you purchased a house, the higher the chance to rent it out. So the annual occupancy rate will be higher. And vice versa - the fewer people live in it, the less chance of finding customers.

2. In large cities, the population is more solvent than in medium and small ones. This means that the rental price will be higher and, as a result, the opportunity to earn more.

3. Small settlements in our country exist mainly due to city-forming enterprises for which they were built. This means that if the company closes, the city ceases to exist. And all your investments burn out. An apartment or a house turns simply into an element of the landscape.

The most requested housing types

It is also important to consider the type factor of residential property. The most rented apartments for students, young families and daily rent. This means that the occupancy rate of a one-room studio will be much higher than a full-fledged three-room apartment. Therefore, it would be more expedient to buy not a luxurious three-ruble note and look for VIP clients, but to borrow two studios for the same money and with a 90% probability rent them both.

Geolocation

By this term we mean the most advantageous location of our property. There are two rules here: rent out where more people are concentrated and where people are willing to pay more.

In any city, housing in the center and near major transport hubs - stations, airports, is most in demand. In the case of students, renting an apartment near a large university will be a winning option.

I would especially like to note the delivery of apartments in resort areas. If you were lucky enough to buy an apartment in Sochi, Adler, Gelendzhik, then with the competent use of real estate, your passive income may become the main one.

Competition

As in any other type of business, rental housing is a competition between hundreds of landlords. To successfully win it, your future apartment should be favorably different from the rest.

- The apartment should be conveniently located - this applies to transport accessibility, the availability of shops, parks, kindergartens and shopping centers, parking lots in the vicinity.

- There should definitely be a quality repair and a minimum set of equipment and furniture

- The view from the apartment window is also an important factor

- Future neighbors should not scare tenants

- The rental price should not scare away future customers, while it is important to squeeze it to the maximum.

Top cities for real estate investment

Moscow (12.5 million people)

The capital of our country and the largest city in Europe with developed infrastructure and a huge number of inhabitants. At the same time with one of the most expensive price tags for rental housing in the world. Potential clients - from visiting students and migrant workers to elite and VIP people.

St. Petersburg (5.3 million people)

The largest tourist, logistics and economic center. The proximity to the EU border and the beauty of the city attract millions of tourists every year.

Surgut (360 thousand people) and Tyumen (770 thousand people)

The richest cities in Russia. The region is famous for the extraction of natural resources and, as a result, a huge amount of oil money. A large number of solvent population is concentrated here. High demand for rental among visiting students and shift workers.

Krasnodar (899 thousand people)

The southern capital of Russia. Large transport and tourist center. Recently, Krasnodar is actively developing, turning into one of the best cities in the world. A large number of tourists are actively heating up the change market.

Sochi (420 thousand people), Adler (111 thousand people), Crimea (2.4 million)

Our resort cities are actually represented by one list. For a short holiday season - 4-5 months, local residents earn money for the whole year. Therefore, buying a house or apartment by the sea will be a great investment option.

Kazan (1.2 million people)

The capital of Tatarstan over the past ten years from a purely republican center has become one of the most beautiful cities in Europe. This is facilitated by the construction of a huge number of infrastructure facilities, the holding of major international competitions and events. The cost of housing is quite high, the city attracts a large number of tourists.

Novosibirsk (1.6 million people)

The third largest city in Russia. Large trade, industrial and transport center of the Siberian region. City of students. It is in it that today the largest number of universities is concentrated.

Let's draw some small conclusions:

- Better less and cheaper - it is in demand

- Buy in large, developed cities

- Consider seasonality and possible occupancy

- Investment in housing pays off for about 18 years

Many wealthy people invest their money in real estate in order to save money in an unstable economic situation. Some of them earn fortunes on such investments.

There are several options for investing your own funds: bank account, securities, currency, gold and real estate. They all have their advantages and disadvantages. The main disadvantage of investing in real estate is the inability to predict with absolute accuracy what will happen in the future with the real estate market in the country where you intend to invest.

Nevertheless, many people study foreign real estate markets, constantly monitor price information, monitor the political and economic situation - and, in the end, manage to catch the very right moment when such an investment makes a profit. There are three advantages to investing in real estate:

- firstly, this is the most reliable option;

- secondly, real estate is forever;

- thirdly, real estate always rises in price.

By purchasing property in your own country or abroad, you can either rent it out or resell it after some time. According to experts, it is most beneficial to engage in such a business in the following countries:

1. Norway. The main advantage of this country is a stable economic situation, so that investors can be calm about the safety of their funds. In addition, when buying a property, all associated costs are no more than 5 percent of the purchase price. If you rent housing in Norway, then your investment can be paid back in just a few years.

2. The south of France. This option is for very wealthy investors, since housing in this area is very prestigious and expensive. However, there is always a great demand for housing - and renting out real estate brings substantial income.

3. United Arab Emirates. This country is unique in many economic indicators. In 2008-2010, there was a slight decline in real estate prices, but in general, the pace of development of the country suggests that in the coming years any investment will pay off here completely.

4. Panama. The reason why this country was included in the list of the most profitable countries for investing in real estate is the growth of the economy and the interest of American tourists, especially pensioners, who often move here even for permanent residence. Panama is called "Latin American Dubai": three hundred skyscrapers are being built here, and the market still has good potential.

5. Turkey. Investing in real estate here is associated with a well-developed tourism sector of the economy: not only Russians and CIS citizens have chosen Turkish resorts in the last decade, but many Europeans prefer Turkey to their own resorts. prices\u003e Housing prices are growing steadily, but still remain below the European level.

6. Morocco. In this country, the situation is similar to the Turkish one, with the only difference being that tourism development has only just begun to gain momentum. According to forecasts of local authorities, in the near future in Morocco the number of vacationers should grow to 10 million people a year.

7. Brazil is another country with a rapidly progressing economy, a healthy political course and huge potential. Investors are particularly interested in the northeast coast.

8. Egypt. The flow of tourists here is still growing, housing demand is consistently high, prices are extremely low. The main thing is to choose the right place and object, since not all real estate for rent in Egypt is equally easy.

9. Thailand. Thailand is also attractive for investors because of the well-developed tourism sector - however, one must carefully choose a city to purchase real estate: in Thailand there are areas where it is extremely difficult to rent out or resell houses.

10. Malaysia. The economic situation here leaves much to be desired, but real estate prices are extremely low.

Of course, this is only an approximate summary there are no countries that you should pay attention to if you are considering investing in real estate. Before deciding to take such a step, you should carefully study all the related factors and systematically monitor the situation on the real estate market.

You can invest in metropolitan housing either in case of urgent need, or because of an excessive surplus of money. Experts have analyzed housing prices in Russian regions. And they determined in which city it is most profitable to buy an apartment for subsequent lease. The results of the study were, to put it mildly, unpredictable. It turned out that you should stay away from both the "northern" capitals. The farther south - the more reliable.

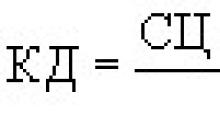

Experts used in their calculations the average apartment prices and average rental rates in 69 of the country's largest cities. To determine the profitability and payback of housing, its value was compared with the average annual rental income.

If you have a desire to earn money, you need to go to Krasnodar. In this southern, although not a resort town, the most profitable apartments are located. According to the federal portal "World of Apartments", on a rental in Krasnodar you can earn 8.4% per annum. Simply put, it is enough to rent housing for 12 years - and you will fully pay for it. High profitability was recorded in Krasnoyarsk and the Leningrad Region - 8.1% and 8%, respectively. Saratov is on the 4th place - 7.7%. Closes the "revenue five" Simferopol - 7.5%.

By summer, the ratio of the cost of supply (3 million rubles) and rent (21.5 thousand rubles per month) among the largest cities of the country was optimal, says the portal’s general director Pavel Lutsenko. - By the beginning of the holiday season, rental rates increased by 2-4%, while the cost of sales since the beginning of the year went negative - by 2.4%.

Rental rates increased in other southern cities, but this did not have a significant effect on profitability, since the average cost of apartments there is much higher. For example, in Simferopol, which occupies the 5th line of the rating, the price tag of an average apartment is 4.4 million rubles at a rental rate of 27.2 rubles. per month. In Sevastopol, the average apartment prices are slightly higher than Simferopol (4.6 million rubles), and the average rates are slightly lower (26.1 thousand rubles per month), which ultimately gives 6.9% per annum. In Sochi, the yield is even lower (6.3%), since the cost of an apartment in a popular resort reached almost 6 million rubles. It is clear that the profitability here will be lower even at high rental rates (31.4 thousand rubles per month).

Now - about the most disadvantageous apartments in terms of revenue generation. The worst is investing in Cheboksary housing. With a relatively expensive cost (2.3 million rubles), the average rental here is only 8.7 thousand rubles per month, so that the maximum yield reaches 4.6%. A very similar situation in Saransk: the cost of the proposal is 2.4 million rubles, the average rates are 9.1 rubles per month, the yield is the same 4.6%. The third from the end of the list is Belgorod with an indicator of 4.9%, then - Oryol (5%).

And finally, a sensation. Closes the top five most disadvantaged housing in Moscow, where the profitability of the apartment is 5.1% per annum. Now in the capital, the average apartment, excluding the elite segment, costs 10.5 million rubles, and is leased for 44.8 rubles per month.

Moscow regularly finds itself an outsider due to prohibitively high housing prices, ”says Pavel Lutsenko. - Even rental rates, the size of which is several times higher than the average for Russia, do not save the situation. By the way, last year the profitability of metropolitan apartments was even lower - 3.7% and was the lowest in the country.

And how many is this in years?

The average profitability of apartments in Russia is 6.3%, the average payback is 16.3 years (for the year, these figures have not changed). For about this period, you can “recapture” housing in Tula (16.2 years) or in Nizhny Novgorod (16.4 years).

It is most profitable to invest in cities with the highest rate of return. You can return the money spent on real estate in Krasnodar for 11.9 years, Krasnoyarsk - for 12.4 years, in the Leningrad region - for 12.5 years, in Saratov - for 13 years, in Simferopol, Makhachkala and Astrakhan - for 13 ,4 years.

Investments in Cheboksary - 21.8 years, in Saransk - 21.6 years, in Belgorod - 20.2 years, in Orel - 20.1 years, will pay off the longest. A Moscow apartment will begin to generate income on average in 19.4 years.

The figures obtained are the most optimistic option. In reality, the real payback period of an average apartment will be even longer, ”Pavel Lutsenko warns. - As already mentioned, the indicators largely depend on the season: business, holiday, holiday, etc. In resorts, the main peak of change falls on 4-5 hot months, the rest of the time housing is mostly idle. And in other cities the average apartment a couple of months a year can remain without tenants. In addition, the final sighting calculation must include the costs of taxes, repairs, a possible replacement of household appliances and various emergency situations.

Every month, in search of real estate abroad, they visit the portal site350,000 people from Russia, Ukraine, Belarus, Kazakhstan and other countries. For a year they look at 40 million pages with ads. We examined the requests of visitors and compiled a rating of the most popular countries.

|

+1 |

Bulgaria |

||

|

Bulgaria |

-1 |

||

|

+2 |

Germany |

||

|

Germany |

-1 |

||

|

-1 |

|||

|

Montenegro |

+1 |

||

|

+2 |

Montenegro |

||

|

-3 |

|||

|

+1 |

Finland |

||

|

Finland |

-1 |

||

|

+2 |

Portugal |

||

|

Portugal |

-1 |

Slovenia |

|

|

Slovenia |

-1 |

||

|

Great Britain |

+2 |

||

|

Croatia |

Croatia |

||

|

Switzerland |

+3 |

Great Britain |

|

|

Dominican Republic |

+1 |

||

|

+2 |

Dominican Republic |

||

|

+2 |

Switzerland |

||

|

-3 |

|||

|

-6 |

|||

|

+7 |

|||

|

+5 |

|||

|

Netherlands |

Netherlands |

||

|

-3 |

|||

|

-3 |

Belarus |

Montenegro

It wins due to lower prices (on the secondary market, the decline continues) and the new law, according to which and live all year on the Adriatic. Demand could be even higher if the purchasing power of the main investors - and in Montenegro they are Russians - has not decreased in recent years.

USA and UK

They rose in the rating due to informational noise (presidential elections and). High-profile political events fuel interest in the country, but by no means always lead to an increase in the number of transactions. Demand remains limited - potential buyers are mainly interested in the “elite”, and there can be few such transactions.

Czech Republic

Consolidated in the top ten. The economy is stable, construction is developing, prices, especially for new buildings in Prague, are growing rapidly, local banks issue mortgages at record low rates. Most buyers are still interested in apartments in the capital worth € 100-200 thousand. In 2016, a new trend emerged - an increase in demand for commercial premises (the share of those interested in “business” real estate reached 18%). In this regard, the Czech Republic began to compete with Germany.

Turkey

Due to the fault of "big politics", which has recently been under construction, it has lost three positions in a year. If the rating was based solely on the requests of the Russians, the country would fall even lower. But Turkey is still actively interested in the citizens of Kazakhstan, Azerbaijan, and Ukraine. The most sought-after region is Alanya, where there are many offers worth up to € 50,000. There is growing interest in Istanbul real estate, which rises in price by 10-15% per year.

France

The most popular country among buyers of luxury real estate (7 out of 10 are looking for objects worth from € 500,000 here). It is consistently included in the TOP-10, and if it were not for the high average check, it would surely fall into the "top five".

Cyprus

One of the last countries in Southern Europe, where prices were still falling in 2016. Every year, the decline slows down, the first signs of stabilization are already visible - an increase in the number of transactions and the pace of construction. Part of the island attracts buyers .

Finland

Loses to the warm sea countries in the struggle for the attention of foreigners. Finnish dachas remained their buyer (mainly from the border regions of Russia), but its financial capabilities have declined in recent years, and prices in Finland have not become more affordable.

Latvia

She stayed in the "top ten" until 2014 - while she was giving out "cheap" residence permits for the purchase of real estate. After increasing the prices for "golden visas" interest began to decline. , the situation has not changed.

Thailand

First entered the Top 15 popular countries. A couple of years of such growth and it will turn from exotic into an ordinary direction for buying a second home. The “land of smiles” is favored by low real estate prices (compared to European resorts), high rental returns (again, by European standards) and an increase in the number of new projects on the coast.

Portugal

So far, can not repeat the success of Spain. The interest of property buyers who speak Russian is significantly lower. Although the conditions in both countries are similar. Here, too, there was a crisis that brought down housing prices, and also ended. It has its own and even more affordable. Apparently, the lack of information affects - nevertheless, we go to Spain much more often.

Slovenia

She finished the year on the 16th line of the rating. For a tiny European country, this is a good result. Five years ago, potential buyers from the CIS confused it with Slovakia, and now they are interested not only in apartments in Ljubljana and on the coast, but also in commercial real estate.

Croatia

Fixed in the TOP-20 popular destinations. Joining the European Union has brought her more European buyers, and demand from Russian-speaking investors is not growing. Despite the simplification of the terms of transactions and .

Switzerland and Austria

Strengthened position. These are stable European countries with strong economies, whose real estate is growing in price at a moderate pace. In a word, excellent directions for long-term investments. If not for the high average bill, the demand for them would have been much larger.

Dominican Republic

It is still the most popular destination among the few lovers of relaxation on the Caribbean Sea (still fly far away). Keeping in the top due to the diversity of the market. Here there are both decent apartments in resort complexes for € 30-50 thousand, and luxury villas for a couple of millions.

Estonia

Although she won a couple of positions over the year, she is still far from her own record (15th place in the ranking in 2012). Previously, demand was more ambitious - buyers were interested in cottages in Estonia, inexpensive apartments in the regions bordering Russia, now demand is small, and only Tallinn uses it.

United Arab Emirates

Lost three positions in a year. Prices for apartments in Dubai are no longer rising, and overall, the Middle East region is restless. The interest of investors from Russia and the CIS is weakening. However, as the situation may change.

Hungary

In 2016, it dropped to six places in the ranking. because of Demand from those interested in immigration to Europe decreased. The country has chances to regain lost ground. Buyers-migrants can be replaced by investors who are impressed by the increase in apartment prices in Budapest (up to 20% per year).

Israel

It attracts not only potential emigrants, but also investors. In large cities, housing is not enough, as a result, prices rise by 10-15% per year. In 2017, the country should maintain its position.

How to calculate the average annual value of fixed assets?

Socio-economic and domestic political development of the country

Signs of a postindustrial society, general characteristics and basic types What are the characteristics of a postindustrial society? Analyze the data

2 what are the objects of accounting

Map from the Pridonskaya microdistrict to Voronezh