No wonder Sberbank of Russia PJSC is considered the main bank of our country and the locomotive of development banking sector. It provides unlimited possibilities for managing your personal savings for clients. Among such operations is the transfer of money from the card to the account of Sberbank. Let us consider in more detail how to transfer money from a Sberbank card to a Sberbank account.

To transfer from a card to an account with Sberbank, use one of the available methods. Among the popular species, we distinguish:

- use of ATMs;

- transfer through Sberbank Online;

- activation of the Mobile Bank application;

- visiting a bank branch and transferring cash through the cashier.

Let us dwell in more detail on each of these methods.

ATM transfer

This method is suitable for people who have a plastic bank card with a green logo on their hands. For the operation, you need to know the account number of the recipient's Sberbank. When fulfilling the requirements, use a simple algorithm of actions:

- head towards the nearest ATM of Sberbank;

- insert a plastic card into the terminal;

- dial a PIN code of 4 digits to be able to use the terminal;

- select “Money transfers” by pressing keys or by touching the touch screen;

- enter necessary information in the appropriate fields that will be displayed there. Usually this is the beneficiary's account number, which consists of 20 digits, as well as the amount of funds to be transferred;

- select the action "Translate";

- wait until you receive a check with all the information about the operation, as well as a plastic card.

Important. Always choose to receive a check, as it can become the main evidence of the operations performed if, as a result of a failure, the funds were withdrawn but not transferred to another person.

When conducting a transaction, remember that there may be a commission. Usually it is 1% of the amount to be transferred. But if the sender is in the same subject Russian Federationas the recipient of funds, the commission is 0%. A day, you can transfer from card to card using an ATM no more than 500,000 rubles per day. Moreover, it does not matter what interval is available between transfers within 24 hours.

Be sure to check the correctness of these details, as making mistakes leads to the fact that the funds hang between accounts, and, in the worst case, are transferred to another individual. In this case, it will be problematic to return the money. To do this, rely on the honesty of the person who suddenly "enriched" at your expense.

World Wide Web Translation

If you need to make a transfer money from personal card to a current account, it is recommended to use the Sberbank Online service. Using the service implies that you have a card of the same bank. To transfer via the Internet, use the following instructions:

- visit the official website of Sberbank of Russia;

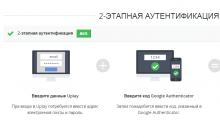

- go through the authorization process, during which indicate the username and password that was used at the time of registration;

- in the menu presented, go to “Payments and transfers”;

- indicate the item “Transfer to private individuals;

- select the card to be debited from. To do this, simply check the box next to it;

- enter the last name, first name and patronymic of the person who should receive the money, the number of his current account in the fields provided, indicate the beneficiary's bank and the BIC of this financial institution;

- confirm the fact of the operation by entering the code that comes to you as a result of the notification via SMS. The message comes to the phone number that was specified when opening an account with Sberbank of Russia.

After completion of the operation, the money will be deducted from the account and transferred to the beneficiary's account. As a rule, the time for transfer is 24 hours. The maximum allowable period is 72 hours. If during this period the money does not come to the recipient's account, it’s time to sound the alarm and check with the employees of the green bank where the money is stuck.

Here you can take the opportunity to replenish your savings account. To do this, select the appropriate item in the menu.

With the help of "Mobile Bank"

For operations with your personal account when using SMS commands, you need to have on your hands even the simplest mobile device to which SMS messages can come. It is also required that the user has a Mobile Bank connected.

To transfer money from a card to a Sberbank account, write an SMS message that will consist of three parts. The first part of the message is the word “TRANSFER”. The second part of the message is the number plastic card the recipient of funds or the phone number to which the card of this bank is attached. The third part of the message is the amount of money to be transferred. The message is sent to the number "900".

There are limits on the transfer of funds - not more than 8000 rubles per 1 operation. In total, you can do 10 financial transactions per day.

How to transfer money from a Sberbank card to a Sberbank account to another person

To transfer money from plastic cards PJSC Sberbank of Russia to the account of the same bank, but to another person, use the menu item: Transfer to a Sberbank client in Sberbank Online.

By clicking on this item, you will see a field in which indicate the number of the plastic card of the recipient of funds. By entering in the appropriate fields the digits of the account number, as well as the amount money transfer, click on the button “Get confirmation code”. A code will come to you - enter it in the appropriate field if you are sure of the correct details of the recipient of funds. As a hint before making a transfer, you will receive information about the recipient: his name, middle name and the first letter of the surname. If you are sure that the recipient is the one, enter the code number. If entered correctly, the funds will be instantly transferred to the counterparty. You can also take the opportunity to leave a comment on the payment. Thus, the recipient of the money will receive a message that relates to this money transfer.

If you don’t know the personal account number of the person to whom you want to transfer money, but you know his phone number, you can transfer with this knowledge. Most importantly, the phone number should be tied to the card of Sberbank of Russia. To transfer, select "by phone number" and specify the appropriate number. Further, the algorithm of the financial transaction exactly coincides with what is used when transferring by personal account number.

Performing Operations Using these methods safely. At the same time, the bank ensures your privacy. Personal data of persons participating in a financial transaction fall under the law on the protection of personal data. It is also possible to keep a history of financial transactions. Thanks to this, you will have complete information about when and to whom you transferred funds and in what volume.

The answer to the question "how to transfer money to the account?" simple enough: you must use one of the above methods. The performance of these operations is not difficult. The most important thing is to know the correct details of the person who should receive the funds.

Important. In no case do not transmit the code message data that you receive to other persons. This can be used for personal gain against you. Someone may want to take advantage of your personal savings and steal them from you. Do not trust your username and password from your personal account, do not trust your mobile device, which provides access to your bank. Remember that your financial protection depends, first of all, on yourself.

To use bank card In addition to paying for services and goods for cashless payments and increasing savings, you must master the transfer from the card. Let's talk about all kinds of ways to transfer money from a card to ... in a word, where you need it.

How to transfer money from a card to another card

Transfer of cashless funds between two cards (Card2Card) - convenient way payment for goods / services sold / provided by a private person, material assistance to a person at any distance, credit card replenishment, etc.

All that is required from the recipient is to inform the sender of 16 or 18 digits on the front of the plastic. There are several options for transferring money from a card by card number.

There are also ways to recharge a card by the phone number to which it is attached.

Online through the website of Alfa Bank, Tinkoff, QIWI, etc.

Any Internet user can transfer money from one visa cards or MasterCard to another without registration and authorization through the Internet resource:

- Alfa Bank;

- VTB 24;

- Promsvyazbank;

- Tinkoff Bank;

- QIWI (Qiwi Bank);

- specialized Card2Card services.

On the Banki.ru portal, you can use the Card2Card service from Alfa-Bank, on Sravni.ru - from Tinkoff and others.

Through the VTB 24 website, in addition to Visa and Mastercard, you can transfer money from and to cards payment system WORLD.

Important: Card2Card transfer through the specified services is not available if the card from which the money is being transferred does not support 3D Secure verification. In most banks, 3DSecure is a confirmation of the operation with a one-time code / password sent in SMS to the phone attached to the card.

Terms of Service:

- the maximum amount of one operation without commission is from 70,000 to 100,000 rubles, depending on the provider;

- the maximum volume of transactions per month is from 500,000 to 1,500,000 rubles. An additional restriction for transfers from Visa is a maximum of 300,000 rubles. in 4 days;

- the number of operations per month (sometimes per day) is limited;

- crediting of funds - from instant to the card of the bank providing the service and / or any Visa card up to 1-5 days to the MasterCard card.

Commission for replenishing the card of the bank providing the service is not charged. Tariffs for transfers to card accounts in other financial institutions are indicated on the websites of providers. The issuing bank may charge its own fee for online translation money from the card.

Please note: for cashless transfers from credit card the issuer, as a rule, charges the same commission as for cash withdrawals. This rule does not apply to the client’s own funds stored on a credit card.

Online via Internet banking or mobile application

Currently issuing a class card to a client Mastercard standard / Visa Classic and higher, most issuing banks provide a free online banking service remote maintenance in online mode.

This service can be used:

- as a personal account on the bank’s website, logging in from a computer (laptop);

- through mobile app for smartphone / tablet, downloaded again from the bank's website.

In order to transfer money to any card using such an online service, you need to log in, go to the “Payments” (“Payments and Transfers”) section and find “Transfer from card to card”. Next, enter the beneficiary’s card number and transaction amount, click “Transfer” and confirm the operation with a one-time SMS password that came to the phone.

Via mobile bank

The term " mobile bank"Has two meanings:

- internet banking for smartphones and tablets, referred to in this article as a “mobile application”;

- money management service on a card account using SMS messages (SMS commands).

We will tell you how to transfer money from a card through a mobile bank (in the second value) of Sberbank of Russia and Alfa Bank.

A Sberbank client can transfer money to another Sberbank card using the phone number associated with the recipient's card account. To do this, send SMS to short number 900 with the text:

Translation 9991234567 700,

where 9991234567 is the phone number, 700 is the transaction amount.

Alfa-Bank card holder can send an SMS message to the number +79037672265:

Translation 4276567887654321 800,

where 4276567887654321 is the card number, 800 is the transaction amount.

Through an ATM

The easiest way to transfer money from one card to another is through an ATM or terminal of the bank that issued the plastic.

It is not recommended to use a self-service device of a third-party financial institution, since it will retain a higher commission.

To avoid difficulties, the client can choose a terminal or ATM in the bank branch during business hours and seek help from a specialist who will tell you the exact sequence of actions.

For the operation, the card number of the recipient of funds is enough.

How to transfer money from card to account

It is possible to transfer from a card to an account that is not tied to plastic, through the Internet bank in which this option is available, or through the branch of the financial institution that issued the sender's card.

To transfer funds, the following recipient data is required:

- account number;

- name and BIC of the bank where the current account is open.

For a transaction through the Sberbank Online Internet bank you need:

- log in

- go to "Payments and transfers";

- select "Transfer and exchange of currencies";

- select “Transfer to private person”;

- enter the above data and confirm the operation.

A more reliable way to transfer money from a card to another bank account is to contact the issuing bank’s office, in addition to a sheet of paper with the recipient’s data, capturing your own passport and card.

How to transfer money from a card to a passbook

Passbook - a means of storage cash savingshaving a long tradition and not yet obsolete.

To transfer money from a card to someone else's savings book, you need to know the name of the recipient, the bank account number of his book and the correspondent account of Sberbank.

The operation can be carried out through the Internet bank or the office of the bank that issued the plastic.

Transfer from card to electronic wallet

Step-by-step procedure on how to transfer money from card to online wallet, depends on who it belongs to - the card holder or another person - and also on the payment system in which the wallet is open.

The main methods of performing the operation:

- through a personal account on the payment system website (to your own wallet);

- via online banking / mobile application;

- through the service of exchange / input-output of electronic money;

- through an ATM or terminal.

To transfer money to another person, you need to know the name of the payment system (for example, Qiwi, Rapida, Yandex.Money) and the wallet number.

The classic way is to contact the nearest bank branch. There, it is necessary to provide the bank employee with information on the basis of which he will write off the funds from one account and put it on another. It is important that the balance of the account is not less than the amount of transfer and commission of the bank. In this case, the listing is not possible. When there is a card, then everything is simpler, transfers can be made from it.

What is needed:

- Details of the account of the IP to which the money is transferred.

- Passport of the person transferring funds.

- The balance of funds in the account, allowing you to complete the operation.

It is important that the balance of the account is not less than the amount of transfer and commission of the bank.

detailed instructions

- A person who is planning to transfer money to an individual entrepreneur must have his own bank account. He should come to any branch of his bank and ask the operator about the bank transfer. A bank employee will ask for the beneficiary's account details and his account number. A person needs to know this information in advance from an individual entrepreneur. Another operator will need the sender's passport and his bank card, if the account is tied to it.

- Some banks offer customers to fill out translation documents themselves. In this case, you need to know the recipient information:

- Account number.

- Correspondent account.

- Surname, name, patronymic.

The bank must inform about the transfer fee in advance.

Filled bank employee or by the client himself, the operator signs the document after checking that the fields are filled in correctly. The client also signs the document. After that, it seals the bank and a note that the payment has been sent.

Deposit to account

Before you can send money from your account, this account should be opened, and then make personal funds to it. A bank account is necessary for an entrepreneur to settle accounts with suppliers and customers. Yet individual entrepreneur receives money from counterparties to his account. Non-cash transfers are regulated by paragraph 2 of Art. 861 of the Civil Code of Russia. According to this law, the entrepreneur must have a checking account. Possible payment in cash or non-cash.

If an individual entrepreneur wants to transfer finances to his account, then the receipt is justified (it should be explained where this money came from). They may appear after the sale of services and goods, come from an accountable person. It is also not forbidden to put own funds.

If an individual entrepreneur wants to transfer finances to his account, then the receipt is justified (it should be explained where this money came from).

When money is received from an accountable person, this is recorded using a receipt. And the accountant is posting.

If the counterparty intends to deposit funds into the account of the entrepreneur, the manager must first issue an invoice. In this account, details for payment are indicated, with them the counterparty goes to the bank and replenishes.

If there are several accounts

An entrepreneur is allowed to have several bank accounts at once. When you want to transfer money from one account to another, you need to go to the bank with a payment order. It indicates the purpose of the payment and says that the transfer is in progress equity, without VAT. In this case, you do not have to pay tax.

In conclusion, we say that to act with bank transfers need to be careful, because non-cash transactions are checked by regulatory authorities. If you do not pay taxes, then tax service this violation reveals just in banking transactions, and the entrepreneur expects heavy fines, up to the criminal case.

You do not know how to transfer money from account to account in the online banking system Sberbank Online? In our review you will find detailed instructions for completing this operation.

How can I send money?

Many of us are faced with the need to make various payments almost daily. This may be payment for purchases in the store or services at various companies, making a monthly payment for utilities or using a loan, paying for mobile communications, transferring money to friends and relatives on their personal account, etc.

Sberbank offers its customers several ways by which they can make their payments:

- by phone number (if it is tied to the card of the recipient),

- by card number

- by account number.

Please note that the last two methods involve the use of completely different details. What is the difference:

- The card number is the longest digital sequence, which is indicated on the front side of the plastic bank card. Most often it consists of 14.16 or 17 digits.

- Account number - these are the details that are indicated in bank agreement (for example, when obtaining a loan). It always costs 20 digits.

If you need to make a payment using this method, you need to first find out the recipient's account number, preferably in writing, in order to eliminate an error.

Step-by-step instruction

To begin, you need to register in the Sberbank Online system in order to start using this service. To do this, you can use the nearest ATM of the company, and if you have activated the Mobile Bank service, then registration takes place on the official website of the bank. detailed instructions given.

After you have received the login and password, as well as all the details of the recipient you need, you should proceed directly to the transfer procedure. Everything happens according to the standard scheme:

- Go to the bank’s website, in the upper right corner click on the button “Sberbank Online. Entrance";

- Log in to your Personal Account;

- Choose the section “Transfers and payments”;

- Next you need to select the recipient.

- If the transfer is between your accounts, select “Transfer between your accounts and cards”,

- If it is intended for another client of the same bank, then you need the link “Transfer to a client of Sberbank”.

- If the recipient has an account with another company, then select “Transfer to a private person in another bank by details”,

- If the recipient is entity, then click on "Organization Translation";

- After that, you select the debiting account, enter, indicate the transfer amount and confirm it via SMS or through a one-time password from the check.

Nuances

Please note that the transfer of funds to other people's accounts (to another private person, organization) is possible only with a debit bank card. If you want to transfer money between your accounts, then for this purpose you can use both a card and a savings account (a deposit with the possibility of spending funds).

We are often asked - is it possible to pay by credit card? We answer: unfortunately not. The credit card is intended exclusively for cashless payment goods and services in retail and online stores, a transfer from it cannot be sent through Sberbank services.

Regarding commissions:

- In the event that the transfer of money is made between the accounts of the same person, then no commission is charged,

- If both accounts are open in the same region, then there will be no commission,

- If you send money to another region to an individual, to another bank or to a third-party organization, then you will have to pay a fee at the rates of Sberbank. It varies from 1 to 2% of the amount transferred.

As you can see, there is nothing complicated in transferring money from account to account in the Sberbank Online system, the main thing is to correctly indicate all the recipient's data. If you have difficulties, you can always get advice on toll free phone hotline can: 8-800-555-55-50.

Opening a current account - banking service for companies and entrepreneurs, providing the convenience of managing funds and conducting transactions. Despite the availability of information, some points cause difficulties for the owners of r / s and their contractors. In particular, it’s not always clear how to transfer money to the bank account of Sberbank. What are the ways? What are their features? These points need consideration.

General Provisions

often necessary to replenish an empty account and conduct further activities. The question is how to conduct a transaction and not violate the law. The first way that comes to mind is to head to the bank and deposit cash through the cashier. This option is popular and in demand among customers. But what to do when accessing the attendant credit organization no but money transfer to or is replenishment extremely important?

When solving the issue, there are two ways to distinguish:

- Depositing personal money to the account.

- The transfer of profit from activities - is carried out through the cash desk or ATM (terminal).

In the first case money transfer to a current account produced in any convenient way:

- Through a bank cashier. The main disadvantage is high interest ratesthat are put forward by the bank.

- Depositing money through an ATM (terminal).

- Application of the Unistream system or its analogues.

- Transfer money to the account of Sberbank from the personal account.

The latter option with the translation looks most preferable. Especially when both accounts are in the same banking institution.

How to transfer money to the bank account of Sberbank?

There are enough ways to transfer funds to an account:

- Through the checkout.

- Mobile banking

- Using an ATM or terminal.

- Sberbank Online.

Consider the main options:

- Using an ATM. You can transfer money when both settlement accounts are tied to a card. The actions are as follows:

- Insert a bank card.

- Dial the PIN code.

- Select a transfer section.

- Indicate the number of "plastic", which requires replenishment.

- Prescribe the required amount and confirm it.

- Online banking. How to transfer money to the account of Sberbankwhen r / s is not tied to the "plastic"? Decision:

- Connect to the Internet banking service (may be paid).

- Log in to your account.

- Enter the translation section.

- Indicate the recipient and the amount.

- Confirm transaction.

The option with online banking is the most popular, because you can complete it in 2-3 minutes money transfer to the account of Sberbank and not spend money on a commission.

- Mobile Bank. Here the principle is similar to that discussed above. To transfer money, you need to log in and select the option you are interested in. The difference is that operations are carried out using a mobile phone. As in the case of online banking, the service may be paid.

- Through the cashier (operator). To deposit funds, it is enough to come to the bank, present a document and transfer the details for replenishment. To transfer money in this way, you will have to pay a commission (as mentioned above).

What to consider?

The main task for individual entrepreneurs and legal entities is to correctly complete the transaction. For example, an entrepreneur in the purpose of payment should prescribe that the account is replenished with personal funds. If you do not indicate the purpose of the transaction, employees of the Federal Tax Service may accept the funds received for the company's profit. As a result, tax is charged on this amount.

Transferring money to a current account from the "personal pocket" is not recorded in the book of costs and profits. In addition, these funds do not belong to the profit category and are not taken into account when calculating tax base. Received money must be reflected in the cash book with the execution of the relevant warrant.

Where to invest a million rubles?

I am looking for an investment project

Real estate investment

Available online deposits in VTB

To whom and on what conditions they give a mortgage in a savings bank