Strict reporting forms are subject to accounting. Especially for such accounting, the legislation approved mandatory rules. Accounting for strict reporting forms in accounting must also be subject to the established procedure. This procedure should ensure the safety of the documentation in question. In particular, for accounting and storage of such forms, the responsible person must be charged with the relevant duties.

Strict reporting forms

Based on Art. 1.1 of the Federal Law of 05.22.2003 N 54-ФЗ (hereinafter referred to as the Law on CCP), strict reporting forms are primary accounting forms, the significance of which corresponds to a cash receipt. Such forms are generated in electronic form and (or) are issued for printing using a special automated system when making payments for services.

It contains a detailed list of requirements for a strict reporting form and the composition of its details. They are similar to the requirements that legislation places on a cashier's check. In particular, forms issued on paper should readily and not lose this property for at least six months.

According to the current version of the Law on CCT in 2017, when calculating, you should issue a form on paper and (or) send the BSO in electronic form to the subscriber number or email address provided by the client. Such sent and printed BSO is equivalent to BSO on paper, provided that the information specified in the paper form is identical to the information in the form sent to the buyer in electronic form.

In order to learn how to take into account the forms of strict reporting, you should refer to another legal act, namely to the Procedure, approved. Decree of the Government of the Russian Federation of 06.05.2008 N 359 (hereinafter - Decree No. 359).

Accounting for strict reporting documents

The procedure for recording, storing and filling out the relevant documentation is contained in clauses 13 - 20 of Decree No. 359. It is these standards that govern how to keep BSO records.

In particular, management needs to:

- to appoint an officer financially responsible for the SSR;

- take measures to create appropriate conditions for the storage of BSO (in safes, special sealed rooms, etc., making it possible to avoid theft or damage to documents);

- keep BSO records in a special book filled out in the prescribed manner (must be numbered, laced, signed by authorized officials and certified with a seal);

- create a special commission for the acceptance of strict reporting forms acquired on the side, accompanied by the completion of the relevant act;

- in order to properly account for strict reporting forms, in established cases, carry out their inventory;

- keep at least five years;

- destroy forms and their roots upon reaching the storage deadline on the basis of the act under the control of a specially created commission.

Accounting BSO (posting)

In order to determine the wiring, you should refer to the Instructions, approved. By order of the Ministry of Finance of the Russian Federation of October 31, 2000, N 94n. This NLA, in particular, answers the question of which account should take into account the documents of strict reporting in accounting.

According to the specified normative act, an off-balance account 006 is opened to account for information on the availability and movement of strict reporting forms. A conditional assessment is used to account for the forms. Analytical accounting is carried out separately for each type of documentation under consideration.

To write off the accounting BSO and the cost of their manufacture on the side, you can use 20 or 44 accounts. In case of self-production, the corresponding costs can also be attributed to these accounts.

The method of accounting for such documents is required for various budgetary institutions that provide various services to customers. Many today have the opportunity to provide services to the population, without applying in the calculations. But there are times when it is necessary to fix in writing the fact of payment for a certain service. Just for this purpose strict receipts are expected.

General Ledger Accounting Book General Information

Legal documents

In order for the leave and control of these documents to be streamlined, on May 6, 2008, the Government of the Russian Federation issued Decree No. 359, which describes in detail how records should be kept in the accounting book. These requirements are presented to budget organizations. There is no rigid framework for entrepreneurs, and in order not to reinvent the wheel, it is advisable to use the same recommendations.

For state, various municipal, budgetary enterprises, the journal should be filled out on the model 0504045. It was developed by order of the Ministry of Finance of the Russian Federation No. 52-n. Date of adoption of the order March 30, 2015.

Although there is still no officially developed form for entrepreneurs, for convenience it is possible to adhere to similar instructions in the law.

The book of strict reporting forms is described in this video:

Her mission

The book monitors the forms that were purchased to carry out their activities.The book should reflect information about

- The number of receipts received strict reporting;

- Used in conducting trade operations or issued in a report to a responsible employee;

- Forms in reserve;

- Written off for various reasons.

Timely filling out information on the forms allows you to control their correct application. Accurate statement of the book of records allows controlling services to quickly find the necessary information on any form.

Rules for filling out the BSO accounting book

Subjects of use

When providing various services, government organizations use strict reporting documents. Each document by number is recorded and recorded in the accounting journal. These requirements apply to entrepreneurs, and to everyone who does not use cash registers in their work.

Moreover, in this book it is necessary to consider only the numbers of issued documents. The contents of the form itself should not be painted. This is taken into account in the receipt itself, a copy of which remains with the employee of the organization. When checking, the accounting journal should be provided for review to the inspection bodies.

Paperwork

Rules and requirements for filling

You can buy a book in a store, or you can do it yourself. If your organization does not expect many strict reporting forms, then even a normal school notebook will suffice. You can download the book form for free.

First fill the title page of the book. We indicate the details of the company (including, etc.) and the data of the responsible employee for filling out the book. The start date of the entries and the end of the book. Some companies require that not only the title page, but also on each inner sheet should bear the seal of the company and the signature of the chief accountant or manager.

Basically, entries are distributed as follows:

- On the left side of the magazine you need to put the date of purchase and the number of forms. In the case when there are a lot of forms, you need to put down the starting number and the final. Be sure to indicate the total number of forms and place of purchase.

- On the right side of the book register used forms as they are spent.

- There are also forms that will need to be written off, that is, they are blank, but they cannot be used. These are specimens that are torn or have lost their normal appearance. They are also written in the book in order and make a note of cancellation.

- The same applies to forms returned by customers for one reason or another.

- In addition, all copies of the forms should also be filed with the book, regardless of whether the document was used or damaged, returned, etc. In accounting, these forms are accounted for on account 006, which just helps to reflect actions with strict reporting documents.

With this kind of filling out a book, you don’t have to look long for information about a particular form.

Sample book fill

Numbering and firmware

In addition to the specified, all sheets of the book of accounting must be numbered and flashed. On the last page of the book, the lacing should be glued with a sheet on which there should be a printed imprint of the organization and the signature of the head or official.

How to fill out a book, an example will tell the video below:

The accounting of strict reporting forms and the organization of their storage are the procedures that enterprises are required to carry out in accordance with the requirements of the law. What legal norms can be used in organizing the accounting of strict reporting forms and ensuring the safety of BSO?

Basic rules for storing strict reporting forms

The rules according to which Russian organizations must keep BSOs are fixed in the Regulation on cash settlements without the use of CCP (hereinafter - the Regulation), approved by Decree of the Government of the Russian Federation No. 359 dated 05/06/2008.

The traditional method of manufacturing BSO is to contact the printing house (paragraph 4 of the Regulation). The legislation of the Russian Federation also allows the issuance of forms with the use of automated systems (paragraph 11 of the Regulation).

As for BSOs made by printing methods, they should be placed in safes or in special premises of the enterprise, in which the safety of forms is guaranteed. Every day, the place where the BSO is stored is subject to sealing or sealing (paragraph 16 of the Regulation).

The functions to ensure the safety of strict reporting forms must be performed by a financially responsible person (hereinafter referred to as the MOT) - an employee of the organization with whom the employer must sign an agreement on full liability (clause 14 of the Regulation).

The MOT begins to fulfill its functions from the moment the BSO arrives at the disposal of the organization (for example, from a printing house). His tasks at the time of receipt of the forms are to ensure that:

- verify the number of forms, their series and numbers with the data specified in the accompanying documents;

- to draw up an act of acceptance of forms;

- enter information on accepted forms into the book of accounting of forms of strict reporting.

The MOT must carry out all 3 actions in the presence of a commission, which is created on the basis of an order from the head of the company (paragraph 15 of the Regulation).

As a book of BSO accounting (or the basis for its creation) by commercial companies, the form corresponding to the number 0504045 according to OKUD can be used. For state and municipal organizations, its use is mandatory (order of the Ministry of Finance of the Russian Federation No. 52n dated 03/30/2015).

The acceptance certificate (a little later we will consider on the basis of what form it should be drawn up) is subject to signing by all members of the commission. It must also be approved by the manager. The book of accounting of forms of strict reporting should be flashed and numbered. It must be signed by the head of the company, chief accountant, and also sealed.

Form storage using automated systems

The “innovative” scenario for the manufacture of BSO — using automated systems (AS) — significantly simplifies the management of the company to organize storage of forms. If the corresponding system satisfies the criteria contained in clause 11 of the Regulation (it is protected against unauthorized access, identifies and records BSO operations for 5 years or more, and stores data on the form in memory), then there is no need to carry out the above procedures, because:

- bSO acceptance from a third-party organization is not carried out;

- copies of the BSO remain in the memory of the computer and other devices in the AS;

- suppliers of modern speakers for organizing BSO turnover, as a rule, include solutions in the software package that allow you to keep a book of records of strict reporting forms in electronic form.

At the same time, once printed with the help of AS, but for one reason or another spoiled BSO should, like those that were created by typographical means, be stored in the safes of the organization or in other reliable places.

The functions of the MOT in the case of using the AC are assigned most often to the accountant trained in working with the corresponding software, less often to the system administrator managing the automated system.

Attention! In connection with the transition to online cash registers, the taxpayer is obliged from July 1, 2018, and in some situations from July 1, 2019 to form a BSO using automated systems for strict reporting forms that can transmit information about mutual settlements to the Federal Tax Service online. For more details, see the article "The Law on Online Cash Boxes - How to apply BSO (nuances)."BSO is issued to the buyer on paper or sent by e-mail or to the customer’s phone number.

Submission of forms to employees of the organization

If the calculations using the BSO are performed not by the MOT, but by another employee of the company, then the corresponding forms will be transferred to him at the disposal of the materially responsible person on the basis of a written application. The data on the issued BSO are entered by the MOT into the book of registration of forms of strict reporting.

Copies of the BSO issued to the organization’s customers, or the roots of the forms (depending on which particular form of BSO is used) are transferred by the employees to the financially responsible person. Data on this is also recorded in the BSO accounting book. If any of the previously issued forms was damaged, then it is crossed out, and then attached to the book of account.

Do the GMEC protocols have legal force?

Some provisions of the legislation governing the BSO turnover are contained in the minutes of the meeting of the State Interdepartmental Expert Commission (GMEC) No. 4 / 63-2001 of June 29, 2001. Do they have legal force that applies to all Russian organizations?

Despite the fact that GMEC ceased to exist on 08/09/2004, its decisions, which were adopted during the period when this institution exercised its powers, are generally binding (letter of the Federal Tax Service of the Russian Federation No. ED-18-2 / 947 of 06/17/2014).

So, with regard to the form of the certificate of acceptance of the BSO, you should use the form that corresponds to the number 070000 OKUD. The order to use this form includes clause 18 of the protocol of the GMEC No. 4 / 63-2001.

Similarly, other provisions of the GMEK protocol No. 4 / 63-2001 remain legally binding. In particular, those that regulate BSO accounting.

Accounting strict reporting forms

The turnover of the BSO is recorded on the off-balance account 006, which is called "Forms of strict reporting." BSO accounting is carried out through postings that reflect the amount of costs for the production of forms (paragraph 22 of the minutes of the meeting of the GMEC No. 4 / 63-2001). Typically, these are postings:

- Dt account 26 "General expenses";

- CT account 60 "Settlements with suppliers and contractors."

In some cases, BSO accounting involves the creation of subaccounts for account 006. This is possible if the forms capitalized by the accounting department are subsequently issued to other employees who actually manage the BSO (we examined a similar scenario above). In this case, sub-account 006-1 “BSO in accounting”, as well as sub-account 006-2 “BSO in performers” can be formed.

Criteria for the correct numbering of strict reporting forms

An important criterion characterizing the accounting and storage of BSOs is the correct numbering of the corresponding forms.

The main requirement for BSO is the presence of a unique 6-digit serial number and a series of 2 letters. At the level of federal legislation, the above criteria are not fixed, however, they are regularly found in departmental legal acts regulating the production of BSO (for example, in the letter of the Ministry of Culture of the Russian Federation No. 2344-01-39 / 03-E4 of 04/13/2009). These provisions can be applied by legal entities in other sectors on the basis of a legal analogy.

The relevant details of the forms - series, number - will need to be recorded in the marked forms (certificate of acceptance of the BSO, the register of BSO).

As we noted at the beginning of the article, BSOs are to be produced by the printing method or with the use of automated systems. In the first case, the organization, as a rule, orders the production of forms from a third-party contractor with the necessary printing equipment. If such an order is carried out for the first time, then you can start the release of the BSO with the AA series and number 000001. But in subsequent orders, printed forms must begin with the number following the one that was present at the last BSO of the previous run.

The use of automated systems for the issuance of forms suggests that the correct numbering of BSOs (in correlation with the entry of the necessary information in the system registers) will be carried out automatically by the appropriate software.

BSO inventory and decommissioning

The tasks that include the process of storing strict reporting forms include inventory. This procedure involves the reconciliation of existing copies of the BSO, as well as their roots with the data contained in the book of accounting of forms of strict reporting. The BSO inventory should be carried out simultaneously with the similar procedure established for cash in cash (paragraph 17 of the Regulation).

After 5 years of storage of forms (including damaged or incomplete), the organization must write off the BSO. This procedure is carried out by drawing up a separate act (you can use the form corresponding to the number 0504816 according to OKUD, and it is mandatory for state and municipal structures). This document is prepared with the participation of the commission, created on the basis of the order of the head of the company.

In the structure of modern automated systems, as a rule, there are solutions that allow issuing the necessary acts on inventory and write-off of BSO in electronic form. Also, the corresponding systems provide algorithms for eliminating decommissioned digital BSO from hardware registers.

Summary

BSOs are equated with cashier checks and must be formed using automated systems capable of transmitting information to the Federal Tax Service online. Accounting of forms in this case is also carried out using such systems. Some taxpayers are legally allowed to switch to the use of online devices from 07/01/2019. Prior to this, they are entitled to use preprinted forms. The purchase of such forms is carried out on the accounts of cost accounting (25,26,44 - depending on the unit), and subsequent accounting using the off-balance account 006.

When providing services to the public to individual entrepreneurs, you can use the right to use BSO. The strict reporting form is a document that confirms the payment of the provided service. For some types of activities, in particular, not attached to a certain place (rendering services of an on-site video / photo operator, makeup artist, etc.), BSOs are the most acceptable option.

But no matter how complicated the procedure for working with CCPs, interaction with strict reporting forms also requires a careful and thoughtful attitude. is an important point in the process of working with forms. Some believe that working with BSO is much easier than with CCT. But in reality this is not quite so. Rather, the cost of forms is less than the maintenance of CCP. But the ease of use can not be said. In legislation, work with BSO is strictly regulated. Forms of strict reporting - important documents that are subject to accounting and storage in accordance with established rules. The necessary information regarding the procedure for handling forms is contained in Government Decision No. 359 of May 6, 2008 (hereinafter referred to as the Resolution).

What you need to know about BSO

Entrepreneurs and organizations that provide services to the population, the full list of which is presented, for example, in the approved classifier of services OK002-93, have the right to apply strict reporting forms. As well as individual entrepreneurs:

- paying UTII;

- applying the patent system (in the implementation of certain types of activities);

- located in remote areas and providing services (the list is approved by each subject of the Russian Federation).

Individual entrepreneurs apply forms when making cash settlements with other individual entrepreneurs or with the public (when providing services). When settling with organizations, the use of BSO is prohibited.

Forms of strict reporting should be ordered at the printing house. You can use an automated system that has certain requirements (such as, for example, storing in memory of each operation with a form for five years, protection against unauthorized persons' access, fixing the series and form number at issue). Do-it-yourself BSO production (printing on a regular printer) is prohibited. Each form must have a list of details specified in clause 3 of the Regulation. The form has a six-digit number, which is assigned when printing in a printing house or during automatic generation. BSOs are filled out clearly and legibly, errors and corrections are not allowed (an incorrectly completed form is crossed out and attached to the book of records for the day on which it was filled).

BSO Accounting Book: General Information

Accounting for BSO for individual entrepreneurs, as well as for organizations, is carried out in a book or journal of BSO accounting. There is no form approved by law. The Decree describes general recommendations for compiling this book. We will analyze them in detail. The book of account must be stitched and sealed with the signature and seal (if any) of the entrepreneur. To do this, each sheet is numbered, holes are made with a hole punch for stitching and fastened with a rope / thread, including title pages. The ends of the rope are tied and glued to them a piece of paper on which the date, the signature of the entrepreneur and the seal (if any) are placed. Thus, it turns out ready-to-use and sealed journal for accounting forms. On the numbered pages of the book there should be a place for the date, signature and stamp of the IP. Due to the fact that when accepting or issuing forms it is required to indicate the date, number, quantity, issuing or receiving BSO persons, as well as their signatures, when creating a journal column, appropriate columns should be provided for this information.

You can familiarize yourself with the sample of filling in the book of accounting of funds received and issued by the cashier in the article:

As mentioned above, there is no approved form, and you can create it yourself or purchase a finished copy. Entrepreneurs can download the BSO accounting book in accordance with the instructions given. An approximate version of the content and general appearance of the book is presented below. IP at its discretion can add or remove the necessary columns.

An individual entrepreneur can also buy or order a BSO accounting book at a printing house (optional). But in any case, it will be necessary to flash and seal (seal) in accordance with the requirements. There is no need to certify the book at the tax office. When using AS (automated system) when printing, data about the form is automatically entered in the book of accounting. If a request to provide information from the AU is received from the tax, then the entrepreneur must provide it. 1C also provides for the possibility of forming a book.

Features of handling strict reporting forms

Each movement of the form must be considered. Reception from the printing house and the movement of forms during the work of the entrepreneur are recorded in the book of accounting. A corresponding act is drawn up for each action. An authorized employee is assigned to accept / issue forms, register, and also to keep a logbook. An agreement on liability is concluded with him. If an individual entrepreneur carries out activities alone, then the obligation to record and store BSOs in the prescribed manner rests with him.

The daily filling of the accounting journal is an inalienable obligation, the fulfillment of which is necessary when using the forms.

Storage and Inventory

Paragraphs 14 to 16 of the Regulation relate to the question of the storage of forms. The legislation specifically spells out the requirements. First of all, it is worth mentioning that the entrepreneur is obliged to create conditions for the safe storage of BSO. After each working day, the forms are sealed and placed in a safe or a reliable box made of metal, and documents are also stored in specially designed rooms (for example, in accounting).

Shelf life of forms (copies or tear-off parts of the form) is 5 years. After a month and after the last inventory, documents can be disposed of. First you need to draw up the appropriate act. For unused forms, there is no strict storage time limit. Surplus or obsolete forms of BSO (with irrelevant IP data) are also destroyed after inventory and drawing up an act of liquidation. An example of an act of liquidation is given below.

Inventory of forms is usually carried out simultaneously with the inventory of cash. Thus, the verification of the proper fulfillment of requirements for the storage and use of BSO is carried out, the remains or shortages are revealed. To conduct an inventory of IPs, it is necessary to approve the inventory commission - indicate the persons involved. The results are recorded in the form of IVN-16, a sample of which is given below. With a planned inventory, the form is drawn up in duplicate.

When identifying BSO deficiencies, it is necessary to understand the reasons and apply the necessary measures to prevent the recurrence of this in the future. The legislation does not provide for liability for the loss of strict reporting forms, but the entrepreneur has the right to impose disciplinary action against the responsible employee.

Speaking of fines. For the lack of a BSO accounting book or its maintenance with violations, an individual entrepreneur may be held administratively and taxly liable. Under article 120 of the Tax Code of the Russian Federation, for a gross violation of accounting, a fine of 10,000 rubles (in case of violation within one tax period) to 30,000 rubles (more than one tax period) is prescribed. In case of non-observance of the procedure and term of storage of reports, article 15.11 of the Code of Administrative Offenses and, accordingly, a fine (in relation to the responsible person or individual entrepreneur) in the amount of from 2,000 rubles to 3,000 rubles can be applied.

For all the ease of use, strict reporting forms are quite demanding to handle. An individual entrepreneur is required to keep a detailed BSO record and comply with storage conditions. Maintaining a BSO accounting book and frequent are two mandatory processes that accompany work with strict reporting forms. Subject to the established procedure for handling these documents, an individual entrepreneur can really simplify his life significantly, eliminating the need to use CCP.

When can strict reporting forms (SSRs) be issued?

A.S. Kolosovskaya, tax consultant

How to work with strict reporting forms

The procedure for registration, storage, destruction of BSO and reflection of operations with them in accounting

As you know, organizations and entrepreneurs providing services to the public are entitled, instead of CCP checks, to issue customers strict reporting forms (BSO) )section 2, Art. 2 of the Federal Law of 05.22.2003 No. 54-ФЗ “On the use of cash registers in cash payments and (or) settlements using payment cards” (hereinafter - the Law on CCT).

In this article we will look at how to work with such forms correctly from the moment of their acquisition to destruction, as well as how to reflect the BSO movement in accounting and tax accounting.

The form of the form depends on the type of service

In order to determine which form you need to use, you need to check if there is a valid approved form for your type of service. If such a form exists, then it is necessary to use it, but if not, you will have to develop the form of the form yourself about p. 3, 5, 7 of the Regulation on the implementation of cash settlements and (or) settlements using payment cards without the use of cash registers, approved. Decree of the Government of the Russian Federation of 05.06.2008 No. 359 (hereinafter - the Regulation). Recall that the type of activity belonging to the services to the population is determined by the All-Russian classifier of such services (OKUN )The all-Russian classifier of services to the population OK 002-93, approved. Decree of the State Standard of Russia dated 06.06.93 No. 163.

BSO Forms Approved “From Above”

For certain types of services, BSO forms can be developed and approved by some federal authority and p. 5-7 Provisions. For example, the Ministry of Transport has the right to establish forms of airline tickets and other documents used in the provision of services for the air transportation of passengers, baggage, cargo in section 4, Art. 105 of the Air Code of the Russian Federation; sub. 5.2.3 p. 5 of the Regulation on the Ministry of Transport of the Russian Federation, approved. Decree of the Government of the Russian Federation of July 30, 2004 No. 395; Order of the Ministry of Transport of Russia dated May 18, 2010 No. 116.

Currently, the following approved by the Ministry of Finance BS ABOUT clause 3 of the Regulation ... approved. Decree of the Government of the Russian Federation of March 31, 2005 No. 171 (expired) :

- receipt of insurance premium (contribution) )approved By order of the Ministry of Finance of Russia dated 05.17.2006 No. 80n;

- receipt for gasification and gas supply services i approved By order of the Ministry of Finance of Russia dated 09.02.2007 No. 14n;

- tour package a approved By order of the Ministry of Finance of Russia dated 09.07.2007 No. 60n;

- security ticket and security receipt i approved By order of the Ministry of Finance of Russia dated 14.01.2008 No. 3n;

- receipt for veterinary services g approved By the order of the Ministry of Finance of Russia dated 04.09.2008 No. 39н.

Now about how to use the old BSO, approved even before the entry into force of the current Regulation on cash payments without CC T:

- BSO approved by the Ministry of Finance during the validity of the old Regulation on cash payments without CCP (from April 12, 2005 to May 20, 2008) should be used by everyone who provides the types of services for which this form was developed and clause 2 of the Decree of the Government of the Russian Federation dated 06.05.2008 No. 359; Clause 3 of the Regulation on cash settlements and (or) settlements using payment cards without the use of cash registers, approved. Decree of the Government of the Russian Federation of March 31, 2005 No. 171 (expired);

- BSO, approved before 12.04.2005, could be applied only until 01.12.2002 8clause 2 of the Decree of the Government of the Russian Federation dated 06.05.2008 No. 359; Letter of the Ministry of Finance of Russia dated 09.06.2009 No. 03-01-15 / 6-291. Although there are still organizations that use such obsolete forms of SSR. For example, there are hotels issuing their guests upon receipt of payment of an invoice from them in form No. 3-G Order of the Ministry of Finance of Russia dated 13.12.93 No. 121. However, the Ministry of Finance clarifies that such a form of the form as a strict reporting document can no longer be used. t Letters of the Ministry of Finance of Russia dated 07.08.2009 No. 03-01-15 / 8-400, dated 19.01.2009 No. 03-01-15 / 1-11.

As a result of those who continue to use outdated BSO, tax officials are fined under Art. 14.5 Administrative Code for the non-use of KKT. However, they lose sight of the fact that the old forms usually have all the necessary details. Therefore, in most cases, the courts cancel the penalty, explaining that the only requirement for the form is the presence of mandatory details in Decisions of the FAS BBO dated 10.06.2009 No. A39-649 / 2009; FAS DVO dated March 25, 2009 No. Ф03-997 / 2009; FAS MO dated 07.07.2009 No. KA-A41 / 5848-09; FAS SZO dated October 19, 2009 No. A44-1605 / 2009; FAS Central Organ of 04.08.2009 No. A62-2237 / 2009. True, there is a court decision in favor of tax in Resolution of the FAS DVO of 03.06.2009 No. Ф03-2286 / 2009. However, recognizing that the offense was, the court nevertheless exempted the service provider from liability due to the insignificance of the deed about art. 2.9 Administrative Code of the Russian Federation; - old SSRs can also be used if an authority endowed with the right to approve SSR forms has not yet been developed l clause 2 of the Decree of the Government of the Russian Federation dated 06.05.2008 No. 359.

Self-developed BSO forms

If you find out that there is no mandatory BSO form for your services (and in most cases this is the case), then from May 2008 you have the right to independently develop a BS form ABOUT Information letter of the Ministry of Finance of Russia of 08.22.2008. It is only important to include in the BSO all the required details listed in the Regulation and clause 3 of the Regulation. That is, there can be no more details than indicated, but you can add additional details to the BSO about sub. “K” p. 3 of the Regulation. However, you should not be especially zealous with additional details. Indeed, even if you, having completed all the required details, do not fill out the additional details you entered, the court can theoretically equate this to the non-issuance of BSO and you will be fined for not using the CC T art. 14.5 Administrative Code of the Russian Federation.

The arrangement of details in the form is also at the disposal of the service providers.

If your services do not have a mandatory BSO form, develop it yourself in compliance with the requirements of the Regulation and approve the order for the organization. For the sample, you can take the old BSO form, removing from there the links to the details of the regulatory document that approved the form of the form, and the OKUD code. This will save you from unnecessary litigation about the legality of using old forms of BSO.

And one more common requirement for all forms: the form must provide the simultaneous filling of a copy of the form or have a tear-off part b clause 8 of the Regulation.

Mandatory details of BS ABOUT clause 3 of the Regulation :

- name of the document, its six-digit number and series;

- name and legal form - for organization or f. and. about. - for an entrepreneur;

- the location of the permanent executive body of the organization, and if there is none, of another body or person who has the right to act on behalf of the organization;

- TIN of the organization or entrepreneur that issued the document;

- type and cost of service;

- amount of payment;

- dates of calculation and preparation of the document;

- position, f. and. about. the person responsible for the transaction, his personal signature, seal of the organization or entrepreneur.

Except when:

- <или> the authority that developed the form established a special procedure for filling it out i sub. "A" p. 8 of the Regulation;

- <или> all details of the BSO are filled in a printing way during its manufacture and sub. "B" p. 8 of the Regulation;

- <или> all details of BSO are filled in electronic form e sub. “C” p. 8 of the Regulation.

Can a cash receipt order (PKO )unified form No. KO-1, approved. Decree of the State Statistics Committee of Russia dated 08/18/98 No. 88 replace BSO?

FFP and a receipt for it can be used as a BSO, if they are made in a printing house and they have all the details required for a BSO. Many court s see, for example, Decisions of the FAS ZCO of 05.11.2009 No. A45-10533 / 2009; FAS software dated 08.10.2009 No. A65-12792 / 2009. True, the presence of litigation shows that such actions are not approved by the tax authorities. There is a court decision not in favor of the organization and Resolution of the FAS SZO dated September 3, 2009 No. A21-1389 / 2009.

In addition, if your cash receipt orders are not just primary cash documents, but also BSOs, then you will have to process, store and take them into account in the same way as strict reporting forms. So it’s safer to still independently develop a form and use it.

How to make a BSO

Strict reporting forms must be made b clause 4 of the Regulation:

- <или> in a printing way;

- <или> using automated systems.

BSO printing houses were printed before. We only recall that on the printing BSO information on the manufacturer should be additionally indicated (abbreviated name, TIN, location, number and year of completion of the order, circulation )clause 4 of the Regulation; Clause 9 of the Regulation.

But what is an automated system? In fact, to clarify on this issue - the competence of the Ministry of Industry and Trade a Letters of the Ministry of Finance of Russia dated 03.08.2010 No. 03-01-15 / 6-170, dated 03.02.2009 No. 03-01-15 / 1-43, dated 06.03.2009 No. 03-01-15 / 2-96. He has not yet issued any clarifications.

The Regulation establishes only the requirements for an automated system, according to which it must a clause 11 of the Regulation:

- have protection against unauthorized access;

- identify, record and save all operations with the form for at least 5 years;

- keep a unique number and series of the form.

At the same time, regulatory authorities believe that a conventional computer for manufacturing BSO is not suitable. The reason is that it does not protect, record and store information about the form. According to the Ministry of Finance and tax authorities, the automated system should meet the requirements for cash registers e Letters of the Ministry of Finance of Russia dated November 25, 2010 No. 03-01-15 / 8-250, dated 03.02.2009 No. 03-01-15 / 1-43; Letter of the Federal Tax Service of Russia for Moscow dated November 30, 2009 No. 17-15 / 126038.

So still this question remains open.

We buy, store and destroy BSO

Attention

A damaged form cannot be simply thrown away. It must be crossed out and attached to the book of account in clause 10 of the Regulation.

First you need to select an employee responsible for the BSO. With such an employee it is necessary to conclude an agreement on full liability and art. 244 of the Labor Code of the Russian Federation; Clause 14 of the Regulation. He will receive a BSO, take them into account in a special book, be responsible for their safety, fill them out himself or give them to those employees who receive cash for services. The responsible employee must accept the purchased forms in the presence of a commission created by order of the head of the commission, checking the number of forms, series and numbers with the data in the printing invoice. Based on the results of acceptance, the commission draws up an act of acceptance of forms in any form, and the responsible employee records their arrival in the BS accounting book ABOUT p. 13, 15 Provisions. And transferring the forms to the employee, who will directly settle accounts with customers, the person responsible for the forms indicates the expense and balance of the forms in the BSO accounting book.

We must say right away that if you issued a BSO immediately after the service was rendered and the revenue hit the cash book for that day, then only for the absence of a BSO accounting book and acts on their acceptance and destruction, no one can bring you to administrative responsibility t art. 14.5, Art. 15.1 Administrative Code of the Russian Federation. And since the acts and the BSO accounting book are not primary documents or accounting registers, you are fined under Art. 120 of the Tax Code of the Russian Federation, the tax authorities also fail.

However, for this reason, do not refuse to compile a book and an act on the destruction of BSO. After all, the organization itself is primarily interested in their design. You need to control the number of forms that are held by employees. A service is not a product, and little can be revealed by inventory. Whereas, according to the BSO accounting book, it is immediately clear that you, for example, handed over 100 forms to an employee receiving money from customers for services, and only 80 returned to you. So, the employee will have to explain where he went about the other 20 forms. In our opinion, what really can be neglected is the act of accepting forms - for the acceptance of BSO, an accounting book and an invoice for the forms issued by the printing house are quite enough.

There is no unified form of the BSO accounting book, therefore it can be developed independently, or you can take the form from the GME Guidelines TO appendix No. 6 to the Instructions for the Application, Production, Storage, and Accounting of Strict Reporting Documents (Appendix No. 2 to the Minutes of the GMEC Meeting dated June 29, 2001 No. 4 / 63-2001) or use the form of the book approved by the Ministry of Finance for the budget in Order of the Ministry of Finance of Russia dated September 23, 2005 No. 123n. Its sheets need to be numbered, laced up, affix the signatures of the head and chief accountant and affixed with the seal of the organization and clause 13 of the Regulation.

We warn the employee

Filling out not all BSO details is equivalent to its non-issuance, which will lead to a fine for not applying the CC T art. 14.5 Administrative Code of the Russian Federation; Clause 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16; Clause 3 of the Regulation; Decisions of the FAS DVO of February 28, 2007 No. Ф03-А51 / 07-2 / 123; FAS SKO dated 04.29.2009 No. А32-18480 / 2008-56 / 286-13АЖ:

- for organization - from 30,000 to 40,000 rubles .;

- for an employee whose job responsibilities include issuing a BSO - from 1,500 to 2,000 rubles.

There are no complex requirements for the storage order of BSO - it’s enough if you keep the forms in a safe, which should be sealed at the end of each working day b clause 16 of the Regulation. In addition, an inventory of forms must be carried out simultaneously with an inventory of cash at the cash desk e clause 17 of the Regulation; p. 3.39, 3.40, 3.41 of the Guidelines for the inventory of property and financial obligations, approved. Order of the Ministry of Finance of Russia dated 13.06.95 No. 49; p. 37, 38 of the Procedure for conducting cash transactions in the Russian Federation, approved. By the decision of the Board of Directors of the Central Bank of the Russian Federation of September 22, 93 No. 40.

Copies and roots of used and damaged forms, packed in sealed bags, must be stored for at least 5 years from the end of the year in which they were used. When this period expires and a month passes from the date of the last BSO inventory, they can be destroyed by creating a commission and drawing up an act to destroy the blank in clause 19 of the Regulation, Clause 1.4 of the List of typical management archival documents generated in the course of activities of state bodies, local authorities and organizations, indicating storage periods, approved. By order of the Ministry of Culture of Russia dated 08.25.2010 No. 558. You can develop a form of such an act yourself or take a form of an act designed for the budget in appendix No. 2 to the Guidelines for Budget Accounting, approved. By order of the Ministry of Finance of Russia dated December 30, 2008 No. 148n.

Take BSO into account

IN accounting BSOs are shown on off-balance sheet account 006 “Forms of strict reporting” in conditional assessment e Chart of accounts for accounting of financial and economic activities of organizations, approved. By order of the Ministry of Finance of Russia dated 10.31.2000 No. 94n. It is easier to evaluate the BSO in the sum of the actual costs of their manufacture.

Previously, GMEC recommended that purchased BSOs first be accounted for on the account 10 “Materials” at their actual cost and, as they are used, written off to the costly account a Instructions for the use, manufacture, storage, and accounting of strict reporting documents (Appendix No. 2 to the Minutes of the meeting of the GMEC dated June 29, 2001 No. 4 / 63-2001). However, this, firstly, complicated accounting. And secondly, it was generally contrary to the purpose of account 10, since BSOs themselves do not have any value, and therefore they can hardly be called inventories. For these reasons, account 10 is incorrect to use for accounting for BSO. Typically, the cost of forms immediately upon their posting is included in the costs of posting: debit of account 26 “General expenses” (or 44 “costs of sale”) and credit of account 60 “Settlements with suppliers and contractors”.

Or office supplies in sub. 17 p. 1 art. 346.16 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated 05.17.2005 No. 03-03-02-04 / 1/123.

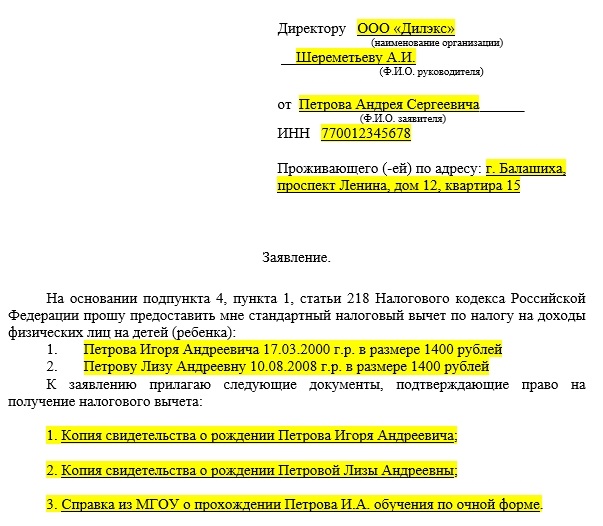

Example. Accounting for strict reporting forms

/ condition / LLC Artel repairs shoes by order of individuals (household services to the population).

08/01/2010 accountant-cashier V.L. Orionova received 1000 receipts (BSO) from the printing house (on the invoice dated 08.08.2010 No. 509), according to which the company accepts cash proceeds.

The cost of printing services is 1062 rubles. (including VAT 162 rubles). LH series of forms, numbers from 000001 to 001000.

The next day, 08/02/2010, 70 forms were handed to shoemaker A.V. Merkuryev, who provides shoe repair services and accepts payment from customers. The shoemaker’s right to receive strict reporting forms in accounting is stipulated by order of the head of the company dated 01.01.2010 No. 5. On 02.08.2010, the shoemaker handed over five copies of receipts for payment of shoe repair services. In addition, the shoe maker spoiled two receipts and also handed them over to the accounting department.

/ decision / For off-balance account 006, the organization opened sub-accounts: 006-1 “Forms of receipts in bookkeeping”, 006-2 “Forms of receipts from the executor”. The off-balance sheet accounting of BSO is kept in the amount of actual costs. The cost of 1 form is 0.9 rubles.

((1062 rub. - 162 rub.) / 1000 pcs.).

Reception of forms from the printing house and their delivery to the shoemaker V.L. Orionova reflected in the book of accounting BSO. She also attached damaged forms to the book.

The book of accounting of forms of receipts for the provision of repair services for 2010

| date | From whom it is received and to whom it is released | Basis (name, number and date of document) | Coming | Consumption | The remainder | ||||||

| number | month | year | quantity | series and form number | quantity | series and form number | signature of the person receiving the forms | quantity | series and form number | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 01 | 08 | 2010 | Typography | Waybill dated 08/01/2010 No. 509 | 1000 | LH 000001 - LH 001000 | - | - | - | 1000 | LH 000001 - LH 001000 |

| 02 | 08 | 2010 | A.V. Merkuryev | The order of the head of January 11, 2010 No. 5 | - | - | 70 | LH 000001 - LH 000070 | 930 | LH 000071 - LH 001000 | |

Let's see what records need to be made by an accountant of Artel LLC in order to reflect operations in accounting.

| Contents of operation | Dt | Ct | Amount, rub. |

| On the day of receipt of receipts (01/01/2010) | |||

| Reflected the cost of acquiring receipts (1062 rub. - 162 rub.) |

26 "General expenses" | 900,0 | |

| Reflected VAT on receipts | 60 "Settlements with suppliers and contractors" | 162,0 | |

| VAT on receipts deducted | 68-VAT | 19 “Value added tax on acquired values” | 162,0 |

| The contingent valuation receipts are accepted for off-balance accounting (0.9 rub. X 1000 pcs.) |

900,0 | ||

| On the day of issuing receipts to the shoemaker (08/02/2010) | |||

| Shoemaker issued receipts (0.9 rub. X 70 pcs.) |

006-1 “Forms of receipts in accounting” | 63,0 | |

| 63,0 | |||

| Shoemaker reported on used and damaged receipts ((5 pcs. + 2 pcs.) X 0.9 rub.) |

006-2 “Forms of receipts from the contractor” | 6,3 | |

Do not forget that even if you use UTII for household services to the population and do not use CCV, you need to use BS ABOUT p. 2, 2.1 Art. 2 of the CCP Law. Otherwise, tax officials can fine you for not using a cash register. a art. 14.5 Administrative Code of the Russian Federation.

Rules for calculating vacation pay after decree

Childcare allowance, taking into account new clarifications from the Ministry of Labor and Social Insurance Fund The Ministry of Labor has reduced the allowance for childcare

How and where to get snls to an individual and a foreigner in Russia?

With changes and additions from special expensive devices

Samsung Galaxy S9 vs S8 comparison, what is the difference?